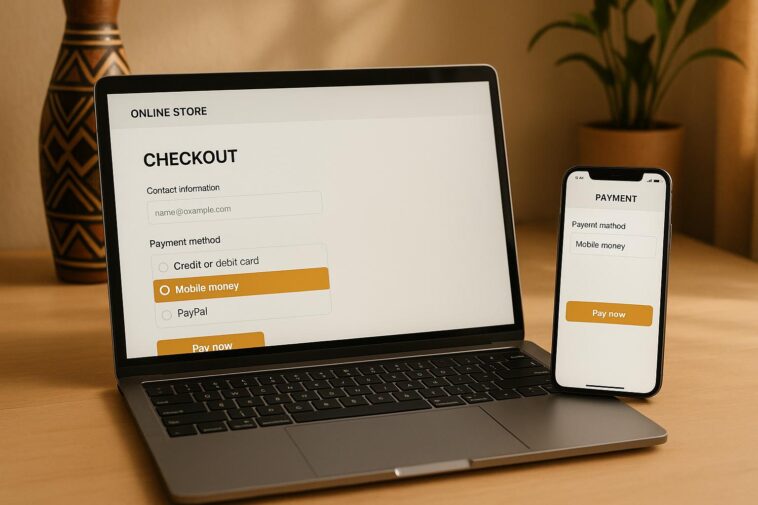

Mobile money APIs are the key to unlocking Africa’s e-commerce potential. With over 835 million mobile money accounts in 2023 facilitating $919 billion in transactions, integrating these APIs allows online stores to connect with millions of unbanked consumers. Here’s what you need to know:

- Why Mobile Money APIs Matter: Mobile money dominates payments in Africa, with platforms like M-Pesa and MTN Mobile Money driving financial inclusion. Without API integration, e-commerce businesses miss out on a massive customer base.

- Getting Started: Ensure legal compliance with KYC and anti-money laundering regulations. Set up technical infrastructure, including RESTful API knowledge and sandbox testing.

- Choosing a Provider: Evaluate providers like MTN, Flutterwave, or pawaPay based on geographic reach, transaction fees, and developer support.

- Integration Process: Register as a merchant, configure APIs with secure protocols like OAuth 2.0, and conduct thorough testing before going live.

- Best Practices: Focus on security, scalability, and regular updates to maintain a reliable and efficient system.

Integrating mobile money APIs is a step-by-step process that requires careful planning, but it opens doors to a growing market with enormous potential.

How to integrate mobile money and card payments to your PHP web application (DPO Payment Gateway)

Requirements Before Starting Mobile Money API Integration

Before integrating a mobile money API into your online store, there are three key steps to address: ensuring legal compliance, setting up the necessary technical infrastructure, and selecting the right provider. Each of these steps lays the groundwork for a seamless and secure integration process.

Legal and Compliance Setup

Navigating regulatory requirements is a crucial first step. Mobile money services come with responsibilities like preventing money laundering, curbing terrorist financing, and avoiding sanctions violations. With the African fintech market projected to hit $65 billion by 2030, businesses must operate within strict regulatory frameworks.

The compliance journey begins with merchant registration and implementing Know Your Customer (KYC) protocols. This involves verifying customer identities using tools like document checks, biometrics, or national digital ID systems. Businesses leveraging biometric verification are reportedly four times more secure than those relying solely on textual methods.

In March 2023, Flutterwave’s Financial Crimes Analyst, Aramide Ayinla, noted:

"Smile ID Biometric KYC has helped us reduce fictitious signups by 90% and reduced merchant onboarding from 24 hours to 10-15 mins."

Customer Due Diligence (CDD) is another vital aspect, requiring businesses to verify customer identities, assess financial risks, and monitor for red flags like adverse media mentions or high-risk geographic locations. Additionally, implementing transaction monitoring systems and maintaining detailed records can help identify suspicious activity.

Data privacy compliance is equally important. Businesses must secure customer consent, protect data, and provide users access to their information. Regular checks against sanction lists, Politically Exposed Persons (PEPs), and adverse media are also critical.

Compliance requirements can vary based on the business model:

- MNO-led models focus on SIM registration and managing agent networks.

- Bank-led models emphasize rigorous KYC processes aligned with banking regulations.

- Third-party provider models require additional due diligence and risk management across multiple partners.

Ghana stands out as a leader in mobile money regulation, ranking first in the 2024 GSMA Mobile Money Regulatory Index (MMRI). Once legal requirements are addressed, the next step is laying a solid technical foundation.

Technical Setup Requirements

With compliance in place, it’s time to focus on the technical aspects. A strong grasp of RESTful APIs and JSON is essential for facilitating communication between your e-commerce platform and mobile money providers.

Start by obtaining API credentials from your chosen provider. The GSMA Mobile Money API Developer Portal offers a wealth of resources, including developer documentation, security guidelines, and reference materials to guide your integration. Using Software Development Kits (SDKs) for platforms like Android, JavaScript, Node.js, PHP, and Java can simplify the process and enhance security.

Testing in a sandbox environment is a must. It allows you to simulate transactions, share API responses, and troubleshoot issues without affecting live operations.

Security is paramount. Implementing OAuth 2.0 through authentication gateways, such as the GSMA API Gateway, ensures that transactions are processed safely.

How to Select a Mobile Money Provider

After addressing compliance and technical requirements, the next step is choosing the right mobile money provider. Sub-Saharan Africa dominates the global mobile money landscape, accounting for 64% of transactions, with leading players like M-Pesa, Orange Money, MTN Mobile Money, and Airtel Money .

Geographic reach should be your top consideration – ensure your provider has a strong presence in your target markets. Look for interoperability to allow users to transact across different mobile money networks.

Evaluate the provider’s documentation quality, SDK availability, technical support, and sandbox tools. These factors can significantly reduce integration time and ongoing maintenance.

When comparing providers, focus on the features they offer, such as transaction types, security protocols, and reporting tools.

Andy Widmann, Group Director at AfriMoney, highlights the benefits of standardized integration:

"By working with the GSMA to comply with their Mobile Money API compliance verification service, we believe we can reduce the costs and time normally associated with API integrations. We also believe that this will make it easier for third-party providers to partner with AfriMoney, thereby supporting further development of the digital ecosystem in our markets and increasing the number of products and services available to our customers."

Lastly, ensure your provider is properly licensed and adheres to local financial regulations. Keep transaction costs in mind, too. Africa remains the most expensive region for money transfers, with an average cost of 8.9% for sending $200 in Q2 2022. However, mobile money providers often offer more competitive rates, particularly within the $19.4 billion intra-African remittance market.

Step-by-Step Mobile Money API Integration Guide

Getting started with mobile money API integration involves several key steps: registering as a merchant, setting up developer tools, configuring APIs, and conducting thorough testing.

Merchant Registration and Account Setup

Begin by registering your business and ensuring you have the necessary licenses, permits, and tax identification numbers, such as a U.S.-based EIN. If you’re operating in the U.S., you’ll also need a business bank account to manage transactions effectively.

When choosing a mobile money API provider, evaluate factors like transaction fees, processing times, customer support, security measures, and ease of integration. Once you’ve selected a provider, complete the merchant account application form with accurate details and submit any required documentation to verify your business. This step is critical, as providers use this information to assess risk and ensure compliance with financial regulations.

The approval process may involve additional documentation requests. Once approved, you’ll receive API credentials and access to developer resources, which are essential for the integration process. Use these resources to streamline your setup and move forward efficiently.

Working with Developer Documentation and Tools

Developer portals and resources, like those following the GSMA specification, can simplify your integration process. Many providers offer Software Development Kits (SDKs), which abstract complex API configurations, improve error handling, and enhance security features. For example, the GSMA Inclusive Tech Lab provides SDKs tailored for use cases such as Merchant Payments, Disbursements, International Transfers, and P2P Transfers. These SDKs are available in popular programming languages, including Java, NodeJS, PHP for backend, and JavaScript and Android for frontend, and include over 500 code snippets to help developers.

John Mark Ssebunya, General Manager – Technology Strategy and Architecture at MTN Group Fintech and Chair of the GSMA Mobile Money API industry working group, highlights the benefits of SDKs:

"The SDKs enable quicker time to value where the core API capabilities are provided like a reusable utility for any developer, hence leaving the developer to focus more time on their innovation competitive advantage."

Developer portals also offer essential resources like security guidelines, API fundamentals, and example code snippets, helping you avoid common pitfalls and reduce development time. Once your tools are in place, you can configure and test your API endpoints.

API Setup and Testing Process

Using your secure credentials, configure API endpoints with strong authentication protocols. OAuth 2.0 authentication, often implemented through gateways like the GSMA API Gateway, ensures secure transaction processing. The GSMA Mobile Money API incorporates industry best practices for both design and security.

Testing is a critical part of the integration process. Conduct load and stress tests to ensure your API can handle high traffic during peak periods. Security testing should be ongoing throughout the development lifecycle to protect against fraud and validate payment data integrity. For instance, examining fund transfers and payment data security is essential to prevent issues like those seen in other systems, such as UPI fraud cases.

Test a variety of scenarios, including successful transactions, failed payments, network timeouts, and edge cases. Documenting this testing process thoroughly will be invaluable for troubleshooting and future maintenance.

Integration Best Practices

From the outset, prioritize security by implementing measures like multi-factor authentication, encryption, and secure communication protocols to safeguard transaction data. Enforce strict access controls and authorization mechanisms to prevent unauthorized API usage. Regular updates and penetration testing can help identify and address vulnerabilities before they become problems.

Monitor transaction statuses with proper error-handling mechanisms for issues such as network failures, insufficient funds, or provider downtime. Continuous performance monitoring of your API allows you to detect and resolve issues early.

Maintain detailed documentation of your integration process, covering API endpoints, authentication methods, error codes, and troubleshooting steps. This will help your team onboard new members and manage updates efficiently.

Finally, stay updated on changes from your API provider. Mobile money providers frequently enhance their systems to improve functionality and security. Use monitoring tools to track API performance, including usage, response times, and error rates. Regularly update your security protocols to remain compliant with evolving standards and regulations.

sbb-itb-dd089af

Testing, Going Live, and Maintenance

Once the API configuration is complete, the next step is to test its functionality, ensure a smooth launch, and maintain its performance over time.

Testing and Validation Methods

Use sandbox environments from providers like Stripe, PayPal, Adyen, and Razorpay to simulate transactions without financial risk. These environments replicate production conditions, allowing you to test thoroughly without incurring real charges during development.

Testing should cover multiple scenarios to ensure the system performs reliably. Functional testing checks that payments process correctly with valid cards, digital wallets, and saved payment details. Meanwhile, negative testing simulates failures like declined payments due to insufficient funds, invalid card details, or expired payment methods.

Security testing is equally important. Validate token-based authorization and test for unauthorized access attempts. The significance of rigorous testing is clear when considering the scale of transactions. For example, in April 2024, UPI transactions in India reached ₹19,64,464.52 crore, underscoring the importance of system integrity and security.

After successful testing, the focus shifts to deploying the API securely and monitoring its performance.

Deployment and System Monitoring

To minimize risks, deploy in stages. Start with beta testing among a small group of trusted users before rolling it out to your entire user base. This phased approach helps uncover and address issues in a controlled setting.

Before going live, conduct load testing to confirm your API can handle peak traffic without performance issues. During deployment, ensure all established security protocols – like encryption and tokenization – are in place to protect sensitive transaction data.

Error handling is another critical aspect. Design clear, user-friendly error messages that help customers and support teams quickly identify and resolve problems.

Once live, implement automated monitoring to track API performance continuously. Set up alerts for unusual error rates, significant changes in performance, or security breaches. Monitor key metrics such as response times, transaction success rates, and system availability to detect and address potential issues before they impact users.

Real-world examples highlight how proper API integration can make or break system reliability.

Maintenance and Updates

After deployment, ongoing maintenance ensures your system remains secure, efficient, and compliant. This includes regular security updates, performance optimizations, documentation revisions, and renewing compliance certifications.

Stay up-to-date with provider changes by subscribing to developer notifications and reviewing changelogs. Test updates in your sandbox environment before applying them to production to avoid disruptions during live transactions.

For reliable asynchronous payment flows, implement webhook retry logic. Log all webhook responses and include fallback mechanisms like status polling to confirm payments when webhook delivery fails.

Security should remain a top priority. Follow PCI DSS guidelines, encrypt communications, and secure API keys with strict access controls. Avoid storing sensitive payment information unless absolutely necessary and approved. Real-time transaction monitoring with alerts can help detect suspicious activity or system issues early.

Regularly review your payment flow across different browsers and devices to maintain a consistent user experience. Establish review cycles to keep your system updated and secure. A governance structure involving both business and technology leaders can help manage decisions about data access, security policies, and updates.

Compliance requirements evolve, so keep an eye on regulatory changes in your operating regions. Mobile money regulations often vary by country, and staying compliant protects your business and customers. Schedule periodic security audits and penetration tests to uncover vulnerabilities before they escalate into major problems.

Document all update procedures, troubleshooting steps, and escalation processes. Comprehensive documentation ensures your team can respond quickly to issues and facilitates smooth transitions when team members change roles.

Mobile Money API Comparison for African Online Stores

Choosing the right mobile money API can make a significant difference in tapping into Africa’s growing e-commerce market. With $1.68 trillion in transactions processed last year across 144 networks, the potential is immense. Here’s a look at some of the leading providers and their offerings.

Coverage Areas and Features

MTN Mobile Money is a leader in the space, operating in 17 African countries and serving 69.1 million active users as of 2022. It handled 13.4 billion transactions worth $221.3 billion that year. MTN supports a wide range of payment types, including consumer-to-business (C2B), business-to-consumer (B2C), business-to-business (B2B), and government-to-person (G2P) payments, all accessible through 30 APIs.

Flutterwave spans over 30 African countries, as well as the USA, UK, and Europe. Its pricing includes a 2.9% + ZAR 1 fee for local card transactions and 4.8% for international ones.

pawaPay focuses solely on mobile money, covering 85% of all mobile money transactions across 19 African countries. This specialization makes it a strong choice for businesses that prioritize mobile money over traditional payment methods.

"The mobile payment system is crucial in African markets, where credit cards are not as widely used as in Europe and everything is generally done with cash. The most important thing for our customers is trust." – Joëlle Hazoume Alao, Business Developer, Program Director, and Board Member of Orange Money

Onafriq (formerly MFS Africa) connects over 400 million mobile wallets in more than 35 African countries. Transaction fees range between 2.50% and 3.00%.

For region-specific solutions, Paystack operates in Nigeria, Ghana, Kenya, and South Africa, charging 2.9% + ZAR 1 for local transactions. Meanwhile, Interswitch offers deep integration with Nigeria’s banking system, with local transaction fees at 1.5% (capped at approximately $4.50).

| Payment Gateway | Countries Supported | Key Features | Transaction Fees |

|---|---|---|---|

| MTN Mobile Money | 17 African countries | 30 APIs, C2B/B2C/B2B/G2P payments | Varies by country |

| Flutterwave | 30+ African countries, USA, UK, Europe | Cards, mobile money, M-Pesa, POS | 2.9% + ZAR 1 (local), 4.8% (international) |

| pawaPay | 19 African countries | 85% mobile money coverage | Custom pricing |

| Onafriq | 35+ African countries | 400M+ mobile wallets | 2.50% – 3.00% |

| Paystack | Nigeria, Ghana, Kenya, South Africa | Cards, mobile money, Apple Pay | 2.9% + ZAR 1 (local), 3.9% + ZAR 1 (international) |

| Interswitch | Nigeria, Ghana, Uganda | Verve Card, Quickteller integration | 1.5% (local, capped at ~$4.50), 3.8% (international) |

Once you’ve considered coverage and features, it’s equally important to assess how easily these APIs can be integrated into your store.

Integration Difficulty and Developer Support

MTN Mobile Money provides comprehensive resources for developers, including detailed documentation, a sandbox environment, and dedicated support. By 2022, over 24,000 developers were working with MTN’s APIs, and 1,600 partners were live in production. That same year, MTN’s APIs handled over 338 million financial transactions.

The GSMA Mobile Money API Compliance Verification Service has further simplified the integration process across multiple providers, cutting down on time and costs.

"By working with the GSMA to comply with their Mobile Money API compliance verification service, we believe we can reduce the costs and time normally associated with API integrations." – Andy Widmann, AfriMoney’s Group Director

pawaPay offers a streamlined experience with a single API and unified dashboard. Developers have praised it as the "Best and easiest integration we have ever done".

Tola Mobile stands out for its exceptional developer support. Andrey Kondratovets from Gameloft Development shared:

"Thank you very much for help during development! That was so far the best assistance, documentation and platform I ever participated with."

Tola Mobile operates in 22 countries, integrates 50 mobile money technologies, and has processed over 2 billion transactions worth more than $1 billion.

KoraPay caters to East and West African markets, offering Mobile Money APIs in Kenyan Shillings, Ghanaian Cedis, Cameroonian CFA Franc, and Ivorian CFA Franc. It also provides test mobile money numbers to simplify development.

When it comes to integration and developer support, MTN Mobile Money and Tola Mobile excel with robust portals and sandbox environments. Flutterwave and Paystack offer broad payment coverage, while pawaPay simplifies the process with a unified API. Onafriq, with its extensive mobile wallet network, is ideal for businesses aiming to reach unbanked populations. The right choice depends on your target market, transaction volumes, and whether your focus is on mobile money or a mix of payment methods.

This analysis equips you to align the strengths of these providers with your technical integration and compliance needs, ensuring a seamless setup for your online store.

Summary and Next Steps

Integrating mobile money APIs presents a significant opportunity for online stores to grow. Digital payment methods are expected to hit a transaction value of $11.55 trillion by 2024, with an annual growth rate of 9.52%. While the process requires careful attention to legal, technical, and provider requirements, the rewards far outweigh the challenges.

To ensure a smooth integration, strong security measures are critical. Use tools like data encryption, tokenization, and structured error handling to protect transactions and address any issues quickly.

Equally important is thorough testing. Before launching, conduct functional, load, and security tests in controlled environments. This approach minimizes risks, prevents costly mistakes, and ensures your system is prepared to handle real-world transaction volumes. Testing also provides an opportunity to fine-tune the user experience.

Speaking of user experience, customization is key. White-label solutions and personalized interfaces that reflect your brand can enhance customer satisfaction. Since mobile money users often prefer simple, familiar processes, designing with scalability in mind is essential. A scalable system ensures your platform can handle growth without requiring major overhauls.

Once the technical groundwork is solid, evaluate providers based on factors like your market needs, transaction volume, and technical compatibility. Start with a pilot program in your main market, using performance data and feedback to guide further expansion. Regular maintenance and monitoring are vital to keep your system running smoothly as transaction volumes grow and new features are implemented. These steps will help you build a secure, scalable mobile money solution that aligns with both current and future business needs.

FAQs

What legal and compliance factors should I consider when integrating mobile money APIs into my online store?

When adding mobile money APIs to your online store, it’s crucial to follow Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are in place to ensure transactions are secure and to minimize the risk of fraud. Fortunately, many mobile money platforms include built-in tools to simplify compliance with these requirements.

It’s also important to meet the payment processing standards set by regulatory authorities in your area. These standards are designed to safeguard both your business and your customers by ensuring transactions are safe and dependable. On top of that, obtaining certifications for API compliance from recognized industry organizations can go a long way in building customer confidence and showcasing your dedication to maintaining high standards.

How can online stores keep transactions secure when using mobile money APIs?

To safeguard transactions when integrating mobile money APIs, online stores need to focus on implementing strong security practices. Start by using secure authentication methods like OAuth 2.0 or JSON Web Tokens (JWT) to confirm user identities. Make sure all data is encrypted both while being transmitted and when stored by relying on secure protocols such as TLS.

Strengthen protection further by adding measures like rate limiting to block misuse, role-based access control to limit who can perform sensitive tasks, and real-time monitoring to quickly identify and respond to potential security issues. Together, these steps help ensure a secure and trustworthy shopping experience for customers.

What should businesses look for when selecting a mobile money provider for their online store?

When choosing a mobile money provider for your e-commerce platform, prioritize critical aspects such as the features and adaptability of the provider’s API and how seamlessly it integrates with your online store. Well-documented resources and reliable support can make the integration process much easier.

You’ll also want to evaluate transaction fees, security measures, and the provider’s capacity to handle various payment options. These factors play a big role in delivering a smooth and secure payment experience for your customers, helping to build their trust and satisfaction.

Related posts

- 8 Solutions to Common African E-commerce Challenges

- How Mobile Money Interoperability Works Across Africa

- Future of Mobile Money in African Marketplaces

- How Mobile Money Boosts E-Commerce Growth