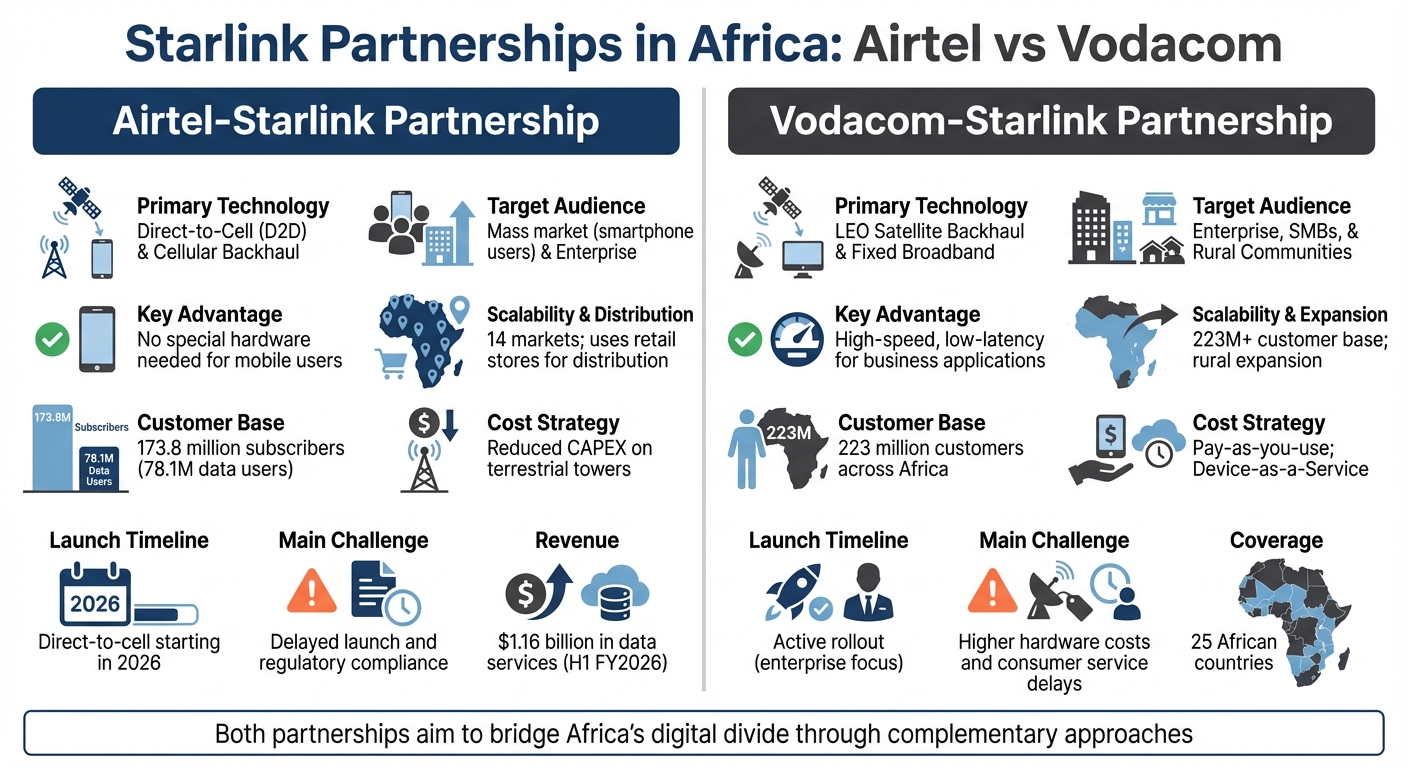

Africa’s connectivity challenges are driving unexpected alliances. In late 2025, Starlink joined forces with Airtel Africa and Vodacom Group to improve internet access in underserved regions. Here’s what you need to know:

- Airtel Partnership: Focused on "Direct-to-Cell" technology, allowing standard smartphones to connect directly to satellites without additional hardware. Launching in 2026 across 14 markets.

- Vodacom Partnership: Emphasizing satellite backhaul for enterprise customers, offering services like pay-as-you-use broadband and equipment leasing. Already active in 25 countries.

- Shared Goal: Both partnerships aim to bridge gaps in rural connectivity, supporting schools, healthcare, and industries like agriculture and mining.

These collaborations combine Starlink’s satellite capabilities with local telecom expertise, addressing challenges like high infrastructure costs in remote areas. With over 396 million combined customers, Airtel and Vodacom are poised to extend reliable internet access to millions across Africa.

1. Starlink-Airtel Partnership

Technology Type

Airtel Africa is incorporating Starlink’s Direct-to-Cell (D2C) technology and cellular backhauling to bring connectivity to remote regions. With D2C, standard LTE smartphones can connect directly to satellites, bypassing the need for costly cell towers. At the same time, cellular backhauling links isolated ground-based stations to Airtel’s core network via satellite, making it possible to extend coverage to areas where fiber optic cables are not an option. Starlink’s latest satellites offer data speeds that are 20 times faster compared to earlier models.

Launch Timeline

The satellite-to-mobile service is set to launch in Africa by 2026, initially focusing on select text and data applications. By May 2025, SpaceX had secured licenses in 9 of Airtel Africa’s 14 markets, with approvals for the remaining regions still in process.

Customer Scale

As of September 2025, Airtel Africa serves 173.8 million subscribers, with 78.1 million of them using data services. This extensive customer base positions the partnership to make a major impact once the service goes live. Notably, data services have surpassed traditional voice revenue, generating $1.16 billion during the first half of fiscal year 2026 (April–September 2025).

"Next-generation satellite connectivity will ensure that every individual, business, and community has reliable and affordable voice and data connectivity even in the most remote and currently underserved parts of Africa." – Sunil Taldar, CEO, Airtel Africa

This strong subscriber base provides a foundation for targeting key regions effectively.

Key Markets

The partnership covers all 14 Airtel Africa markets, focusing on connecting remote schools, healthcare facilities, rural businesses, and underserved communities. By combining satellite technology with existing infrastructure, the collaboration also aims to improve network resilience during natural disasters and ensure critical services remain operational when terrestrial networks are disrupted.

2. Starlink-Vodacom Partnership

Technology Type

Vodacom has teamed up with Starlink to incorporate Low Earth Orbit (LEO) satellite backhaul into its existing network, creating a hybrid system. Here, Starlink’s satellites serve as data relays, complementing Vodacom’s traditional infrastructure. Unlike Airtel’s direct-to-cell strategy, Vodacom is also authorized to resell Starlink equipment and broadband services. This includes offerings like pay-as-you-use backup internet and a "100% unbreakable" service tailored for critical operations.

This integration builds on Vodacom’s extensive market presence, enhancing accessibility and reliability for customers.

Customer Scale

Vodacom’s reach is massive, with more than 223 million customers across Africa. This partnership significantly extends Starlink’s footprint, especially in areas where traditional infrastructure struggles to keep up. It aligns with Vodacom’s Vision 2030 strategy, which aims to grow its customer base to 260 million and expand financial services to 120 million users within the next five years. By connecting Starlink’s satellite network with Vodacom’s vast audience, the collaboration addresses connectivity challenges in underserved regions.

"Low Earth orbit satellite technology will help bridge the digital divide where traditional infrastructure is not feasible, and this partnership will unlock new possibilities for the unconnected." – Shameel Joosub, CEO, Vodacom Group

This partnership is a step toward making high-speed internet accessible across a broader geographic area.

Key Markets

The collaboration covers 25 African countries where Starlink operates as of November 2025. These include South Africa, Kenya, the Democratic Republic of the Congo, Lesotho, Tanzania, and Mozambique. The initiative focuses on connecting rural schools, healthcare facilities, and industries like mining, oil and gas, agriculture, and tourism. In South Africa, Starlink has committed 2.5 billion South African rand (around $145.6 million) to meet local regulations requiring 30% black ownership. However, its commercial rollout in the country has experienced delays due to these compliance requirements.

"By collaborating with Vodacom, Starlink can deliver reliable, high-speed connectivity to even more customers, transforming lives and communities across the continent." – Chad Gibbs, Vice President of Starlink Operations, SpaceX

Vodacom Partners with Elon Musk’s Starlink: What This Means for Africa’s Internet Future

sbb-itb-dd089af

Advantages and Disadvantages

Starlink-Airtel vs Starlink-Vodacom Partnership Comparison in Africa

Examining the operational details of these partnerships reveals the practical tradeoffs involved in their implementation across Africa.

Each collaboration comes with its own strengths and challenges that influence its rollout and adoption.

The Airtel-Starlink partnership relies on Direct-to-Cell technology, which allows standard smartphones to connect directly to satellites – no special hardware required. This setup significantly reduces the need for costly terrestrial towers, keeping capital expenditures down. Scheduled to launch in 2026 across 14 markets, this approach holds promise but faces regulatory challenges, such as South Africa’s requirement for a minimum 30% local ownership by historically disadvantaged groups, which could slow progress.

On the other hand, the Vodacom-Starlink partnership focuses on enterprise and small business customers, offering flexible pricing models like pay-as-you-use and device-as-a-service. These options help lower upfront hardware costs. With a massive customer base of over 223 million, this partnership is well-positioned to serve industries like mining, oil and gas, and agriculture. However, customers must purchase or lease satellite terminals, which makes the initial investment higher.

| Feature | Airtel-Starlink Partnership | Vodacom-Starlink Partnership |

|---|---|---|

| Primary Technology | Direct-to-Cell (D2D) & Cellular Backhaul | LEO Satellite Backhaul & Fixed Broadband |

| Target Audience | Mass market (smartphone users) & Enterprise | Enterprise, SMBs, & Rural Communities |

| Key Advantage | No special hardware needed for mobile users | High-speed, low-latency for business applications |

| Scalability | 14 markets; uses retail stores for distribution | 223M+ customer base; rural expansion |

| Cost Strategy | Reduced CAPEX on terrestrial towers | Pay-as-you-use; Device-as-a-Service |

| Launch Timeline | Direct-to-cell starting in 2026 | Active rollout (enterprise focus) |

| Main Challenge | Delayed launch and regulatory compliance | Higher hardware costs and consumer service delays |

This table highlights the key benefits and challenges for each partnership. Together, these factors paint a clearer picture of the hurdles and opportunities these alliances bring to Africa’s tech landscape.

Conclusion

The partnerships between Starlink, Airtel, and Vodacom signal a shift from rivalry to collaboration in building infrastructure. Airtel’s Direct-to-Cell technology is set to launch in 2026 across 14 markets, while Vodacom has already begun its enterprise-focused rollout. Together, these efforts aim to bridge connectivity gaps for everyday users and meet the specific needs of industries like mining, agriculture, and energy.

The data speaks volumes about the potential impact. For instance, Airtel Africa generated $1.16 billion in data services revenue during the first half of fiscal year 2026. Starlink’s presence in 25 African countries provides the backbone, while local telecom operators bring essential expertise in market dynamics, regulatory frameworks, and distribution. This collaboration not only enhances internet access but also opens doors to economic growth across multiple sectors.

For businesses, startups, and remote communities, the benefits are tangible. Pay-as-you-use pricing lowers initial costs, while reliable internet ensures smooth operations, even in the most remote locations like schools and health centers. LEO satellites add an extra layer of reliability during emergencies, and tailored solutions cater to industries operating off the grid. This approach offers a practical path to narrowing Africa’s digital divide.

As the rollout continues, stakeholders must keep an eye on regulatory factors, such as South Africa’s 30% local ownership requirement, and prepare for Airtel’s 2026 Direct-to-Cell launch. Success will hinge on balancing technical advancements with compliance, affordability with quality, and investment with long-term sustainability. This partnership model could be a game-changer in achieving widespread connectivity across Africa in the years to come.

FAQs

How will Starlink’s Direct-to-Cell technology improve internet access in remote areas?

Starlink’s Direct-to-Cell (D2C) technology enables smartphones to connect directly to low-Earth orbit satellites, bypassing the need for traditional cell towers. Starting in 2026, Airtel Africa plans to roll out this service in 14 African countries. With D2C-compatible phones, users will be able to access voice, text, and data services, even in areas that previously had no coverage. Essentially, the satellite functions as a cell tower in space.

This breakthrough has the potential to transform connectivity in remote regions. By eliminating the need for costly infrastructure, it lowers expenses, extends internet access to underserved areas, and offers faster, more dependable broadband services. Remote communities stand to gain significantly, with better access to fintech, e-commerce, and online education. Additionally, essential services like health clinics will benefit from reliable internet connections. The technology also shines during power outages or infrastructure disruptions, offering rural areas a dependable solution for staying connected.

What challenges could affect the Starlink and Airtel partnership in Africa?

The partnership between Starlink and Airtel faces several obstacles that could influence its success in Africa. One of the biggest challenges is navigating regulatory barriers. Many governments in the region lack clear frameworks for satellite-based services, and in some cases, political concerns have led to potential restrictions on Starlink equipment.

Another hurdle is the cost of user terminals, which remains steep. For many small businesses and underserved communities, the added burden of paying in foreign currency further limits accessibility. This creates a significant barrier to widespread adoption.

Traditional telecom operators also pose resistance, fearing that satellite services might eat into the revenue generated by their existing infrastructure. On top of that, managing a hybrid system that integrates satellite and terrestrial networks brings additional layers of complexity and expense.

The timeline for rollout, slated for 2026, adds another layer of uncertainty. Between now and then, regulatory shifts, currency instability, or new competitors could disrupt the partnership’s plans, making the road ahead anything but straightforward.

How will the Vodacom-Starlink partnership benefit businesses in Africa?

The partnership between Vodacom and Starlink offers businesses fast and dependable internet in places where traditional options like fiber or cell towers simply aren’t available. By merging Starlink’s satellite technology with Vodacom’s mobile network, companies can access low-latency, high-speed connections – perfect for tasks like running cloud-based applications, hosting video calls, and managing data-intensive operations.

What’s more, Vodacom’s role as a reseller of Starlink equipment and services makes it easier for businesses to get everything they need from a single provider. This streamlined approach not only helps cut costs but also simplifies support and extends connectivity to underserved regions. With this collaboration, industries like fintech, e-commerce, and remote work can expand into new areas, powered by scalable internet solutions designed to meet future demands. This partnership is set to drive innovation and growth across Africa.

Related Blog Posts

- Top 7 African Countries Using Partnerships for Rural Internet

- Guide to Rural Telecom Infrastructure in Africa

- AI Startups in Africa: Role of Infrastructure Policies

- How mmWave Improves Internet Access in Africa