African nations are prioritizing data sovereignty by hosting data locally to protect sensitive information, comply with regulations, and boost their economies. Here’s why this matters:

- Data Sovereignty Defined: Ensures data generated within a country’s borders is governed by its laws, avoiding foreign surveillance and retaining economic value.

- Regulatory Push: Countries like Nigeria and South Africa mandate local storage for sensitive government, financial, and healthcare data.

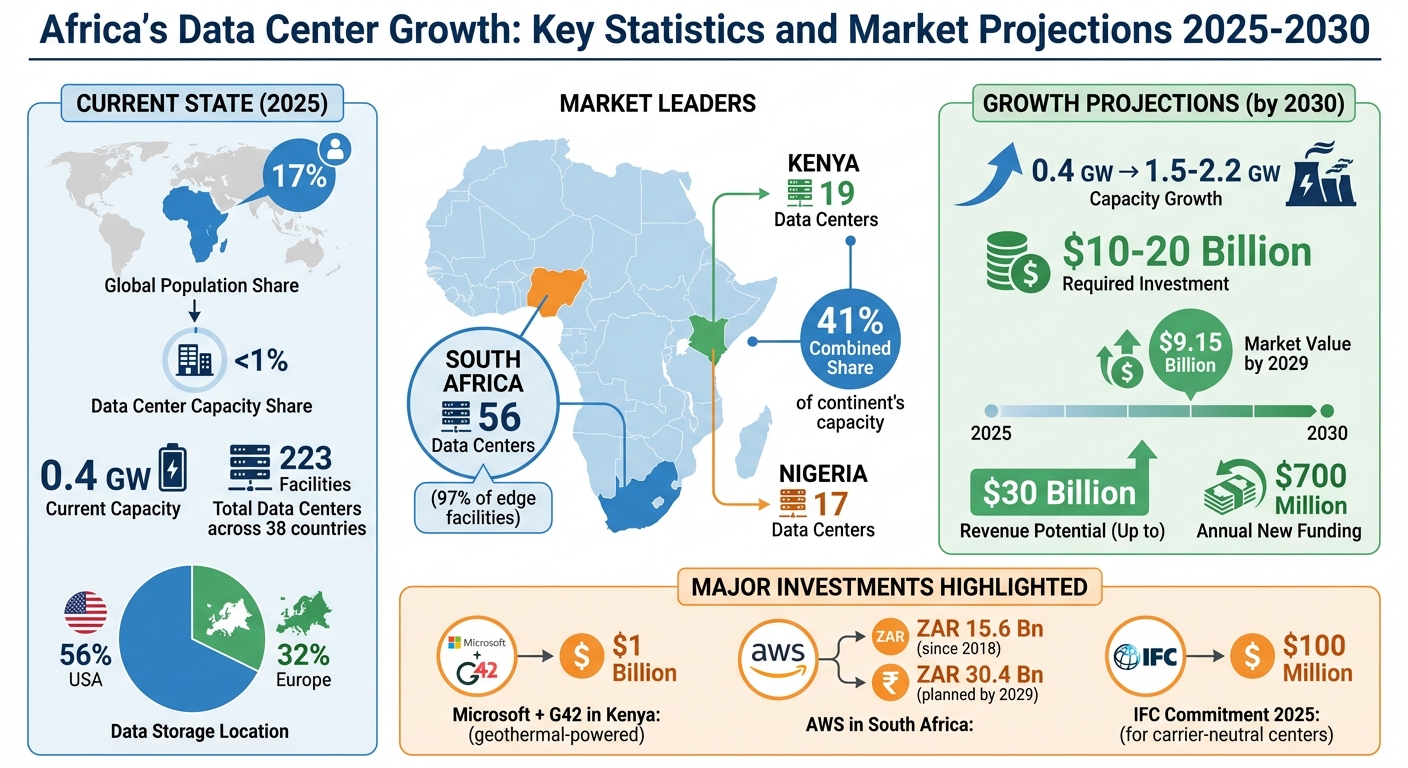

- Economic Opportunity: Africa’s data center market is projected to grow from $0.4 GW in 2025 to up to 2.2 GW by 2030, requiring $10–$20 billion in investment.

- Infrastructure Challenges: Limited power, high costs, and skills shortages hinder growth, but investments in local data centers and fiber networks are addressing these gaps.

- Business Benefits: Local hosting reduces latency, improves security, and aligns with data protection laws, helping businesses cut costs and enhance services.

Africa’s focus on localized cloud solutions is reshaping its digital landscape, balancing regulatory demands with economic growth potential. Up next: a deeper dive into data protection laws and infrastructure developments.

Africa’s Data Center Growth: Key Statistics and Market Projections 2025-2030

Data Protection Laws and Compliance Requirements in Africa

Data Protection and Localization Laws by Country

Across Africa, nations are introducing data protection laws that emphasize local data storage. Take South Africa’s Protection of Personal Information Act (POPIA), for example. Effective since July 1, 2021, this law goes beyond protecting individual data – it also safeguards information related to "juristic persons", such as companies and legal entities. This means businesses in South Africa must handle corporate data with the same care as personal data. Penalties for non-compliance can reach up to 10% of a company’s global turnover.

South Africa’s National Data and Cloud Policy, unveiled in May 2024, further tightens localization rules. According to the policy:

"Government data that incorporates content pertaining to the protection and preservation of national security and sovereignty of the Republic shall be stored only in digital infrastructure located within the borders of South Africa."

- Republic of South Africa, National Policy on Data and Cloud 2024

Other African nations are also stepping up. Kenya’s Data Protection Act imposes strict rules on biometric data. In August 2023, Kenya’s High Court halted Worldcoin‘s biometric campaign, ordering the deletion of all collected iris scans within seven days due to issues with consent and impact assessments. Meanwhile, Nigeria’s National Information Technology Development Agency (NITDA) introduced a data classification framework in February 2025. This framework requires sensitive data from sectors like finance, healthcare, and government to be stored on servers within Nigeria. In addition, South Africa’s Revenue Service (SARS) mandates prior approval to store employee tax information outside the country.

Despite these efforts, Africa faces a data storage challenge. Although the continent is home to 17% of the global population, it accounts for just 1% of the world’s data center capacity. A significant portion of African data – 56% – is stored in the United States, while 32% is housed in Europe. These localization laws aim to shift more of this data back to African soil.

Cross-Border Data Transfers and Government Control

South Africa’s POPIA places strict limits on cross-border data transfers. Data can only be sent to countries with laws offering "adequate protection" similar to South African standards. For sensitive or children’s data, businesses must secure regulator approval before transferring it abroad.

This regulatory environment often forces global companies to adapt by creating localized data storage systems. Instead of benefiting from global economies of scale, businesses face the added costs of building local data centers or forming partnerships with regional providers. These demands are fueling a surge in data center investments. By 2030, Africa’s data center capacity is expected to grow from 0.4 gigawatts (GW) in 2025 to between 1.5 and 2.2 GW, requiring $10 billion to $20 billion in investments.

Several nations are already taking steps to strengthen their data infrastructure. In June 2021, Senegal opened the $18.2 million Diamniadio National Data Centre to reduce reliance on foreign servers. Similarly, Zimbabwe launched its National Data Centre in Harare in February 2021, funded as part of a $98 million broadband initiative backed by the China Export-Import Bank.

At the regional level, frameworks like the African Union (AU) Data Policy Framework and the AU Digital Transformation Strategy (2020–2030) aim to harmonize data governance across member states. However, until these frameworks gain wider traction, businesses will continue grappling with diverse national regulations.

How to Comply with Local Data Regulations

Navigating Africa’s data protection laws requires businesses to adopt clear compliance strategies. The first step is understanding how your data is classified. For instance, Nigeria mandates local hosting for finance, healthcare, and government data, while South Africa requires government data tied to national security to remain within its borders.

In South Africa, appointing an Information Officer and conducting annual impact assessments can help identify compliance gaps. These assessments provide a roadmap for managing data collection, storage, and usage in line with local laws.

When choosing cloud providers, ensure contracts include terms that align with local data residency rules. Many global providers, such as AWS, Microsoft Azure, and Google Cloud, now offer localized solutions. AWS, for example, has invested approximately ZAR 15.6 billion ($850 million) in South Africa since 2018, with plans to invest an additional ZAR 30.4 billion ($1.65 billion) by 2029. Microsoft, on the other hand, is building a geothermal-powered data center in Kenya with a $1 billion commitment.

Alternatively, partnering with local providers can simplify compliance. Companies like Rack Centre in South Africa, Galaxy Backbone in Nigeria, and MainOne across West Africa are designed to meet national regulations. Some, like Okra (Nebula) in Nigeria, even offer billing in local currencies, reducing exposure to exchange rate fluctuations.

As Kashifu Inuwa, Director-General of NITDA, put it:

"By enforcing local data hosting, the government seeks to create a thriving cloud ecosystem that benefits local businesses and consumers."

For businesses with cross-border operations, it’s crucial to ensure that data transfers only occur to countries with legal protections equivalent to local laws. In South Africa, this means compliance with POPIA standards. Ignoring these rules could result in severe financial penalties, making compliance not just a legal necessity but a business imperative.

#1 Next Stop, Africa – Why Should We Care About African Data Centers?

African Cloud Infrastructure Today

Africa’s cloud infrastructure is evolving rapidly, driven by the need to balance regulatory compliance with performance demands.

Data Center Distribution Across Africa

As of mid-2025, Africa is home to 223 data centers spread across 38 countries. However, this growth is uneven, with South Africa leading the way at 56 facilities, followed by Kenya with 19 and Nigeria with 17. These three countries alone account for 41% of the continent’s data center capacity.

South Africa’s dominance is especially notable, hosting 97% of Africa’s edge data centers. Other countries are also expanding: Morocco has 12 facilities, while Tanzania, Mauritius, and Angola have 11, 10, and 8 centers, respectively.

Regional differences are stark. Southern Africa leads with 32 carrier-neutral data centers, followed by West Africa with 20 and East Africa with 17. Central Africa lags behind with just 3 facilities, though this is starting to shift. The Democratic Republic of Congo (DRC) is emerging as a key player, with new facilities in Kinshasa and plans for mining hubs like Goma and Lubumbashi. In 2024, Meta supported this growth by financing the 2Africa cable landing at Muanda, enabling new carrier-neutral data centers in Kinshasa.

Despite these developments, Africa represents less than 2% of global colocation data center capacity, even though the continent makes up 17% of the world’s population. The market is projected to grow significantly, reaching $9.15 billion by 2029.

New Technologies and Investment in African Cloud

The trend of small-scale data centers is giving way to massive campuses built by global hyperscalers to handle AI workloads and meet local data laws. For example, in May 2024, Microsoft and G42 announced a $1 billion investment to develop a 100-megawatt geothermal-powered data center in Kenya’s Naivasha geothermal zone, slated to open in 2026. Brad Smith, Vice Chair and President of Microsoft, called it:

"The single largest and broadest digital investment in Kenya’s history, reflecting our confidence in the country, the government, its people, and the future of East Africa."

Other major players are also making moves. In January 2024, Google Cloud launched its Johannesburg cloud region at a Teraco facility, integrating it with the Equiano subsea cable. Similarly, Oracle signed a 2024 agreement to establish two public cloud regions in Morocco – Casablanca and Settat – marking its first presence in North Africa.

The market is also shifting toward AI-optimized infrastructure. Companies like Mistral AI and Zadara are introducing "sovereign AI clouds" that meet local data regulations while offering high-performance computing. Mistral AI explains:

"Frontier AI should be in your hands. What used to be a choice between a few third-party cloud providers is now the right to build your AI environment to your spec, and own it top to bottom."

Local providers are stepping up too. Nigeria’s Okra (Nebula) and Alibaba Cloud, through BCX, now offer services billed in local currencies, helping businesses manage exchange rate risks.

How Fiber Networks Enable Cloud Expansion

The backbone of Africa’s cloud growth lies in robust fiber optic networks. Subsea cables like Google’s Equiano and Meta’s 2Africa are turning coastal cities into global connectivity hubs, linking Africa directly with Europe, Asia, and the Americas. These cables reduce latency and bandwidth costs, enabling real-time applications like video conferencing, online gaming, and financial trading to thrive on African servers.

This connectivity is closely tied to the growing data center ecosystem. Hyperscale data centers are increasingly colocated with major fiber landing stations to optimize performance. For instance, Google Cloud’s Johannesburg region, launched in January 2024, leverages the Equiano cable to connect cities like Johannesburg, Cape Town, Lagos, and Nairobi. Similarly, Microsoft’s $1 billion facility in Kenya is strategically positioned near key fiber landing points along the Indian Ocean[8,11].

Fiber-supported infrastructure significantly cuts latency – by 50–200 milliseconds – which boosts performance for e-commerce, streaming, and mobile banking. For industries like finance and healthcare, this means meeting data residency requirements without compromising speed.

Terrestrial fiber networks play a crucial role too, extending connectivity from coastal landing points to inland cities and neighboring landlocked countries[8,11]. South Africa’s dense fiber network is a major reason it hosts 97% of the continent’s edge data centers. In contrast, Nigeria’s data centers are heavily concentrated in Lagos, where unreliable power grids force 14 of its 17 facilities to rely on costly diesel generators, consuming 137 MW of power.

Expanding fiber networks also enable private infrastructure, allowing businesses to bypass the public internet with dedicated fiber connections. This improves data reliability, security, and compliance with local data laws. With these advancements, the market is expected to reach $5 billion by 2026, driven by AI adoption and regulatory pressures to keep data within borders.

Why Businesses Benefit from African-Hosted Cloud

Switching to African-hosted cloud infrastructure brings clear advantages for startups, enterprises, and government agencies across the continent. Beyond meeting regulatory requirements, these benefits include faster performance, cost savings, and contributions to local economic growth. It’s part of Africa’s broader push for data sovereignty through localized cloud solutions.

Lower Latency and Better Performance

Hosting data locally means shorter travel distances, which significantly reduces connection delays. When African businesses rely on undersea cables to route traffic through Europe or North America, latency can climb to 300–500 milliseconds. In contrast, local data centers often deliver latency under 50 milliseconds. This faster response time is a game-changer for real-time applications like mobile banking, video conferencing, and online gaming.

Industries that rely heavily on data processing see particular benefits. Fintech platforms handling instant payments, e-health systems accessing medical imaging, and AI-driven tools requiring rapid processing all thrive on high-performance local infrastructure. As Alexis Akwagyiram, Managing Editor at Semafor Africa, notes:

"Proximity to the facilities reduces transit costs for internet service providers, enabling them to cut prices paid by customers. With time, this is likely to have a multiplier effect by stimulating economic activity online."

By improving speed and reliability, local hosting helps African businesses compete on a global scale while serving their local markets more effectively. It also strengthens data integrity and safety.

Stronger Security and Compliance

Local cloud solutions don’t just improve performance – they also enhance security. Hosting data locally avoids potential conflicts with U.S.-based providers, which are subject to laws like the CLOUD Act and USA PATRIOT Act. These regulations can require data disclosure, potentially clashing with African laws such as South Africa’s POPIA.

Local providers are also tailored to meet regional compliance standards, including Nigeria’s NDPR, Kenya’s DPA 2019, and Egypt’s Law No. 151. In contrast, international providers often require costly customizations to align with these frameworks. For critical sectors like government and defense, local providers can offer private cloud solutions that keep data entirely within national borders and off the public internet.

When it comes to cyberattacks, local providers often go beyond standard file-level encryption. Many use advanced techniques like fragment distribution, which splits files into thousands of pieces stored across multiple local nodes. This method renders ransomware attacks ineffective, as the dispersed data cannot be reassembled or encrypted by malware. With Africa seeing a 400% surge in cyberattacks since 2020, this level of protection is becoming essential.

Practical examples highlight these benefits. In 2023–2024, a Tanzanian healthcare network migrated 5 terabytes of patient records and 10 terabytes of medical imaging to a private cloud in Dar es Salaam. Over six months, they achieved full audit compliance, zero breaches in 18 months, and a 30% cost reduction compared to international providers. Similarly, a major South African bank implemented a private cloud in Johannesburg, cutting costs by 40% while maintaining flawless security audit results.

Economic Benefits and Job Creation

Beyond performance and security, African-hosted cloud infrastructure is a powerful driver of economic growth. By 2030, local data center development is expected to generate $20 billion to $30 billion across the value chain. The continent’s data center market alone is projected to reach $9.15 billion by 2029, with Nigeria’s colocation revenue growing at over 18% annually to hit $578 million by 2030.

These projects also create jobs. For example, AWS has generated 2,200 roles in South Africa. Additionally, local currency billing – like Nigeria’s Okra Nebula service – helps businesses avoid exchange rate risks. Local cloud initiatives also address the growing demand for tech skills, with 97% of African organizations identifying skills gaps as a challenge. Migration projects with cloud providers give local IT teams opportunities to learn and grow.

The benefits ripple outward. Cheaper ISP transit costs lead to more affordable internet for consumers, boosting online activity. Data-heavy industries like fintech, e-health, and AI can scale without performance bottlenecks, unlocking new business opportunities and creating jobs across the continent. African-hosted cloud solutions are not just about technology – they’re about enabling the future of business and innovation in Africa.

sbb-itb-dd089af

Obstacles to Building African Cloud Infrastructure

While the advantages of expanding cloud infrastructure in Africa are clear, the road to achieving it is riddled with challenges. These obstacles impact both the providers building data centers and the businesses aiming to adopt local cloud solutions.

Power and Connectivity Problems

One of the biggest hurdles for data centers in Africa is unreliable electricity. For instance, Nigeria’s power grid delivers an average of only four hours of electricity per day. As a result, the country’s 17 data centers rely almost entirely on costly diesel generators, consuming an estimated 137 MW of power capacity by 2025. This heavy reliance on diesel not only inflates operational costs but also makes running data centers in Africa far more expensive than in other regions. To make matters worse, drought conditions intensify the competition for limited water resources, further complicating cooling systems for data centers.

A lack of infrastructure means data centers are concentrated in a few urban hubs. South Africa alone accounts for 97% of all identified edge data center facilities in Sub-Saharan Africa. Moreover, three countries – South Africa, Kenya, and Nigeria – host over 41% of the continent’s total data center infrastructure, leaving smaller markets and rural areas underserved. As Sumit Kanodia, Investment Director at the Emerging Africa Infrastructure Fund, aptly puts it:

"Data center capacity is ‘a fraction of where it needs to be’ in much of the continent to create opportunities for rapid growth."

Although undersea cables have improved international bandwidth, gaps in regional fiber networks and high transit costs for internet service providers continue to hinder local cloud performance. With demand for data center capacity in Africa expected to rise from roughly 0.4 gigawatts (GW) today to between 1.5 and 2.2 GW by 2030, addressing these power and connectivity issues becomes even more pressing. These challenges also pave the way for financial and workforce constraints that further complicate the situation.

High Costs and Skills Shortages

Constructing modern Tier III and IV data centers across Africa requires an estimated $10 billion to $20 billion by 2030, making the financial barrier to entry steep. Even when these facilities are built, the cost of cloud services in Africa often surpasses that of similar services in North America or Europe, despite lower income levels in the region.

The skills gap adds another layer of difficulty. A staggering 97% of African organizations anticipated significant challenges in finding tech talent in 2023, with recruitment cited as the most pressing issue. The problem is exacerbated by brain drain, as skilled professionals are often recruited by international firms offering higher salaries. For instance, a senior developer in South Africa earns around $35,000 annually, compared to over $120,000 for the same role in the United States. To unlock its full economic potential, Africa needs to create about 25 million new IT jobs. However, only 5% of AI talent in Africa currently has access to the advanced computing tools and data centers required for innovation. These economic and talent-related obstacles are further compounded by the complexity of navigating diverse data laws across the continent.

Different Laws Across Countries

Fragmented data protection laws across African nations create significant challenges for businesses looking to scale regionally. For example, countries like Algeria, Gabon, Niger, and Morocco mandate that personal information be stored locally, while nations such as Kenya, South Africa, Tunisia, and Uganda impose strict restrictions on cross-border data transfers. South Africa’s Protection of Personal Information Act (POPIA) is particularly unique, as it extends data protection to "juristic persons" (such as companies and trusts), preventing businesses from leveraging standardized international frameworks like GDPR. Non-compliance can result in penalties as high as 10% of global turnover.

This regulatory patchwork forces businesses to customize solutions for each country, diverting resources from innovation to compliance. Over half of surveyed African tech leaders identified legal and regulatory constraints as major barriers to cloud adoption. Alarmingly, only 10% of these leaders believe that current policies and legal frameworks adequately support cloud adoption. Beyond general data laws, industries like finance, telecommunications, and oil and gas impose even stricter hosting requirements, adding another layer of complexity. Overcoming these legal and regulatory hurdles is essential for the broader adoption of locally hosted cloud solutions, which will be explored further in the discussion.

How to Adopt African-Hosted Cloud Solutions

Adopting African-hosted cloud solutions comes with its challenges – like navigating diverse regulations and infrastructure issues – but it’s entirely possible with the right approach. The trick is finding a balance between meeting compliance requirements and addressing operational needs while choosing suitable partners and deployment models.

Determine Your Data Sovereignty Needs

Start by classifying your data based on its regulatory sensitivity. Not all data needs to be hosted locally; only certain types, like those governed by specific residency laws, require this. For example, South Africa’s National Data and Cloud Policy mandates that government data stays within the country’s borders. Similarly, Nigeria’s NITDA framework requires that sensitive data in finance, healthcare, and government sectors be stored locally.

Beyond legal requirements, consider the reliability of the infrastructure. Kenya is known for its stable, green-energy-supported infrastructure, but grid reliability can vary widely in other regions. To protect your operations, include clauses in your contracts that address potential regulatory changes.

Once you’ve assessed these factors, you can move on to selecting the most suitable cloud model.

Select the Right Cloud Model

Your choice of cloud model should align with the data classifications you’ve established. Public cloud solutions are popular due to their scalability and cost-effectiveness – around 45% of African businesses use this model for their workloads.

For data that’s subject to stricter regulations, hybrid models may be a better fit. These combine public cloud for non-sensitive, scalable workloads with private or colocation facilities for compliance-critical data. If speed and lower upfront costs are priorities, rehosting may work best. However, if you’re looking for enhanced scalability, security, and modernization, refactoring might be the way to go – 40% of leaders in Southern Africa have already adopted this approach.

Infrastructure location also plays a significant role. As of mid-2025, South Africa leads with 56 data centers, followed by Kenya with 19 and Nigeria with 17, collectively accounting for 41% of the continent’s data infrastructure. When choosing a provider, make sure their power backup systems can handle the region’s grid reliability challenges.

Work with Local Providers and Stay Informed

Teaming up with local data center providers can help you meet regulatory requirements while supporting regional growth. For instance, in July 2024, Nigerian fintech company Okra introduced "Nebula", a cloud platform allowing businesses to pay for services in Nigerian Naira. This initiative helps startups avoid the high costs of USD-based billing from global providers. Additionally, in February 2025, Nigeria’s NITDA finalized a framework requiring international providers like AWS and Microsoft Azure to host sensitive financial and healthcare data within Nigeria. This has led to partnerships with local firms such as Rack Centre and MainOne.

With 97% of African organizations reporting tech skills shortages, partnering with system integrators and cloud service providers is essential. Ensure these partners meet international standards (like ISO) and comply with local regulations, such as Nigeria’s Data Protection Act (NDPA) 2023. Given that over half of African tech executives cite legal and regulatory hurdles as major challenges to cloud adoption, staying up-to-date on policy developments is critical. Platforms dedicated to African tech news can help you monitor regulatory changes and new cloud infrastructure projects across the continent.

The Future of African-Hosted Cloud Infrastructure

Africa’s data center market is poised for a major transformation. Despite accounting for just under 1% of global capacity while representing 17% of the world’s population, the market is projected to hit a value of $9.15 billion by 2029. Capacity is expected to grow from 0.4 GW to between 1.5 and 2.2 GW, unlocking up to $30 billion in revenue by the end of the decade.

South Africa, Kenya, and Nigeria currently dominate the market, but investments are starting to flow into emerging economies like the Democratic Republic of Congo, Ethiopia, and Angola. These regions are seeing $700 million annually in new funding, with the International Finance Corporation (IFC) committing $100 million in 2025 to develop carrier-neutral data centers. As Sumit Kanodia, Investment Director at the Emerging Africa Infrastructure Fund, explains:

"Within Africa there is a huge discrepancy… Data center capacity is a fraction of where it needs to be in much of the continent to create opportunities for rapid growth."

This influx of investment is paving the way for policy changes aimed at fostering regional collaboration and meeting ambitious growth targets.

African governments are increasingly focusing on turning data sovereignty into a tool for economic growth. The African Union’s Data Policy Framework and Digital Transformation Strategy (2020–2030) aim to standardize regulations across borders, giving the continent stronger negotiating power with global tech giants, who currently control over 70% of the market. Roland Mwesigwa Banya of New America highlights the importance of this moment:

"The continent’s projected $9.15 billion data center market by 2029 represents a critical juncture where current choices will determine whether Africa achieves genuine digital sovereignty or recreates colonial dependency patterns."

Meanwhile, technological advancements are reshaping the digital landscape. For instance, Microsoft and G42 are investing $1 billion in a geothermal-powered data center in Kenya’s Naivasha zone, set to be operational by 2026. This project combines renewable energy with cutting-edge technology to address power challenges while meeting growing demand. Additionally, the rise of sovereign edge cloud providers and platforms offering local currency billing, like Nigeria’s Okra Nebula, is making African-hosted solutions more accessible and affordable for local businesses.

Collaboration between governments, private companies, and international partners will be critical in the coming years. With 56% of African data stored in the U.S. and 32% in Europe, moving data back to local servers is both a sovereignty goal and a lucrative opportunity. However, success hinges on addressing infrastructure gaps in power and connectivity while crafting policies that encourage, rather than hinder, investment. Striking the right balance between local data residency requirements and participation in global digital trade will be key to unlocking Africa’s full potential in the cloud infrastructure market.

FAQs

What challenges does Africa face in developing its cloud infrastructure?

Africa faces multiple challenges in building out its cloud infrastructure. One of the most pressing issues is power reliability. Frequent outages and an underdeveloped grid not only drive up operating costs but also deter potential investors. On top of that, shortages in water supply, high-speed internet connectivity, and transport infrastructure restrict data center development to a handful of urban areas, leaving much of the continent without adequate coverage.

Regulatory hurdles add another layer of complexity. Fragmented data localization laws and overlapping privacy rules make compliance particularly tricky, especially when it comes to managing cross-border data flows. The lack of a unified, continent-wide approach to data sovereignty only makes the situation more challenging.

Finally, scaling cloud infrastructure across Africa requires a massive financial commitment – experts estimate investments between $10 billion and $20 billion will be needed by 2030. Securing this level of funding remains a significant obstacle to progress.

How do data protection laws differ across African countries?

Data protection laws across Africa are anything but uniform, with each country setting its own rules and enforcement practices. Take Nigeria, for example: its Data Protection Act (NDPA) requires either explicit consent or a valid legal basis to process personal data. Meanwhile, South Africa’s Protection of Personal Information Act (POPIA) goes a step further, safeguarding data for both individuals and organizations. It also limits cross-border data transfers unless equivalent protections are ensured. Over in Kenya, the Data Protection Act insists that sensitive personal data – particularly in industries like finance and telecommunications – be stored within the country.

Some nations, like Ghana and Rwanda, have adopted frameworks inspired by the EU’s GDPR, offering a more structured approach. On the other hand, some African countries still lack comprehensive data protection laws. This patchwork of regulations creates hurdles for businesses operating across multiple borders, making careful compliance planning a must for any cloud-based operations hosted in Africa.

What are the economic advantages of hosting cloud data locally in Africa?

Hosting cloud data within Africa brings notable economic advantages. It keeps a larger share of the continent’s digital spending local, generating employment opportunities in areas like construction, operations, and cybersecurity. On top of that, it directly contributes to GDP growth. With the African digital economy projected to reach $180 billion by 2025, storing data locally ensures that much of this value remains within the region.

Beyond economic benefits, local data hosting offers practical perks for businesses. It reduces latency, improves connection speeds, and lowers operational costs, all of which are particularly valuable for startups and fintech companies. Faster connections not only boost productivity but also encourage greater adoption of cloud services. Countries such as Nigeria, Kenya, Morocco, and South Africa are emerging as major players in the global data center market. These nations are attracting foreign investments and driving advancements in cloud technologies and AI, thereby reinforcing Africa’s digital infrastructure and bolstering economic stability.

Related Blog Posts

- Best Practices for SME Cybersecurity in Africa

- Top 7 African Countries Using Partnerships for Rural Internet

- AI Startups in Africa: Role of Infrastructure Policies

- AfDB Report: AI Could Add $1 Trillion to Africa’s GDP by 2035