Zimbabwe is introducing new digital regulations starting January 1, 2026, which will impact tech companies and investors. Key changes include:

- 15% Digital Services Tax: Applied to offshore payments for services like streaming, ride-hailing, and satellite internet.

- Cyber and Data Protection Act: Requires businesses to register with POTRAZ, appoint a Data Protection Officer ($800–$2,500/month), and comply with strict data protection rules. Non-compliance may lead to fines or imprisonment.

- National Digital Roadmap (2026–2030): Focuses on AI, blockchain, and 5G adoption, supported by new Digital Hubs and an AI Committee.

While aimed at boosting revenue and protecting local businesses, these measures could deter foreign investment due to high costs and complex compliance requirements. Compared to Nigeria and Kenya, Zimbabwe’s approach may hinder local infrastructure growth and innovation.

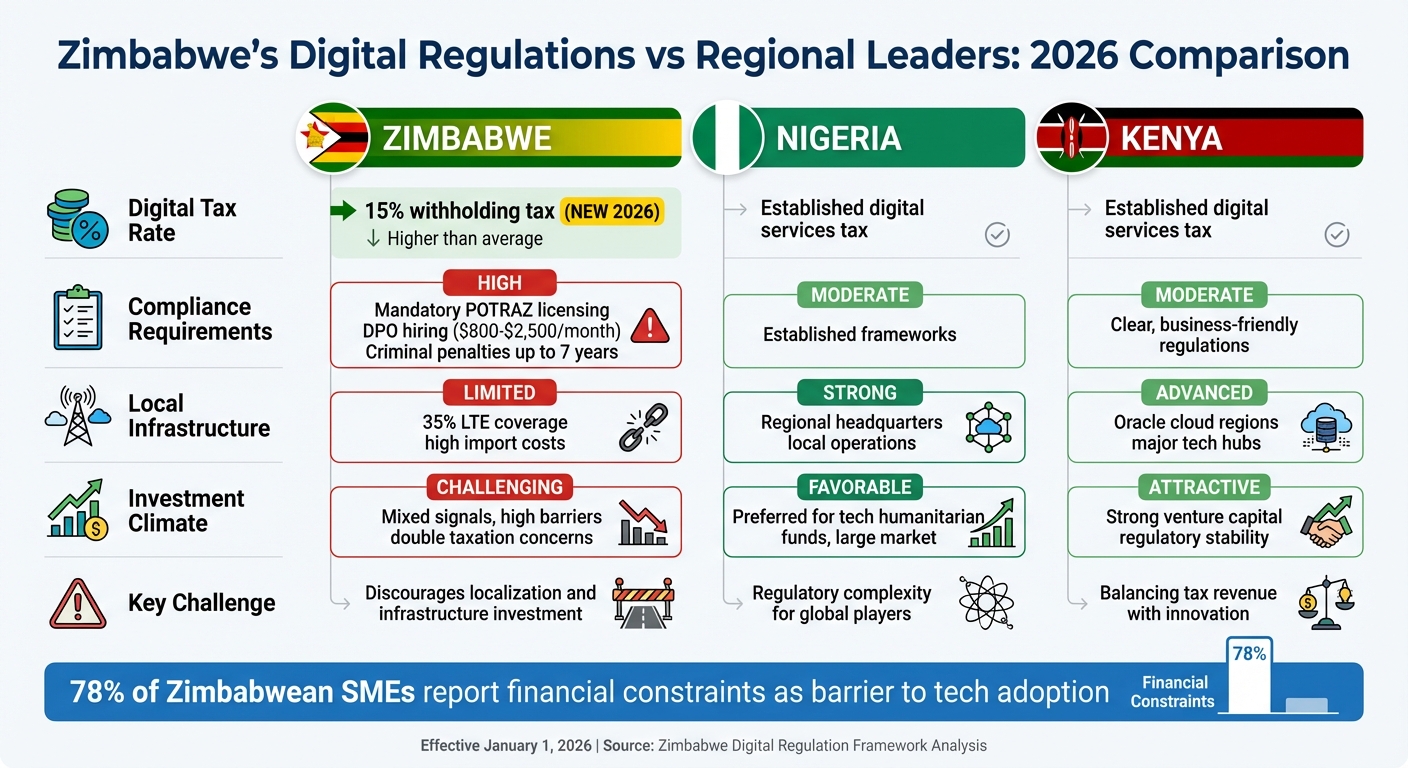

Quick Comparison

| Feature | Zimbabwe | Nigeria | Kenya |

|---|---|---|---|

| Digital Tax Rate | 15% withholding tax | Established digital services tax | Established digital services tax |

| Compliance Requirements | Mandatory licensing, DPO hiring | Moderate | Clear and business-friendly |

| Local Infrastructure | Limited | Strong | Advanced |

| Investment Climate | Mixed signals, high barriers | Favorable for large markets | Attractive for global tech firms |

Zimbabwe’s regulatory changes present challenges for companies operating in its digital economy. Early compliance and strategic planning will be critical for businesses to navigate these new rules effectively.

Zimbabwe vs Nigeria vs Kenya Digital Regulation Comparison 2026

Zimbabwe’s 15% Digital Tax Explained, iShowSpeed in Harare | Africa Tech Kin with Danny that Guy

Understanding Zimbabwe’s Digital Regulation Framework

Zimbabwe has introduced a set of regulations targeting three key areas: taxation, data protection, and digital transformation. One notable measure is the Digital Services Withholding Tax (DSWT), which imposes a 15% tax at the transaction point. This tax is automatically collected by local banks and mobile money operators, meaning digital service providers – like streaming platforms, e-hailing services, and online advertisers – don’t need to handle tax collection themselves.

The Cyber and Data Protection Act (SI 155 of 2024) requires businesses to register as data controllers with POTRAZ (Postal and Telecommunications Regulatory Authority of Zimbabwe). Additionally, companies must hire a certified Data Protection Officer, which can cost between $800 and $2,500 per month. This requirement introduces extra operational expenses for organizations.

On the digital transformation front, Zimbabwe has launched the 2026–2030 National Digital Roadmap, which aims to accelerate the adoption of technologies like AI, blockchain, and 5G. Minister of ICT Tatenda Mavetera highlighted the roadmap’s goals, stating:

"position Zimbabwe to fully leverage emerging technologies such as Artificial Intelligence, blockchain, and 5G".

To further this vision, the government is establishing an AI Committee and converting existing Community Information Centres into Digital Hubs to promote entrepreneurship.

The Smart Zimbabwe 2030 Master Plan outlines a broader strategy for digital transformation. Built on three pillars – Policy/Regulation/Standards, Secure Infrastructure, and Skills Development – this plan targets sectors like government, agriculture, health, and trade. Its phased rollout began with foundational infrastructure and cybersecurity measures, followed by initiatives in Smart Government, Education, Agriculture, and Health. Future phases will expand into Energy, Cities, Transport, and Mining.

This structured approach not only highlights opportunities for tech companies and investors but also sets the stage for comparing Zimbabwe’s digital regulation framework with those of Nigeria and Kenya.

1. Zimbabwe’s Digital Regulation Framework

Regulatory Impact on Tech Companies

Zimbabwe’s updated digital regulations bring significant compliance demands for tech companies. Any business handling personal data electronically is now required to secure a license from POTRAZ and appoint a Data Protection Officer (DPO) within 90 days of starting operations. Non-compliance comes with steep penalties – failing to obtain a license could result in a $1,000 fine or up to seven years in prison, while neglecting to appoint a DPO carries a $400 fine or a two-year prison sentence.

Adding to the burden is the 15% Digital Services Withholding Tax, which is collected directly by banks and mobile money operators at the time of transactions. This tax increases costs for foreign platforms like Netflix, Spotify, and Amazon Prime. There’s also confusion about whether non-commercial entities, such as churches or even WhatsApp group administrators, need to comply with licensing rules.

These challenges create a ripple effect, complicating the investment landscape.

Investment Opportunities and Risks

The regulatory framework offers mixed signals to investors. On one hand, it aims to generate revenue from international tech companies. On the other, its high tax rates and intricate compliance requirements could scare off potential investments. Cybersecurity specialist Sammy Tatenda Nyere points out:

"The tax does reduce the incentive for these companies to deepen their local engagement. This includes investments in local data centers, customer support infrastructure, skills transfer, and localized pricing."

MISA Zimbabwe has echoed similar concerns:

"Strict regulations can stifle innovation and discourage investment in the technical sector. Foreign investors are often keen on issues of stability and predictability."

This cautious approach stands in contrast to the more investor-friendly policies seen in countries like Nigeria and Kenya, which will be discussed later.

Innovation and Infrastructure Development

The 15% digital tax could have unintended consequences for innovation and infrastructure growth. While Zimbabwe’s neighbors, like Zambia, have encouraged digital investment with zero-tax policies and fiber network reforms, Zimbabwe’s strategy may push companies to keep their operations offshore. This discourages investments in local data centers, customer service hubs, and other infrastructure. Ironically, while the government seeks to generate revenue from foreign tech giants, its policies might make it less appealing for those companies to establish a physical presence in the country.

2. Nigeria’s Digital Tax Policies

Nigeria’s approach to digital taxation mirrors the mechanics seen in other regions but is deeply shaped by the country’s unique market conditions. The policies specifically target multinational digital service providers that operate without a local presence.

However, these taxes often end up being passed along to local consumers and small businesses. Dr. Tapiwa Mashakada, Former Zimbabwean Minister of Economic Planning, sheds light on this dynamic:

"The digital services tax is charged [to] consumers and business using foreign digital services. It’s not charged [to] the service providers, therefore, it’s business as usual for these companies."

This policy landscape plays a critical role in shaping Nigeria’s investment climate.

Investment Opportunities and Risks

Despite the tax burden, Nigeria remains a key destination for tech investments. In January 2026, the country was chosen as the primary location for a tech-focused humanitarian impact fund. This decision reflects confidence in Nigeria’s relatively advanced digital economy and stronger regulatory environment compared to smaller African markets. The presence of regional headquarters and local infrastructure operated by global tech firms further boosts its appeal.

Nigeria’s large market size also incentivizes deeper local engagement. For instance, in January 2026, Nigerian regulators began consultations on Direct-to-Device satellite services, with Amazon LEO exploring potential operations.

Innovation and Infrastructure Development

Nigeria’s digital tax policies present both opportunities and challenges when it comes to infrastructure growth. On one hand, the country’s large market encourages some companies to maintain local operations. On the other, high tax rates may discourage investments in areas like data centers, customer support, and workforce development. Linda Masarira, Leader of the Labour, Economists and African Democrats (LEAD), highlights the importance of balanced policies:

"Africa should tax digital value creation, but the risk is when policy becomes fragmented and punitive, creating double taxation and compliance complexity. The best African approach is regional coherence not sudden high levies that feel like revenue desperation."

Nigeria’s experience shows that market size plays a critical role. With Africa’s digital economy projected to hit $700 billion by 2035, Nigeria has the scale to absorb regulatory costs that could overwhelm smaller markets. That said, if not carefully managed, digital taxation risks becoming a "consumption penalty", hindering genuine economic growth.

sbb-itb-dd089af

3. Kenya’s AI and ICT Strategies

Kenya has established itself as a leader in the digital economy, with a framework that prioritizes local integration and clear regulations. By focusing on digital industrialization, skill-building, and creating local value, the country has become a hub for regional headquarters and infrastructure investments from global tech giants. This approach creates an environment where tech companies can operate efficiently and thrive.

Regulatory Impact on Tech Companies

Kenya’s regulatory setup is designed to encourage local integration and provide clarity for businesses. With well-defined rules, tech firms can make informed decisions about setting up data centers, customer support hubs, and development teams. This clarity helps Kenya avoid the pitfalls of systems that impose high service taxes alongside additional fees, which can complicate operations.

As ZimCyberSecurity notes, "Applying a similar tax framework in a smaller, import-dependent digital economy without complementary industrial and infrastructure policies risks turning digital taxation into a consumption penalty rather than a tool for digital equity or economic development". Kenya’s approach, by contrast, offers incentives that promote deeper local involvement, making it a more attractive destination for tech investments.

Investment Opportunities and Risks

Kenya’s regulatory maturity and market size continue to attract venture capital and fuel expansion opportunities. Zimbabwe, meanwhile, is working to close its own gaps by introducing initiatives like the Zimbabwe Investment and Development Agency (ZIDA) portal, which simplifies 62 procedures across 21 government departments.

Zimbabwe is also making strides with its National AI Strategy (2026–2030), an ambitious plan to advance its tech sector. The strategy includes the creation of a National AI Innovation Fund and a regulatory sandbox called the "Innovation Crucible", designed to help startups test their solutions before launching them widely. Dr. Jenfan Muswere, Zimbabwe’s Minister of Information, Publicity and Broadcasting Services, describes the strategy as "a declaration of intent to actively shape the country’s technological future based on three core imperatives, namely: economic sovereignty and competitiveness…". These initiatives aim to strengthen infrastructure and open doors for further investment.

Innovation and Infrastructure Development

Kenya’s ecosystem actively supports innovation by investing in local talent and infrastructure. Its regulatory framework encourages long-term commitments from global tech firms and promotes local operations. For other nations to replicate Kenya’s success, measures like reduced tax rates, exemptions for small and medium enterprises (SMEs), and incentives for infrastructure development may be necessary. These steps could shift the focus of tech companies from merely viewing markets as revenue opportunities to fostering deeper, more meaningful engagement.

Benefits and Drawbacks

Zimbabwe’s digital tax measures, when compared to the more established frameworks in Nigeria and Kenya, send a mix of messages. The introduction of a 15% Digital Services Withholding Tax on January 1, 2026, aims to create a level playing field for local businesses. However, critics argue that it may cause more harm than good. Linda Masarira, Leader of Labour, Economists and African Democrats (LEAD), expressed concerns:

"Fifteen percent is too steep for a consumption-facing tax, and it risks being felt as a blanket punishment on SMEs, creators, and advertisers".

While the tax is intended to boost revenue and support local businesses, it also brings operational challenges. Strict compliance requirements can place a heavy financial and administrative burden on companies. This stands in stark contrast to Kenya and Nigeria, where regulatory frameworks are more established and provide clearer paths for businesses to navigate.

| Feature | Zimbabwe | Nigeria | Kenya |

|---|---|---|---|

| Digital Tax Rate | 15% withholding tax (new 2026) | Established digital services tax | Established digital services tax |

| Key Benefit | Seeks to create fair competition for locals | Preferred by tech-focused humanitarian funds | Strong AI and ICT strategies; hosts major cloud infrastructure |

| Main Challenge | Double taxation concerns with 2% IMTT; discourages localization | Regulatory complexity for global players | Balancing tax revenue with innovation growth |

| Infrastructure Investment | Limited; 35% LTE coverage and high import costs | Strong local infrastructure and global firm presence | Advanced; hosting Oracle cloud regions |

| Compliance Burden | High; mandatory licensing and DPO appointment with criminal penalties | Moderate; established frameworks | Moderate; clear regulations encouraging local integration |

Beyond compliance, Zimbabwe’s regulatory approach poses strategic risks. The focus on punitive measures rather than supportive policies may hinder growth. Cybersecurity expert Sammy Tatenda Nyere warned:

"Applying a blanket digital tax framework in a smaller, import-dependent digital economy like Zimbabwe without complementary industrial and infrastructure policies risks turning digital taxation into a consumption penalty".

Meanwhile, Kenya continues to attract venture capital thanks to its regulatory stability, and Nigeria is a growing hub for tech-driven humanitarian investments. Zimbabwe, on the other hand, risks driving businesses to adopt foreign payment methods to sidestep local taxes.

The difference is stark: Nigeria and Kenya offer more stable environments with mature digital economies, while Zimbabwe’s higher levies and regulatory uncertainties create challenges. Adding to these struggles, 78% of Zimbabwean SMEs report financial constraints as a primary barrier to adopting technology, highlighting the steep road ahead for the nation’s digital transformation.

Conclusion

Zimbabwe’s digital regulation framework presents a challenging landscape for tech companies and investors. With the 15% Digital Services Withholding Tax set to take effect on January 1, 2026, and strict data protection requirements already in place, compliance is no small task. Companies must register with POTRAZ as data controllers by March 12, 2025, or risk fines up to $1,000 or even seven years’ imprisonment. On top of that, appointing a Data Protection Officer – at a monthly cost ranging from $800 to $2,500 – adds to the financial strain.

To navigate these hurdles, companies need to act decisively. Investing in local infrastructure is key to avoiding classification as non-resident entities subject to the withholding tax. Establishing local data centers and support hubs could help mitigate these challenges. For investors looking to tap into Africa’s growing digital economy, Zimbabwe’s regulatory environment demands careful consideration and strategic planning.

Immediate action is essential. Companies should audit their data practices, register with POTRAZ, and hire certified Data Protection Officers. Pricing models may need adjustment to decide whether to absorb the 15% tax or pass it on to consumers, keeping in mind that taxes are withheld at transaction points.

In this uncertain regulatory climate, early compliance and building a local presence could be the difference between thriving and falling behind. Compared to countries like Nigeria and Kenya, Zimbabwe’s stringent measures require faster adaptation to instill investor confidence. As Sammy Tatenda Nyere aptly put it:

"Digital taxation should be designed to support digital adoption and resilience, not inadvertently undermine them".

Success in Zimbabwe will come to those who see these regulations not as barriers, but as opportunities to establish sustainable, locally integrated operations in a rapidly evolving market.

FAQs

What impact will Zimbabwe’s 15% Digital Services Tax have on foreign tech companies?

Zimbabwe plans to introduce a 15% Digital Services Tax in 2026, a move that will likely raise expenses for foreign tech companies operating in the country. These companies will be required to withhold and remit this tax on transactions involving digital services, which could cut into their profits and make competing in the local market more challenging.

To adapt, businesses may need to rethink their pricing strategies or even modify their operational models to account for the added cost. This shift could also shape how they evaluate growth and investment opportunities within Zimbabwe’s tech industry.

What challenges do tech companies face under Zimbabwe’s new data protection laws?

Tech companies in Zimbabwe are navigating a complex landscape under the country’s new data protection laws. A major requirement is obtaining a data controller’s license from the Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ). This applies to businesses handling personal data for 50 or more individuals. To secure this license, companies must ensure transparency in how they collect and use data, implement robust security protocols, and appoint a qualified Data Protection Officer (DPO).

The timeline is tight – licenses must be secured by March 12, 2025. Beyond that, maintaining compliance is an ongoing task, as failure to adhere to the regulations could result in penalties. Companies are also required to establish clear policies for managing personal data, protect sensitive information, and handle cross-border data transfers in line with the law. These mandates can be particularly challenging for smaller businesses or those less familiar with such regulatory demands, making compliance a significant operational hurdle.

How does Zimbabwe’s digital regulation compare to Nigeria and Kenya in terms of attracting tech investments?

Zimbabwe is taking its first steps toward shaping a digital regulation framework, with recent initiatives focused on attracting investments and updating its digital infrastructure. A notable example is the planned launch of an eRegulations investment portal in September 2025, designed to streamline processes for investors. Additionally, the introduction of a 15% digital services tax in January 2026 aims to generate revenue from foreign digital service providers. These efforts highlight Zimbabwe’s ambition to establish a more organized and modern digital economy.

By comparison, countries like Nigeria and Kenya have already laid the groundwork with well-developed regulatory frameworks that have drawn significant investments. Nigeria’s Data Protection Regulation (introduced in 2019) emphasizes data privacy and cybersecurity, creating a stable environment for digital businesses. Kenya, on the other hand, has made strides with its Data Protection Act (also enacted in 2019) and forward-thinking fintech regulations, which have encouraged a flourishing digital economy and bolstered investor confidence.

Though Zimbabwe is moving in the right direction, its regulatory landscape is still in its infancy compared to the more established systems in Nigeria and Kenya. That said, continued reforms could make Zimbabwe a stronger contender for tech investments in the years to come.

Related Blog Posts

- Healthtech Regulation 2025: What Founders Need to Know

- Tech Policy 2025: New Data Laws in Nigeria and South Africa

- DR Congo’s €8B Digital & Infrastructure Plan: Opportunities for Telecoms, Fintech, and Tech Builders

- Mali’s Tech & Security Shift: How New Policies Impact Internet Access, Telecoms and Startups