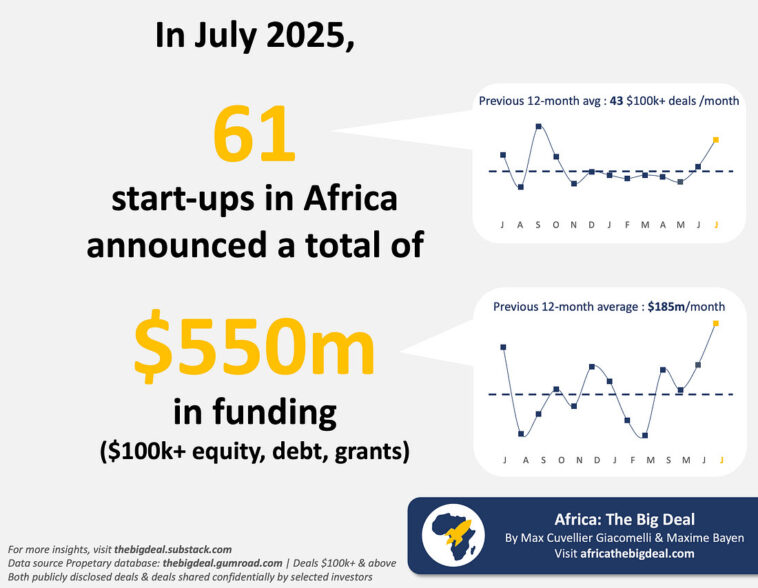

In July 2025, a total of 61 start-ups across Africa announced funding rounds of at least $100,000—a significant jump from the average of around 40 per month observed in the first half of the year. Of these, 41 were based in the Big Four markets, yet there was a healthy geographical spread overall, with start-ups from 15 countries securing funding. Notably, this included the first-ever $100,000+ deal recorded in Libya.

The total amount raised for the month reached an impressive $550 million—the highest monthly figure for African start-ups in over two years. Remarkably, 83% of this capital was captured by just two companies, both rooted in Kenya and operating in the energy sector. d.light expanded its receivables financing by $300 million, while Sun King secured a $156 million debt facility. When smaller debt rounds are included, debt accounted for $493 million, or 89% of the total raised in July. Since the beginning of the year, debt has made up 45% of all funding on the continent.

On the equity side, announcements totaled $58 million, marking the second-lowest month for equity funding this year. The standout equity deal came from Rwazi, which closed a $12 million Series A round. Despite the slow month, this was enough to push the year’s total equity funding past the $1 billion mark—reaching the milestone earlier than in 2024 (October), and nearly matching the pace of 2023 (June).

Almost tantalizingly, the ecosystem fell just $25 million short of hitting the $2 billion milestone for total funding raised (excluding exits). Still, with momentum building, that landmark now seems only days—or at most, weeks—away.

Want to get your brand in front of Africa’s most engaged business audience?

Whether you’re in tech, finance, energy, logistics, or beyond — we’ve got you covered.

👉 Advertise with us.