In January 2025, South African insurtech startup Naked secured $38 million in Series B funding, the largest insurtech investment in Africa. Naked, founded in 2018, offers AI-driven, fully digital insurance for cars, homes, and personal items. The funding, led by BlueOrchard with support from IFC, Hollard, Yellowwoods, and DEG, will boost its AI capabilities, expand its product offerings, and improve accessibility for underserved populations in South Africa and beyond.

Key highlights:

- Largest African insurtech investment: $38 million raised.

- Innovative model: Fixed fees, surplus donations to charity.

- AI-powered platform: 90-second quotes, claims via app.

- Affordable options: Third-party car insurance starting at $3.80/month.

- Expansion plans: Focus on underserved markets across Africa.

This funding positions Naked to reshape insurance access and affordability across the continent while addressing regulatory and market challenges.

About Naked Insurtech

Company History and Development

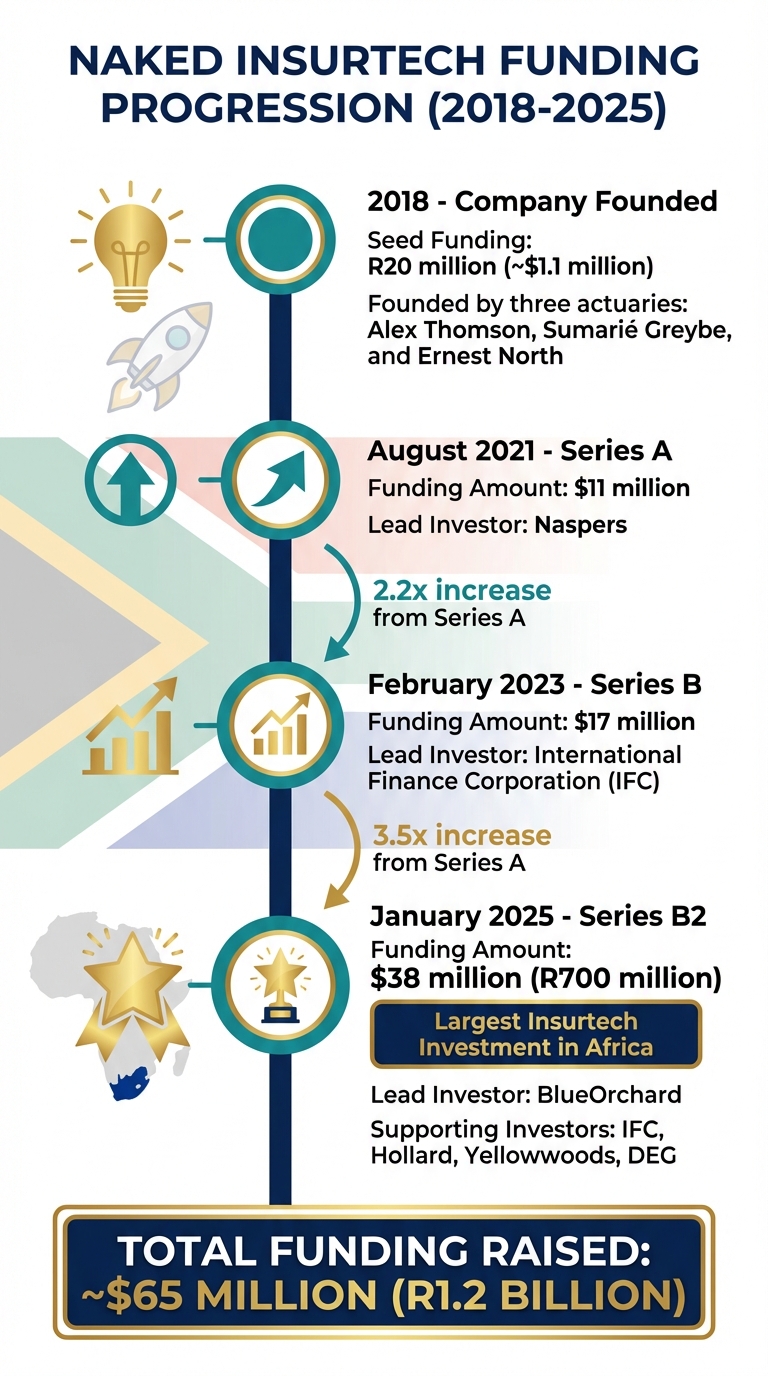

Naked was established in 2018 by three actuaries – Alex Thomson, Sumarié Greybe, and Ernest North – who set out to reshape South Africa’s insurance industry. Drawing from their experience as executives at Ernst & Young, they launched the company with R20 million (around $1.1 million) in seed funding to create an AI-powered insurance platform. The company gained momentum in August 2021 with $11 million in Series A funding led by Naspers. By February 2023, the International Finance Corporation spearheaded a $17 million funding round to expand Naked’s AI capabilities and product range. Starting with car insurance, Naked has since broadened its offerings to include home, contents, and single-item coverage.

What sets Naked apart is its partnership with Hollard Insurance Group through a cell captive arrangement. In this setup, Hollard underwrites the policies while Naked focuses on delivering a seamless digital experience. This collaboration has made Naked the only fully digital insurer in South Africa, leveraging AI to simplify and modernize the insurance process.

How the AI Platform Works

Naked built its platform from the ground up, avoiding the inefficiencies of legacy systems. Its AI-driven algorithms handle everything from generating quotes to processing claims, with the ability to provide binding quotes in under 90 seconds through its mobile app. One of its standout features is "Naked Pause", which allows users to temporarily suspend accident coverage when their car isn’t in use – a practical solution for many drivers. Additionally, the platform offers climate-related insurance, covering damages from flooding and extreme weather events.

Business Model and Social Impact

Naked’s approach goes beyond technology, rethinking both its business model and its role in society. The company takes a fixed percentage of premiums to cover its costs and profit, donating any surplus to charities chosen by its customers. This eliminates the typical conflict of interest where insurers benefit from denying claims.

In a country where about 70% of vehicles are uninsured and life insurance (excluding funeral cover) has low adoption, Naked is working to make insurance more accessible. For example, it offers third-party car insurance for as little as R70 (approximately $3.80) per month, which includes R10 million (around $540,000) in liability coverage. This affordability helps address the insurance gap in South Africa.

FSD Africa Unveils $30M Fund to Boost Climate-Ready Insurtechs Across Africa

The $38M Series B Funding Round

Naked Insurtech Funding Journey 2018-2025

Funding Amount and Context

In January 2025, Naked secured a $38 million Series B2 funding round (approximately R700 million), making it the largest insurtech investment in Africa to date. This milestone cements Naked’s position as a leader in digital insurance across the continent. Since its launch in 2018, the company has raised a total of about $65 million (roughly R1.2 billion).

South Africa plays a dominant role in Africa’s insurance market, accounting for 70% of the continent’s $68 billion industry, with annual premiums surpassing $47 billion. This funding not only reinforces Naked’s market dominance but also supports its ongoing efforts to enhance AI capabilities and expand its services. The involvement of strategic investors in this round adds even more momentum to the company’s growth.

Investors in the Round

The Series B2 round was led by BlueOrchard, a global impact investment firm, marking its first investment in Naked. The round also saw increased contributions from existing investors, including the International Finance Corporation (IFC), part of the World Bank Group; Hollard Insurance Group, Naked’s underwriting partner; Yellowwoods; and DEG, Germany’s development finance institution.

Richard Hardy, Private Equity Investment Director for Africa at BlueOrchard, shared his perspective on the investment:

"Naked’s focus on using technology to expand access to insurance fits perfectly with our InsuResilience Investment Fund strategy. This funding will help Naked broaden its reach and develop new products that strengthen the financial resilience of its customers."

Adamou Labara, IFC’s Country Manager for South Africa, highlighted the broader societal impact of expanded insurance access:

"Improving access to insurance products is a key driver of financial inclusion in South Africa as it has the potential to preserve assets, increase incomes and reduce uncertainties."

Monika Beck from DEG emphasized the innovative approach that Naked brings to the table:

"The improved access to insurance cover is an important engine for financial transformation and inclusion in South Africa. With Naked, we are investing in an up-and-coming company whose innovative business model is making it easier for many people to access affordable insurance cover."

The participation of both new and existing investors underscores confidence in Naked’s vision and growth trajectory.

Previous Funding Rounds

Naked’s funding journey has been marked by steady growth. It started with a seed round of R20 million (around $1.1 million), followed by an $11 million Series A in August 2021, led by Naspers. In February 2023, the company raised $17 million in a Series B round, led by the IFC. The latest 2025 Series B2 round of $38 million more than doubles the 2023 raise and is nearly 3.5 times larger than the Series A from 2021.

Co-founder Alex Thomson reflected on the significance of this achievement:

"This investment marks an exciting milestone as we continue to define a new category of insurance. It’s a strong vote of confidence from both our existing shareholders and our new investor, BlueOrchard."

sbb-itb-dd089af

How Naked Will Use the Funds

AI and Technology Improvements

Naked is set to strengthen its position in digital insurance by channeling more resources into automation and artificial intelligence (AI). The company plans to enhance its AI systems across key areas like underwriting, claims processing, and customer service to support its fully digital insurance platform. These upgrades are aimed at improving risk assessment and pricing precision, which could open doors to new market opportunities.

Market and Product Expansion

A significant portion of the $38 million funding will go toward expanding Naked’s product range, which currently includes car, home, contents, and standalone item insurance. The company is also focused on addressing the large uninsured population in South Africa. Beyond its home market, Naked sees its AI-driven platform as a model for growth in other parts of Africa, such as East Africa, where insurance adoption remains low.

Richard Hardy, Private Equity Investment Director for Africa at BlueOrchard, emphasized the potential impact of this expansion:

"This funding will help Naked broaden its reach and develop new products that strengthen the financial resilience of its customers."

Marketing and Regulatory Compliance

In addition to technological and market growth, Naked plans to ramp up marketing efforts and ensure compliance with regulatory requirements. The new funds will support advertising campaigns aimed at attracting more customers. This comes at a time when digital communication is highly favored by 60% of South African millennials when dealing with insurers.

The funding will also cover regulatory capital needs, including liquidity risk management and adherence to global standards like IFRS 17, as required by the Prudential Authority. Furthermore, the funds will bolster Naked’s "cell captive" arrangement with Hollard. Under this setup, Naked provides a capital buffer for extreme loss scenarios, while Hollard underwrites the policies, reinforcing Naked’s unique approach to insurance.

What This Means for African Insurance

Naked’s Role in African Insurtech

Naked has carved out a distinct position in Africa’s insurance technology space with its fully digital, AI-driven platform. The company’s recent $38 million Series B funding round stands as the largest investment in African insurtech to date. Its "Naked Difference" business model reflects a bold departure from conventional insurance practices, signaling a shift in how insurance can be delivered across the continent.

Expanding Insurance Access

This funding aims to address critical gaps in insurance coverage across Africa. For instance, life insurance adoption in South Africa remains below 10%, excluding funeral policies. By leveraging automation, Naked reduces claims processing costs by approximately 30%, enabling the potential for lower premiums and more affordable products for consumers. Adamou Labara, Country Manager for South Africa at IFC, highlighted the importance of this shift:

"Improving access to insurance products is a key driver of financial inclusion in South Africa as it has the potential to preserve assets, increase incomes and reduce uncertainties."

South Africa currently dominates Africa’s insurance market, accounting for 70% of the continent’s $68 billion industry. However, Naked’s innovative approach could serve as a model for regions like East Africa, where insurance penetration remains far lower.

Opportunities and Challenges

Naked’s digital-first strategy brings clear advantages but also faces significant hurdles as it seeks to expand across Africa’s diverse markets. For example, its platform, which boasts the ability to settle basic claims in under 15 minutes and achieves a 60% completion rate for claims from start to finish, highlights its operational efficiency. Customers can manage their entire insurance experience through a mobile app, including unique features like instantly pausing accident coverage.

However, scaling across Africa means navigating a maze of regulatory differences. Each country has its own licensing, capital requirements, and compliance standards, creating barriers to seamless cross-border growth. Insurance penetration varies widely, reflecting disparities in digital adoption, trust, and affordability. For example:

| Country | Insurance Penetration (% of GDP) | Key Barriers |

|---|---|---|

| South Africa | 11.5% | Affordability, climate risk, high lapse rates |

| Kenya | 2.2% | Low awareness, limited product relevance |

| Nigeria | 0.4% | Affordability, low trust, limited digital reach |

| Africa Average | <3% | Regulatory fragmentation, distribution costs |

Another challenge lies in overcoming language and cultural differences. Many AI models struggle to perform effectively in underrepresented African languages. Additionally, there is a shortage of skilled professionals needed to develop and maintain the complex AI systems that drive platforms like Naked’s.

Despite these challenges, the $38 million investment equips Naked with the resources to tackle these obstacles head-on, paving the way for broader insurance accessibility and innovation across the continent.

Conclusion

Naked Insurtech’s $38 million Series B2 funding round marks a major milestone for digital-first insurance and stands as the largest insurtech investment in Africa to date. The company’s AI-powered platform, capable of delivering binding quotes in under 90 seconds and handling claims without human intervention, has demonstrated its ability to operate at scale in a market where nearly 70% of vehicles remain uninsured.

This funding validates Naked’s unique approach – charging a fixed fee and donating surplus funds to charity – to eliminate traditional conflicts of interest. By combining transparency with operational efficiency, the company is strategically positioned to offer more affordable insurance options to underserved populations, laying the groundwork for long-term growth.

The investment also highlights a scalable solution to Africa’s protection gap, with South Africa alone representing 70% of the continent’s $68 billion insurance market. It creates opportunities for expansion into regions like East Africa, where insurance adoption rates are even lower. Naked’s fully automated platform, accessible via a mobile app, offers the flexibility to adapt to these emerging markets.

While the potential is clear, challenges such as evolving regulations and varying levels of digital adoption across Africa could complicate growth. However, with support from impact-driven investors like BlueOrchard and the International Finance Corporation, Naked now has the resources to tackle these hurdles while continuing to focus on financial inclusion.

Ultimately, Naked’s success won’t just be measured by revenue – it will hinge on its ability to make insurance accessible and reliable for millions of Africans who have long been excluded from formal financial protection. This funding positions the company to redefine insurance accessibility across the continent.

FAQs

How does Naked Insurtech use AI to make insurance more accessible?

Naked Insurtech’s AI-powered platform simplifies the insurance process by automating key tasks like underwriting and risk evaluation. With this system, users can receive quotes in less than 90 seconds and handle everything – from buying policies to filing claims – directly through a mobile app.

By eliminating the need for agents, the platform cuts operational expenses, which translates to lower premiums. This approach not only makes insurance more affordable but also extends its reach to a wider audience, addressing the insurance gap across Africa.

How is Naked’s insurance model different from traditional insurers?

Naked takes a fresh approach to insurance with its fully digital, AI-driven platform that makes the entire process a breeze. From getting a quote in less than 90 seconds to managing policies or filing claims, everything happens seamlessly through their app – no need for agents or brokers. Their use of automation and machine learning ensures accurate pricing and smooth claims handling.

What makes Naked stand out even more is its innovative fee system. Instead of pocketing unclaimed premiums, they take a fixed percentage and donate any leftover funds to charities chosen by their customers. This model eliminates the usual conflicts of interest found in traditional insurance, aligning the company’s goals with those of its policyholders.

While Naked prioritizes cutting-edge technology and a user-friendly experience, they also ensure financial security through a "cell captive" arrangement. This setup, backed by a traditional insurer, combines the best of both worlds: modern innovation with the stability and compliance of a trusted insurance framework.

How will Naked use the $38 million from its Series B funding to grow?

The $38 million secured during Naked’s Series B funding round is set to fuel the company’s growth and technological advancements. This investment will go toward refining its AI-powered insurance platform, creating additional insurance offerings, and exploring opportunities in new markets. Moreover, the funds will bolster marketing initiatives, attract new customers, and ensure compliance with regulatory capital standards.

Related Blog Posts

- Top 5 Regions for MobilityTech Funding in Africa

- 10 Investors Investing in African Fintech

- 11 Investors Investing in African Healthtech

- African Startups Raise $289M in Jan 2025: A 240% YoY Surge