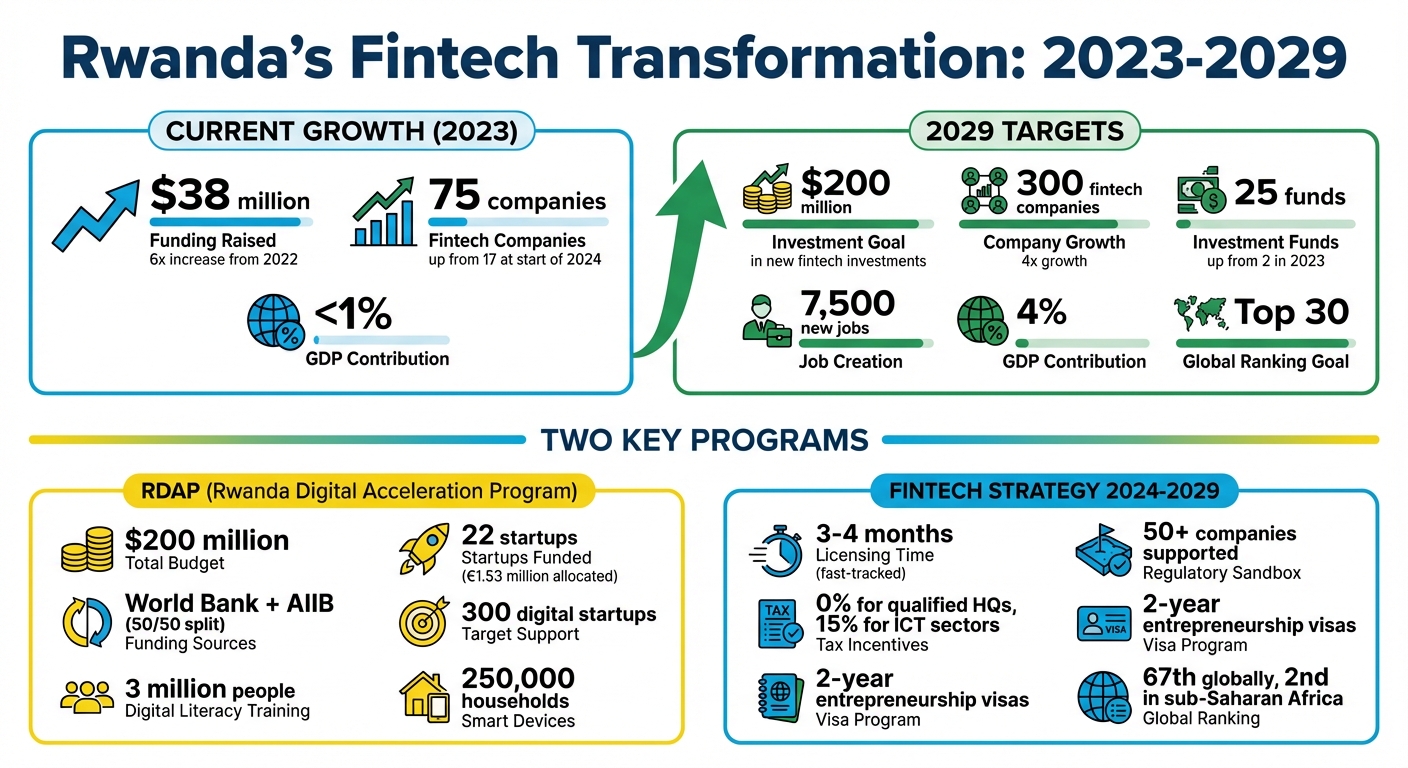

Rwanda’s fintech sector is growing fast, with funding jumping six times to $38 million in 2023. The government has ambitious goals: attract $200 million in fintech investments by 2029, grow from 75 to 300 fintech companies, and increase the sector’s GDP contribution from less than 1% in 2024 to 4% by 2029. Two key initiatives are driving this growth:

- Rwanda Digital Acceleration Program (RDAP): A $200 million program supporting early-stage startups with non-dilutive funding, digital infrastructure, and training for millions of users.

- Fintech Strategy 2024–2029: Focused on scaling fintech companies with tax incentives, faster licensing, and partnerships like license passporting with Ghana.

These programs are already showing results, with startups like Kayko and DoctorAI securing funding and scaling operations. Rwanda’s clear regulations, tax benefits, and supportive ecosystem are attracting investors and positioning the country as a fintech hub in Africa.

Rwanda Fintech Growth: Key Metrics and Targets 2023-2029

1. Rwanda Digital Acceleration Program (RDAP)

Funding Structure

The Rwanda Digital Acceleration Program (RDAP) operates with a $200 million budget, funded equally by the World Bank and the Asian Infrastructure Investment Bank (AIIB). Notably, this marks AIIB’s first digital acceleration investment in sub-Saharan Africa. The program focuses on two main goals: strengthening entrepreneurship support organizations, such as incubators and accelerators, and directly funding startups.

Startup funding follows a structured, tiered approach. Early-stage ventures receive seed capital through Hanga Venture Ignite, while scaling companies can access larger grants via Hanga Venture Ignite Plus. By late 2025, the program had allocated over €1.53 million to 22 startups spanning 13 sectors, including fintech, healthtech, and agtech. Importantly, this funding is non-dilutive, allowing startups to grow without giving up equity. Additionally, a new debt fund managed by the Development Bank of Rwanda is set to launch in Q2 2026, offering commercial-style financing for high-growth tech companies.

Impact on Ecosystem

RDAP goes beyond funding by actively nurturing a thriving digital ecosystem. The program aims to support at least 300 digital startups, with a strong focus on female-led businesses. It also invests in the infrastructure needed to boost fintech adoption, such as financing smart devices for 250,000 households and delivering digital literacy training to 3 million people. These efforts help build a consumer base essential for fintech solutions to succeed.

The program’s impact is already visible. For example, in late 2025, Kayko, a digital commerce startup founded by Kevin and Crepin Kayisire, used RDAP’s resources to onboard 8,500 businesses, including 500 on monthly subscription plans. This success helped Kayko secure $1.2 million in follow-on investments from a South African angel investor, Luxembourg’s development fund, and a German-backed firm. Meanwhile, DoctorAI, led by CEO Dr. Kevin Muragijimana, reached 19,000 active users by January 2026. The platform’s AI diagnostic tool achieved an impressive 95.4% accuracy rate for chest X-rays.

These achievements highlight the program’s role in preparing startups for further investment and scaling opportunities.

Investor Confidence

RDAP’s funding strategies have also shifted investor perceptions. Moving from grant-based funding to commercial financing has bolstered investor confidence. Magnifique Ishimwe from the Development Bank of Rwanda shared:

"We initially assumed most of these companies were too early for commercial capital. But strong performers in our portfolio proved us wrong – their user growth, revenue traction, and ability to attract follow-on investors showed there’s real room for commercial financing alongside catalytic support".

This realization led to the development of the new debt fund, set to launch in 2026. Designed for early-stage tech companies with validated business models, the fund provides a bridge for startups that aren’t quite ready for traditional venture capital but still need access to growth capital.

2. Rwanda Fintech Strategy 2024-2029

Funding Structure

Rwanda’s fintech roadmap for 2024-2029 builds on the foundation laid by RDAP, aiming to attract $200 million in new fintech investments and grow the number of investment funds from just 2 in 2023 to 25 by 2029. This ambitious plan is designed to establish a strong local base for venture capital and private equity, making it easier for investors to tap into the region’s potential.

To draw foreign capital, the Kigali International Financial Centre (KIFC) offers enticing incentives like 0% tax rates for qualified headquarters and a 15% tax rate for key ICT sectors. Additionally, foreign startup founders can benefit from two-year entrepreneurship visas, further encouraging global participation in Rwanda’s fintech ecosystem.

Impact on Ecosystem

The strategy envisions a transformation of Rwanda’s fintech landscape, aiming to grow the sector fourfold – from 75 fintech companies in 2024 to 300 by 2029. This expansion is projected to create 7,500 new jobs and increase the fintech sector’s contribution to Rwanda’s GDP from less than 1% to 4% by 2029. To support this growth, the government has streamlined the licensing process, cutting approval times to approximately 3–4 months.

In a major step toward regional integration, the National Bank of Rwanda and the Bank of Ghana signed a Memorandum of Understanding (MoU) in February 2025. This agreement enables fintech companies to operate in both markets through license passporting, making Rwanda a strategic gateway for regional expansion. As Jean Claude Nshimiyimana from Andersen in Rwanda put it:

"Rwanda is not competing on size, but on agility and strategic positioning, providing a launchpad for FinTechs planning to conquer the broader African market".

Investor Confidence

Thanks to these strategic initiatives, investor confidence in Rwanda’s fintech sector has grown significantly. The Fintech Heritage Sandbox, launched in 2022, has already supported over 50 companies in testing their solutions. By November 2024, 17 fintech firms were actively using the sandbox to validate their innovations.

Rwanda’s global standing further reflects its progress. It ranks 67th globally in the Global Financial Centres Index and is the 2nd highest-ranked country in sub-Saharan Africa, just behind Casablanca. These rankings underscore Rwanda’s growing reputation as a fintech hub with a forward-thinking regulatory environment.

Singapore, Rwanda deepening partnership in fintech

sbb-itb-dd089af

Pros and Cons

RDAP and the Fintech Strategy aim to attract fintech investment in Rwanda, but they go about it in very different ways. RDAP focuses on building digital infrastructure and supporting early-stage entrepreneurs. On the other hand, the Fintech Strategy prioritizes scaling financial technology companies by offering a fast-tracked 3–4 month licensing process and regulatory sandboxes, which have already benefited over 50 companies.

The two approaches also differ in how they boost investor confidence. RDAP emphasizes long-term benefits by investing in foundational infrastructure, which might take time to show returns. Meanwhile, the Fintech Strategy provides immediate incentives, such as regulatory clarity, tax advantages (like 0% rates for eligible headquarters), and a goal to attract $200 million in investments by 2029. However, it faces challenges like high intermediation costs and low consumer trust.

Here’s a side-by-side look at their strengths and challenges:

| Feature | Rwanda Digital Acceleration Program (RDAP) | Rwanda Fintech Strategy 2024-2029 |

|---|---|---|

| Primary Focus | Building digital infrastructure and supporting startups | Growing a fintech ecosystem and attracting investments |

| Key Strength | Provides connectivity and seed funding | Delivers regulatory clarity with sandboxes and expedited licensing |

| Main Challenge | Slower returns due to infrastructure-heavy focus | Struggles with high intermediation costs and limited consumer trust |

| Investor Appeal | Sets the stage for long-term digital economy growth | Offers immediate market opportunities with clear regulatory pathways |

These two programs are designed to complement each other. RDAP works on breaking down barriers by creating the digital infrastructure necessary for innovation. In contrast, the Fintech Strategy helps companies expand quickly through initiatives like license passporting agreements with countries such as Ghana.

Industry leaders have weighed in on this dual approach:

"The cost of intermediation remains high. It’s crucial for us to address this if we are to create a more inclusive and competitive sector" – Herbert Asiimwe, Head of Financial Sector Development at the Ministry of Finance and Economic Planning.

"Rwanda is not competing on size, but on agility and strategic positioning, providing a launchpad for FinTechs planning to conquer the broader African market" – Jean Claude Nshimiyimana, Andersen in Rwanda.

These insights underline how Rwanda is positioning itself as a fintech hub by balancing foundational development with strategies for rapid scaling.

Conclusion

Rwanda is carving out a new path for fintech growth with its dual-initiative approach. The sharp rise in fintech funding stems from two key programs that support startups at every stage of their journey. The Rwanda Digital Acceleration Program (RDAP) provides early-stage financing through efforts like Hanga Venture Ignite and bolsters digital infrastructure. At the same time, the Fintech Strategy 2024–2029 creates a regulatory framework and offers incentives to attract substantial investments, targeting $200 million by 2029. Together, these initiatives are building a strong foundation for a thriving fintech ecosystem.

In 2023, Rwanda saw a significant leap in startup funding, raising $38 million – a six-fold increase compared to 2022. The fintech ecosystem expanded rapidly, growing from just 17 companies at the start of 2024 to around 75 by the end of the year, with a bold goal to reach 300 by 2029.

RDAP focuses on helping entrepreneurs get their ventures off the ground, while the Fintech Strategy ensures clear regulatory guidance and market access for scaling up. Regulatory sandboxes, a core feature of the strategy, have already supported over 50 companies. To complement these efforts, the government is transitioning from grants to commercial debt financing through the Development Bank of Rwanda, with the first deployments expected in Q2 2026.

Rwanda is also positioning itself as a regional fintech hub through the Kigali International Financial Centre and fintech passporting agreements. The country aims to rank among the top 30 globally in fintech and increase the sector’s GDP contribution from less than 1% in 2024 to 4% by 2029. As Magnifique Ishimwe from the Rwanda Development Bank highlighted:

"We initially assumed most of these companies were too early for commercial capital. But strong performers in our portfolio proved us wrong – their user growth, revenue traction, and ability to attract follow-on investors showed there’s real room for commercial financing".

FAQs

What is the Rwanda Digital Acceleration Program, and how does it help fintech startups?

The Rwanda Digital Acceleration Program (RDAP) is a government-driven initiative designed to fuel the growth of digital startups in Rwanda. Backed by the World Bank and the Asian Infrastructure Investment Bank, this program is powered by a $200 million fund aimed at expanding broadband access, upgrading digital infrastructure, and implementing policies that encourage innovation.

A standout feature of RDAP is its non-dilutive financing. This type of funding allows startups to secure capital without giving up ownership stakes, enabling entrepreneurs to grow their businesses while maintaining full control. By improving internet connectivity, nurturing innovation ecosystems, and increasing access to funding, RDAP is positioning Rwanda as a fintech hotspot and drawing substantial investment to the region.

What is Rwanda’s Fintech Strategy 2024-2029, and how will it shape the sector?

Rwanda’s Fintech Strategy 2024-2029 lays out an ambitious roadmap to position the country as a top fintech hub in Africa. The plan prioritizes driving innovation, boosting digital financial inclusion to 80%, and attracting $200 million in investments by 2029. It also sets a goal to expand the number of fintech companies from 75 to 300 and generate around 7,500 jobs.

The strategy includes several key initiatives, such as streamlining regulatory processes and exploring cutting-edge solutions like a Central Bank Digital Currency (CBDC). Rwanda also aims to secure a spot among the top 30 global fintech leaders. By nurturing a supportive environment for fintech growth, the plan is designed to fuel economic development and establish Rwanda as a major player in both regional and global fintech landscapes.

What is driving investor interest in Rwanda’s fintech startups?

Investor interest in Rwanda’s fintech sector is growing for several reasons. The government has rolled out an ambitious five-year fintech strategy (2024–2029) aimed at positioning Rwanda as a regional financial hub. With a target of $200 million in investments and a plan to attract 25 investment funds, the strategy focuses on creating a business-friendly environment through regulatory updates, promoting digital financial inclusion, and improving infrastructure. These measures signal Rwanda’s strong commitment to fostering innovation and economic growth, giving investors added confidence.

Rwanda’s global standing is also on the rise. Kigali has climbed in the Global Financial Centres Index, and the country secured $38 million in startup funding in 2023. Initiatives like the Kigali International Financial Centre, paired with advancements in digital infrastructure, are further solidifying Rwanda’s reputation as a dynamic hub for fintech. For investors looking to tap into emerging markets, Rwanda offers a promising landscape filled with potential.

Related Blog Posts

- 10 Investors Investing in African Fintech

- 10 Top Investors in Startups in Kenya

- Kenya Startup Funding Trends 2025

- Fintech Funding in Africa: Regional Breakdown