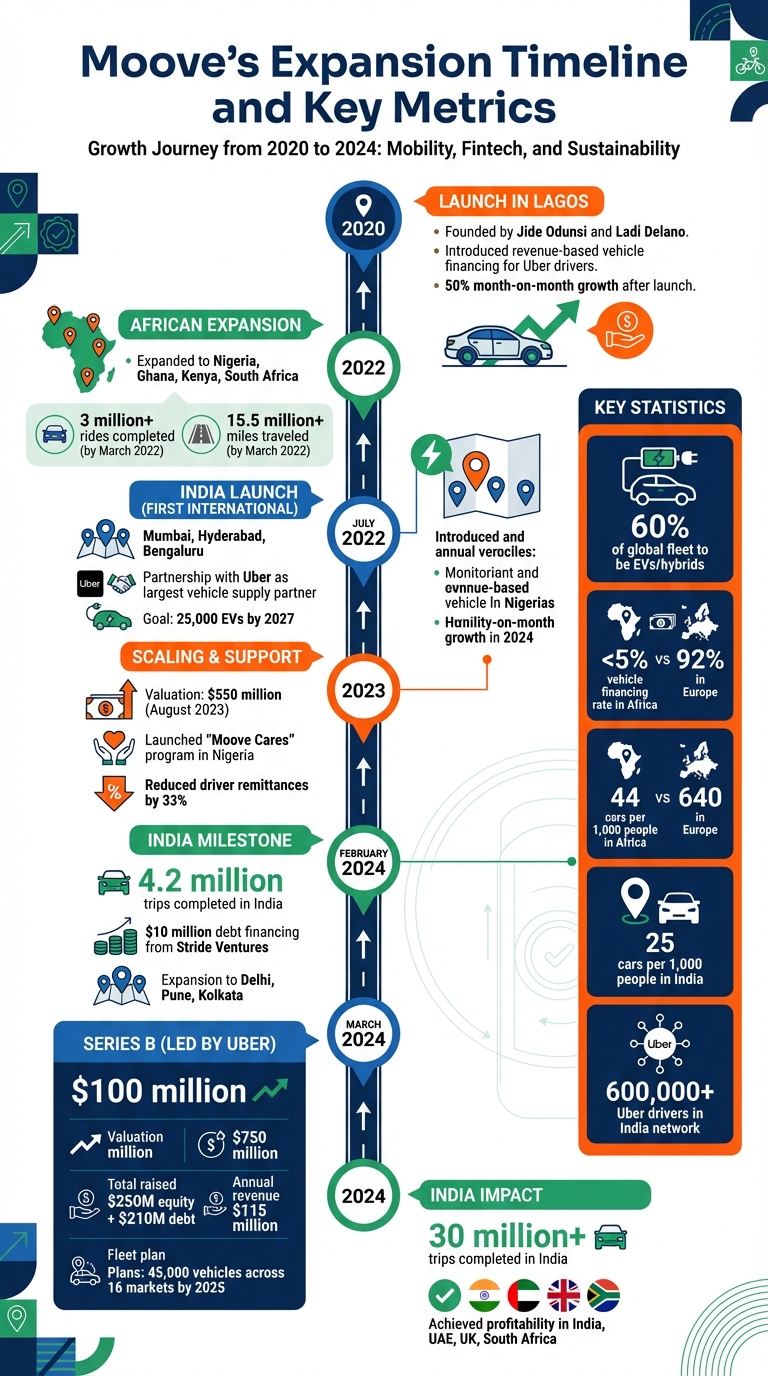

Moove, an African mobility fintech company, launched in Lagos, Nigeria, in 2020 to address the lack of credit access for gig workers. By using trip data and earnings for alternative credit scoring, Moove enables drivers to purchase vehicles via a rent-to-own model. The company quickly grew across African markets like Nigeria, Ghana, and Kenya before expanding internationally to India in July 2022.

Here’s what you need to know about Moove’s India expansion:

- Launch Cities: Mumbai, Hyderabad, and Bengaluru.

- Partnership: Uber, with a goal to deploy 25,000 electric vehicles (EVs) by 2027.

- Impact: By February 2024, Moove-financed vehicles had completed over 30 million trips in India.

- Funding: Secured $10 million in debt financing in 2024 to expand into cities like Delhi and Kolkata.

- Sustainability Goal: 60% of its global fleet to consist of EVs or hybrids.

Moove’s growth highlights its ability to address credit gaps in emerging markets while supporting India’s push for cleaner transportation. However, challenges like driver income instability and competition in the car financing market remain.

Moove’s Growth Journey: From Lagos to India (2020-2024)

Building Moove in Africa

How Moove Started

Jide Odunsi and Ladi Delano founded Moove in Lagos in 2020 to tackle a significant challenge. At the time, Uber faced overwhelming rider demand but struggled with a shortage of drivers who owned cars. Meanwhile, traditional banks were unwilling to finance gig workers who lacked credit histories or collateral.

"Moove was initially started to solve a problem for Uber, which at the time had a lot of demand with people ordering trips but there were few drivers with cars in Lagos." – Ladi Delano

Moove introduced a game-changing approach: revenue-based vehicle financing. Instead of relying on credit scores or collateral, the company assessed trip data and driver earnings from ride-hailing platforms to approve loans. Drivers could then purchase new vehicles and repay the loans through a percentage of their weekly income. This model addressed a stark reality in Africa, where fewer than 5% of vehicles are bought with financing, compared to 92% in Europe. Vehicle ownership in Africa is also strikingly low, with fewer than 44 cars per 1,000 people, compared to 640 per 1,000 in Europe.

Growth Across African Markets

Building on its early success, Moove quickly expanded into various African markets. The model proved effective right from the start, with the company experiencing a remarkable 50% month-on-month growth following its launch. By March 2022, Moove-financed vehicles had completed over 3 million rides and traveled more than 15.5 million miles across Nigeria, Ghana, Kenya, and South Africa. The company also diversified its offerings, extending financing to vehicles used for logistics, delivery services, and public transit, including trucks, buses, three-wheelers, and motorcycles.

In 2023, as Nigeria faced 30% inflation and climbing fuel prices, Moove introduced its "Moove Cares" program to support drivers during tough economic times. The initiative reduced driver remittances by 33% and extended repayment terms from 48 months to 60 months, making vehicle ownership more manageable despite the financial pressures.

Launching in India: Partnerships and First Results

Working with Uber

In July 2022, Moove marked its first international expansion by entering the Indian market. The company partnered with Uber as its largest vehicle supply partner in the EMEA region, initially focusing on three key cities: Mumbai, Hyderabad, and Bengaluru. This collaboration positioned Moove as a "mega fleet partner", providing drivers with an alternative to high-interest loans or private vehicle borrowing, as described by Uber.

The partnership came with an ambitious target: deploying 25,000 electric vehicles on Uber’s platform over a five-year period. This goal aligned with Uber’s electrification plans and India’s 2030 renewable energy goals. For the first year, Moove aimed to roll out 5,000 CNG and electric vehicles, with plans to grow the fleet to 30,000 vehicles across 300 cities. Abhilekh Kumar, Director of Business Development at Uber India South Asia, highlighted the significance of Moove’s approach:

"Moove has created an innovative ‘rent to own’ model that provides a flexible option for drivers who want to get into the business of ride hailing without having to borrow from car owners or take bank loans".

This strategic entry into the Indian market set the stage for promising outcomes.

First Milestones

Moove’s expansion in India quickly showed results. By February 2024, vehicles financed by Moove had completed over 4.2 million trips on Uber’s platform across the country. These numbers demonstrated the scalability of its model and its ability to adapt to a market with unique challenges compared to Africa.

The early success fueled further growth. In February 2024, Moove secured $10 million in debt financing from Stride Ventures to expand into new cities, including Delhi, Pune, and Kolkata. Reflecting on this milestone, Binod Mishra, Moove’s Regional Managing Director, shared:

"Our vehicles have completed over 4.2 million trips, significantly impacting India’s mobility sector. With the robust support of Stride Ventures, we stand on the cusp of transforming vehicle ownership nationwide".

Funding and Expansion Plans

$10 Million Debt Financing in 2024

In February 2024, Moove secured a $10 million debt facility from Stride Ventures, marking its first external debt funding in India. This funding was a critical step toward scaling its fleet to over 5,000 vehicles and expanding into major cities like Delhi, Pune, and Kolkata.

This investment highlighted growing confidence in Moove’s potential. Apoorva Sharma, Managing Partner at Stride Ventures, expressed the significance of the partnership:

"Our alliance with Moove is set to transform vehicle ownership accessibility throughout India, marking a significant leap towards social and economic advancement".

In addition to the $10 million facility, Moove secured a $10 million revolving credit line, granting the company flexible capital to support its operations. This debt structure was a strategic move, enabling fleet expansion without equity dilution while ensuring the financial agility needed to navigate India’s dynamic mobility sector. This financial backing also paved the way for future global funding opportunities.

Previous Funding and Valuation

Moove’s earlier funding rounds played a pivotal role in bolstering its expansion plans. In March 2024, the company closed a $100 million Series B round, led by Uber and supported by Mubadala, which brought its valuation to $750 million. This was a notable jump from its $550 million valuation in August 2023.

The Series B funding was aimed at accelerating Moove’s global expansion, with plans to add 45,000 vehicles across 16 markets by the end of 2025. By early 2024, Moove had raised a total of $250 million in equity and $210 million in debt. The company also demonstrated strong financial growth, with annual recurring revenue increasing from $90 million in 2023 to $115 million in 2024. Co-founder Ladi Delano underscored the importance of this milestone:

"This funding milestone not only expands our operational capacity but also supports our drive to profitability by the next financial year".

Business Model and Environmental Focus

Data-Driven Financing

Moove’s rent-to-own model offers a creative solution to ownership hurdles in emerging markets. Instead of relying on upfront payments, deposits, or traditional credit checks, Moove employs alternative credit scoring technology. This system uses drivers’ performance data from ride-hailing platforms like Uber to assess creditworthiness. By analyzing real-time earnings, trip counts, and telematics, Moove’s proprietary credit engine bypasses traditional banks, which often exclude gig workers from accessing loans.

The company’s repayment system is revenue-based, meaning loan payments are automatically deducted as a percentage of weekly earnings directly from the driver’s marketplace wallet. For example, a driver in India might pay around $66 weekly over four years after making an initial deposit of $780. After a repayment period of 36 to 60 months, the driver fully owns the vehicle. This comprehensive package includes financing, insurance, maintenance, and even health insurance, creating a supportive environment for what Moove calls "mobility entrepreneurs".

"Moove has created an innovative ‘rent to own’ model that provides a flexible option for drivers who want to get into the business of ride-hailing without having to borrow from car owners or take bank loans." – Abhilekh Kumar, Director of Business Development, Uber India South Asia

This approach not only makes vehicle ownership more accessible but also lays the groundwork for Moove’s push toward a greener fleet.

Electric and Hybrid Vehicle Goals

Moove is also leveraging its financing model to promote sustainability. The company has pledged that 60% of its global fleet will consist of hybrid or electric vehicles. In India, this aligns with its partnership with Uber to expand the use of electric vehicles on the platform. Moove began operations in India in July 2022, with plans to introduce 5,000 compressed natural gas (CNG) and electric vehicles within the first year. By 2024, Moove-financed vehicles had already completed over 30 million trips on Uber’s Indian platform.

The shift to electric vehicles offers multiple benefits. They reduce operating costs through lower maintenance and fuel expenses, which boosts driver earnings while minimizing default risks for Moove. As of early 2024, the company had reached profitability in markets like India, the UAE, the U.K., and South Africa. In London, Moove operates an entirely electric fleet and aims to have 10,000 electric vehicles on the road by 2025, a move projected to cut annual CO₂ emissions by 63,000 tons.

sbb-itb-dd089af

Challenges in the Indian Market

Tackling Credit and Ownership Barriers

In India, vehicle ownership remains strikingly low – only 25 out of every 1,000 people own a car, a stark contrast to Europe. This leaves the majority of gig drivers unable to access traditional bank loans. Moove steps into this gap with its alternative credit scoring system, which uses Uber performance data to assess eligibility. However, the revenue-based repayment model isn’t without its hurdles. Take the case of Mumbai driver Karamjeet Singh: in August 2023, his Moove-financed vehicles were impounded after a 12-day family emergency, despite him having already paid $2,390. No refunds were issued, highlighting a significant challenge for drivers facing income instability. While Moove’s Binod Mishra stated that such cases affect less than 5% of Indian customers, they reveal the delicate balance between offering flexible financing and navigating the realities of drivers’ financial volatility. Co-founder Ladi Delano addressed this concern:

"It’s very important to understand that before vehicles get recovered or impounded, there’s a long process that is very delicately managed to ensure that we support our customers to get back on the road".

These issues underscore the need for Moove’s strong collaboration with Uber, which plays a key role in scaling its operations and mitigating such challenges in the Indian market.

Expanding Through Uber Partnership

Moove relies heavily on its exclusive partnership with Uber to overcome operational challenges and grow in India. This collaboration connects Moove to a network of over 600,000 drivers, allowing for seamless weekly repayment deductions directly from driver earnings. It has also accelerated Moove’s entry into major cities like Mumbai, Hyderabad, and Bangalore.

This strategic integration helped Moove achieve profitability in India by early 2024, joining its other successful markets in the UAE, U.K., and South Africa. However, the company isn’t without competition. Rivals such as OTO, Revfin, Turno, and Ascend Capital are also vying for a share of India’s booming $14.87 billion car loan market. To stand out, Moove has partnered with Reliance General Insurance to provide health insurance for Indian drivers, addressing gaps in social safety nets. This move not only strengthens its value proposition but also builds trust with its driver community in a highly competitive landscape.

$150M Revenue & $500M Capital: Transforming Mobility Markets w/ Tingting Peng, Moove

Conclusion

Moove’s journey from Lagos to Mumbai showcases how African fintech can thrive on a global scale. By using driver performance data instead of traditional credit scores, its revenue-based financing model has successfully expanded to 13 markets across three continents.

A key factor in this growth has been Moove’s partnership with Uber. This collaboration connects Moove’s innovative financing system to Uber’s extensive network of over 600,000 drivers in India, tackling the challenge of low vehicle ownership in emerging markets.

Beyond operational achievements, Moove is making strides in sustainable transportation. The company’s pledge to ensure 60% of its financed vehicles are hybrid or electric sets it apart in promoting eco-friendly mobility. Moove plans to roll out 25,000 electric vehicles on Uber’s platform in India, while its upcoming fleet of 10,000 EVs in London is expected to reduce annual carbon emissions by approximately 63,000 tons. This approach not only supports global climate goals but also lowers fuel and maintenance costs for drivers, making loan repayment more manageable.

For emerging markets, Moove’s success marks a turning point in mobility financing. Traditional banks often fail to serve gig workers without collateral or formal credit histories, but Moove’s funding – bolstered by a recent $10 million debt facility and over $250 million raised in equity rounds – demonstrates the scalability of its model.

Of course, challenges remain. Issues like driver impoundments and income instability highlight the need for ongoing adjustments in a competitive landscape. However, Moove’s adaptability – seen in its deployment of CNG vehicles in Nigeria and fully electric fleets in London – shows its readiness to tackle these hurdles.

With plans to expand into 16 markets by 2025, Moove is transforming mobility financing in emerging economies. By doing so, it’s opening up new pathways for millions to access economic opportunities through reliable transportation.

FAQs

How does Moove’s rent-to-own program help drivers in India own their vehicles?

Moove’s rent-to-own program provides a practical solution for Indian drivers looking to join Uber without the burden of upfront vehicle costs or the need for a traditional bank loan. Here’s how it works: drivers select a CNG or electric vehicle from Moove’s fleet, and Moove takes care of financing the purchase. Drivers then repay the loan gradually by allocating a fixed percentage of their weekly Uber earnings. Once the total payments cover the vehicle’s cost plus a small fee, ownership of the car is transferred to the driver.

What sets this model apart is Moove’s use of performance analytics to evaluate creditworthiness. This approach allows drivers without standard credit histories to participate in the program. By linking repayments to actual earnings, Moove ensures the process remains manageable and adaptable. This initiative not only helps drivers shift from renting to owning their vehicles but also removes significant financial hurdles along the way.

What challenges does Moove face as it expands into the Indian market?

Moove’s presence in the Indian mobility market is growing, with operations in cities like Bengaluru, Mumbai, and Hyderabad, and an ambitious goal to expand its fleet to 5,000 vehicles. However, detailed information about the specific challenges the company is facing remains scarce.

While reports focus on Moove’s funding and expansion plans, they don’t shed light on potential hurdles like meeting regulatory standards, handling competition from established players, or managing operational complexities. Any struggles, such as dealing with local regulations or addressing driver-related risks, have yet to be documented publicly.

How is Moove promoting sustainable transportation in India?

Moove is reshaping transportation in India by rolling out 10,000 electric vehicles (EVs) over the next three years. This bold move is set to cut emissions in cities like Mumbai, Hyderabad, and Bengaluru while making eco-friendly travel an option for more gig-economy drivers. It’s a step toward the company’s vision of building the largest EV and hybrid fleet in the world.

What sets Moove apart is its credit-scoring and financing platform, which helps drivers lease or own environmentally friendly vehicles. This approach not only supports drivers in adopting greener transportation but also promotes sustainability in urban mobility. On top of that, Moove is working with autonomous mobility technologies to enhance efficiency and reduce unnecessary vehicle miles. These initiatives align with global climate goals, paving the way for cleaner and smarter cities in India.

Related Blog Posts

- Ride sharing and ride hailing startups in Africa

- Top 5 Regions for MobilityTech Funding in Africa

- Funding Trends in African E-Mobility Startups

- Corporate VC in Africa Hits 3-Year High in H1 2025