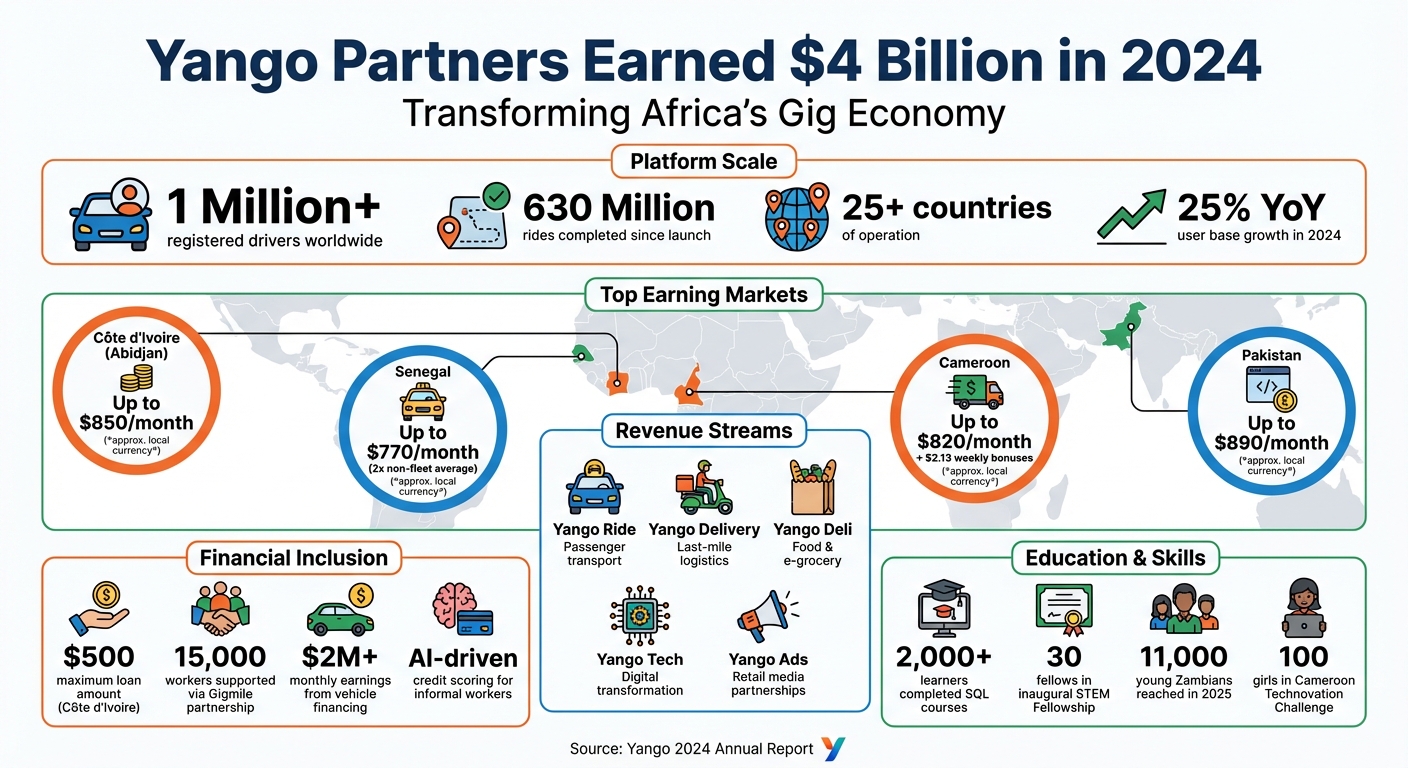

Yango‘s gig economy platform helped drivers earn a total of $4 billion in 2024, showcasing its role in creating income opportunities across Africa and beyond. With over 1 million drivers completing 630 million rides since its launch, Yango has become a key player in the gig economy. Here’s what you need to know:

- Earnings Breakdown: Drivers in top markets like Côte d’Ivoire, Cameroon, and Senegal earned up to $850/month, with bonuses and demand-driven pricing boosting income.

- Diverse Services: Yango Ride, Delivery, Deli, Tech, and Ads contributed to revenue, while partnerships like Gigmile supported vehicle access for 15,000 workers.

- Financial Tools: In-app lending in Côte d’Ivoire provided drivers with loans up to $500, using AI-based credit scoring to assess eligibility.

- Growth Drivers: Investments in digital infrastructure, AI tools, and partnerships with fintech and leasing firms made entry easier for drivers and improved earnings.

- Education and Inclusion: Yango launched STEM programs and mobility hackathons, while promoting electric vehicles and digital literacy for underserved communities.

Yango’s $4 billion milestone highlights how platforms can transform income streams for gig workers while addressing financial challenges and fostering skill development.

Yango’s $4B Gig Economy Impact: Key Statistics and Earnings Breakdown 2024

How Yango Partners Earned $4 Billion in 2024

Revenue by Service Type

Yango’s super-app model played a central role in driving partner earnings in 2024, with revenue flowing from a variety of services. These included Yango Ride for passenger transport, Yango Delivery for last-mile logistics, Yango Deli for food delivery and e-grocery services, and Yango Tech, which provided digital transformation and fulfillment solutions to retailers like Spar and Nana across the GCC and India. Additionally, Yango Ads collaborated with retail media and tourism promoters to generate further income.

Strategic investments in asset-backed financing also contributed significantly. For instance, a partnership with Gigmile deployed 10,000 vehicles across 13 cities, supporting 15,000 gig workers. This initiative alone generated over $2 million in monthly rider earnings.

Together, these diverse revenue streams powered Yango’s robust regional performance, detailed below.

Top Markets and Regional Performance

West and Central Africa stood out as the most lucrative regions for Yango partners. Cities like Abidjan in Ivory Coast, Douala in Cameroon, and Dakar in Senegal offered some of the highest monthly earning potentials. In Abidjan, drivers earned up to 520,000 FCFA (about $850) monthly. In Cameroon, partners reached up to 500,000 FCFA (around $820) per month, with weekly bonuses of up to 1,300 FCFA (approximately $2.13). Meanwhile, drivers in Senegal earned as much as 469,577 CFA (roughly $770) per month, more than doubling the regional non-fleet average.

Ethiopia emerged as a fast-growing market after Yango’s 2023 launch in Addis Ababa. Within less than a year, the platform attracted 1 million users, significantly boosting trip volumes for local drivers. In Pakistan, operations expanded to major cities like Karachi, Lahore, Faisalabad, Islamabad, and Rawalpindi, where drivers earned up to 250,000 Rs (approximately $890) monthly.

Income Impact on Gig Workers

Yango’s $4 billion milestone translated into direct earnings for over 1 million registered drivers worldwide. The platform’s smart order distribution system ensured drivers spent less time waiting for trips, automatically assigning ride requests back-to-back to maximize their active earning hours.

"The partnership was underpinned by a shared understanding of how efficient delivery systems scale across emerging markets… with the aim of improving delivery efficiency while advancing financial inclusion for gig and informal workers." – Daniil Shuleyko, CEO, Yango Group

Incentives like guaranteed bonuses, peak-hour surge pricing, and priority trip assignments for branded vehicles further boosted driver income. Additionally, Yango’s diversification into delivery and logistics allowed partners to earn across multiple service categories, giving them the flexibility to switch between roles based on demand and personal preference.

Financial Services for Yango Partners

In-App Lending and Cash Advances

In December 2024, Yango introduced a groundbreaking financial service in Côte d’Ivoire, collaborating with COFINA, a microfinance institution, and Yabx, an embedded finance platform. This service allows drivers to access loans of up to 300,000 CFA (approximately $500) directly through the Yango Pro app. With repayment periods ranging from two to eight weeks, the system uses AI-driven credit scoring to evaluate drivers’ app activity, trip history, and earnings. This innovative approach enables drivers without traditional credit histories to qualify for formal loans for the first time.

"By embedding lending directly within the Yango platform, we are removing barriers to financial access, offering users quick and convenient access to capital. We believe embedded lending has the potential to transform access to credit in underserved regions." – Puneet Chopra, Chief Growth Officer, Yabx

The entire lending process is fully digital. Drivers can apply, receive approval, and have funds deposited directly into their accounts – all without stepping into a bank. While currently available only to drivers in Côte d’Ivoire, Yango plans to extend these financial services to riders, food delivery agents, and merchants in the future.

Solving Common Financial Problems

Yango’s financial solutions go beyond quick cash advances, addressing deeper challenges faced by gig workers. Many traditional banks in Africa view gig workers as high-risk borrowers due to the absence of formal employment contracts, steady paychecks, or established credit histories. This gap, often referred to as the "missing middle", leaves many without access to essential financial services.

Yango’s cash advance program bridges this gap by using platform data to assess creditworthiness. The AI system identifies patterns in earnings and trip activity, treating these as indicators of financial stability. By doing so, it helps transition informal workers into the formal digital economy. With a user base growing at over 25% annually, this program provides a scalable solution for thousands of drivers who previously struggled to secure working capital.

"By providing this lending service to our partners’ drivers and users, we empower them to fulfill their dreams and achieve the desired results by investing in their businesses." – Kadotien Soro, Country Manager, Yango Côte d’Ivoire

This service not only offers immediate financial relief but also helps drivers manage their daily expenses more effectively. Real-time earnings tracking within the app further simplifies cash flow management, giving drivers greater control over their finances.

What Drove Yango’s Growth in 2024

Infrastructure Investments

Yango’s path to reaching $4 billion in 2024 was paved with strategic investments in digital infrastructure. One standout move was integrating Yabx’s Lending-as-a-Service directly into the Yango Pro app. This seamless integration allowed drivers to access capital without leaving the platform, simplifying the lending process for informal workers.

The company also developed AI-powered credit scoring systems that assessed drivers’ digital footprints. By analyzing factors like trip patterns, earnings consistency, and app activity, Yango could determine creditworthiness even for drivers who had never qualified for traditional bank loans. This opened up financial opportunities for many who had previously been excluded from formal lending systems.

Operationally, Yango established local hubs and 24/7 support teams while deploying advanced tools like smart order distribution, traffic forecasting, and mapping technologies. These innovations minimized dead mileage and improved trip efficiency, boosting driver earnings. With over 1 million registered drivers across more than 30 countries, these investments created a cycle where higher earnings attracted more drivers, fueling further growth.

This robust infrastructure laid the foundation for external partnerships that further accelerated the company’s expansion.

Partnerships with Fintech Companies

Yango capitalized on its upgraded infrastructure by forming key partnerships with fintech companies to enhance financial access for drivers and break down entry barriers. For example, a collaboration with COFINA and Yabx in Côte d’Ivoire introduced a driver cash advance service that combined local expertise with AI-driven solutions to offer personalized financing.

"This partnership with Yango and Yabx represents a significant step forward in offering financing solutions tailored to the needs of Yango drivers. We are proud to play a part in building a more inclusive and resilient digital economy." – Amed Sié TOURE, Managing Director, COFINA Côte d’Ivoire

Additionally, partnerships with leasing and insurance providers reduced upfront costs for new drivers, making it easier for them to start earning on the platform. These initiatives significantly lowered barriers to entry, contributing to a 25% year-over-year growth in Yango’s user base in 2024. By combining financial accessibility with operational efficiency, Yango not only boosted driver earnings but also cemented its leadership in the African gig economy.

sbb-itb-dd089af

Skills Training and Long-Term Programs

Digital Skills and Education Programs

Yango is committed to fostering workforce development through education, with a strong focus on STEM initiatives. In 2024, the company launched four flagship programs aimed at building digital skills across Africa. Over 2,000 learners in Ghana, Côte d’Ivoire, and Zambia successfully completed free SQL data analysis courses, equipping them with sought-after skills to expand their career prospects.

Among these efforts, the Yango STEM Fellowship stands out as the company’s most ambitious educational program. First introduced in Zambia in 2024, the fellowship provided comprehensive support – including full financial aid, mentorship, and hands-on workshops – to its inaugural group of 30 fellows, who graduated in 2025. By early 2025, the program extended to Côte d’Ivoire, aiming to empower young innovators to pursue careers in technology.

"Our goal is to help build the digital cities and digital opportunities of tomorrow – together with the countries we serve." – Daniil Shuleyko, CEO of Yango Group

To further strengthen digital capacity, Yango organized mobility hackathons in six African nations, focusing on data science and machine learning challenges. In Cameroon, the company supported the Technovation Challenge, where 100 girls developed technology and entrepreneurship projects under the guidance of local mentors. This initiative is part of Yango’s broader effort to increase female representation in STEM fields.

Electric Mobility and Social Inclusion Projects

Beyond digital education, Yango is also working to modernize transportation and promote inclusivity. In Côte d’Ivoire, the company is piloting electric vehicle solutions designed to modernize urban transport systems and reduce operational costs for drivers. These initiatives not only align with Yango’s vision for sustainable urban mobility but also open up income opportunities within the growing electric vehicle sector.

Social inclusion remains a key priority for Yango. In 2025, the company’s programs reached over 11,000 young Zambians, offering road safety training and career fairs. Additionally, Yango introduced digital literacy programs for visually impaired students, ensuring that underserved communities have access to technology. Together, these initiatives create a holistic support system, helping gig workers progress from initial training to meaningful career opportunities.

Yango

Conclusion: What Yango’s $4 Billion Milestone Means

Yango reaching the $4 billion mark in 2024 shows just how far Africa’s gig economy has come, transforming into a powerful driver of economic growth and opportunity. Operating in 25 countries, Yango is helping workers, often overlooked by traditional financial systems, gain access to financial tools and opportunities that were once out of reach.

The platform’s influence is clear: in Senegal, drivers using Yango earn more than double the average income of non-fleet drivers. Meanwhile, the transportation and warehousing sector is set to create nearly 387,000 new jobs by 2033, solidifying gig platforms as a major source of employment. These developments not only reflect a thriving market but also provide a roadmap for sustainable growth and innovation.

For entrepreneurs, Yango’s financial services, like the Driver Cash Advance program offering loans up to $500, and its partnership with Gigmile for vehicle financing, illustrate how integrated financial tools can spur reinvestment and business growth. Kadotien Soro, Country Manager for Yango Côte d’Ivoire, emphasized this point:

"This lending service empowers drivers to reinvest in their businesses and reach their goals. It’s a valuable opportunity, and we encourage all beneficiaries to use these funds wisely for growth."

Investors, too, have reason to take note. With Gigmile deploying over $18 million in financed mobility assets and utilizing AI-driven credit scoring to assess platform performance rather than traditional collateral, the potential to unlock capital for millions of informal workers is immense.

This $4 billion milestone underscores that Africa’s gig economy is not just growing – it’s reshaping economic landscapes. By blending infrastructure with financial inclusion, platforms like Yango are proving how rapidly these solutions can scale their impact. The focus now shifts to how quickly these transformative models can expand their reach and deepen their influence.

FAQs

How can Yango drivers access short-term loans through the app?

Yango has introduced a handy in-app lending feature called Driver Cash Advance, designed to help drivers access short-term loans directly through the Yango app. By partnering with financial institutions, Yango uses drivers’ activity on the platform to build credit profiles – even for those who don’t have traditional credit histories.

With just a few taps, drivers can apply for loans of up to $500, which are instantly deposited into their Yango wallet upon approval. These funds can cover essential expenses like fuel, vehicle maintenance, or other work-related costs. Repayment is straightforward and flexible, with terms ranging from 2 to 8 weeks. Payments are automatically deducted from the driver’s earnings, ensuring a smooth and hassle-free process. While this feature is currently exclusive to Yango drivers, there are plans to make it available to other platform users in the future.

What has driven Yango’s success in the gig economy?

Yango has carved a niche for itself in the gig economy by combining cutting-edge technology with a driver-first mindset. At the heart of this is the Yango Pro app, which uses advanced algorithms to match drivers and couriers with customers in a way that’s both efficient and seamless. Add to this the appeal of flexible working hours, instant cash payouts, and weekly bonuses, and it’s easy to see why Yango is a favorite among gig workers – even for those who don’t own a vehicle.

Since its debut in Ivory Coast in 2018, Yango has expanded its reach to more than 13 African countries, creating a network of nearly one million drivers and couriers. The company has also partnered with over 1,700 small and medium-sized businesses, while investing in local talent and educational initiatives. This approach has not only helped gig workers collectively earn an impressive $4 billion in 2024 but has also contributed significantly to economic growth across the region.

How does Yango help drivers access vehicles and financial support?

Yango simplifies the process for drivers to kickstart and expand their ride-hailing businesses by tackling two common hurdles: access to vehicles and financial support. To help with immediate expenses, Yango has partnered with financial service providers to offer an in-app Driver Cash Advance. Drivers can borrow up to $500 for short periods (ranging from 2 to 8 weeks), which can be used for essentials like fuel, vehicle maintenance, or other operational costs.

On top of that, Yango works with financial institutions to provide flexible vehicle financing solutions. Through Yango’s partner network, drivers can lease or purchase cars at discounted rates, enabling them to start earning even if they don’t currently own a vehicle. These efforts are designed to equip drivers with the resources and opportunities they need to thrive in the gig economy.

Related Blog Posts

- Ride sharing and ride hailing startups in Africa

- Top 5 Regions for MobilityTech Funding in Africa

- 10 Startups to Watch in 2025 in West Africa

- Funding Trends in African E-Mobility Startups