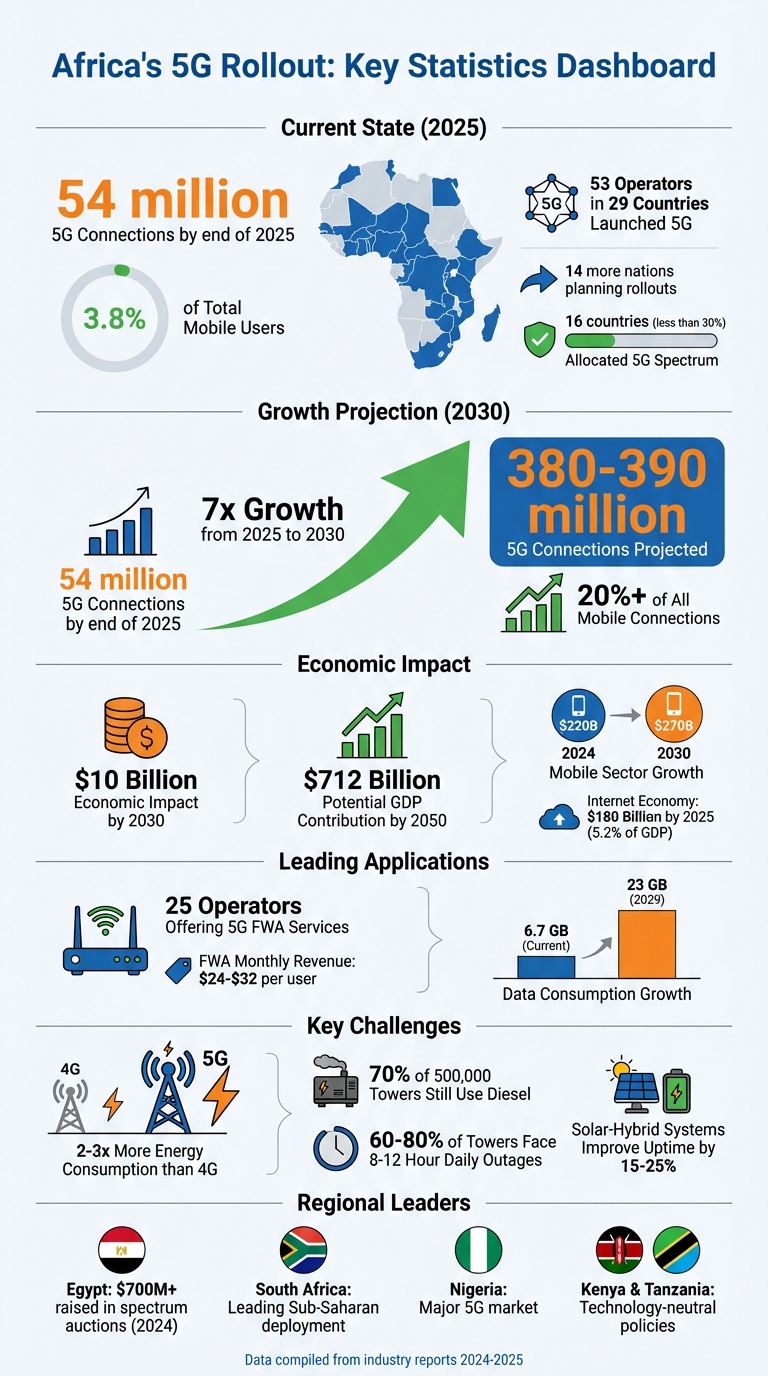

Africa’s 5G rollout is gaining momentum, with 54 million connections projected by the end of 2025 – just 3.8% of mobile users. While challenges like spectrum allocation and infrastructure gaps persist, progress is evident in countries like Egypt, South Africa, and Nigeria. Key highlights include:

- 53 operators in 29 countries launched 5G by late 2025, with 14 more nations planning rollouts.

- Fixed Wireless Access (FWA) is leading applications, offering broadband in underserved areas.

- Smartphones under $100 expected by the decade’s end, driving adoption.

- Energy challenges are being addressed with solar-battery systems and energy outsourcing models.

- 5G’s economic impact: $10 billion by 2030, supporting sectors like fintech, healthcare, and agriculture.

Despite hurdles, 5G is set to transform industries, boost connectivity, and drive Africa’s digital economy forward.

Africa’s 5G Rollout: Key Statistics and Projections for 2025-2030

5G Network Expansion Across Africa

Countries and Operators Leading 5G Deployment

Egypt has emerged as North Africa’s frontrunner in 5G development, driven by an aggressive push in spectrum allocation. Between January and October 2024, the country held auctions that generated over $700 million. Major players like Telecom Egypt, Vodafone Egypt, Orange Egypt, and Etisalat Misr secured 3.5 GHz spectrum licenses during this period.

In Sub-Saharan Africa, 5G deployment follows a more fragmented, multi-operator model. For instance, Free Senegal acquired 90 MHz in the 3.5 GHz band from the Senegalese regulator in December 2023 to kickstart its 5G network. Similarly, in October 2023, Namibia’s Communications Regulatory Authority allocated spectrum in the 700 MHz and 800 MHz bands to operators such as TN Mobile, MTC, and Loc8 Mobile.

Elsewhere, Tunisia’s Ministry of Communication Technologies made significant strides in December 2024 by assigning 30 MHz in the 700 MHz band and 300 MHz in the 3.5 GHz band to Tunisie Telecom, Orange Tunisia, and Ooredoo Tunisia. Even smaller markets like Comoros are stepping into the 5G arena. In May 2025, Yas (Axian) and Huri (Comores Telecom) were awarded licenses to commence commercial 5G deployment. These varied approaches highlight the diverse strategies shaping 5G rollouts across the continent.

Regional Patterns: Sub-Saharan vs. North Africa

The rollout of 5G across Africa reflects stark regional differences. Sub-Saharan Africa tends to prioritize a "4G-first" strategy, with 4G networks remaining the primary focus for new subscriptions while 5G adoption takes a gradual path. Countries like Kenya and Tanzania have embraced technology-neutral policies, enabling operators to repurpose existing spectrum for 5G deployment.

In contrast, North Africa, particularly Egypt, emphasizes dedicated 5G spectrum allocations. This strategy supports high-density urban coverage and industrial applications, albeit with higher upfront costs. This focused approach allows for faster deployment in urban hubs. By mid-2025, only 16 African nations had allocated 5G spectrum.

Infrastructure challenges also differ by region. Sub-Saharan Africa faces hurdles like low Average Revenue Per User (ARPU) in rural areas and power supply issues, leading to the adoption of cost-effective solutions like solar-powered macro sites. Meanwhile, urban centers in countries such as South Africa and Kenya are reaching spectrum capacity, necessitating network densification to keep up with demand.

Primary 5G Applications in Africa

As 5G networks expand, their applications are becoming increasingly clear, particularly in improving broadband access and driving industrial productivity. Fixed Wireless Access (FWA) has emerged as the leading 5G application across the continent. By late 2025, 25 operators in countries such as Angola, South Africa, Nigeria, Kenya, Zambia, and Zimbabwe had launched 5G FWA services. This technology offers fiber-like speeds without the need for extensive physical infrastructure, making it particularly useful in suburban areas with limited traditional broadband options.

MTN Group has targeted high-income households with its 5G FWA services, generating monthly ARPU between $24 and $32. This approach not only boosts revenue but also addresses connectivity gaps for both businesses and residential users. By 2029, monthly smartphone data consumption in Sub-Saharan Africa is expected to rise significantly, from 6.7 GB to 23 GB.

Beyond broadband, 5G is finding a foothold in industrial connectivity. Industries like mining, maritime operations, and urban infrastructure are leveraging 5G to enhance operational efficiency. Educational institutions are also tapping into 5G FWA to provide high-speed internet, helping to narrow the digital divide in both urban and suburban areas.

sbb-itb-dd089af

Challenges and Solutions in 5G Deployment

Infrastructure and Spectrum Limitations

By June 2025, fewer than 30% of African countries – just 16 nations – had allocated spectrum for 5G services, compared to over 90% in Europe. This lack of spectrum creates a major hurdle for operators eager to roll out commercial 5G networks. Spectrum costs also differ drastically across the continent. For example, Egypt’s October 2024 auction raised $550 million for 3.5 GHz licenses, while Namibia charged much lower fees – ranging from $0.28 to $0.43 million – for 700/800 MHz bands.

Beyond spectrum allocation, the high cost of expanding fiber-optic backhaul in suburban and rural areas poses another challenge. To bridge this gap, operators are increasingly adopting E-Band microwave links, which operate around 80 GHz, as a high-capacity alternative to physical fiber. Meanwhile, legacy 2G and 3G networks continue to occupy valuable spectrum, slowing its repurposing for 5G. As of mid-2025, fewer than 15% of Sub-Saharan countries had initiated 2G shutdowns. To address this issue, regulators in countries like Kenya and Tanzania have implemented technology-neutral policies, allowing operators to reuse existing spectrum for 5G. However, these technical challenges are further complicated by significant energy and power constraints.

Energy and Power Solutions

5G networks consume 2–3 times more energy than previous mobile generations, creating serious challenges in regions with unstable power grids. In Sub-Saharan Africa, 60–80% of telecom towers face grid outages lasting 8–12 hours daily. Moreover, around 70% of the continent’s 500,000 telecom towers still rely on diesel generators. Between 2023 and 2025, fuel costs surged by 40–60% in many African markets, making diesel-powered operations increasingly unsustainable.

To tackle these issues, solar-battery hybrid systems are emerging as a game-changer. Operators using these systems report uptime improvements of 15–25% compared to diesel generators. The adoption of the Energy-as-a-Service (ESCO) model has also gained momentum. This model allows operators to outsource power infrastructure to specialized companies through long-term contracts, typically spanning 10–15 years. By doing so, operators eliminate upfront capital expenses and cut energy costs by 20–40%. A notable example occurred in July 2025, when Zoodlabs partnered with CrossBoundary Energy to deploy a solar-hybrid power solution for Sierra Leone’s first 5G network. This project combined advanced solar systems with intelligent energy management platforms to address the country’s 6MW grid demand cap and frequent outages.

Policy and Regulatory Changes

Governments across Africa are implementing policy reforms to accelerate 5G deployment. A key trend is the adoption of technology-neutral regulations, enabling service providers in countries like Kenya and Tanzania to reuse their existing spectrum for 5G without waiting for new auctions. This approach not only speeds up initial rollouts but also enhances network efficiency.

Spectrum pricing strategies are evolving as well. Egypt, for instance, focused on high-value auctions to boost state revenue, raising $700 million between January and October 2024. Conversely, Namibia opted for lower fees to encourage smaller operators and accelerate infrastructure development. In December 2024, Tunisia’s Ministry of Communication Technologies took a balanced approach, allocating 30 MHz in the 700 MHz band and 300 MHz in the 3.5 GHz band to Tunisie Telecom, Orange Tunisia, and Ooredoo Tunisia to kickstart national 5G deployment. These differing strategies highlight the varying priorities among nations – balancing revenue generation with rapid infrastructure expansion.

How 5G Enables Innovation and Startups

Industry Changes Powered by 5G

5G is revolutionizing industries across Africa with its game-changing capabilities. Offering speeds of up to 30 Gbps and latency as low as 1 millisecond, it far outpaces 4G’s 300 Mbps speeds and 20–30 millisecond delays.

In the fintech world, 5G’s network slicing allows the creation of secure, isolated virtual networks. This is a huge step forward for blockchain transactions and AI-driven financial services, especially as mobile money transactions surpassed $800 billion in 2023.

Healthcare is also undergoing a transformation. 5G enables telemedicine and even remote surgeries, connecting rural clinics to specialized hospitals through high-speed, low-latency links. With telemedicine expected to grow by 25% annually, this advancement is helping bridge critical healthcare gaps.

Agriculture is benefiting, too. By integrating 5G with IoT and AI, precision farming becomes possible. Farmers can use real-time weather data, automated irrigation systems, and drones for crop monitoring – all of which improve efficiency and yield.

In industrial operations, private 5G networks are being rolled out in sectors like mining, ports, and manufacturing. These networks support drone inspections, real-time equipment tracking, and automated guided vehicles, boosting productivity by as much as 30%.

Opportunities for African Startups

The technological leap brought by 5G is creating fertile ground for startups to thrive. African entrepreneurs are harnessing standalone 5G’s cloud-native architecture and ultra-low latency – delivering response times as fast as 1 millisecond – to develop cutting-edge IoT and cloud-based applications. This opens doors to innovations like AI-powered healthcare diagnostics, immersive VR and AR tools for education, and mission-critical automation solutions for industries.

"When you open the capabilities of the entire network to developers, you can really scale up innovation to a level that we can’t even now realize", said Majda Lahlou-Kassi, Vice President and Head of Customer Unit West and Southern Africa at Ericsson.

Fixed Wireless Access (FWA) is another promising area. With 25 African operators already offering 5G FWA services, startups can target high-income households and small businesses in areas lacking fiber connectivity. The expected arrival of sub-$100 5G smartphones later this decade will further widen the market for these innovations.

5G’s Role in Africa’s Digital Economy

5G isn’t just about industry and startups – it’s poised to reshape Africa’s entire digital economy. By 2050, a fully developed digital economy powered by 5G could contribute up to $712 billion to Africa’s GDP, with an estimated $26 billion added by 2030 alone. Africa’s internet economy is also projected to hit $180 billion by 2025, making up 5.2% of the continent’s GDP.

The technology supports massive IoT deployments, capable of handling up to 1,000,000 devices per square kilometer. This capacity is essential for smart cities, automated supply chains, and data-driven operations across various industries.

"5G is the technology that will complement other emerging technologies such as AI, blockchain, and IoT for the digitalization of our sectors", noted Angela Wamola, Head of Africa at GSMA.

Africa’s young and tech-savvy population – one-third of the global youth population – combined with surging mobile data consumption (which jumped from 5.3 GB per month in 2019 to 15.6 GB in 2024), creates a fertile market for 5G-driven innovations. While challenges around spectrum, infrastructure, and policy remain, ongoing efforts are paving the way for 5G’s transformative impact across the continent.

Looking Ahead to 2025 and Beyond

Key Takeaways from Africa’s 5G Rollout

Africa’s 5G rollout is still in its early stages, with projections indicating 54 million connections by the end of 2025 – just 3.8% of the continent’s total mobile users. However, the pace is expected to pick up significantly in the latter half of the decade. By 2030, the number of 5G connections is forecast to jump to 380–390 million, accounting for over 20% of all mobile connections in Africa. These figures highlight the ongoing push to address the spectrum and infrastructure hurdles previously discussed.

Fixed Wireless Access (FWA) services are already gaining traction, with 25 operators focusing on high-revenue segments. These services generate monthly revenues ranging from $24 to $32.

Spectrum allocation remains a critical challenge. As of mid-2025, fewer than 30% of African countries – just 16 – had assigned 5G spectrum, a stark contrast to the over 90% in Europe. Still, there are signs of progress. In October 2024, Egypt’s auction of 3.5 GHz spectrum raised $550 million, with major players like Vodafone, Orange, and Etisalat participating. Similar auctions in Tunisia, Senegal, and Namibia reflect a growing commitment from governments to accelerate 5G infrastructure development.

Opportunities for Startups and Investors

The expanding 5G ecosystem is opening doors for innovation across multiple sectors. The integration of 5G with technologies like AI, IoT, and cloud computing is creating new possibilities. Fintech remains a standout sector, with mobile money transactions dominating Africa’s digital economy. Thanks to 5G’s low latency and high capacity, secure, real-time financial applications are now within reach, going far beyond what 4G could support.

Healthtech also stands to benefit significantly. Startups can leverage 5G’s ultra-low latency to develop AI-powered tools for telemedicine and remote diagnostics, connecting rural clinics to urban hospitals in real time. In agriculture, IoT sensors powered by 5G can enable precision farming, helping farmers boost productivity while cutting costs.

For investors, the initial focus should be on high-revenue segments such as urban areas, small and medium-sized enterprises (SMEs), and affluent households. Once these markets are established, scaling to broader, mass-market applications becomes more feasible. The mobile sector’s overall contribution to Africa’s economy is projected to grow from $220 billion in 2024 to $270 billion by 2030.

Africa’s Digital Transformation Beyond 2025

The opportunities tied to 5G are part of a larger digital transformation unfolding across Africa. Even as 5G adoption grows, 4G is expected to remain the dominant technology through the end of the decade, likely accounting for half of all subscriptions by 2029. This dual-track approach – expanding 4G while rolling out 5G – will shape the continent’s connectivity landscape.

Satellite-to-mobile connectivity is emerging as a key solution for bridging coverage gaps in remote areas where traditional cell towers aren’t practical. Pairing this with spectrum refarming, which allows operators to repurpose existing spectrum for 5G, offers a cost-effective way to expand coverage and bring connectivity to underserved regions.

Looking further ahead, the potential of 5G extends beyond connectivity. By 2030, 5G-powered ICT solutions could help reduce global greenhouse gas emissions by up to 15%. At the same time, African telecom operators are evolving into full-scale tech companies, laying the foundation for a digital economy projected to add an extra $50 billion to GDP by 2030. From spectrum auctions to industrial IoT applications, these advancements are setting the stage for a transformative digital future.

Zimbabwe’s Tech Boom: 5G Surges, Starlink Dominates, & AI Gets a Record Deal? | Africa Tech Kin

FAQs

What challenges does Africa face in deploying 5G networks?

Africa’s journey toward 5G implementation comes with its fair share of challenges. One of the biggest roadblocks is the absence of well-defined spectrum policies and regulatory guidelines. Without these, allocating the high-frequency bands that 5G demands becomes a slow and complicated process. On top of that, Africa’s diverse and expansive geography – ranging from sprawling rural areas to rugged terrains – adds another layer of complexity. Building the essential infrastructure, such as fiber networks and backhaul systems, is not only costly but also tough to execute in such conditions.

Another pressing issue is affordability. For many consumers, the high price of 5G-compatible devices is out of reach, especially when paired with lower-than-average income levels across the continent. Telecom operators, too, face financial hurdles as they attempt to make 5G deployment cost-effective in markets that are still in their early stages. Lastly, the shift from older 3G and 4G networks to a fully functional 5G ecosystem is no small feat. It demands significant investment in new equipment and a carefully planned approach to phasing out outdated systems – an effort that many countries are only beginning to tackle.

How will 5G transform industries like fintech and healthcare in Africa?

5G’s blazing fast connectivity and minimal lag are poised to transform industries like fintech and healthcare across Africa. In the fintech space, 5G will make mobile-first services like instant payments, digital wallets, and AI-driven credit scoring faster and more dependable. This means financial tools will become easier to access and more affordable for users. Over in healthcare, 5G will pave the way for advancements like remote diagnostics, telemedicine, and real-time health monitoring through connected devices, leading to better patient care and improved outcomes.

By 2025, more than 50 operators across 29 African countries are expected to roll out 5G services. This infrastructure will empower startups and businesses to create solutions that simplify financial transactions and enhance healthcare delivery, boosting economic growth and improving everyday life across the continent.

How are African countries addressing energy and infrastructure challenges for 5G deployment?

African countries are coming up with practical ways to handle the energy and infrastructure hurdles of 5G deployment. One key approach is infrastructure sharing, where existing 4G sites are reused, and antennas are co-located. This helps lower costs and speeds up the rollout process. On top of that, many nations are embracing renewable energy options, such as solar-powered base stations, to sidestep issues caused by unreliable electricity grids.

To improve connectivity in remote or underserved areas, some countries are turning to satellite technology and introducing new undersea cable links to ensure stable backhaul connections. These strategies, paired with government-backed policies, are playing a crucial role in addressing energy and infrastructure challenges as 5G networks continue to grow across the continent.

Related Blog Posts

- Top 7 African Countries Using Partnerships for Rural Internet

- MTN Data Analytics: Impact on African Telecom

- How mmWave Improves Internet Access in Africa

- Airtel Africa to Launch ‘Direct-to-Cell’ Satellite Service in 2026