Generative AI is transforming banking in Africa by addressing key challenges like long wait times, limited access in rural areas, and language diversity. By analyzing unstructured data, it enables banks to offer personalized services, multilingual chatbots, fraud detection, and simplified onboarding processes.

Key insights:

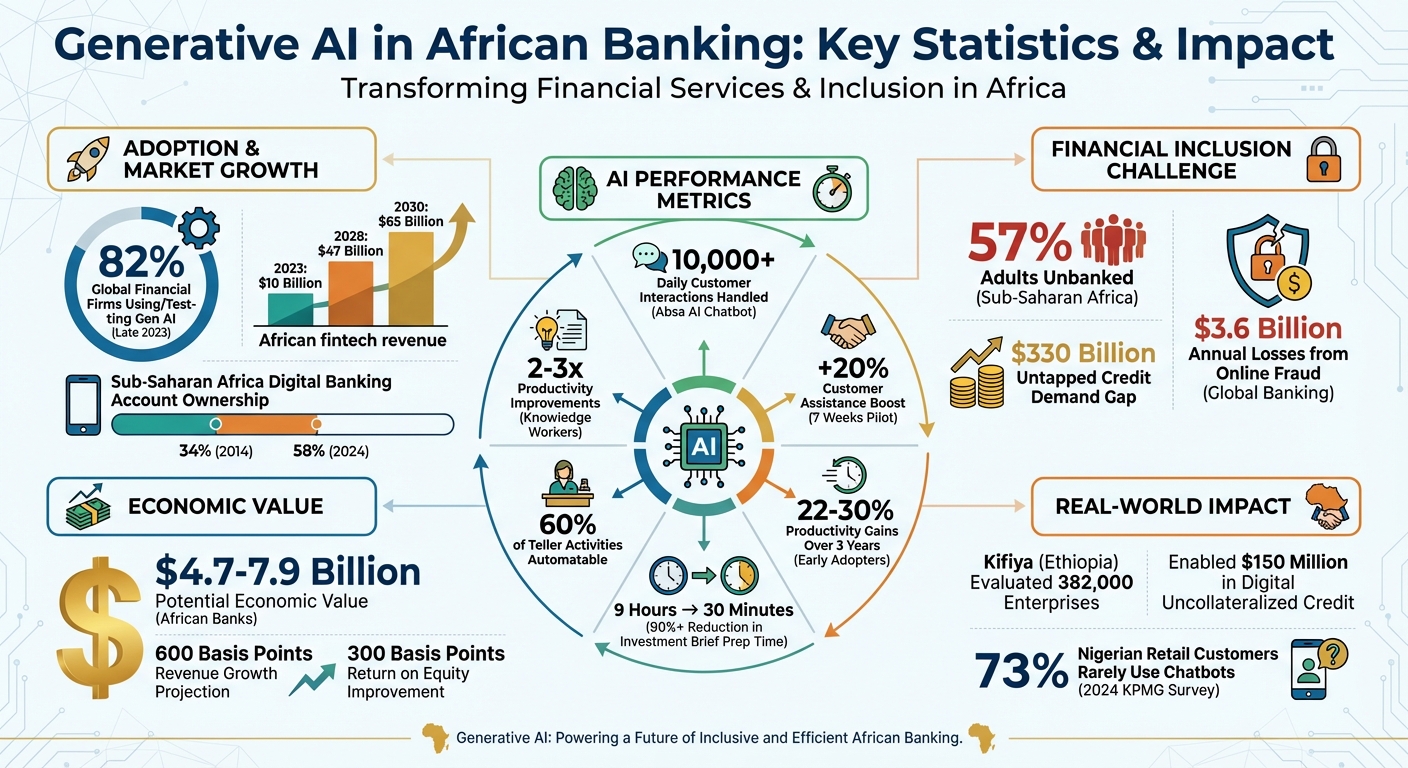

- 82% of financial services firms globally were using or testing generative AI by late 2023.

- AI-powered chatbots reduce wait times and handle thousands of daily interactions.

- Tools like AI-driven credit scoring help individuals without formal credit histories access loans.

- AI supports multilingual communication, expanding access across Africa’s diverse linguistic landscape.

Despite the progress, challenges like outdated systems, regulatory hurdles, and uneven internet access remain. However, banks investing in AI are seeing faster service, improved customer trust, and increased financial inclusion. With fintech revenue in Africa expected to grow to $65 billion by 2030, AI is set to play a critical role in shaping the future of banking across the continent.

Generative AI Impact on African Banking: Key Statistics and Growth Metrics

Customer Experience Challenges in African Banking

Main Customer Experience Problems

African banks face a range of obstacles that make delivering smooth customer experiences difficult. Long wait times at physical branches are common, and rural populations often have limited access to banking services. On top of that, unreliable electricity and underdeveloped data centers disrupt the consistency of digital services, making it hard to rely on online banking solutions.

A staggering 57% of adults in Sub-Saharan Africa remain unbanked, leaving a $330 billion gap in untapped credit demand across the region. Traditional banking models often exclude individuals who lack formal credit histories, even though many have legitimate financial needs. Language diversity across 54 countries and low levels of digital financial literacy further complicate the customer experience, making it difficult for people to navigate complex banking products.

Another pressing issue is the rise in online fraud, which contributes to over $3.6 billion in annual losses for the global banking sector. This erodes customer trust in digital channels. Adding to the frustration, fragmented customer service systems force users to interact with multiple channels for different needs, creating inconsistent and often inefficient support experiences.

These persistent challenges have driven an increasing focus on AI-powered solutions to transform banking in Africa.

AI Adoption in African Banks

AI is quickly becoming a key tool for African banks to tackle customer experience challenges. For example, Absa Bank has introduced an AI-powered chatbot that handles more than 10,000 customer interactions every day. This has dramatically reduced wait times and made customer support more scalable.

The growth of digital banking in Sub-Saharan Africa is undeniable. Between 2014 and 2024, account ownership through formal banks or mobile money services surged from 34% to 58%. In early 2025, UBA doubled down on its digital transformation efforts by rebranding its "Advanced Analytics" unit as "Artificial Intelligence & Advanced Analytics" and appointing a Chief AI Officer to drive efficiency. Meanwhile, in Ethiopia, Kifiya has used AI to evaluate creditworthiness for over 382,000 micro, small, and medium enterprises, enabling roughly $150 million in digital, uncollateralized credit – no traditional banking history required.

Despite these advancements, AI adoption is not uniform across the continent. A 2024 KPMG survey revealed that 73% of retail banking customers in Nigeria rarely use bank chatbots. As a result, many institutions are prioritizing internal AI applications, like summarizing customer feedback and automating document processing. Employees at major banks are also turning to tools like ChatGPT and Microsoft Co-Pilot to simplify complex tasks, such as breaking down legal jargon in corporate account applications. This shift has cut processing times from 20 minutes to just seconds.

"The companies that will win are those that invest completely in modelling localised data, and in understanding the nuances of that data, within the financial sector and beyond." – Dr. Olumide Okubadejo, AI Strategist

Regulatory and Infrastructure Factors

While AI offers tremendous potential, regulatory and infrastructure challenges continue to pose hurdles. Data protection laws, such as Nigeria’s NDPR, require banks to carefully manage customer privacy and address algorithmic bias, adding layers of complexity to AI adoption. In South Africa, frequent electricity disruptions and rising inflation force banks to juggle innovation with cost management.

Legacy systems represent another significant barrier. Many banks operate on outdated, non-cloud-enabled infrastructure with siloed data, preventing a unified view of customer information. Additionally, there is a notable talent gap in areas like prompt engineering, model fine-tuning, and AI-driven data management.

Access to mobile and internet services also varies widely across Africa, influencing how customers engage with AI-powered tools. Addressing these foundational issues is essential to unlocking the full potential of AI in the banking sector. Despite these challenges, the future looks promising – Africa’s fintech revenue is projected to grow thirteenfold, reaching $65 billion by 2030.

sbb-itb-dd089af

How Generative AI Improves Customer Experience

AI Chatbots for Multi-Channel Support

Banks across Africa are now leveraging generative AI chatbots to provide around-the-clock support across multiple channels. Take Zenith Bank, for example. In August 2021, they introduced ZiVA (Zenith Intelligent Virtual Assistant) on WhatsApp. This chatbot allows customers to handle tasks like opening accounts, checking balances, transferring funds, topping up airtime, paying bills, and even applying for loans – without ever stepping into a branch. As Group Managing Director Ebenezer Onyeagwu put it, this move was "driven by the need for additional secured channels of communication with our customers as we deepen our retail penetration".

These AI tools are designed for natural conversations, so instead of navigating complicated menus, customers can simply say things like "pay my mother", and the chatbot takes care of the rest. Results have been promising: during a pilot program, a generative AI chatbot boosted customer assistance by 20% within just seven weeks. Beyond chatbots, banks are also using AI "co-pilots" to assist front-office staff, cutting down on hold times and ensuring consistent answers to complex questions. Early adopters of this technology in banking could see productivity gains of 22% to 30% over three years.

Generative AI doesn’t stop there – it’s also reshaping how financial advice is delivered.

Personalized Financial Advice and Product Recommendations

Generative AI goes beyond efficiency by personalizing financial advice. By analyzing data like transaction histories, income trends, and spending habits, AI can recommend tailored investment options, savings plans, and insurance products. It even incorporates alternative data – such as social media activity and online shopping behavior – to assess creditworthiness for individuals who lack formal credit histories.

"Generative AI can go beyond these limited factors and incorporate a broader range of data points… such as social media behaviour, online shopping patterns, and even sensor data from wearable devices." – Marius Van den Berg, EY Africa Financial Services Leader

In August 2023, Nedbank in South Africa explored 40 AI and data analytics use cases, including "Copilot" in collaboration with Microsoft. This initiative aims to improve "next-best-action" strategies and increase cross-selling to its 2.8 million digitally active clients, who make up 69% of the bank’s retail main-banked customers. CEO Mike Brown highlighted the bank’s progress:

"We have already delivered a number of AI solutions that have generated benefits by utilising machine learning and data science techniques to make intelligent data‐driven decisions"

Simplified Digital Onboarding

Generative AI is also making account setup, Know Your Customer (KYC) processes, and loan applications quicker and easier. Customers can interact with AI chatbots that ask relevant questions in a conversational tone, completing the entire process in minutes. For instance, Zenith Bank integrates this technology into WhatsApp, enabling users to open accounts without downloading extra apps or visiting a branch.

AI also uses semantic search to simplify how customers find financial products. Instead of needing precise terms, users can express their goals, like "I want to save for my child’s education", and the AI suggests tailored product bundles.

Fraud Detection and Real-Time Alerts

While improving customer convenience, generative AI also strengthens fraud detection. By learning from extensive fraud patterns, it spots unusual transactional behaviors more effectively than older systems. It even analyzes unstructured data – like social media posts, news, and customer interactions – to detect risks that traditional methods might overlook. When suspicious activity is flagged, customers receive immediate alerts with clear instructions, boosting both trust and security.

In early 2025, United Bank for Africa (UBA) emphasized its commitment to AI by renaming its "Advanced Analytics" team to "Artificial Intelligence & Advanced Analytics." This change reflects a strategic focus on AI-driven compliance and fraud detection. Sterling Bank’s Managing Director Abubakar Suleiman summed up the urgency:

"If we fail to pay attention to artificial intelligence, all our efforts at ease of doing business will come to nought. Companies that fail to embrace AI will become less competitive and they will die"

Multilingual AI for Financial Inclusion

Africa’s rich linguistic diversity has often posed challenges to financial accessibility, but generative AI is breaking down these barriers. Multilingual AI chatbots now enable banks to serve underbanked communities in their native languages. This inclusivity ensures that customers who are less comfortable with English or French can still navigate banking products and services effectively.

Dr. Olumide Okubadejo, an AI strategist, highlighted this shift in perspective:

"Before, it was: ‘How can we integrate this fun, interesting tool into our systems?’ But now, there’s a thought process around: ‘How can AI drive tomorrow’s sense of what banking should be?’"

How to Implement Generative AI in African Banking

Evaluating Readiness and Setting Goals

Start by assessing your current infrastructure. A recent study highlights that 37% of bankers lack confidence in their institution’s technological capabilities, including infrastructure, controls, and available talent. Legacy systems often present the biggest hurdles – outdated architectures with inefficient data flows can severely limit AI integration.

Instead of asking, "Can our systems handle AI?" take a "future-back planning" approach. Think about what your banking services should look like for customers in three years and work backward to identify the technology and data you’ll need. Focus on areas with the most immediate impact. For instance, if your customer service team is overwhelmed or onboarding processes take too long, those are prime candidates for improvement. Launch two or three targeted projects to showcase the potential of AI and build internal support.

These evaluations lay the groundwork for addressing the technical and data needs outlined in the next section.

Technology and Data Requirements

Generative AI thrives on unstructured data – things like chat logs, social media posts, and customer emails – not just the structured data found in traditional systems. To harness this, invest in vector databases and strong data pre-processing pipelines to ensure data quality and accessibility. However, fragmented data ownership and governance often create roadblocks. Establishing a unified data governance framework is essential for scaling AI efforts.

When selecting AI models, smaller, domain-specific models trained on proprietary data often deliver better accuracy and cost-efficiency compared to large, general-purpose models. Deciding whether to build, buy, or partner is critical. Many African banks are collaborating with fintechs or adopting cloud-native, API-enabled platforms to overcome legacy system limitations. Also, ensure your infrastructure has enough server capacity and storage to support AI deployment.

Building AI for Local Users

AI’s value depends on whether customers actually use it. In Africa’s mobile-first environment, interfaces should be lightweight and designed as conversational digital assistants, reducing clicks and screens for simplicity. Natural language interfaces can make interactions more intuitive.

Language support plays a key role in accessibility. AI-driven translation for languages like Amharic, Swahili, and Zulu can expand financial inclusion. Involve frontline staff in testing to ensure the AI feels intuitive and aligns with local cultural expectations.

Customizing AI to meet these local needs helps create accessible and user-friendly banking experiences.

Risk Management and Compliance

Generative AI isn’t perfect – it can produce inaccurate or misleading outputs. That’s why robust human oversight is essential, especially in high-stakes applications like credit scoring. Automated content moderation can serve as an initial safeguard, while technical settings, such as adjusting the "temperature" of AI responses, can help control the system’s creativity.

Data privacy is another critical concern. To comply with stringent data protection regulations, consider using generative AI to create synthetic datasets. These preserve the statistical integrity of real data while protecting sensitive customer information. Governance frameworks should also be updated to address algorithmic bias and ensure fairness in automated decisions.

"For financial institutions, adopting Generative AI is not merely adopting technology; it’s about embracing change and shaping the future of finance."

Cross-functional teams are key. Data scientists should work closely with risk, legal, and compliance experts from the start. This collaborative approach ensures that AI innovation aligns with regulatory requirements while enhancing customer trust and service quality.

Measuring Results and Future Trends

Key Performance Metrics

Once implementation strategies are in place, the next step in the AI transformation journey for African banking is evaluating outcomes and looking ahead to future possibilities. Measuring the impact of AI is absolutely crucial.

Start by assessing active AI user adoption and engagement. For customer-facing tools, metrics like the Customer Effort Score (CES), task success rate, and latency are key indicators of how seamlessly customers can complete their tasks. Faster response times and higher Net Promoter Scores (NPS) are signs of better customer experiences.

Performance metrics can be grouped into three categories: model performance (accuracy and precision), operational efficiency (response time and throughput), and business impact (cost savings and revenue growth). Another useful metric is "Time-to-Proficiency", which tracks how quickly users go from initial exposure to consistent usage – providing insight into the effectiveness of training programs. Interestingly, despite high adoption rates, many firms struggle to extract real value from AI, highlighting the importance of tracking precise metrics.

Efficiency and Inclusion Results

Generative AI has the potential to unlock between $4.7 billion and $7.9 billion in economic value for African banks. Early adopters are already seeing productivity gains of 22% to 30% over just three years. For instance, banks have slashed the time needed to prepare investment briefs by over 90%, reducing it from nine hours to just 30 minutes.

The implementation of generative AI is projected to boost revenue growth by 600 basis points and return on equity by 300 basis points. Automation is also transforming routine tasks – about 60% of teller activities can now be automated or augmented. Knowledge workers using AI for tasks like report generation are achieving productivity improvements of 2x to 3x. Beyond efficiency, AI is making financial services more inclusive. For example, AI-driven credit scoring, which uses alternative data like social media behavior, is enabling access to credit for people without traditional financial histories. Additionally, AI-powered translation tools for languages such as Amharic, Swahili, and Zulu are helping local startups support small-business owners by automating financial reports in their native languages.

These measurable gains highlight how AI is reshaping banking, paving the way for even more transformative advancements.

Future Developments in Banking AI

Building on these achievements, the future of AI in banking looks even more dynamic. The industry is moving beyond simple chatbots toward "agentic AI" – autonomous systems that can handle complex, multi-step workflows without constant human intervention. This shift underscores the growing importance of AI in the sector. For example, in July 2025, United Bank for Africa renamed its "Advanced Analytics" team to "Artificial Intelligence & Advanced Analytics" under a directive from its Group Managing Director, signaling a deeper commitment to AI adoption.

"Before, it was: ‘How can we integrate this fun, interesting tool into our systems?’ But now, there’s a thought process around: ‘How can AI drive tomorrow’s sense of what banking should be?’"

– Dr. Olumide Okubadejo, AI Strategist

Expect AI to take personalization to the next level. Instead of generic marketing, banks will use AI to create real-time, tailored content based on individual customer profiles. Another exciting trend is "adaptive banking", where AI dynamically designs or reconfigures financial products to align with market conditions and customer needs. Traditional menu-based systems are also fading, as natural language interfaces promise to simplify user experiences.

With African fintech revenues expected to grow from $10 billion in 2023 to $47 billion by 2028, the pressure to adopt these innovations will only increase. The race to stay competitive is just beginning, and AI is at the forefront of this transformation.

AI, Banks and the Unbanked: Can Technology Fix Nigeria’s Financial Inclusion Gap?

Conclusion

Generative AI is reshaping the African banking landscape in ways that are both measurable and transformative. For example, it has slashed the time needed to prepare investment briefs by over 90%. Beyond operational efficiency, AI is also playing a crucial role in expanding financial access, offering innovative solutions to millions of unbanked individuals.

This progress is challenging banks to rethink how they engage with their customers. The institutions that will lead the way are those designing solutions tailored to the unique needs of African markets. As Dr. Olumide Okubadejo aptly puts it:

"The companies that will win are those that invest completely in modelling localised data, and in understanding the nuances of that data, within the financial sector and beyond"

Sterling Bank’s Managing Director, Abubakar Suleiman, offered a stark warning earlier this year:

"Companies that fail to embrace AI will become less competitive and they will die"

To stay ahead, banks must address critical risks while embracing innovation. Success hinges on a balanced strategy: using AI tools to boost internal productivity, investing in localized data modeling, creating robust governance systems, and ensuring human oversight for high-stakes decisions. The technology is ready, but the real challenge lies in whether institutions can reimagine banking to meet the needs of Africa’s next generation.

FAQs

How is generative AI helping rural communities in Africa access banking services?

Generative AI is transforming banking in rural African communities by closing gaps in financial services. AI-driven chatbots and virtual assistants, designed to understand local languages and dialects, offer around-the-clock support for tasks like checking account balances, applying for loans, and managing transactions – all without the need for a physical bank branch.

By examining alternative data sources, such as mobile money activity and seasonal farming trends, AI enables quicker and more cost-effective credit-risk evaluations. This allows banks to provide microloans and savings options to individuals who don’t have traditional credit histories. On top of that, AI-powered fraud detection tools enhance trust by reducing risks, while automation helps cut operational expenses, making it easier for banks to reach remote areas.

As mobile banking continues to grow across Africa, generative AI is delivering personalized financial services straight to users’ phones, giving rural communities unprecedented access to the formal financial system.

What challenges do African banks face when adopting AI technologies?

African banks encounter several obstacles when trying to integrate AI technologies into their operations. One of the biggest challenges is regulatory uncertainty. With guidelines for AI use in areas like customer interactions and decision-making still in development, banks are often forced to take a cautious approach, limiting their efforts to smaller-scale implementations.

Another significant issue is the high cost of adopting AI. Modernizing outdated systems, investing in advanced computing infrastructure, and paying for AI model licenses can be a heavy financial burden, particularly for banks operating on tight budgets. On top of that, many banks face a shortage of skilled professionals in AI and data science, which slows down their ability to fully leverage these technologies.

The problem doesn’t stop there. Poor data quality and fragmented systems make it even harder to implement AI effectively. Since reliable and well-structured data is essential for any AI solution to work, this lack of quality data can derail progress. Lastly, moving from small-scale pilot projects to full-scale AI deployment poses its own set of challenges. Banks often struggle with unclear ROI metrics, a lack of governance frameworks, and internal resistance to adopting new and fast-changing technologies.

How is AI helping banks in Africa overcome language barriers?

Generative AI is changing the game for how banks in Africa connect with their customers by enabling smooth communication in a variety of local languages and dialects. With advanced AI models capable of translating and generating text in real time, a single chatbot can now act as a multilingual assistant. This means customers can access banking services in languages like Swahili, Yoruba, Amharic, and Hausa, breaking down language barriers and making banking accessible to more people.

On the operational side, AI is streamlining internal processes by transforming unstructured customer messages into structured data, efficiently routing queries, and generating documents in multiple languages. This reduces the need for human translators, speeds up response times, and ensures customers receive consistent service. Thanks to AI, users can handle transactions, get support, and communicate in the language they’re most comfortable with, while banks provide scalable and tailored services to diverse linguistic communities.

Related Blog Posts

- Solving Africa’s Tech Talent Gap with AI Training

- The Rise of AI Startups in Africa: Tools, Trends & Talent

- AI Adoption in Africa 2025: South Africa Leads, Others Catch Up

- Zoho Insights: Why “Augmented Teams” Are Africa’s AI Future