Safaricom is investing $500 million to transform itself from a telecom provider into a tech leader by 2030. The company is focusing on AI, fintech, and infrastructure upgrades to support Kenya’s businesses, farmers, and entrepreneurs. Key initiatives include:

- AI-powered M-Pesa upgrades: Fraud detection (89% accuracy), faster transactions (up to 12,000 per second), and real-time issue resolution.

- New Data Centers: The NBOX1 Nairobi Campus, with a 22.5 MW capacity, supports AI workloads and local startups.

- Developer Tools: The Daraja 3.0 API platform enables businesses to integrate directly with M-Pesa, fostering app development.

- Agriculture Solutions: Tools like FarmerAI provide real-time insights to farmers, enhancing productivity.

These efforts aim to position Kenya as a tech hub while addressing local challenges like financial inclusion and agricultural inefficiencies.

M-PESA Fintech 2.0: Africa’s Next-Gen Mobile Money Revolution #MPESANation

AI Integration: Upgrading M-Pesa and Other Services

Safaricom is taking M-Pesa to the next level by embedding AI into its core operations. Transitioning to a cloud-native Fintech 2.0 platform, the company now enables real-time monitoring, fraud detection, and automated issue resolution. These upgrades are part of Safaricom’s broader goal to spearhead Kenya’s digital transformation.

How AI Is Improving M-Pesa

AI is making a big difference in fraud prevention. In June 2025, Safaricom teamed up with Amazon Web Services (AWS) to introduce graph neural networks that analyze user and transaction relationships. This system achieved an impressive 89% accuracy rate (F1 score) in detecting social engineering fraud.

The Fintech 2.0 platform has also significantly increased transaction capacity, jumping from 4,500 to 6,000 transactions per second, with the ability to scale up to 12,000 during peak times. Beyond efficiency, AI is enabling hyper-personalized services. In August 2025, Safaricom and Huawei rolled out an "Idea-to-Cash" solution, which uses natural language processing to turn customer requirements into financial products instantly, cutting launch times from weeks to mere moments.

"By integrating AI-driven capabilities into our core business systems, we are not only enhancing operational efficiency but also enabling faster, more agile product launches."

- James Maitai, Chief Technology Information Officer, Safaricom

AI is also transforming customer support. The Zuri chatbot, now powered by Generative AI through Amazon Bedrock and SageMaker, can handle complex queries for over 30 million M-Pesa users. Meanwhile, the Daraja 3.0 API platform offers AI-enhanced support and advanced security features.

These advancements are laying the groundwork for a scalable AI infrastructure that supports long-term growth.

Safaricom‘s $500 Million AI Infrastructure Investment

To support its AI ambitions, Safaricom has committed $500 million (approximately KES 65 billion) over three years to build AI-ready infrastructure across East Africa. This isn’t just about upgrading servers – it’s about creating a foundation for a thriving AI ecosystem. In May 2025, Safaricom partnered with iXAfrica to establish the NBOX1 Nairobi Campus, a data center with a design capacity of 22.5 megawatts, making it the largest in Greater East Africa. These facilities are tailored for high-density AI computing and advanced data analytics.

To ensure the success of this initiative, Safaricom has trained 5,000 employees in AI fundamentals. Collaborating with AWS, Huawei, Google, and iXAfrica, the company is deploying cloud platforms, machine learning models, and AI-powered business systems. What’s more, this infrastructure isn’t just for Safaricom. It’s designed to support local startups, government agencies, and enterprises that need access to AI capabilities but lack the resources to build their own data centers.

Fintech 2.0: M-Pesa’s Major Upgrades

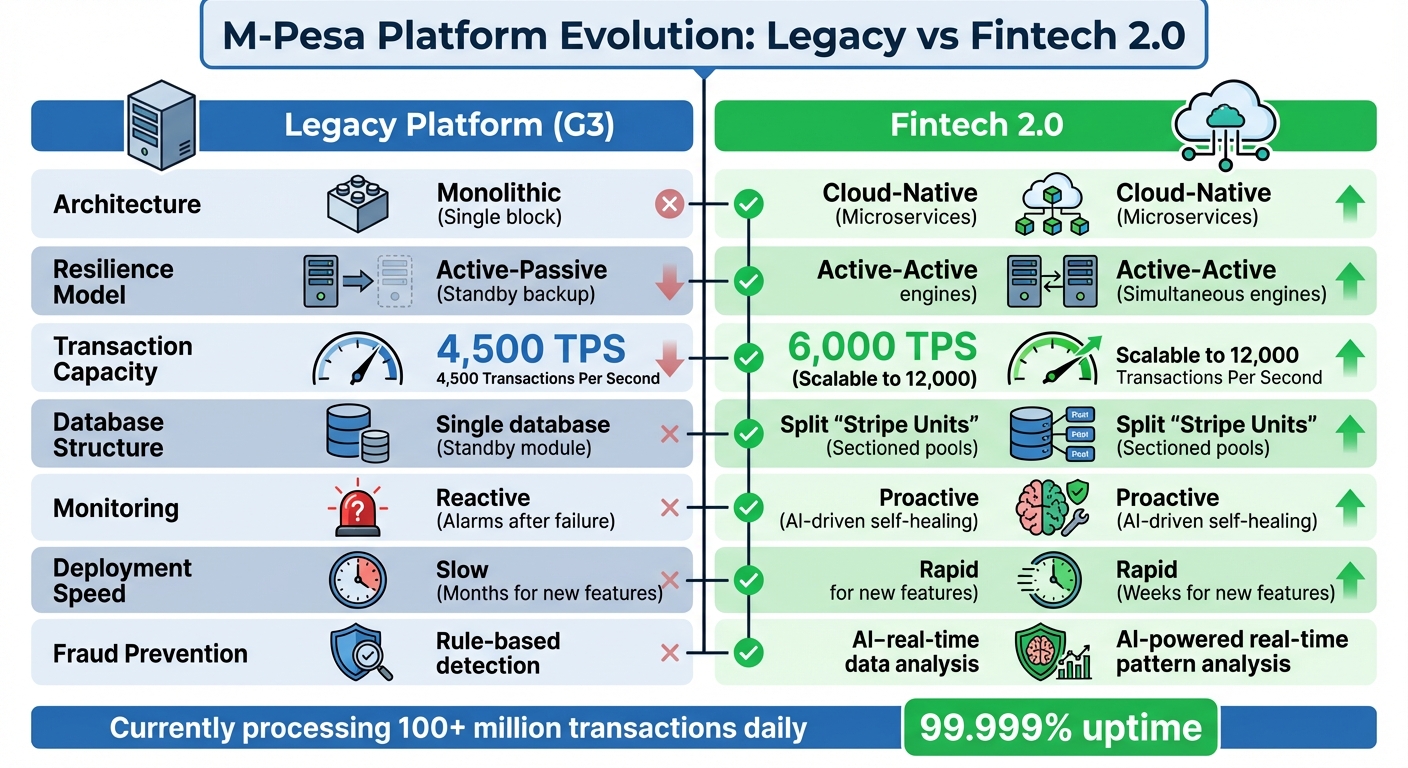

M-Pesa Fintech 2.0 Platform Upgrade: Before vs After Performance Comparison

Safaricom’s Fintech 2.0 marks a major leap forward for M-Pesa, with a complete overhaul of its technical foundation. This transformation, overseen by Felix Rop, Head of Financial Services IT, and Esther Waititu, Chief Financial Services Officer, was executed on September 22, 2025. During off-peak hours, the team successfully migrated 35 million users to the new system, following several rehearsals to ensure a seamless transition. Coupled with AI-driven enhancements, Fintech 2.0 strengthens M-Pesa’s performance and security.

Faster Transactions and Cloud-Native Architecture

M-Pesa has transitioned from a monolithic system to a cloud-native microservices architecture. This new structure allows for modular updates to key services like bill payments, withdrawals, and transfers without interrupting operations.

The core database has been divided into stripe units, supported by an active-active architecture. This setup ensures continuous operation across multiple hosting sites, with automatic failovers if one site encounters issues. Unlike the previous active-passive model, where a single failure could disrupt the entire system, the new approach isolates problems to specific segments, protecting the service for all 35 million users.

The platform now handles peak loads more effectively and boasts an impressive 99.999% availability rate.

"The system that we have today, for example, has one single database… if that database goes down, it impacts all customers. With the upgraded platform, the database would be split into sections, called stripe units… it will be possible for the rest to continue as the problem is fixed." – Felix Rop, Head of Financial Services IT, Safaricom

This upgrade involved a collaborative effort from 210 Kenyan developers, 100 on-site partner developers, and 300 remote developers worldwide. On November 25, 2025, Safaricom introduced Daraja 3.0, the updated developer gateway for Fintech 2.0. This gateway offers enhanced Security APIs for identity verification and enables businesses to create mini-apps within the M-Pesa Super App, which already serves 4.7 million active users.

Machine Learning for Fraud Prevention

Machine learning now plays a critical role in M-Pesa’s system, particularly in fraud prevention. Using anomaly detection, the platform identifies unusual transaction patterns that deviate from normal behavior. Predictive analytics further supports the system by forecasting transaction volumes and traffic trends, enabling proactive resource allocation to maintain system reliability. Additionally, self-healing capabilities allow the platform to detect and address threats or technical issues automatically, reducing the need for manual intervention.

"The Fintech 2.0 platform incorporates AI capabilities, enabling the company to detect fraud earlier and more effectively protect its customers." – Dr. Peter Ndegwa, Group CEO, Safaricom

Before and After: M-Pesa Performance Comparison

The shift to Fintech 2.0 has delivered significant improvements across multiple areas:

| Feature | Legacy Platform (G3) | Fintech 2.0 |

|---|---|---|

| Architecture | Monolithic (Single block) | Cloud-Native (Microservices) |

| Resilience Model | Active-Passive (Standby backup) | Active-Active (Simultaneous engines) |

| Transaction Capacity | 4,500 TPS | 6,000 TPS (Scalable to 12,000) |

| Database Structure | Single database (Standby module) | Split "Stripe Units" (Sectioned pools) |

| Monitoring | Reactive (Alarms after failure) | Proactive (AI-driven self-healing) |

| Deployment Speed | Slow (Months for new features) | Rapid (Weeks for new features) |

| Fraud Prevention | Rule-based detection | AI-powered real-time pattern analysis |

Currently, the platform processes over 100 million transactions daily. In the last fiscal year alone, M-Pesa handled 37.15 billion transactions worth KES 38.29 trillion.

These advancements position M-Pesa for broader partnerships and growth in new regions.

sbb-itb-dd089af

Partnerships and Regional Expansion

Safaricom’s vision to become a regional tech leader hinges on forging strategic global partnerships. These collaborations bring in the expertise and infrastructure needed to advance AI services and broaden digital access across East Africa.

Partnerships with AWS, Huawei, and iXAfrica

In May 2025, Safaricom joined forces with iXAfrica Data Centers to launch Kenya’s first AI-ready data center. The NBOX1 Nairobi Campus, with a design capacity of 22.5 megawatts, now stands as the largest data center project in Greater East Africa. It offers enterprise suites starting at 350 kilowatts and scaling up to 1 megawatt, specifically engineered to handle the heavy demands of AI and analytics workloads.

"Through this partnership with iXAfrica, we are enhancing our enterprise portfolio with premium data center services that meet the highest global standards while supporting sustainable digital growth." – Dr. Peter Ndegwa, CEO, Safaricom PLC

In June 2025, Safaricom deepened its collaboration with Amazon Web Services (AWS) by integrating Generative AI into its customer service operations. Leveraging Amazon Bedrock and SageMaker, the company upgraded its Zuri chatbot and improved fraud detection accuracy to an impressive 89%. Just two months later, in August 2025, Safaricom teamed up with Huawei’s CBS Billing team to launch an AI-powered "Idea to Cash" solution. This system uses advanced AI models to automate tariff configurations, enabling instant product launches. James Maitai, Safaricom’s Chief Technology Information Officer, highlighted the impact:

"By integrating AI-driven capabilities into our core business systems, we are not only enhancing operational efficiency but also enabling faster, more agile product launches".

These partnerships are paving the way for Safaricom’s growth across the region.

Expanding M-Pesa Across East Africa

Building on these collaborations, Safaricom is scaling its services across East Africa, targeting a market of over 300 million people. This expansion is supported by investments in AI infrastructure and cloud services.

A key milestone in this growth is the Fintech 2.0 platform upgrade, which has boosted M-Pesa’s transaction capacity to 6,000 transactions per second, with scalability up to 12,000 TPS. In November 2025, the company launched Daraja 3.0, a cloud-native API platform that enables developers across East Africa to create and host services directly within the M-Pesa Super App. This initiative not only fosters innovation within the M-Pesa ecosystem but also strengthens Safaricom’s role in advancing regional technology.

"Daraja 3.0 is a gateway to the next frontier of fintech. By empowering developers with secure, scalable, and intuitive tools, we are unlocking new possibilities in digital finance." – Esther Waititu, Chief Financial Services Officer

Safaricom’s infrastructure strategy also taps into Kenya’s renewable energy resources, which power over 90% of the country’s electricity grid. This approach supports sustainable growth across vital sectors like agriculture, healthcare, and retail.

Impact on Kenya’s Tech Ecosystem and Startups

Supporting Entrepreneurs and Financial Inclusion

Recent infrastructure improvements have opened up exciting opportunities for Kenya’s startup scene, with the developer community growing from 70,000 to 79,900 members.

In November 2025, the launch of Daraja 3.0 made it possible for startups to create and deploy mini-apps within the M-Pesa Super App. This platform now hosts over 80 apps spanning industries like healthcare, travel, and insurance. Safaricom has also used AI and big data to make saving more accessible, lowering the minimum savings amount to under 100 Kenyan shillings (around $0.77). These efforts now support 1.2 million medium-sized businesses, with 44% of M-Pesa transactions offered at no cost. Additionally, the Spark Accelerator Fund – a partnership between M-Pesa Africa and Sumitomo – provides direct funding and scaling assistance to early-stage fintech and tech startups.

These advancements in financial inclusion and support for developers are fueling growth across Kenya’s tech landscape.

Growth in E-Commerce, AgriTech, and Digital Payments

With M-Pesa’s expanded capabilities, sectors such as e-commerce and AgriTech are undergoing rapid transformation. These developments not only empower entrepreneurs but also reinforce Safaricom’s role in shaping a forward-thinking tech environment in Kenya.

One standout example is FarmerAI, introduced in February 2025 through a collaboration with Opportunity International. This tool delivers real-time agricultural insights via SMS and WhatsApp to over 1,000 potato farmers. It integrates with DigiFarm, a platform serving 1.4 million users and supporting Kenya’s agricultural sector, which contributes 22.4% of the country’s GDP and employs 5.6 million small-scale farmers.

"FarmerAI is the first solution we are bringing to farmers that enables them to interact with AI and feel the power of that technology… This AI chatbot will allow smallholder farmers access verifiable information on common questions to guide their decisions." – Dr. Peter Ndegwa, CEO, Safaricom

Safaricom’s use of AI extends beyond agriculture. AI-powered fraud detection systems now achieve 89% accuracy, while automated product launch tools have cut time-to-market to near real time. These advancements create a secure and dynamic environment for innovation to thrive.

Conclusion

Safaricom’s bold $500 million investment in AI infrastructure and the debut of Fintech 2.0 mark a shift in the company’s role – from a consumer of global technology to a creator of solutions tailored to local needs. With increased transaction capacity and advanced AI-powered fraud detection, Safaricom is setting the stage to empower millions of entrepreneurs and businesses across East Africa. These advancements go beyond technical upgrades; they offer real-world benefits for Kenya’s business owners and innovators.

These initiatives are also driving Kenya’s tech ecosystem forward. Consider this: 5.6 million smallholder farmers contribute 22.4% to Kenya’s GDP. Tools like FarmerAI and DigiFarm are stepping in to tackle economic challenges with AI solutions designed specifically for the region. Meanwhile, the Daraja 3.0 platform enables businesses to tap into millions of M-Pesa users by integrating services directly within the M-Pesa Super App.

"Africa has an opportunity to define its own AI destiny. We must move beyond being passive consumers of AI technologies… It will serve as a catalyst for intelligent digital solutions." – Cynthia Kropac, Chief Enterprise Business Officer, Safaricom

As Africa’s digital economy heads toward a forecasted $712 billion valuation by 2050, Safaricom’s strategic moves are positioning Kenya as a rising technology powerhouse. Through key global partnerships, the company is securing the computational muscle needed for AI innovation while prioritizing data sovereignty and regulatory compliance.

Ultimately, the success of these efforts won’t just be measured in faster transactions or bigger data centers. It will be reflected in the number of businesses launched, the improvements in farmers’ productivity, and the expanded access to financial services for more Kenyans. By aligning with its Vision 2030, Safaricom is reshaping the region’s tech landscape and paving the way for a more inclusive, dynamic future.

FAQs

How will Safaricom’s AI upgrades improve the M-Pesa experience?

Safaricom is introducing AI-powered improvements to M-Pesa, aiming to make the platform faster, more dependable, and capable of meeting increasing demand. These upgrades are designed to boost the system’s capacity and durability, ensuring seamless digital transactions for its users.

By incorporating AI, operations will become more efficient, downtime will decrease, and the overall experience for users will improve. This translates to smoother, safer services for M-Pesa customers, reinforcing its position as a cornerstone of Kenya’s financial landscape.

How are global partnerships driving Safaricom’s tech innovation and growth?

Global partnerships play a crucial role in driving Safaricom’s tech advancements, opening doors to cutting-edge technologies, specialized expertise, and state-of-the-art infrastructure. These collaborations have been instrumental in creating Kenya’s first AI-ready infrastructure, enhancing Safaricom’s ability to design and roll out forward-thinking solutions.

In addition, these alliances are fueling Safaricom’s $500 million investment in AI across East Africa. This investment is not just about technology; it’s about boosting regional growth and strengthening key sectors like agriculture, healthcare, and finance. By teaming up with universities, regulators, and global tech providers, Safaricom is cultivating a thriving ecosystem that supports local developers and cements its position as a leader in digital transformation within Kenya and beyond.

How is Safaricom helping startups grow in Kenya’s tech ecosystem?

Safaricom is making waves in Kenya’s startup scene by committing over $500 million in the next three years to bolster AI infrastructure and drive digital transformation. This investment includes building AI-ready data centers, cloud platforms, and developer tools – laying the groundwork for startups to innovate and grow their ideas into scalable solutions.

Beyond infrastructure, Safaricom is backing startups at every stage of their journey. Through specialized subsidiaries, the company provides funding for early-stage ventures and invests in established tech firms. By collaborating with universities, working closely with regulators, and equipping its workforce with skills in AI and data science, Safaricom is creating a dynamic ecosystem. This approach is empowering startups to make meaningful contributions to essential sectors like fintech, healthcare, and agriculture.

Related Blog Posts

- Top 5 Startups to Watch in Kenya in 2025

- 10 Top Investors in Startups in Kenya

- Future of Mobile Money in African Marketplaces

- Kenya Startup Funding Trends 2025