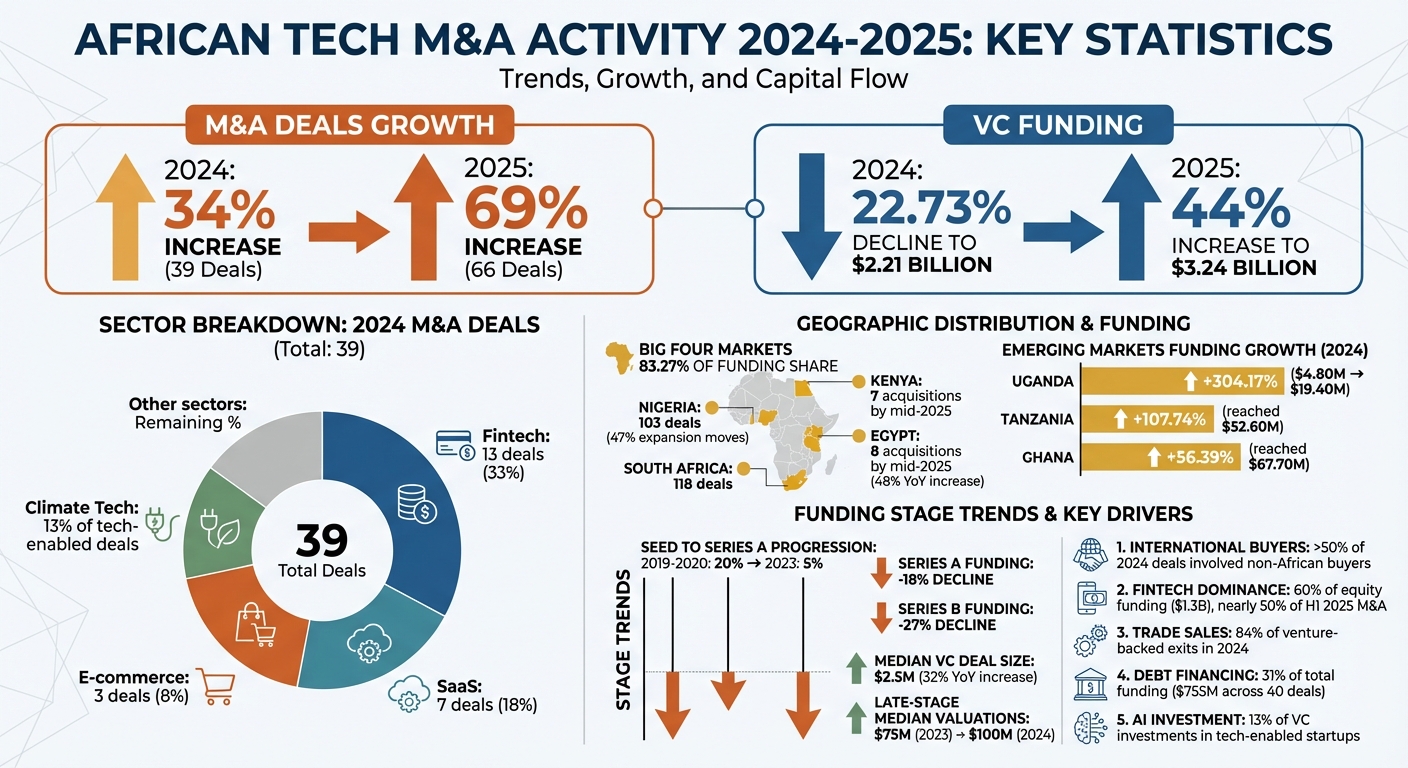

Mergers and acquisitions (M&A) in Africa’s tech sector surged by 34% in 2024, with 39 deals recorded, while venture capital funding dropped 22.73% to $2.21 billion. This shift highlights how startups turned to M&A for survival and growth amid funding challenges. Key drivers included declining Series A and B funding, market consolidation, and increased international investor participation. Fintech led with 13 deals, followed by SaaS and climate tech sectors. The "Big Four" markets – Nigeria, Kenya, Egypt, and South Africa – dominated activity, but emerging markets like Uganda and Tanzania showed promising growth.

Key Takeaways:

- Decline in VC Funding: Venture capital fell sharply, pushing startups to prioritize acquisitions over organic growth.

- Fintech Dominance: Fintech accounted for 13 of 39 deals, leveraging acquisitions for faster market access and regulatory compliance.

- Market Consolidation: Companies used M&A to address operational gaps, expand regionally, and secure critical licenses.

- Global Interest: Over half of 2024 deals involved international buyers, marking a shift from previous years.

- Emerging Markets: Secondary hubs like Uganda (+304% funding growth) and Tanzania (+107.74%) are gaining traction.

Africa’s tech ecosystem is evolving, with M&A becoming a primary growth strategy. Entrepreneurs should focus on efficiency and profitability, while investors may find opportunities in emerging markets beyond the "Big Four."

African Tech M&A and VC Funding Trends 2024-2025

What Drove the Growth in M&A Activity

How Declining Venture Capital Funding Affected M&A

The sharp drop in venture capital funding forced startups to rethink how they could grow. With traditional fundraising drying up, few companies managed to hit critical revenue milestones of $10–50 million through organic growth. The numbers tell the story: in 2023, only 5% of seed-funded startups progressed to a Series A round, a steep decline from 20% during the 2019–2020 period. On top of that, Series A and Series B funding amounts dropped by 18% and 27%, respectively. In this challenging environment, mergers and acquisitions became a crucial lifeline. Take the Kenyan startup Wasoko and Egypt-based MaxAB, for instance. In August 2024, they joined forces to create Africa’s largest B2B e-commerce platform, targeting the $600 billion informal retail sector. Moves like this highlight how market consolidation is reshaping competition across the region.

Market Maturity and Consolidation

By 2024, the African tech ecosystem hit a pivotal moment where consolidation started to outweigh direct competition. Companies began using acquisitions not just as exit strategies, but to gain capabilities that would have taken years to develop independently. Established players turned to M&A to address operational gaps and solidify their positions in the market. For example, Nigerian fintech company LemFi acquired Irish fintech Modular Finance to expand its global reach, while identity verification startup Prembly bought Kenyan HR tech firm Peleza to diversify its offerings. The fintech sector led this wave of consolidation, logging 13 M&A deals in 2024, followed by the Software-as-a-Service sector with seven deals. Adding to the momentum, international investors played a significant role, accelerating these trends even further.

Global and Regional Investor Participation

International investors brought a new dynamic to the M&A scene in 2024. Deals involving non-African buyers made up more than half of all transactions – an impressive shift from earlier years when regional players dominated.

As Seddik El Fihri, Managing Director & Partner at BCG, noted, "Inbound deals account for well over half of all transactions – a sharp increase from several years ago when most deals were between regional players".

High-profile deals underscored this trend. French media group Canal+ made a $1.8 billion bid to acquire South African broadcaster MultiChoice Group, while global private equity giant Carlyle completed an $820 million buyout of Energean’s Egyptian and Mediterranean assets. The numbers are striking: the total value of M&A deals in Africa jumped by 36% during the first nine months of 2024, far surpassing the global increase of 10%. This surge of international capital not only filled the gap left by limited domestic venture funding but also reinforced the growing strategic importance of African tech assets on the global stage.

Industries Leading M&A Deals in 2024

Fintech Takes Center Stage

In 2024, fintech led the charge in mergers and acquisitions (M&A) across Africa, making up 13 of the 39 total deals. This dominance was fueled by factors like market consolidation, faster regulatory approvals, and instant access to payment infrastructure. Fintech companies, which secured 60% of the tech ecosystem’s equity funding – amounting to $1.3 billion – had both the capital and the urgency to expand through acquisitions. Many deals were strategic, allowing companies to sidestep drawn-out regulatory processes by acquiring businesses with the necessary licenses already in place.

Cyril Collon of Partech remarked, "The African VC ecosystem remains resilient… driven by key sectors, particularly fintech, which continue to power forward, demonstrating the strength of the ecosystem".

The fintech sector’s ability to generate revenue quickly made it particularly appealing during the so-called "funding winter." While fintech dominated, other industries also played a role in shaping the M&A landscape.

Climate Tech and Agri-Tech Make Gains

Climate tech emerged as a rising star in 2024, doubling its share of tech-enabled M&A deals to 13%. This growth highlighted a shift in investor focus toward businesses solving agricultural and environmental challenges, offering both meaningful impact and financial returns. Agri-tech, in particular, drew acquirers due to its ability to address inefficiencies in supply chains while leveraging Africa’s vast agricultural economy. As climate issues and food security concerns escalated, companies offering integrated supply chain solutions became prime targets.

Logistics, Transport, and Other Noteworthy Sectors

Beyond fintech and climate tech, Software-as-a-Service (SaaS) companies saw seven deals, while e-commerce recorded three in 2024. Logistics and transport also stood out, with M&A activity driven by the need to address infrastructure challenges. Transporting goods in Sub-Saharan Africa remains 50% to 75% more expensive than in other developing regions. Acquirers focused on companies providing tools for operational efficiency, digital transformation, or access to informal retail networks. These assets promised immediate market access and improved operational capabilities, making them attractive investments.

Where M&A Deals Are Happening in Africa

Kenya, Nigeria, Egypt, and South Africa Lead Deals

The "Big Four" markets – Nigeria, Kenya, Egypt, and South Africa – continue to dominate mergers and acquisitions (M&A) activity across Africa. In 2024, these countries accounted for a staggering 83.27% of all venture capital funding on the continent. South Africa led the way in transaction volume with 118 deals, while Nigeria followed closely with 103 deals, reclaiming its position as the top destination for equity investments. By mid-2025, Egypt and Kenya had recorded 8 and 7 acquisitions, respectively, maintaining the momentum into early 2025.

These markets are prime for consolidation. For instance, in June 2025, Nigerian fintech company Moniepoint acquired a 78% stake in Kenya’s Sumac Microfinance Bank. This move allowed Moniepoint to secure a banking license and navigate regulatory challenges more effectively. Meanwhile, South Africa’s Nedbank made headlines by acquiring SME payments provider iKhokha in an all-cash deal worth $92.4 million, showcasing how M&A is driving digital innovation. Nigerian firms, in particular, have been proactive, accounting for 47% of expansion moves in 2024 – a strategy aimed at countering inflation and currency instability.

However, the dominance of these markets is gradually diminishing. Their share of total equity funding volume dropped from 79% in 2023 to 67% in 2024, pointing to a more diversified ecosystem. Egypt, for example, saw a 48% year-over-year increase in equity deal counts, signaling renewed vigor. South Africa also remained a hotspot for major deals, such as Canal+’s $1.8 billion bid to acquire MultiChoice Group. While these countries continue to lead, other emerging markets are quickly catching up.

Growth in Ghana, Tanzania, and Uganda

Beyond the Big Four, secondary markets like Ghana, Tanzania, and Uganda are gaining momentum, offering new opportunities for companies aiming to expand across Africa. Uganda witnessed a massive 304.17% increase in funding in 2024, jumping from $4.80 million to $19.40 million. Tanzania saw a 107.74% rise, reaching $52.60 million, while Ghana experienced a 56.39% growth, hitting $67.70 million. Both Tanzania and Ghana surpassed the $50 million equity funding milestone in 2024.

This surge in funding is drawing more M&A interest as larger players look to expand regionally. For example, in November 2025, Madagascar-based AXIAN Telecom acquired the Wananchi Group – parent company of Kenya’s Zuku and Tanzania’s Simbanet – for $63 million. This deal gave AXIAN a 99.63% stake and significantly expanded its operations across Kenya, Tanzania, and Uganda. Similarly, in June 2025, the ACKWEST Group acquired Safiyo, a deeptech firm from Ghana, to boost its data capabilities and strengthen its presence in emerging West African markets. These developments highlight how secondary markets are becoming pivotal entry points for companies with pan-African ambitions.

sbb-itb-dd089af

What to Expect in 2025 and Beyond

More Consolidation Across Sectors

The trend of consolidation that gained momentum in 2024 is showing no signs of slowing down. In 2025, Africa saw 66 acquisitions, a 69% jump from the 39 deals recorded in 2024. This shift reflects a change in how startups approach growth. Instead of focusing solely on aggressive expansion, many are opting for strategic mergers to improve efficiency and profitability.

Fintech remains at the forefront of this consolidation wave, driving nearly 50% of all M&A activity in the first half of 2025. A notable example is Flutterwave’s acquisition of Nigerian open banking startup Mono in January 2026. The deal, valued between $25 million and $40 million, allows Flutterwave to integrate services like bank account verification, identity checks, and recurring payments into a streamlined platform. Meanwhile, sectors like climate tech and AI are also seeing increased activity, with AI now accounting for 13% of venture capital investments in tech-enabled African startups.

"H1 2025 will be remembered as the moment the ecosystem began to scale through strategy, not speed." – Stephen Agwaibor, TechCabal Insights

This strategic shift is also influencing how deals are structured.

Changes in Deal Structures and Valuations

As startups adjust to evolving market dynamics, deal structures are becoming more flexible. All-stock acquisitions are gaining traction, enabling companies to acquire competitors or enter new markets by converting acquired investors into shareholders. For instance, in January 2025, Nigerian mobility fintech Moove acquired Brazilian car rental marketplace Kovi through an all-stock deal. This move gave Moove immediate access to the Latin American market while expanding its fleet.

Investor behavior is also shifting. The median VC deal size rose to $2.5 million in 2024, a 32% year-on-year increase, reflecting a preference for more established ventures. Late-stage median valuations climbed from $75 million to $100 million between 2023 and 2024. However, funding is becoming more polarized, with investors focusing on either early-stage startups or well-established companies, leaving mid-stage ventures in a tough spot. Trade sales dominated exits in 2024, making up 84% of all venture-backed exits, with an average holding period of 3.8 years.

Alternative strategies are also emerging. Strategic partnerships are offering startups a way to expand their reach and cut costs without relying on traditional fundraising. Debt financing remains a key player, accounting for 31% of total funding in 2024. By the end of that year, startups had raised $755 million across 40 debt deals.

These evolving dynamics are creating new opportunities for both entrepreneurs and investors.

Opportunities for Entrepreneurs and Investors

The ongoing consolidation and changing deal structures present exciting opportunities for those who can navigate the shifting landscape. Regulatory-led acquisitions are becoming a popular strategy for entering new markets. For example, in July 2025, South African payments infrastructure company Stitch acquired Efficacy Payments. This acquisition secured Stitch a full card-acquiring license, allowing it to operate as a full-stack payments company without relying on third-party processors.

For entrepreneurs, the focus is shifting toward achieving early operational efficiency. Investors and markets now prioritize sustainable unit economics over rapid user growth. Startups facing regulatory challenges may find it more efficient to acquire smaller, licensed companies rather than tackling complex compliance requirements on their own.

Investors, on the other hand, should explore opportunities beyond the Big Four markets. Secondary hubs like Uganda and Tanzania are showing impressive growth. Uganda, for instance, saw a 304.17% increase in funding in 2024, rising from $4.80 million to $19.40 million. Tanzania experienced a 107.74% jump, reaching $52.60 million. These emerging markets offer less competition and significant growth potential. Additionally, with total funding in 2025 hitting $3.24 billion – a 44% year-on-year increase – despite fewer deals overall, the focus is clearly shifting toward quality over quantity, favoring strategic planning and sustainable business models.

Conclusion

Africa’s tech landscape is undergoing a dynamic transformation, reflected in the numbers: a 34% rise in mergers and acquisitions (M&A) in 2024 and an impressive 69% jump to 66 deals in 2025. This comes against the backdrop of a 22.73% decline in venture capital funding, signaling a strategic shift in the ecosystem.

For entrepreneurs, the message is clear: focus on unit economics and operational efficiency. Companies that can demonstrate profitability are increasingly attractive as acquisition targets or consolidators. Strategic M&A is emerging as a quicker way to enter regulated markets, as highlighted by recent acquisitions. Building a business model that can sustain itself is no longer a luxury – it’s now the foundation for growth.

Investors, on the other hand, should start looking beyond the dominant markets of Nigeria, Kenya, Egypt, and South Africa. Secondary hubs like Uganda, which saw a 304% increase in funding, and Tanzania, with a 107% rise, offer promising opportunities with less competition. The growing focus on late-stage investments suggests that established ventures leading consolidation efforts are among the safer and more resilient bets.

The market is shifting its focus from sheer volume to creating value. Total funding is projected to reach $3.24 billion in 2025, with fintech accounting for nearly 50% of early-year activity.

"Rather than exits that generate returns for shareholders, many acquisitions will likely be… ‘coping deals’ – mergers driven by the need to survive rather than scale aggressively." – Victor Basta, Founder and Managing Partner of Magister Advisors

Success in this evolving ecosystem will depend on strategic planning, disciplined operations, and leveraging M&A to drive sustainable growth. These insights provide a roadmap for entrepreneurs and investors navigating Africa’s maturing tech sector in 2026 and beyond.

FAQs

Why has venture capital funding in Africa’s tech sector declined?

Venture capital funding in Africa’s tech sector has taken a hit, largely due to tighter global financial conditions and a tough economic climate. In 2024, the number of deals dropped by 22%, while the total value of those deals shrank by 28%. These declines highlight the strain caused by higher financing costs, inflation, and weaker inflows of foreign capital, all of which have made it more difficult for startups to secure the funding they need.

Early-stage startups have been hit the hardest. Many are struggling to close Series A and B funding rounds, often resorting to extension rounds instead of raising fresh equity. On top of that, regulatory uncertainties and cautious investor behavior have dampened enthusiasm for early-stage investments, even though funding for more established companies has remained relatively steady.

In short, Africa’s tech ecosystem is grappling with economic instability, rising costs, and limited access to liquidity, all of which are creating significant challenges for venture capital activity.

How are fintech companies gaining from the surge in African M&A activity?

Fintech companies are riding high on a 34% increase in African mergers and acquisitions (M&A) activity in 2024. Out of 39 total deals, 13 were centered on fintech, making it a standout sector. Why the buzz? M&A gives fintech firms access to larger funding pools – both equity and debt – that would be tough to secure on their own. Case in point: in early 2025, fintechs raised a whopping $638.8 million, accounting for 45% of all tech funding. Debt financing also surged, growing 75% year-over-year, underscoring the financial advantages of consolidation.

But it’s not just about the money. M&A is also a fast track for fintechs to scale operations and expand into new regions. Take the merger of Kenya’s Wasoko and Egypt’s MaxAB in August 2024 – this deal significantly broadened their market presence and customer base. Combining forces also drives innovation by merging technology and talent, which helps fintechs refine their offerings, simplify compliance, and stay competitive.

This wave of M&A activity signals growing investor confidence. Big funding rounds like Moniepoint’s $250 million Series C and TymeBank’s $110 million Series D in late 2024 highlight the momentum. These investments are setting fintechs up for strategic growth, service expansion, and higher valuations in an increasingly unified market.

What opportunities are available in emerging African markets beyond the Big Four economies?

Emerging markets across Africa, beyond the well-known "Big Four" economies – Nigeria, South Africa, Kenya, and Egypt – are increasingly catching the eye of investors and entrepreneurs. These regions present a mix of untapped opportunities and less crowded competition. In 2024, West Africa made waves with $7.97 billion in deal value spread across 135 transactions. Countries like Ghana, Côte d’Ivoire, and Senegal fueled this growth, especially in fintech, B2B e-commerce, and renewable energy sectors. Over in East Africa, nations such as Tanzania, Uganda, and Rwanda showed strong momentum, with investments pouring into logistics, health-tech, and ed-tech to address pressing regional needs. North Africa also saw a surge, with Morocco and Tunisia becoming key players in SaaS-driven digital payments and agri-tech innovations.

For investors and startups ready to venture beyond the dominant Big Four, these markets hold exciting prospects. The demand for green energy solutions, AI-driven technologies, and cross-border trade platforms is growing rapidly. Success in these regions will depend on understanding local regulations, building strong regional partnerships, and adapting to the unique economic landscapes. Those who can navigate these challenges are well-positioned to ride the next wave of growth in Africa’s evolving tech ecosystem.

Related Blog Posts

- The State of Venture Capital in Africa in 2024

- Fintech Funding in Africa: Regional Breakdown

- African Startups Raise $289M in Jan 2025: A 240% YoY Surge

- Nigeria & Kenya Lead as Africa’s Big 4 Dominate 2025 Funding