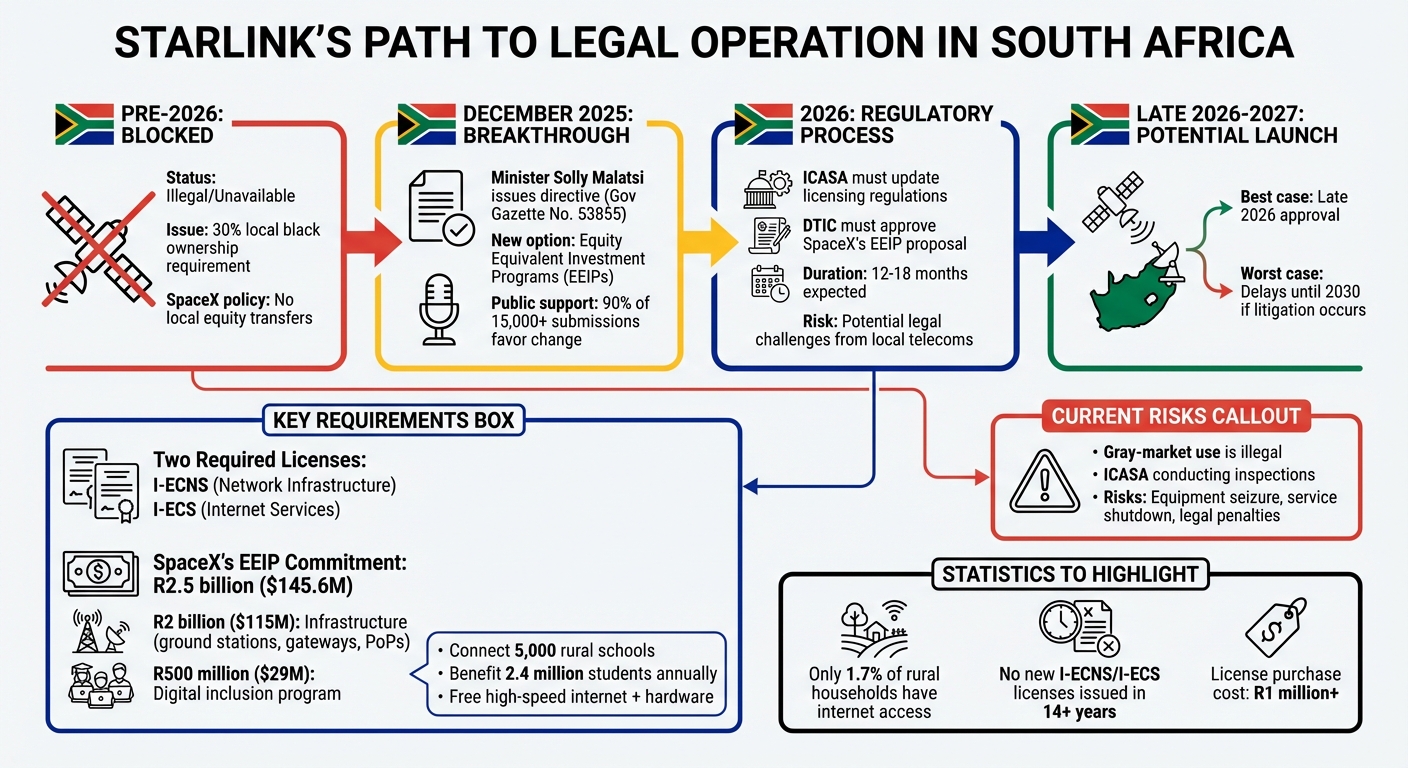

Starlink’s legal status in South Africa remains unresolved as of January 2026. The service is currently prohibited because SpaceX has not secured the required licenses from ICASA, primarily due to the country’s 30% local black ownership requirement under B-BBEE regulations. However, a new policy introduced in December 2025 allows companies to meet this requirement through Equity Equivalent Investment Programs (EEIPs) instead of equity transfers.

Key Points:

- Current Status: Starlink is unavailable legally in South Africa. Accessing it through unofficial channels violates local laws and carries risks like service shutdowns and equipment seizures.

- Licensing Hurdles: ICASA mandates two licenses (I-ECNS and I-ECS) along with compliance with local ownership rules. SpaceX’s global policy against local equity ownership has been a major obstacle.

- New Opportunity: EEIPs allow companies to invest in local projects instead of transferring equity. SpaceX has pledged $145.6 million toward infrastructure and educational initiatives to meet these requirements.

- Timeline: Regulatory updates could take 12–18 months, with Starlink potentially launching legally by late 2026, barring delays or legal challenges.

This regulatory shift could make Starlink accessible, offering high-speed internet to underserved areas while complying with South Africa’s economic transformation goals.

Starlink South Africa Licensing Timeline and Requirements 2026

South Africa Drops 30% Black Ownership Rule for Musk’s Starlink | Firstpost Africa | N18G

Starlink’s Current Legal Status in South Africa

As of January 2026, Starlink is still not legally available in South Africa. The Independent Communications Authority of South Africa (ICASA) has declared the service unlawful since SpaceX does not hold the required Electronic Communications Services (ECS) and Electronic Communications Network Services (ECNS) licenses needed to operate within the country. This regulatory barrier has left Starlink in a state of uncertainty.

For now, the service is only accessible via gray-market channels, which are illegal. ICASA has emphasized that both offering and using Starlink without proper authorization violates the Electronic Communications Act. This situation highlights the hurdles Starlink must overcome to operate lawfully in South Africa.

Why Starlink Doesn’t Have a License Yet

The main obstacle preventing Starlink’s licensing is ICASA’s requirement for 30% local black ownership, a stipulation rooted in South Africa’s Broad-Based Black Economic Empowerment (B-BBEE) regulations for telecommunications licensees. SpaceX, which retains full ownership of its subsidiaries globally, has consistently refused to cede equity in any market. This impasse has kept Starlink from moving forward in South Africa.

Ryan Goodnight, SpaceX’s Senior Director of Market Access and Development, explained that Starlink could begin operations in South Africa "tomorrow" if four specific licensing clauses were removed. Although a ministerial directive issued in December 2025 introduced the possibility of Equity Equivalent Investment Programs (EEIPs), ICASA still needs to complete a formal inquiry and amend its regulations before SpaceX can apply for a license. Until these issues are resolved, Starlink’s legal status remains in limbo, leaving users at risk.

Risks of Using Starlink Through Unofficial Channels

South Africans who access Starlink through unofficial means face serious legal and operational risks. ICASA has already begun inspecting Starlink installations. The regulator is collaborating with other government agencies to address unauthorized use, particularly targeting businesses that rely on gray-market Starlink. These users risk having the service geofenced or abruptly shut down.

"Should the investigation yield any breach with regulatory and legislative frameworks, the Authority will explore the applicable enforcement actions within its disposal which may include amongst others lodging a formal complaint with the International Telecommunication Union (ITU)."

– Mothibi Ramusi, Chairperson, ICASA

If ICASA escalates enforcement, users could face equipment seizures or sudden service termination. Legal experts strongly advise waiting for Starlink to obtain official licensing. This avoids potential liabilities, loss of equipment, and unexpected disruptions while the regulatory framework is being finalized.

ICASA Licensing Rules for Starlink

Starlink faces significant hurdles as it navigates South Africa’s regulatory landscape. To legally operate in the country, the company must meet ICASA’s licensing requirements and adhere to local ownership laws. These challenges highlight the tension between SpaceX’s global policies and South Africa’s regulatory framework.

ICASA Requirements for Internet Service Providers

In South Africa, internet service providers must secure two critical licenses to operate:

- Individual Electronic Communications Network Service (I-ECNS) license: This allows companies to build and manage network infrastructure.

- Individual Electronic Communications Service (I-ECS) license: This permits the sale of internet services to consumers.

Additionally, providers need radio frequency spectrum authorization, but this is only available to I-ECNS license holders. All hardware – like satellite dishes and routers – must also pass ICASA’s Type Approval process to meet technical and safety standards.

However, obtaining these licenses is no small feat. ICASA has not issued new I-ECNS or I-ECS licenses in over 14 years, forcing companies to purchase existing ones, often at costs exceeding R1 million. On top of that, providers must comply with the Electronic Communications Act and the ICT Sector Code, which set strict technical and transformation guidelines for the telecommunications industry.

B-BBEE Ownership Rules and Starlink’s Challenge

The regulatory challenges don’t stop at technical licensing. ICASA’s local ownership rules present another major roadblock. Under the Electronic Communications Act, internet service providers must have at least 30% local ownership to align with South Africa’s broad-based economic empowerment goals.

For Starlink, this requirement is a dealbreaker. SpaceX’s global policy prohibits local shareholding, making compliance with the 30% equity rule impossible. While SpaceX has established a local subsidiary – SpaceX Internet Services South Africa (Pty) Ltd – in anticipation of launching services, the ownership rule has stalled progress.

A potential workaround lies in the December 2025 ministerial directive, which introduces Equity Equivalent Investment Programs. However, ICASA would need to formally update its regulations before Starlink could submit a license application under this framework. Until then, the company remains at an impasse.

Equity Equivalent Investment Programs (EEIPs) as an Alternative

Faced with Starlink’s challenges over local equity requirements, South Africa offers a different approach through Equity Equivalent Investment Programs (EEIPs). Instead of handing over 30% equity, companies can invest in audited programs aimed at uplifting historically disadvantaged communities. These investments are valued at 30% of a firm’s local operations or 4% of its annual local revenue. The Department of Trade, Industry & Competition oversees and approves these programs to ensure compliance and impact.

This model has already proven effective in South Africa’s automotive industry. Back in 2019, leading manufacturers like BMW, Ford, and Toyota set up a sector-specific fund to support marginalized groups as an alternative to direct equity transfers. Now, the ICT sector is adopting the same framework to attract foreign tech investment while advancing economic transformation.

Public reception has been overwhelmingly positive. Of the 19,000 submissions received by the Department of Communications, about 90% supported EEIPs as a valid compliance option.

Starlink’s Investment Commitments in South Africa

To meet EEIP requirements, SpaceX has pledged a local investment of R2.5 billion (around $145.6 million). This includes R2 billion (approximately $115 million) for infrastructure projects like ground stations, gateways, and Points of Presence (PoPs), and R500 million (roughly $29 million) for a digital inclusion program.

The digital inclusion initiative is especially ambitious. It aims to connect 5,000 rural schools with free high-speed internet and hardware, potentially benefiting 2.4 million students every year. This is a game-changer in a country where only 1.7% of rural households currently have internet access. The program will also operate on an open-access model, enabling local providers to use the same infrastructure.

"Starlink’s local investment would include new ground stations, gateways, Points of Presence (PoPs), and about R500-million on a programme to connect 5,000 schools with free internet and hardware."

- Ryan Goodnight, Senior Director of Market Access, Starlink

Beyond education, Starlink is partnering with the National Sea Rescue Institute (NSRI) to provide satellite connectivity for rescue operations along South Africa’s vast 1,864-mile coastline, where mobile coverage is often lacking. The company also plans to establish a local entity, pay taxes, and comply with regulatory fees – all while meeting local transformation standards.

How EEIPs Could Enable Starlink’s License in 2026

These investments could secure Starlink’s license through the EEIP framework. However, the Independent Communications Authority of South Africa (ICASA) must first update its regulations to align with the ICT Sector Code. This process could take 12–18 months, meaning Starlink’s launch might not happen until late 2026 or 2027.

Once the EEIP framework is incorporated into licensing rules, Starlink can submit its R2.5 billion investment plan as proof of compliance. The Department of Trade, Industry & Competition will then assess whether the initiatives meet transformation objectives. This pathway allows Starlink to retain full ownership while fulfilling its Broad-Based Black Economic Empowerment (B-BBEE) obligations through audited investments.

The regulatory update could also open doors for 4–5 other international companies previously deterred by the equity requirement. This marks a significant shift in how South Africa balances foreign investment with its economic transformation goals.

"Starlink complies with local laws in every market where it’s licensed, and we’ll do the same in South Africa."

- Ryan Goodnight, Senior Director of Market Access, Starlink

Despite strong public support and the success of EEIPs in other sectors, political opposition persists. Critics, including the EFF and MK Party, argue that EEIPs treat disadvantaged groups as "beggars and resellers" instead of true stakeholders. Even so, the overwhelming public backing and the proven effectiveness in the automotive sector suggest that EEIPs are likely to move forward as planned.

sbb-itb-dd089af

Expected Regulatory Changes in 2026

Proposed Updates to ICASA Regulations

On December 12, 2025, Communications Minister Solly Malatsi issued a directive through Government Gazette No. 53855, instructing ICASA to revise its licensing rules. The goal? To recognize Equity Equivalent Investment Programs (EEIPs) as an alternative to the 30% local black-ownership requirement. This represents a major adjustment in South Africa’s approach to foreign investment in the telecommunications sector.

The directive aims to resolve a long-standing legal conflict. ICASA had previously ignored the ICT Sector Code, which allows for EEIPs. Under the proposed updates, the Department of Trade, Industry and Competition (DTIC) will take on the role of approving these investment plans. Once the DTIC gives the green light to a company’s EEIP, ICASA would be required to accept it as meeting empowerment requirements for licensing. This change sets the stage for ICASA to overhaul its current regulatory framework.

"Malatsi is telling Icasa it should not pretend it sits above the national empowerment framework – and to end a regulatory interpretation that has, for several years, placed South Africa at odds with its own B-BBEE legislation."

- Duncan McLeod, Editor, TechCentral

ICASA is expected to launch a formal review process, including public consultations, to amend its "Standard Terms and Conditions for Individual Licences" and "Processes and Procedures" regulations. However, local telecom operators may push back, potentially lobbying for access to the same EEIP options. This could complicate and delay the amendment process.

Expected Timeline for Starlink’s Approval

With this directive in place, the regulatory changes are expected to roll out during 2026. At this time, Starlink has yet to apply for the required Electronic Communications Network Service (ECNS) and Electronic Communications Service (ECS) licenses. The company appears to be waiting for ICASA to finalize its updated regulations before moving forward.

Industry analysts predict that the regulatory environment will be ready, and commercial launches could occur by late 2026. However, if local operators challenge the changes in court, the timeline could stretch significantly. Communications lawyer Dominic Cull of Ellipsis Regulatory Solutions cautions:

"If there’s litigation, we literally could be in 2030 before they (Starlink) qualify to get the licences."

- Dominic Cull, Communications Lawyer, Ellipsis Regulatory Solutions

Public sentiment strongly favors the proposed policy shift. Of the 15,000 substantive submissions received, around 90% supported the changes. This widespread support is fueled by the stark reality that only 1.7% of rural households currently have internet access.

What Starlink’s Launch Means for Users and Businesses

Benefits for Users and Businesses

Starlink is set to revolutionize internet access in South Africa, especially in rural and underserved areas that have struggled with limited connectivity. By using Low Earth Orbit satellites, the service can provide high-speed, low-latency internet where traditional broadband or fiber infrastructure simply doesn’t exist.

For businesses, the transition from unofficial roaming kits to licensed service brings several advantages. These include ZAR-based billing, valid warranties, and access to local support. SpaceX has committed a total investment of $145.6 million, which includes $115 million for infrastructure like ground stations and gateways, and $29 million to connect 5,000 schools with free high-speed internet. This infrastructure expansion is expected to generate jobs for local construction firms, fiber contractors, and technical support teams. Additionally, local Internet Service Providers (ISPs) can tap into a reseller model, enabling them to offer satellite internet under their own brands without the need for significant capital outlay.

"By collaborating with Vodacom, Starlink can deliver reliable, high-speed connectivity to even more customers" – Chad Gibbs, Vice President, SpaceX

The hardware for Starlink is estimated to cost between $700 and $875 for the one-time kit, with monthly subscription fees ranging from $52 to $76+. While the upfront costs might seem steep, the service is a game-changer for areas where internet options have historically been expensive or unreliable. This reliable and licensed service environment is poised to benefit businesses significantly.

Compliance Requirements for Businesses Using Starlink

To make the most of Starlink, businesses need to meet specific compliance standards. With ICASA’s updated licensing framework in place, businesses must ensure that Starlink holds the required I-ECS and I-ECNS licenses before deploying the service. Only ICASA Type Approved hardware should be installed to avoid the risk of equipment being seized.

Businesses must also comply with South Africa’s Protection of Personal Information Act (POPIA) and other national data security regulations when managing sensitive customer data.

"New market entrants – including those offering new or disruptive technologies – will not be exempt from transformation obligations" – Solly Malatsi, Minister of Communications and Digital Technologies

Additionally, businesses should keep an eye on Starlink’s EEIP commitments, as these could open up opportunities for local supplier development and funding partnerships for small businesses.

Conclusion: Starlink’s Path Forward in South Africa

Starlink’s status in South Africa hinges on regulatory changes expected in 2026. As of early 2026, the service remains technically prohibited. However, a policy directive issued by Minister Solly Malatsi in December 2025 has set the stage for potential approval. This directive instructs ICASA to accept Equity Equivalent Investment Programmes (EEIPs) as an alternative to the existing 30% local black ownership requirement. Through the EEIP framework, SpaceX could maintain full ownership of Starlink while contributing to impactful local initiatives such as infrastructure projects, skills development, and support for black-owned small businesses.

The path to legalizing Starlink involves two key steps: first, the Department of Trade, Industry and Competition (DTIC) must approve Starlink’s EEIP proposal, which must equal either 30% of the company’s South African operations or 4% of its annual local revenue. Second, ICASA must conduct a public consultation process and update its licensing rules to align with the national B-BBEE ICT Sector Code. Once these approvals are in place, ICASA will issue the licenses needed to legalize Starlink’s operations in South Africa.

"The awarding of a licence will remain in the hands of communications regulator Icasa… There will be a lot of issues remaining that can only be worked out between the applicant and Icasa." – Solly Malatsi, Minister of Telecommunications and Digital Technologies

Despite these developments, legal challenges from local telecom operators could push the licensing timeline back, potentially delaying Starlink’s official launch until as late as 2030.

For businesses and rural communities, keeping an eye on ICASA’s licensing process is critical. With rural connectivity rates still alarmingly low and 90% of public comments supporting the EEIP framework, the anticipated regulatory changes could reshape internet access across South Africa. Staying informed about DTIC’s EEIP decisions and ICASA’s amendments will be essential for businesses looking to adapt to this evolving tech landscape.

FAQs

What are the risks of using Starlink without proper authorization in South Africa?

Using Starlink in South Africa without proper authorization can lead to serious legal and practical consequences. The Independent Communications Authority of South Africa (ICASA) has made it clear: Starlink is not currently licensed to operate in the country. This means any attempt to import, sell, or use Starlink equipment through unofficial channels could result in legal penalties, including fines or other enforcement measures.

Beyond the legal risks, there are practical challenges to consider. Unofficial Starlink equipment might be unreliable, lack proper customer support, or even face confiscation by authorities. On top of that, service disruptions could leave users without internet access altogether.

To steer clear of these issues, it’s wise to wait until Starlink meets South Africa’s licensing requirements. With regulatory changes on the horizon, legal access to the service may become available soon.

How do Equity Equivalent Investment Programs (EEIPs) help SpaceX meet South Africa’s regulations?

Equity Equivalent Investment Programs (EEIPs) offer companies like SpaceX an alternative way to meet South Africa’s Black Economic Empowerment (B-BBEE) requirements. Normally, businesses in sectors like telecommunications are required to transfer 30% ownership to historically disadvantaged groups to comply with these regulations. However, EEIPs provide a different path.

Through EEIPs, companies can fulfill their obligations by investing in areas such as skills development, infrastructure projects, or supporting small businesses. This not only ensures compliance with empowerment policies but also helps attract foreign investment by offering more flexibility.

For SpaceX and its Starlink service, EEIPs open the door to operating in South Africa without the need to transfer direct ownership. This approach aligns with local regulations while providing greater access to the market.

When will Starlink become legally available in South Africa?

Starlink is on track to become legally available in South Africa, but only after the Independent Communications Authority of South Africa (ICASA) updates its regulations and issues the required licenses. This process is expected to follow regulatory changes initiated by the communications minister, likely concluding in late 2025.

These regulatory updates are part of a larger effort to comply with new empowerment regulations, with major changes anticipated by 2026. Once these measures are in place, Starlink will be able to operate legally, bringing satellite internet services to more areas across South Africa.

Related Blog Posts

- Starlink Partners with Airtel & Vodacom: From Rival to Ally

- South Africa’s DA Pushes for Starlink Entry to Boost Connectivity

- Starlink in South Africa: Pricing, Availability, Setup Guide & Legal Status (2026 Update)

- Starlink South Africa 2026: Pricing by Package (Roam vs Residential), Speeds, and How to Order