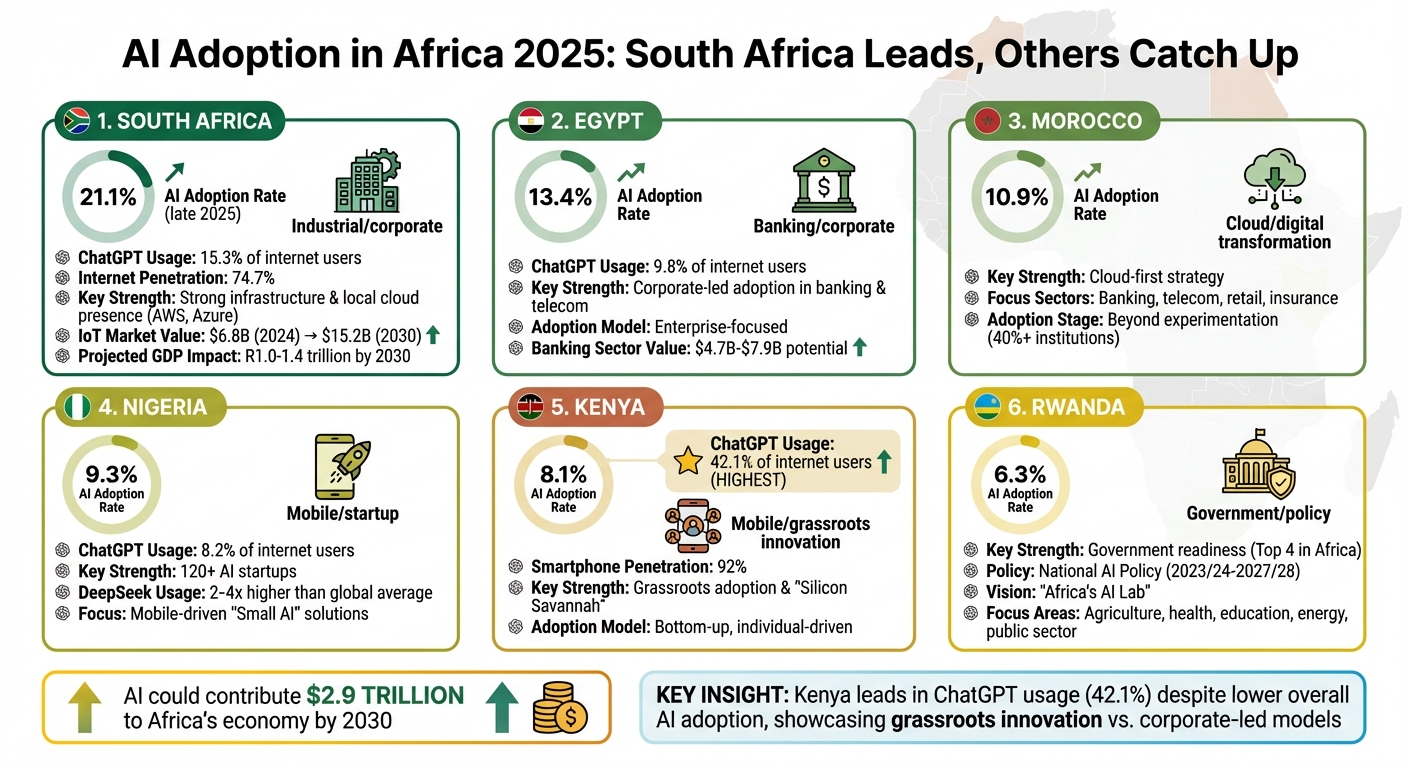

Africa is rapidly advancing in AI adoption, with South Africa leading the charge. By 2025, South Africa’s strong infrastructure, progressive policies, and private sector innovation have positioned it as a regional leader. Meanwhile, countries like Kenya, Nigeria, Morocco, Rwanda, and Egypt are closing the gap by leveraging their unique strengths to integrate AI into key sectors like healthcare, agriculture, finance, and education.

Key Highlights:

- South Africa: Internet penetration at 74.7% (2024), $6.8B IoT market, and robust policies like POPIA and the Cybercrimes Act.

- Kenya: Grassroots AI adoption leads to a 42.1% ChatGPT usage rate, driven by mobile access.

- Morocco: Focuses on AI in banking, telecom, and retail, supported by a cloud-first strategy.

- Rwanda: Strong government readiness with a National AI Policy and AI-focused initiatives.

- Nigeria: Growth in mobile-driven AI tools and over 120 AI startups despite challenges like talent shortages.

- Egypt: Corporate-led AI adoption with advanced banking and telecom applications.

The continent’s AI growth faces challenges like limited compute power, uneven infrastructure, and low venture capital. However, the rise of lightweight, mobile-friendly "Small AI" solutions is helping overcome these barriers, especially in low-income regions. By 2030, AI could contribute $2.9 trillion to Africa’s economy, transforming industries and driving GDP growth.

AI Adoption Rates Across 6 African Countries in 2025

1. South Africa

AI adoption levels

South Africa stands out as a regional leader in the Fourth Industrial Revolution, driven by strong research initiatives, private-sector innovation, and evolving government policies. By June 2025, the public sector had implemented at least 23 AI tools across areas like healthcare, public safety, and conservation. Beyond government efforts, industries such as finance and mining are significantly investing in AI, supported by the availability of local cloud infrastructure.

The Internet of Things (IoT) market in South Africa was valued at $6.8 billion in 2024 and is expected to nearly double, reaching $15.2 billion by 2030. Under moderate AI adoption scenarios, these technologies could contribute between R1.0 and R1.4 trillion to the country’s GDP by 2030. These developments are driving transformative changes across multiple industries.

Key sectors impacted

South Africa’s digital advancements are fueling innovation in critical areas like healthcare, financial services, agriculture, and public safety.

Healthcare is undergoing a much-needed transformation. With a doctor-to-patient ratio of just 0.8 per 1,000 people – far below the UK’s 3.0 or Brazil’s 2.3 – AI is playing a crucial role in addressing healthcare shortages. For example, Envisionit Deep AI uses computer vision to streamline medical imaging diagnoses, while the government’s MomConnect platform, active since 2014, provides personalized maternal health advice via SMS and WhatsApp.

In financial services, AI is expanding access to underserved populations. Jumo, an AI-driven marketplace, connects traditional banks with customers previously excluded from financial systems by using predictive credit scoring based on non-traditional data. By 2030, this sector is expected to add R340 billion to the GDP.

Agriculture is also benefiting from AI innovations. Aerobotics, for instance, uses AI-powered drone imagery to detect pests and diseases, helping farmers improve crop yields. This sector is projected to contribute R210 billion to the economy by 2030.

In public safety, AI is enhancing law enforcement capabilities. Cape Town’s Smart Safety Technology Suite uses computer vision to analyze CCTV footage in real time, enabling faster responses to incidents like gunshots and tracking suspects. Conservation efforts are also leveraging AI, with drones equipped to differentiate between humans and animals, aiding in the fight against rhino poaching.

Infrastructure and policy

South Africa’s infrastructure offers a significant advantage for AI adoption. Local data centers from AWS and Azure ensure compliance with data residency requirements while reducing latency for AI applications. This has been a key factor in driving enterprise adoption across various sectors.

The country’s regulatory framework further supports AI integration. The Protection of Personal Information Act (POPIA) of 2013 safeguards data privacy, while the Cybercrimes Act of 2020 addresses digital security. Additionally, the National Artificial Intelligence Policy Framework, finalized in 2024, aims to incorporate AI technologies to boost economic growth and establish South Africa as a continental leader. As the Department of Communications and Digital Technologies explains:

"The National Artificial Intelligence (AI) Policy Framework aims to integrate AI technologies to drive economic growth, enhance societal well-being, and position South Africa as a leader in AI innovation."

Startup and funding ecosystem

South Africa’s startup ecosystem is thriving, with a strong focus on AI solutions tailored to local challenges. Companies like Aerobotics, Envisionit Deep AI, and Jumo are leading the charge, alongside many others developing "Small AI" solutions – mobile-based, cost-effective applications designed for sectors like agriculture and education that don’t require extensive infrastructure. This approach is especially relevant in addressing issues such as literacy, with about 81% of Grade 4 learners in South Africa struggling to read for meaning. AI-powered educational tools present a promising opportunity to tackle this challenge.

2. Morocco

AI Adoption Levels

Morocco stands out as a leader in AI adoption, with top executives actively participating in regional CIO roundtables to strategize on integrating generative AI into the economy. This aligns with a larger trend across the region, where over 40% of institutions are either experimenting with generative AI or have already implemented major solutions.

On an individual level, adoption is growing, fueled by the availability of affordable mobile apps. While business and government applications are still in the early stages, many organizations are moving beyond initial experiments to tackle specific socio-economic challenges. These shifts are beginning to reshape critical areas of the economy.

Key Sectors Impacted

The influence of AI is becoming increasingly clear in Morocco’s most technologically advanced industries. Key sectors like banking, telecommunications, retail, insurance, and the public sector are seeing transformative changes.

- Banking: AI is revolutionizing customer operations, software development, and risk management.

- Telecommunications: Companies are using AI to enhance customer service, improve marketing strategies, and optimize network performance.

- Retail: Businesses are leveraging AI for hyper-personalized marketing and outbound sales efforts.

- Insurance: AI is streamlining customer service and claims management.

Organizations are moving beyond basic "copilot" AI tools, adopting strategies that not only improve productivity but also transform workflows. As McKinsey & Company highlights:

"African institutions are rapidly catching up with, and in some cases leading, global developments".

Infrastructure and Policy

Morocco benefits from a cloud-first strategy, bypassing older fixed-line systems in favor of cloud-based AI solutions. This approach positions the country as a key player in unlocking the $61–$103 billion in annual economic value generative AI could bring to Africa. Traditional AI and machine learning are expected to account for at least 60% of the potential AI value across African economies.

However, challenges remain. Fragmented data sources and a lack of specialized AI analytics tools are significant hurdles that organizations must overcome to fully realize AI’s benefits.

3. Kenya

AI Adoption Levels

By July 2025, Kenya achieved a 42.1% ChatGPT adoption rate among internet users aged 16 and older. This figure far surpasses adoption rates in other major African economies like South Africa (15.3%), Egypt (9.8%), and Nigeria (8.2%). With a smartphone penetration rate of 92%, most Kenyans have easy access to AI tools via mobile devices.

What sets Kenya apart is its grassroots approach to AI adoption. Unlike South Africa, where large corporations are the primary drivers of AI integration, Kenya’s growth is fueled by individuals, small businesses, and startups incorporating AI into their daily activities. This bottom-up adoption model enriches Africa’s diverse AI ecosystem. Analyst Nana Appiah Acquaye highlights:

"Kenya’s remarkable lead in artificial intelligence adoption reflects its unique digital landscape, where widespread mobile internet access, strong English proficiency and a vibrant startup culture have created ideal conditions for AI tools to flourish."

This dynamic environment is sparking transformations across multiple sectors.

Key Sectors Impacted

AI is reshaping key areas of Kenya’s economy. In education, schools are using generative AI tools to create personalized learning experiences tailored to each student’s needs. In healthcare, AI-powered chatbots are providing maternal health support, making critical information more accessible. Meanwhile, the finance sector benefits from mobile-based credit scoring and fraud prevention systems, which are expanding financial inclusion. Kenya’s advanced telecommunications industry is also leveraging AI for customer service improvements and network optimization. Additionally, the agriculture sector is embracing mobile-friendly "Small AI" tools that address farming challenges affordably and effectively.

These advancements are bolstered by robust infrastructure and forward-thinking policies.

Infrastructure and Policy

Kenya unveiled its National AI Strategy 2025–2030 on March 27, 2025, laying out a structured framework built on three pillars: AI Digital Infrastructure, Data, and AI Research & Innovation. This strategy aims to position Kenya as a regional hub for AI research, development, and commercialization. Alongside this, the government is working on policies such as the Kenya Robotics and AI Society Bill and the Draft IT Artificial Intelligence Code of Practice, though a comprehensive legal framework for AI is still in progress. Kenya’s mobile-first infrastructure allows it to leapfrog traditional development stages, much like it did during its mobile payments revolution.

Startup and Funding Ecosystem

Kenya’s "Silicon Savannah" is at the heart of its AI innovation. This ecosystem thrives on a combination of tech-savvy youth, strong English proficiency, and practical applications that meet local needs. Kenya’s early adoption of AI provides a competitive edge, attracting international tech investments and fostering homegrown AI solutions. Analysts estimate that generative AI could unlock between $61 billion and $103 billion in annual economic value across Africa, with Kenya poised to capture a significant share of this potential. Mark Elliott, Division President for Africa at Mastercard, underscores this:

"Africa’s engagement with AI is already reshaping lives – not just in labs, but in farms, clinics and classrooms."

Kenya’s progress is not just a local success story – it reflects and contributes to Africa’s broader AI transformation, showcasing the continent’s growing role in the global AI landscape.

4. Rwanda

AI Adoption Levels

Rwanda is making strides in government readiness for AI, even though the adoption of generative AI among its population remains relatively low. By the end of 2025, only 6.3% of Rwanda’s working-age population had embraced generative AI – a figure that lags behind countries like South Africa, Egypt, Nigeria, and Kenya. Despite this, Rwanda stands out as one of the top four African nations in government preparedness for AI, sharing this distinction with Egypt, Mauritius, and South Africa. The country is also gaining recognition as a hub for AI governance and innovation by hosting major events, such as the Global AI Summit on Africa in Kigali. These efforts reflect Rwanda’s ambition to lead targeted AI-driven advancements across various sectors.

Key Sectors Impacted

With its strong foundation in AI readiness, Rwanda has zeroed in on five critical areas for AI integration: agriculture, health, education, energy, and the public sector. The government envisions transforming the nation into "Africa’s AI Lab" and a global leader in AI research. This vision is encapsulated in the National AI Policy, which emphasizes the importance of data:

"Data is the energy that will fuel Rwanda as Africa’s AI Hub".

To bring this vision to life, Rwanda has rolled out initiatives like incorporating AI into its national curriculum and creating a dedicated "Teacher Corps" to ensure educators are equipped for this transformation. Additionally, the National AI Program connects startups, industry leaders, and researchers to tackle sector-specific challenges. These efforts align with the growing momentum of AI innovation across the continent.

Infrastructure and Policy

Rwanda’s National AI Policy, which spans the fiscal years 2023/24 to 2027/28, outlines six key focus areas: developing 21st-century skills, building reliable infrastructure, implementing a robust data strategy, driving AI adoption in both public and private sectors, and ensuring ethical AI practices. To oversee these ambitious goals, the government established the Responsible AI Office (RAIO) within the Ministry of ICT and Innovation. Meanwhile, the Rwanda Utilities Regulatory Authority (RURA) has introduced guidelines to promote ethical AI use. Supporting these initiatives is a "Cloud First" strategy, which includes feasibility studies for a continental AI-ready hyperscale data center. These measures underline Rwanda’s commitment to becoming a leader in AI governance and innovation.

5. Nigeria

AI Adoption Levels

Nigeria is carving out a space as a key player in AI within Sub-Saharan Africa. While it still lags behind South Africa and some North African nations in overall adoption, the momentum is undeniable. By mid-2025, 9.3% of Nigeria’s working-age population had adopted AI, a climb from 8.7% earlier in the year. This growth reflects a shift toward practical, mobile-driven "Small AI" applications in areas like agriculture and healthcare. Though slower compared to its regional peers, Nigeria’s progress signals a noteworthy shift in how AI is being integrated across the continent.

The availability of open-source AI models has been a game-changer, lowering entry barriers significantly. One standout example is DeepSeek, a Chinese AI platform that has gained popularity in Nigeria through free access and partnerships with companies like Huawei. In fact, DeepSeek’s usage in Africa, including Nigeria, is estimated to be 2 to 4 times higher than in other parts of the world. The country’s AI ecosystem is thriving, with over 120 AI-focused startups identified by 2025. These startups are fueled by local partnerships and Nigeria’s distinct market dynamics, setting the stage for AI to reshape industries across the nation.

Key Sectors Impacted

The financial services sector is leading Nigeria’s AI adoption. Banks and fintech firms are moving past experimental phases and rolling out AI solutions across their operations. These tools are being used for tasks like risk assessment, document verification, and fraud detection. In May 2025, a Nigerian telecom provider introduced a generative AI chatbot as a digital assistant. This tool integrates with existing customer relationship management (CRM) systems, offering 24/7 customer support, facilitating airtime purchases, and activating services – all while improving response times and customer satisfaction.

Agriculture and healthcare are also undergoing significant changes. Local startups are leveraging AI to deliver precise crop forecasts, streamline operations, and enhance diagnostic services. As PwC Nigeria emphasizes:

"For Nigeria, AI represents more than just a technological shift; it is a strategic opportunity to accelerate inclusive growth, enhance public services, and position the country as a digital leader on the African continent".

These advancements are underpinned by government initiatives and infrastructure improvements, which aim to create a solid foundation for AI-driven growth.

Infrastructure and Policy

Nigeria has taken steps to build a supportive framework for AI development. Institutions like the National Centre for Artificial Intelligence and Robotics (NCAIR) and the Nigeria Artificial Intelligence Research Scheme (NAIRS) provide funding and technical resources. Meanwhile, the 3MTT (Three Million Technical Talent) program is training 3 million Nigerians in technical skills to address the skills gap created by brain drain. On the regulatory side, the Nigeria Data Protection Regulation (NDPR) lays the groundwork for data privacy, though AI governance remains fragmented across multiple bodies.

Despite these efforts, challenges persist. The high cost of GPU hardware and data storage continues to hinder local organizations, and the emigration of skilled professionals exacerbates the talent shortage. However, the National AI Strategy outlines a clear vision to position Nigeria as a digital leader, aligning with projections that AI could contribute up to $15.7 trillion to the global economy by 2030. These initiatives aim to secure Nigeria’s place as a driving force in Africa’s digital transformation.

sbb-itb-dd089af

6. Egypt

AI Adoption Levels

Egypt is recognized as one of Africa’s major tech hubs, yet its AI adoption rates tell a different story. As of July 2025, only 9.8% of Egyptian internet users aged 16 and older had embraced AI. This figure lags significantly behind Kenya’s 42.1% and South Africa’s 15.3%, though it edges out Nigeria’s 8.2%. Interestingly, the issue isn’t rooted in infrastructure or the strength of Egypt’s digital economy – both of which are well-developed. Instead, the slower adoption is attributed to limited grassroots integration, which has hindered broader usage.

Egypt’s AI adoption is largely driven by corporations, setting it apart from other African nations where grassroots usage plays a bigger role. According to the 2024 McKinsey State of AI Africa survey, Egyptian companies are actively experimenting with or implementing notable generative AI solutions. This corporate-led approach positions Egypt as a hub for enterprise-focused AI innovation, fostering sector-specific advancements rather than widespread public adoption.

Key Sectors Impacted

The banking sector in Egypt is at the forefront of AI deployment, leveraging generative AI for tasks like credit risk assessments and automated memo drafting. Telecommunications and technology industries are also making strides, using AI to improve customer operations and marketing efforts. These advancements could unlock between $4.7 billion and $7.9 billion in economic value for Africa’s banking sector as a whole.

Telecommunications and technology industries, being among Egypt’s most digitally advanced sectors, are also reaping the benefits of AI. Across the African continent, AI’s impact in telecommunications alone could generate up to $9.6 billion in value.

Infrastructure and Policy

Egypt has centralized its AI efforts through the National Council for Artificial Intelligence and a comprehensive national AI strategy. The Ministry of Communications and Information Technology plays a key role in promoting digital inclusion and skill development via initiatives like "Digital Egypt" and institutions such as the Applied Innovation Center, Information Technology Institute (ITI), and National Telecommunication Institute (NTI).

On a continental level, Egypt is a signatory to the African Union‘s Continental Artificial Intelligence Strategy, adopted in June 2024. This strategy emphasizes an Africa-led, people-focused approach to building AI infrastructure and talent. Dr. Amani Abou-Zeid, African Union Commissioner for Infrastructure and Energy, highlighted the potential of AI, stating:

"For us Africans, Artificial Intelligence presents tremendous opportunities. It is a driving force for positive transformational positive change as well as economic growth and social progress".

Further support comes from organizations like the Technology Innovation and Entrepreneurship Center (TIEC) and the Information Technology Industry Development Agency (ITIDA), which focus on fostering startups, attracting investments, and supporting business growth. Despite these efforts, challenges remain, particularly in areas like compute capacity, locally relevant data, and the development of digital skills.

CNBC Africa AI Summit 2025: Highlights Special

Strengths and Challenges

Africa’s journey with AI is a story of contrasts. The pace of adoption varies widely across the continent, with each nation showcasing its own strengths and facing unique hurdles. These differences highlight the diverse opportunities and obstacles in the region’s AI landscape.

South Africa stands out with an AI adoption rate of 21.1% as of late 2025. This progress is bolstered by the presence of local AWS and Azure infrastructure, alongside a robust 74.7% internet penetration. However, the regional disparities are striking: Gauteng boasts 86% internet penetration and 55% 5G availability, while Limpopo lags behind with just 54% internet access and 12% 5G coverage.

In Kenya, AI adoption sits at 8.1%, driven by grassroots efforts but held back by steep connectivity costs and limited venture capital. Nigeria, with a 9.3% adoption rate, faces similar challenges. African startups collectively attract only 9% of global AI venture capital, leaving the remaining 91% concentrated in high-income countries.

Morocco and Egypt show moderate adoption rates of 10.9% and 13.4%, respectively. Yet, both nations grapple with a "context gap" – the dominance of English in AI training data limits the development of applications in local languages. Across the continent, access to computing power remains a critical issue. Only 5% of African AI professionals have access to high-performance computing, and a mere 1% work with on-premise facilities.

Rwanda, despite its strong policy frameworks, records a modest 6.3% AI adoption rate. The country faces a significant barrier in digital literacy, with fewer than 5% of people in low-income regions possessing basic digital skills.

The World Bank succinctly captured the essence of these challenges:

"Compute is the new electricity in the AI era – essential but unevenly distributed".

This inequality is starkly visible in data center capacity. Low-income countries account for less than 0.1% of global capacity, while high-income nations dominate with 77%. Such disparities partly explain the popularity of open-source platforms like DeepSeek in Africa. These platforms are used two to four times more frequently on the continent, as they bypass subscription fees and offer more accessible solutions.

Conclusion

South Africa is at the forefront of AI adoption in Africa, with 15.3% of its internet users engaging with ChatGPT and over 60% of its workforce utilizing generative AI tools. The country’s ambitious goal of securing $3.7 billion in AI investments by 2030 underscores its dedication to reshaping industries like manufacturing and healthcare. However, the AI story in Africa is far from limited to South Africa.

Kenya exemplifies how grassroots innovation can drive adoption, boasting a ChatGPT usage rate of 42.1% among internet users – nearly three times that of South Africa. In Nigeria and Egypt, sector-specific applications are making waves, such as AI-powered customer service platforms in telecommunications and automated credit systems in banking. Meanwhile, Morocco is focusing on strategic policies to promote ethical AI practices and improve digital literacy, emphasizing that sustainable growth in AI requires both technological progress and regulatory frameworks. Together, these efforts highlight Africa’s collective drive toward a shared AI future.

The path forward aligns with the World Bank’s "Four Cs" framework: Connectivity, Compute, Context, and Competency. As Dr. Amani Abou-Zeid of the African Union aptly stated:

"Adapting AI to African realities is critical. AI systems should be able to reflect our diversity, languages, culture, history, and geographical contexts".

Adopted in July 2024, the Continental AI Strategy serves as a unified guide for African nations to strengthen these pillars collaboratively.

The potential economic impact is enormous. In South Africa alone, AI and IoT technologies could contribute between R1.0 trillion and R1.4 trillion to GDP by 2030, with manufacturing expected to account for R380 billion of that total. Across the continent, generative AI promises to unlock substantial annual economic value. By leveraging lightweight "small AI" solutions that overcome traditional infrastructure challenges, African nations are building a foundation for transformative growth that transcends barriers.

FAQs

What makes South Africa a leader in AI adoption across Africa?

South Africa has emerged as a leader in AI adoption, thanks to robust government initiatives, forward-thinking strategies, and a dynamic tech community. In 2024, the government rolled out the AI Policy Framework and the Draft National AI Strategy, laying the groundwork for advancing research, nurturing talent, upgrading infrastructure, and promoting ethical AI practices. These efforts have created a supportive environment that draws in both local tech visionaries and international investors.

The country also boasts several advantages, including access to extensive data resources, expanding computational capabilities, and a highly skilled workforce. Public-private collaborations, thriving startup hubs, and comprehensive training programs are further fueling advancements in areas like agriculture, healthcare, finance, and energy. Altogether, these elements solidify South Africa’s position as a driving force in Africa’s AI evolution.

How are Kenya and Nigeria addressing challenges in adopting AI technologies?

Kenya is making the most of its widespread mobile internet access and increasing use of AI tools like ChatGPT to spark progress in areas like healthcare, finance, and agriculture. Entrepreneurs are stepping up, blending strong consumer interest with government-backed programs, such as data-sharing initiatives and accelerator platforms. These efforts aim to cut costs and tackle hurdles like limited infrastructure and a shortage of skilled professionals.

Meanwhile, Nigeria is moving forward at a slower but steady pace, addressing challenges such as infrastructure gaps and regulatory uncertainties. The country is focusing on public-private partnerships, national AI strategies, and investments in data centers to strengthen its position. Additionally, steps are being taken to build a skilled workforce and improve internet connectivity, laying the groundwork for a more resilient AI ecosystem. Together, these actions are helping both Kenya and Nigeria push forward in adopting AI across essential industries.

How can lightweight AI models help overcome infrastructure challenges in Africa?

Africa encounters several hurdles in building the infrastructure needed to support AI solutions. Issues like limited internet access, inadequate computing resources, a lack of region-specific data, and a shortage of skilled professionals create significant challenges. These obstacles make deploying resource-heavy AI systems across the continent a tough task.

This is where ‘Small AI’ – lightweight AI models – comes into play. These models are designed to function effectively with minimal resources. While detailed examples of ‘Small AI’ applications in Africa are scarce, their potential is undeniable. They can bridge infrastructure gaps by requiring less computing power, operating with limited datasets, and functioning in environments with low connectivity. These advancements could make AI solutions more accessible and practical across the region.

Related Blog Posts

- Solving Africa’s Tech Talent Gap with AI Training

- The Rise of AI Startups in Africa: Tools, Trends & Talent

- North vs. Sub-Saharan Africa: AI Investment Trends

- AfDB Report: AI Could Add $1 Trillion to Africa’s GDP by 2035