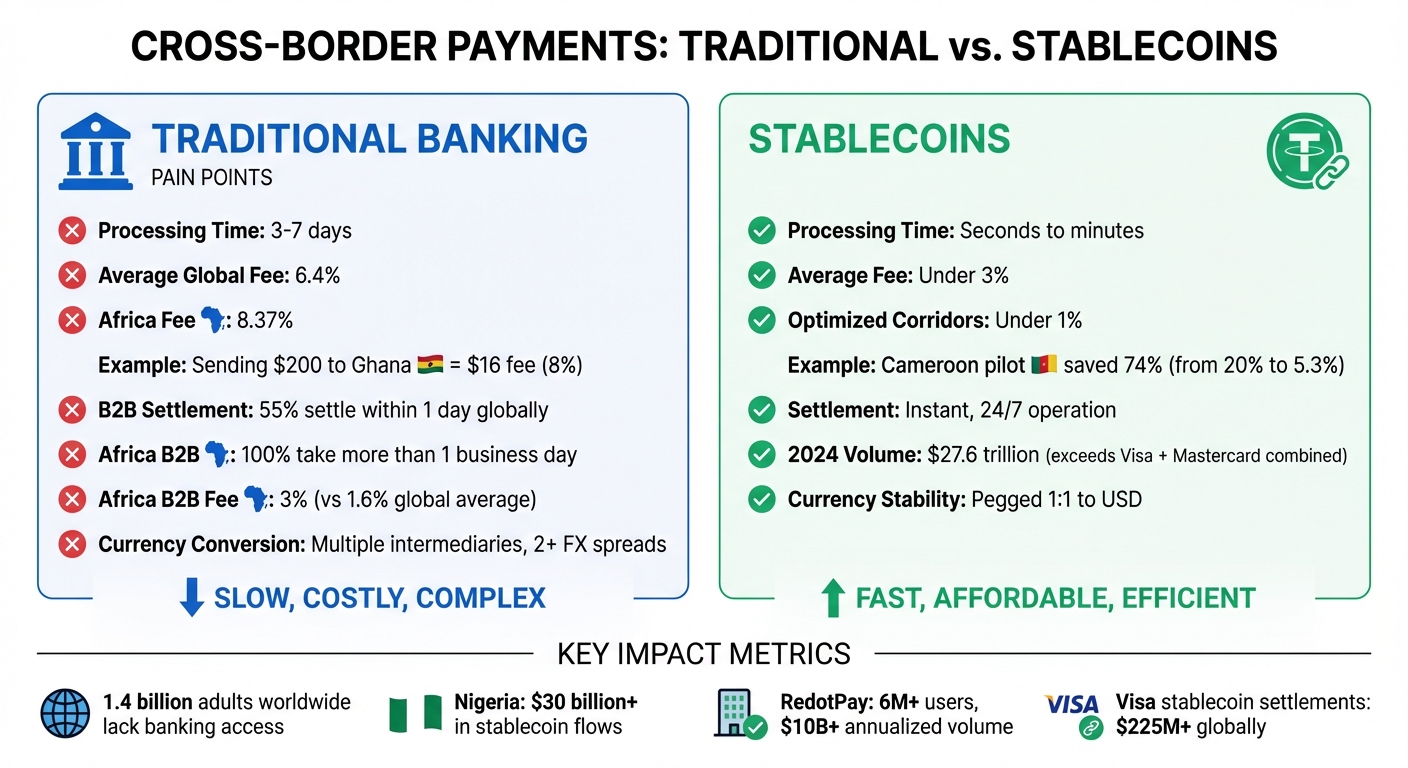

Stablecoins are transforming international payments by solving three key issues: high fees, slow transaction times, and currency instability. Unlike traditional banking systems, which can take 3–7 days and charge up to 20% in fees, stablecoins offer faster, low-cost, and reliable transactions. Pegged to assets like the U.S. dollar, they eliminate the volatility of cryptocurrencies, making them a dependable option for businesses and individuals alike.

Key Takeaways:

- Faster Payments: Transactions settle in seconds or minutes, bypassing banking delays.

- Lower Costs: Fees drop from an average of 8.37% in Africa to under 3%.

- Stability: Pegged to the U.S. dollar, stablecoins avoid currency fluctuations.

- Real-World Impact: A pilot in Cameroon saved merchants 74% in fees, cutting costs from 20% to 5.3%.

Stablecoins are particularly impactful in regions like Africa, where traditional systems are costly and inefficient. They also provide access to global trade for unbanked populations, reduce exchange rate risks, and simplify cross-border transactions. Whether you’re a business managing international payments or an individual sending remittances, stablecoins offer a practical, efficient alternative to outdated systems.

Traditional Cross-Border Payments vs Stablecoins: Cost and Speed Comparison

Problems with Traditional Cross-Border Payments

High Fees and Slow Processing Times

Traditional international payment systems come with fees that stack up at every stage. For instance, sending $10,000 from Kenya through standard banking channels can cost an upfront fee of $25–$50, with additional intermediary fees of around $30 each. Smaller transfers are hit even harder. Sending $200 to Ghana incurs an $16 fee – 8% of the total – and sending to other African countries can cost over $20, or 10%.

Delays only add to the financial strain. Globally, 55% of business-to-business (B2B) transactions settle within a day. However, every single B2B payment originating from Sub-Saharan Africa takes more than one business day. This isn’t just inconvenient – it’s costly. Businesses need to maintain extra working capital to cover the time their funds are stuck in transit. On top of that, average B2B payment fees in Africa stand at 3%, nearly double the global average of 1.6%. These inefficiencies highlight why alternative solutions, like stablecoins, are gaining attention.

And then there’s the added headache of currency conversion.

Exchange Rate Fluctuations in International Trade

Currency volatility introduces a significant risk to international transactions. With 54 sovereign nations in Africa using dozens of different currencies – many of which lack liquidity with one another – transactions become complicated. Take, for instance, a business in Lagos paying a supplier in Nairobi. It can’t directly convert Naira to Shillings. Instead, the payment converts from Naira to USD or EUR, gets routed through offshore banks, and then converts again to Shillings. This process incurs two separate foreign exchange spreads and multiple fees.

The issue is compounded by settlement delays of 3–7 days. Exchange rates fluctuate constantly, and businesses are exposed to this risk the entire time their funds are in transit. In Nigeria, where inflation hit 21.88% in July 2025, even a minor rate change during this period can erase profit margins. By 2024, Nigeria faced $7 billion in matured foreign exchange obligations, leaving foreign airlines owed over $700 million because businesses couldn’t access the USD needed to pay their international partners.

"African businesses and the global enterprises who work across many countries on the continent are not just managing supply chains; they are managing volatile FX portfolios."

– Sebastien Davies, Principal, Aquanow

These complexities only deepen the inefficiencies, especially in regions where banking access is limited.

Banking Access Barriers

Roughly 1.4 billion adults worldwide don’t have access to banking services, including one in six adults in Kenya. Without a bank account, these individuals are effectively locked out of formal international payment systems. They can’t receive remittances from family abroad, pay for imported goods, or engage in global commerce.

Even for those with bank accounts, the system isn’t much easier. Around 80% of cross-border payment transactions from African banks are routed offshore for clearing and settlement by foreign institutions. This adds layers of complexity, drives up costs, and extends delays. The result? The very people who most need affordable international payment options are the ones most excluded. Stablecoins offer a potential solution to these systemic barriers, providing a way to bypass traditional banking hurdles.

How Stablecoins Are Changing Cross-Border Payments – Beyond the Cards #17

How Stablecoins Solve Cross-Border Payment Problems

Stablecoins tackle many of the challenges associated with traditional cross-border payments by using blockchain technology to create a system that’s faster, cheaper, and more reliable. Let’s break down how they achieve this.

Stability Through Dollar Pegging

Stablecoins like USDT and USDC maintain a 1:1 peg to the U.S. dollar by holding reserves in traditional currency or liquid assets such as short-term U.S. Treasuries, which are kept in independent custody. This setup ensures that one USDC is always equal to one dollar, offering price stability that most cryptocurrencies can’t match due to their volatility.

For businesses involved in global trade, this stability is a game changer. Traditional cross-border payments often take 3–7 days to process, during which fluctuating exchange rates can create financial uncertainty. With stablecoins, transactions settle almost instantly, guaranteeing that the recipient gets the exact intended value. In regions with high inflation or limited access to hard currency, stablecoins act as a "dollar substitute", allowing businesses to hold and transact in a stable global currency without needing a U.S. dollar bank account. For example, as of December 2025, Tether (USDT) had a market capitalization exceeding $184 billion, demonstrating widespread confidence in its dollar peg.

Lower Transaction Costs

Stablecoins significantly reduce transaction fees by bypassing the need for correspondent banking networks. Blockchain fees for stablecoin transfers are often just a few cents, regardless of the amount being sent.

This cost advantage is especially evident in remittances. Traditional remittance services charge an average fee of 6.4% globally, with fees climbing to 8.37% in Sub-Saharan Africa. In contrast, stablecoin-based transfers can lower these costs to under 3%. This makes them particularly valuable for individuals and small businesses. In June 2025, Visa expanded its stablecoin settlement services to the CEMEA region (Central and Eastern Europe, Middle East, and Africa) through a partnership with Yellow Card, processing over $225 million in stablecoin settlements globally.

"Stablecoins solve multiple pain points in cross-border transactions. They’re faster, cheaper, and still connected to familiar systems like bank accounts and mobile money wallets." – Mori Sylla, West Africa Commercial and Operations Lead, Due

Instant Global Transactions

Unlike traditional systems that can take days to settle, stablecoins operate continuously, completing transactions in seconds or minutes. This eliminates delays caused by settlement queues, banking holidays, or time zone differences, directly improving cash flow and working capital for businesses.

In May 2025, Flutterwave launched a pilot program using the Polygon blockchain, enabling merchants to process cross-border transactions with USDC. This solution helped avoid the high fees and slow processing times associated with traditional African payment systems. By December 2025, RedotPay, a fintech specializing in stablecoin payments, had grown to over 6 million users across 100 markets, handling an annualized payment volume of more than $10 billion by offering instant, borderless transactions. In fact, stablecoin transfer volumes reached $27.6 trillion in 2024, surpassing the combined transaction volumes of Visa and Mastercard.

These instant settlements underline the growing role of stablecoins in reshaping cross-border payment systems, particularly in regions like Africa, where digital economies are rapidly expanding. Such advancements highlight how stablecoins are becoming a practical solution for global financial transactions.

sbb-itb-dd089af

Stablecoin Use Cases in Africa

Across Africa, startups are turning to stablecoins to revolutionize cross-border remittances and business payments. By leveraging blockchain technology, stablecoins help reduce fees and eliminate settlement delays, addressing the unique financial needs of the region. These platforms integrate seamlessly with familiar tools like mobile wallets and bank accounts, making cross-border money transfers easier than ever. Let’s dive into some specific examples that highlight these advantages.

Remittance Platforms for Personal Transfers

Take Yellow Card, for instance – a platform showcasing the transformative role of stablecoins in personal remittances. In November 2024, Yellow Card partnered with Xoom, a PayPal service, to enable cross-border transfers to countries like Cameroon, Ivory Coast, and Senegal. This partnership allows users in the US, UK, EU, and Canada to send money directly to recipients’ mobile wallets or bank accounts through Yellow Card’s stablecoin-powered system.

The impact was immediate. Shortly after incorporating stablecoins, Yellow Card saw a significant shift in transaction preferences: users moved from 100% Bitcoin to 99% USDT. This trend underscores the appeal of stablecoins’ consistent value compared to the volatility of other cryptocurrencies. Additionally, by converting stablecoins directly into local currencies, these platforms slash traditional remittance fees from an average of 8.37% to under 1% in optimized corridors.

Business Payment Solutions for Small and Medium Enterprises

Stablecoins are also reshaping how African businesses manage payments, offering solutions to cash flow and accessibility issues. In May 2025, Flutterwave introduced a pilot program on the Polygon blockchain, enabling merchants to use USDC for instant fund transfers. This approach eliminates the high fees and delays typically associated with traditional banking systems.

Other startups are also stepping up to simplify business transactions. For example, fintech company Due allows businesses and individuals across Africa to transact with over 90 countries instantly. By working with regulated entities and adhering to SOC 2 compliance standards, Due uses stablecoins as a neutral settlement layer, helping businesses overcome liquidity challenges and avoid capital being tied up unnecessarily.

In Zimbabwe, Lipaworld, co-founded by Jonathan Katende, launched an on-demand grocery delivery service in December 2025. This platform lets users abroad purchase family essentials using Circle’s USDC. The service not only minimizes cash risks for local merchants but also provides diaspora communities with a dependable way to support their families. As Katende put it:

"We wanted to go beyond moving money. We wanted to change livelihoods".

Nigeria’s Stablecoin Adoption

Nigeria stands out as Africa’s largest market for stablecoin adoption, with flows exceeding $30 billion amid rising inflation. The country has introduced a formal regulatory framework under the 2025 Investment and Securities Act, placing virtual assets under the oversight of the Securities and Exchange Commission. This regulatory clarity has fueled widespread acceptance of stablecoins as a legitimate payment option.

For Nigerian businesses, stablecoins offer a way to access hard currency when local banks struggle with dollar shortages. With over 80% of cross-border payments from African banks requiring offshore clearing and settlement, stablecoins present a faster alternative, completing transactions in minutes instead of days. This efficiency ensures smoother operations even during liquidity crises, solidifying stablecoins as a practical solution for managing cross-border transactions in Nigeria.

Risks and Safety Measures for Stablecoin Users

Stablecoins offer clear benefits, but they come with their own set of risks. To make the most of them, users need to stay alert, understand the technology, and follow basic safety practices. Here’s how you can protect yourself and your assets.

Protecting Against Scams and Theft

Fraud is a major issue in the world of stablecoins. For example, in June 2025, the United States Department of Justice seized $225 million in USDT tied to an international scam operation known as a "pig butchering" syndicate. In this type of fraud, scammers gain victims’ trust before persuading them to transfer funds.

To safeguard your funds, start with a secure digital wallet from a trusted provider. Enable two-factor authentication and keep your private keys safe – losing them means losing access to your funds permanently. Be wary of unsolicited investment offers, especially those that promise guaranteed returns. Stick to platforms with strong Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, as these measures help reduce fraudulent activity.

In addition to securing your wallet, staying compliant with legal requirements is equally important.

Following Legal Requirements

Understanding and adhering to local regulations is critical when dealing with stablecoins. Rules vary widely by country, and failing to comply could result in frozen accounts or other legal complications. For instance, in May 2025, the fintech company Due demonstrated how to navigate these regulatory challenges by meeting international standards, including Virtual Asset Service Provider (VASP) registration and SOC 2 compliance.

Before using stablecoins, check their legal status in your country and in the country of the recipient. Some nations ban virtual assets entirely, while others require specific licenses for service providers. As Mori Sylla pointed out:

"Some countries have banned the use of virtual assets. It’s one of the biggest challenges".

When converting stablecoins back to your local currency, use services that work with regulated banks or mobile money platforms. Avoid informal channels or "black market" exchanges, as these could lead to account freezes or other issues.

Choosing Reliable Stablecoin Issuers

The stability and security of your funds depend heavily on the issuer behind the stablecoin. The collapse of TerraUSD (UST) in May 2022 is a prime example. This algorithmic stablecoin lost its peg to the US dollar, plunging to just 10 cents and triggering a "death spiral" that wiped out $40 billion in investor value. Even established issuers have faced scrutiny; in October 2021, Tether was fined $41 million by the CFTC for misleading consumers about its fiat reserves, which were found to be fully backed only 27.6% of the time between 2016 and 2018.

To minimize risks, choose stablecoins that provide monthly, independently audited reports of their reserves. Opt for coins backed 1:1 by high-quality liquid assets such as cash or short-term US Treasury bonds held in regulated financial institutions. Look for issuers that comply with frameworks like the US GENIUS Act or the EU’s MiCAR regulations, which require transparency in reserve management and regular public disclosures. Avoid algorithmic stablecoins, as these rely on code rather than physical reserves and are more likely to lose their peg during market turbulence. Tools like Proof of Reserve offer real-time verification of collateralization, giving you added peace of mind.

Conclusion

Stablecoins are changing the game for cross-border payments by tackling three major pain points: currency instability, high transaction fees, and slow processing times. Pegged to the US dollar and driven by blockchain technology, stablecoins eliminate the need for traditional banks that often charge hefty fees and cause delays. In 2024 alone, stablecoin transfers hit an impressive $27.6 trillion, outpacing the combined transaction volume of Visa and Mastercard.

In regions like Africa, where remittance fees average 8.37% – far above the UN’s target of 3% – the impact of stablecoins is striking. For example, a pilot program in Cameroon slashed fees from 20% to 5.3%, saving merchants approximately $16,200 in just six months. Unlike traditional payments, which can take three to seven business days to process, stablecoins settle transactions in minutes and operate around the clock. These advantages highlight their growing role in reshaping financial systems.

The numbers back this up. Between July 2023 and June 2024, Nigeria alone processed nearly $22 billion in stablecoin transactions. By June 2025, Visa had expanded its stablecoin settlement services to the CEMEA region through a partnership with Yellow Card, building on over $225 million in global stablecoin settlements. These examples show that stablecoins aren’t just a concept – they’re actively revolutionizing how international payments are handled.

Whether you’re sending money to loved ones abroad, paying overseas suppliers, or safeguarding your savings from local currency fluctuations, stablecoins present a practical alternative to traditional banking. To get started, opt for regulated platforms that work with mobile money systems, choose issuers with transparent reserves, and stay up to date on local regulations. The move toward digital cross-border payments is gaining momentum, and stablecoins are at the forefront of this shift.

FAQs

How do stablecoins stay stable in volatile markets?

Stablecoins hold their value by being linked to a stable asset, such as fiat currency (like the U.S. dollar), commodities (like gold), or even other cryptocurrencies. This connection ensures that each stablecoin remains tied to a consistent and predictable value.

In some cases, stablecoins rely on algorithmic systems to maintain their stability. These mechanisms automatically adjust the coin supply based on market conditions, helping to balance value even during periods of volatility.

What are the main advantages of using stablecoins for cross-border payments in Africa?

Stablecoins are reshaping cross-border payments across Africa by tackling persistent issues like steep fees, delays, and unpredictable currency values. These digital currencies are tied to stable fiat currencies – like the U.S. dollar – helping them maintain a consistent value. This reliability shields recipients from wild currency swings, ensuring they keep the full value of their funds.

When it comes to speed and cost, stablecoins outshine traditional payment methods. Transactions settle within minutes rather than days, and fees are a fraction of what conventional providers charge. This makes them a game-changer for people sending remittances or businesses navigating international trade.

Beyond cost and speed, stablecoins are driving financial inclusion. All you need is a smartphone to access a digital wallet, eliminating the need for traditional banks. This opens up opportunities for freelancers, small business owners, and remote communities to engage securely and efficiently in the global economy.

What steps should I take to safely use stablecoins for payments?

To use stablecoins safely, it’s essential to stick to a few best practices:

- Pick reliable, regulated stablecoins: Go for stablecoins issued by well-known companies that provide regular third-party audits to confirm their reserves are fully backed. This helps reduce the risks tied to unregulated issuers.

- Choose platforms with strong compliance measures: Use exchanges or wallets that enforce strict Know-Your-Customer (KYC) and anti-money-laundering (AML) policies. These platforms often include consumer protection features like clear terms of service and dispute resolution processes.

- Secure your digital assets: Protect your private keys by using hardware wallets, and always enable two-factor authentication for your wallets and exchanges. Keep your software updated and consider spreading your holdings across different assets to lower risk.

By following these steps, you can enjoy the convenience and cost-efficiency of stablecoins while keeping potential risks in check.

Related Blog Posts

- 5 Challenges in Cross-Border Mobile Payments and Solutions

- Why African Merchants Struggle with Cryptocurrency Adoption

- Q&A: Blockchain’s Role in African Remittances

- Stablecoin Adoption: Ripple USD (RLUSD) Gains Traction in Africa