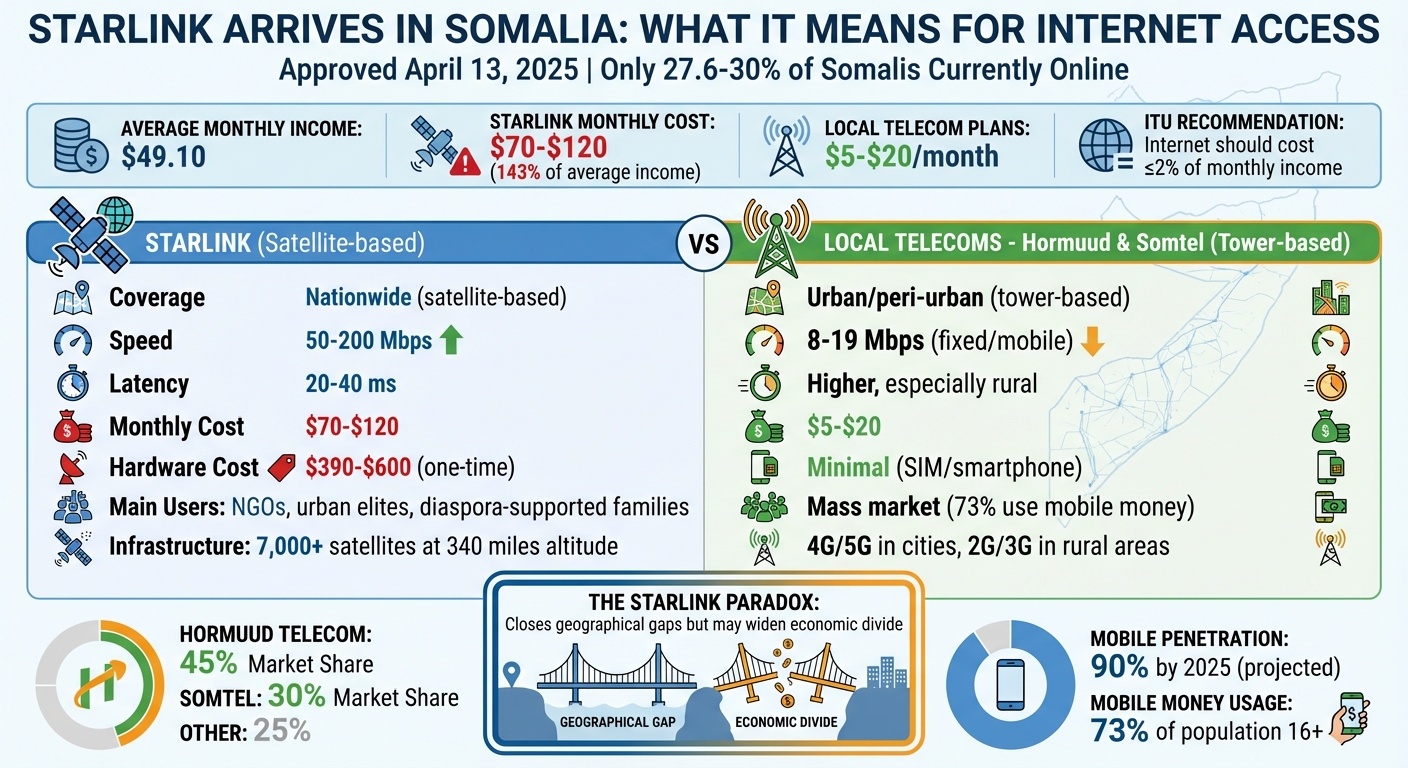

Starlink is now available in Somalia, but its high costs limit its reach. Here’s what you need to know:

- Approval Date: Starlink was officially licensed on April 13, 2025.

- Current Internet Landscape: Only 27.6%–30% of Somalis are online, with rural areas facing the biggest connectivity challenges.

- Starlink’s Offer: Speeds of 50–200 Mbps, nationwide coverage via satellites, and low latency (20–40 ms).

- Costs: $390 for hardware and $70–$120 monthly, far exceeding Somalia’s average monthly income of $49.10.

- Impact on Local Providers: Telecoms like Hormuud and Somtel dominate urban areas with affordable mobile data ($5–$20/month) but struggle to reach rural regions.

- Challenges: Starlink’s pricing makes it accessible primarily to urban elites, NGOs, and diaspora-supported families, leaving most Somalis priced out.

Quick Comparison Table:

| Factor | Starlink | Local Telecoms (Hormuud, Somtel) |

|---|---|---|

| Coverage | Nationwide (satellite) | Urban/peri-urban (towers) |

| Speed | 50–200 Mbps | 8–19 Mbps (fixed/mobile) |

| Monthly Cost | $70–$120 | $5–$20 |

| Hardware Cost | $390–$600 | Minimal (SIM/smartphone) |

| Main Users | NGOs, elites, diaspora | Mass market |

Starlink addresses rural access gaps but risks widening economic divides due to its high costs. Local providers remain the affordable choice for most, but rural connectivity remains a challenge.

Starlink vs Local Telecoms in Somalia: Coverage, Speed, and Cost Comparison

Starlink lands in Somalia Game Changer or Digital Takeover?! | Soomalida & Social Media | GlobalNet

1. Starlink

Starlink operates through a network of over 7,000 low-Earth orbit satellites positioned around 340 miles (550 km) above the Earth. This setup drastically reduces latency to about 20–40 ms, making it comparable to fiber-optic speeds. For context, traditional satellites orbit at altitudes ranging from 12,400 to 21,700 miles (20,000–35,000 km), resulting in much higher latency. Starlink’s download speeds, ranging between 50–150 Mbps, represent a massive leap from the local averages of 11.65 Mbps for mobile and 8.34 Mbps for fixed internet connections.

Starlink officially launched on August 5, 2025, offering a hardware kit priced at US$390 and a monthly subscription fee of US$70. While the hardware cost aligns with pricing in Kenya, the monthly subscription in Somalia is about US$20 higher than Kenya’s benchmark. The self-installation kit includes a satellite dish, a router, and requires only a clear sky, making it accessible even in Somalia’s most remote areas.

| Feature | Starlink | Local Telecoms |

|---|---|---|

| Download Speed | 50–150 Mbps | 5–11.65 Mbps |

| Latency | 20–40 ms | Generally higher, especially in rural areas |

| Coverage | Nationwide (satellite-based) | Primarily urban (tower/cable-based) |

| Monthly Cost | US$70 | Lower, but with limited rural reach |

| Hardware Cost | US$390 (one-time) | Typically lower for mobile devices |

Starlink is currently available in cities like Mogadishu, Bosaso, Kismayo, and Baidoa. However, the US$70 monthly fee is prohibitively expensive for most Somalis, as it far exceeds the country’s average monthly income of US$49.10 – amounting to about 143% of the average income. This cost places Starlink beyond the reach of most households, limiting its appeal to urban elites, international organizations, and families supported by diaspora funds. For comparison, the International Telecommunication Union recommends that internet costs should not exceed 2% of monthly income, a threshold Starlink clearly surpasses in Somalia.

Next, we’ll take a closer look at how local telecom providers measure up to this new entrant.

2. Local Telecom Operators (e.g., Hormuud Telecom, Somtel)

Somalia’s telecom industry has grown in a unique way, driven by private operators stepping in to build infrastructure during years of instability. This has led to a competitive market where Hormuud Telecom holds 45% of the market and Somtel claims 30%. These companies have tapped into submarine cables like EASSy, DARE1, and the Peace Cable to connect Somalia to the world. Thanks to these efforts, mobile penetration is projected to reach 90% by 2025. However, competition thrives alongside a noticeable gap in network quality between urban and rural areas.

In cities like Mogadishu, users enjoy access to 4G and even commercial 5G services. In contrast, about half of rural areas still depend on 2G or limited 3G coverage. Despite these disparities, local operators offer affordable pricing, with mobile data costing approximately $0.50 per GB. Data plans typically range from $5 to $20 for 1–5 GB. On the bright side, Somalia’s median fixed internet download speed of 18.76 Mbps surpasses the Sub-Saharan Africa average of 12.11 Mbps.

One of the standout features of local telecom providers is their integration of mobile money services. Around 73% of Somalis aged 16 and older use mobile money platforms, with urban usage reaching 83% and rural usage at 72%. Hormuud’s EVC Plus is a popular choice, enabling seamless transactions even as the average revenue per user hovers around $3 per month.

"Somalia’s telecom sector demonstrates how innovation can flourish even in fragile states. The private sector has been resilient, and with the right regulatory framework, we believe it can attract scalable capital and deliver impact."

– IFC Digital Infrastructure Unit

As the market evolves, regulatory reforms are playing a crucial role. The National Communications Authority recently formalized interconnection agreements among major operators. These changes could pave the way for expanding rural networks and exploring satellite solutions, helping local providers stay competitive against emerging players like Starlink.

sbb-itb-dd089af

3. Current Internet Pricing Models

Somalia’s internet market presents a striking contrast between affordability and accessibility. Local mobile operators like Hormuud and Somtel offer low-cost services in urban areas, making connectivity relatively affordable for city dwellers. However, these networks struggle to extend their reach into rural regions. On the other hand, satellite providers like Starlink offer coverage across the entire country but at prices far beyond what most Somalis can afford. This stark difference in cost and coverage shapes the choices available to consumers.

Currently, Somali consumers spend about 5.3% of their Gross National Income (GNI) on mobile voice and internet services. For fixed internet, the costs can skyrocket to as much as 80% of GNI per capita. Considering Somalia’s average annual income is under $500, even basic internet access becomes a heavy financial burden for many families. These figures highlight the affordability of local options compared to the premium costs of satellite services.

Starlink’s pricing drives this divide even further. The standard hardware kit costs $390 (SOS 220,000), while the Mini version ranges from $200 to $210. Monthly subscription fees range between $70 and $120, resulting in annual expenses that can reach up to three times the average Somali income. This pricing structure effectively limits Starlink’s user base to urban elites, international organizations, and households supported by the Somali diaspora.

"The Universal Service Fund (USF), that noble global mechanism wherein governments collect fees and distribute subsidies to ensure telecommunication access for all, seems to have entirely missed the Somali vocabulary."

– MI, Author/Analyst at Somali Waa kuma

For now, the absence of subsidies means consumers must bear the full cost of staying connected. While the National Communications Authority has introduced regulatory reforms, questions remain about satellite services, data protection, and spectrum allocation. In the meantime, market forces and service providers continue to dictate pricing, leaving many Somalis struggling to afford reliable internet access.

Pros and Cons

Starlink and local telecom providers each bring their own advantages and challenges to the table. Starlink shines when it comes to reaching remote areas, especially where traditional infrastructure is lacking. With speeds ranging from 50–200 Mbps and latency between 20–50 ms, Starlink bypasses the need for ground cables or towers, making it capable of covering the entire country. This is particularly important for Somalia, where most of the population lives in rural areas. However, the cost is a major hurdle. The hardware alone costs between $390 and $600 – equivalent to about 44 days of income for the average Somali citizen. On top of that, monthly fees range from $70 to $120, which can be prohibitive for many.

Local telecom operators, on the other hand, excel in urban settings. Companies like Hormuud Telecom and Somtel dominate these markets with affordable options. Basic mobile data plans cost between $5 and $20 per month, with data priced at approximately $0.50 per gigabyte. These providers have even rolled out 5G in major cities and support mobile money platforms like EVC Plus and ZAAD. These platforms are widely used – 73% of Somalis over the age of 16 actively rely on them. However, their reach is mostly limited to urban and nearby areas, leaving rural communities underserved, even though 90% of the population has access to at least a 2G signal.

"For routine internet use in cities where reliable local service is available, local ISPs remain the more affordable choice." – Newsdesk, Somali Stream

Here’s a quick comparison of the two:

| Factor | Starlink | Local Operators (Hormuud, Somtel) |

|---|---|---|

| Primary Coverage | Nationwide/Remote (Satellite) | Urban/Peri-urban (Towers/Fiber) |

| Monthly Cost | High ($70–$120) | Low ($5–$20) |

| Hardware Cost | High ($390–$600) | Negligible (SIM/Smartphone cost) |

| Typical Speed | 50–200 Mbps | 8–19 Mbps (Fixed/Mobile) |

| Scalability | High (No ground infrastructure) | Moderate (Requires physical towers) |

| Local Integration | None (No mobile money support) | High (Integrated mobile wallets) |

The contrast is clear: Starlink offers faster speeds and wider coverage but comes with a steep price tag. Meanwhile, local providers are budget-friendly and deeply embedded in the economy but struggle to serve rural areas effectively. This has led to what some analysts call the "Starlink Paradox." While Starlink has the potential to close geographical gaps, its high costs may deepen the economic divide, making it accessible primarily to urban elites, NGOs, and households supported by the diaspora.

Conclusion

Somalia’s decision to approve Starlink on April 13, 2025, marks an important step in the country’s journey toward digital connectivity. With 72.4% of the population still offline, particularly in rural and nomadic areas, Starlink’s satellite technology addresses a key challenge that traditional infrastructure struggles to overcome. Offering faster speeds and broader coverage, Starlink brings technical advantages, but its high cost poses a significant barrier.

At $70 per month, Starlink’s subscription fee is far beyond Somalia’s average monthly income of $49.10. This pricing restricts its accessibility to a narrow group, such as diaspora-supported households, NGOs, and businesses. This situation highlights what experts call the "Starlink Paradox" – a service designed to close geographical gaps but with the potential to widen economic disparities.

For now, local internet providers remain focused on urban markets, where they offer more affordable options. These providers face only indirect competition from Starlink, as their current customer base is unlikely to switch. However, the government hopes Starlink’s arrival will push local companies to expand fiber-optic networks and improve services in areas that are currently underserved.

"We hope Starlink will increase the quality of the existing internet in Somalia and will make the internet service reach more remote areas." – Mustafa Yasiin, Director of Communication at the Ministry of Telecommunications

Looking ahead, Somalia’s internet landscape is likely to evolve into a two-tier system. Starlink will cater to high-end users and remote institutions, while local providers will continue to dominate the mass market with affordable urban-focused plans. For now, Starlink’s impact on consumer pricing appears limited to niche segments, leaving the broader market dynamics largely unchanged.

FAQs

How affordable is Starlink for the average Somali household?

Starlink’s pricing creates a tough barrier for many in Somalia. At $70 per month for the subscription and a $390 hardware setup fee, the service is far out of reach for most residents, especially considering the country’s average monthly income is only about $150. For many, particularly in rural and underserved areas, these costs are simply too steep.

Though Starlink promises high-speed internet that could help close the digital gap, the high price tag may prevent widespread use. To make it more accessible, approaches like subsidies or shared access models might be necessary.

How could Starlink’s arrival impact Somalia’s telecom industry?

Starlink’s arrival in Somalia could shake things up in the local telecom scene by introducing fresh competition and shifting the market landscape. Unlike traditional telecom providers that depend on land-based networks, Starlink uses satellites to deliver high-speed internet with low latency – even in the most remote corners of the country. This capability could fill connectivity gaps in underserved areas, creating new challenges for existing operators.

Local telecom companies might respond by finding ways to collaborate, such as forming partnerships or adopting hybrid models to resell Starlink’s services in rural regions. However, the cost of Starlink – approximately $70 per month, plus hardware expenses – may initially limit its reach. Still, its presence could push local providers to step up their game, improving network quality and rethinking pricing strategies. In the long run, Starlink’s entry could spark innovation, increase competition, and help expand digital access throughout Somalia.

Why is Starlink important for improving internet access in rural Somalia?

Starlink is transforming internet access in rural Somalia by delivering high-speed connectivity to places where traditional options like fiber optics or cell towers simply can’t reach. With its satellite-based system, all that’s needed is a clear view of the sky and a straightforward setup – perfect for remote areas with tough terrain and minimal infrastructure.

This is a big deal for Somalia, where nearly 70% of the population doesn’t have reliable broadband, especially in rural regions. By closing this gap, Starlink has the potential to enhance education, improve healthcare delivery, and unlock economic opportunities, bringing meaningful change to communities that have long been underserved.

Related Blog Posts

- Starlink Partners with Airtel & Vodacom: From Rival to Ally

- South Africa’s DA Pushes for Starlink Entry to Boost Connectivity

- Starlink in South Africa: Pricing, Availability, Setup Guide & Legal Status (2026 Update)

- Starlink South Africa 2026: Pricing by Package (Roam vs Residential), Speeds, and How to Order