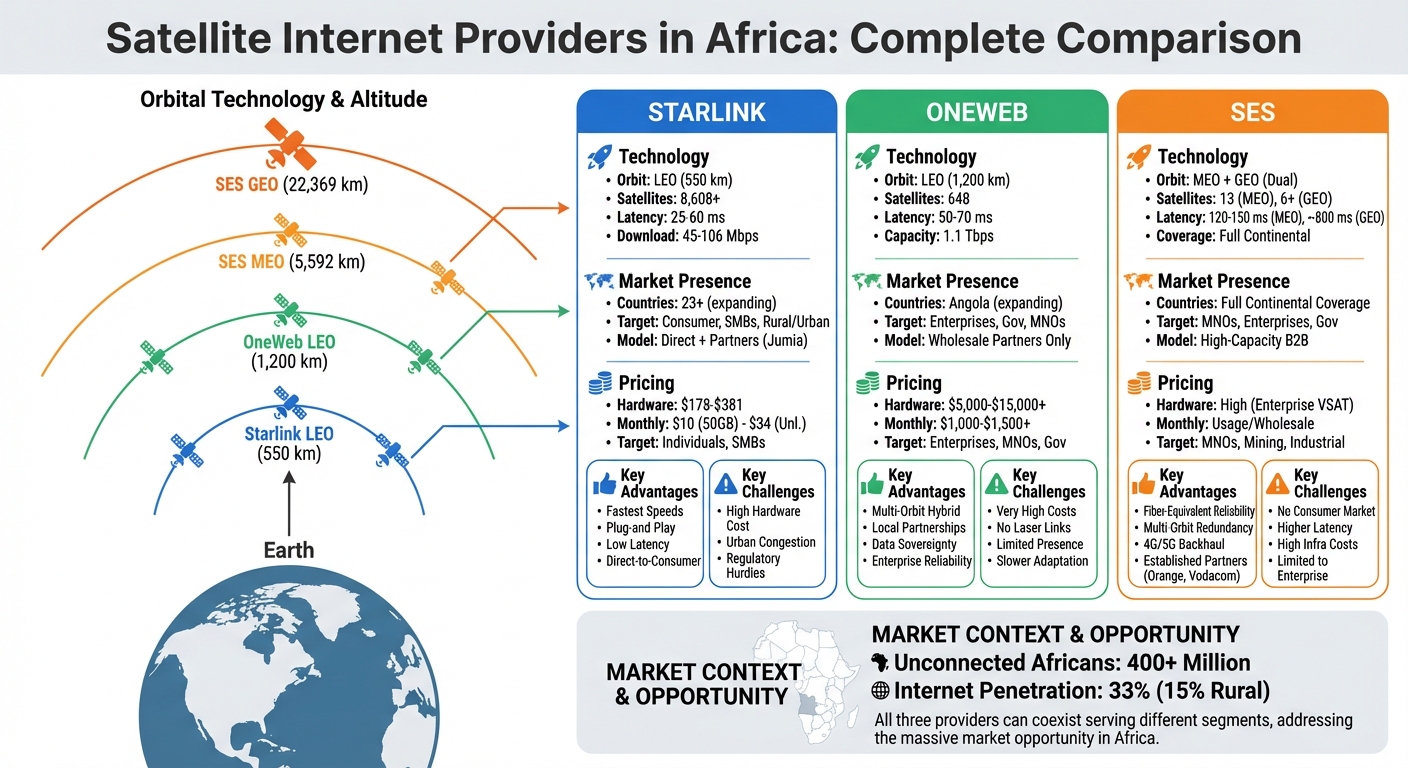

Africa’s satellite internet race is heating up, with Starlink, OneWeb, and SES competing to bridge the digital divide. Here’s the current landscape:

- Starlink: Direct-to-consumer model with affordable plans starting at $10/month in some regions. It’s operational in 23 African countries and offers fast speeds (45–106 Mbps) with low latency (25–60 ms). However, hardware costs ($216–$381) and urban network congestion are challenges.

- OneWeb: Focuses on enterprises and governments through partnerships with local operators. Its middle-ground latency (50–70 ms) and hybrid LEO-GEO network appeal to high-revenue sectors, but costs remain high for individual users.

- SES: Targets enterprises and telecoms with a dual-orbit GEO-MEO system. It provides reliable backhaul for 4G/5G networks and industrial projects but doesn’t compete in the consumer market.

With over 400 million Africans still offline, the market has room for all players. Starlink leads in consumer adoption, while OneWeb and SES cater to businesses. The winner will balance affordability, regulatory compliance, and infrastructure challenges.

Starlink vs OneWeb vs SES: Africa Satellite Internet Comparison 2026

Starlink‘s Approach in Africa

Technology and Network Infrastructure

Starlink operates in low Earth orbit at just 342 miles (550 km) above the ground, a stark contrast to traditional GEO satellites that hover at 22,236 miles (35,786 km). This proximity significantly reduces latency from over 600 milliseconds to a much faster 25–60 milliseconds. By October 2025, Starlink had launched 8,608 satellites and was already operational in 23 African countries.

One of Starlink’s key advantages is its ability to bypass traditional infrastructure like fiber-optic cables or cell towers. Instead, users only need a clear view of the sky and a straightforward two-step setup process. To enhance performance, Starlink has also established local Points of Presence (PoP) in countries like Nigeria and Kenya. These ground-based gateways directly connect users to major internet hubs. For example, the Nairobi PoP, launched in January 2025, cut multi-server latency by 81%, bringing it down to 53 milliseconds, while upload speeds more than doubled to 14.85 Mbps.

The results speak for themselves. In Botswana during Q1 2025, Starlink recorded median download speeds of 106.36 Mbps, dwarfing the 9.36 Mbps average of local ISPs. Kenya and Nigeria reported speeds of 45–50 Mbps with latencies of 53 ms and 60 ms, respectively. This robust network supports Starlink’s tailored approach to serving diverse user needs across the continent.

Market Approach and Target Customers

Starlink focuses on three core customer groups: rural communities lacking dependable internet, urban users dissatisfied with sluggish local ISPs, and businesses or startups needing reliable connectivity. The service is available directly on Starlink’s website and through regional partners like Jumia, a strategy that has gained traction across Africa.

Pricing is tailored to local markets. In Kenya, the "Residential Lite" plan costs just $10 per month for 50GB, while unlimited plans range from $28 to $34 in most countries. Hardware prices vary as well, with the Starlink Mini priced at $178 in Kenya and the standard kit costing $381 in Nigeria. Abel Boreto, an investor in Nairobi, shared his experience:

"Safaricom was quite on the high side and the internet wasn’t even reliable so I decided to try out Starlink, which is more affordable ($10 per month for 50GB) to subscribe and use in the long term".

Starlink is also expanding into enterprise solutions. In July 2023, it partnered with Africa Mobile Networks (AMN) to provide backhaul for over 1,500 mobile base stations in remote Nigerian regions without fiber access, enabling local operators to deliver 3G and 4G services. By May 2025, a similar deal with Airtel Africa aimed to connect schools and hospitals across 14 countries.

Advantages and Obstacles

Starlink’s technology and strategy provide clear benefits but also come with challenges.

Speed is a standout feature. In Q1 2025, Starlink delivered speeds 7.6 times faster than traditional ISPs in Burundi and 6.6 times faster in Mozambique. Its plug-and-play setup eliminates the need for lengthy installations or on-site technicians. As Olumide Lewis, a tech worker in Lagos, explained:

"Since we bought our Starlink, we have had some peace of mind. We don’t spend our time thinking about the bad internet again because everything just works".

However, affordability remains a hurdle. In Nigeria, where the average monthly income is ₦200,000 (about $142), the ₦318,000 ($216) hardware cost and ₦57,000 ($38.72) monthly fee are prohibitive for many. Diseye Isoun, CEO of Content Oasis, pointed out:

"If a Nigerian is earning ₦200,000 ($142.08) a month… whether you bundle or not, they still can’t afford it".

High demand has also created capacity issues. In major cities like Lagos, Nairobi, Abuja, and Harare, Starlink has had to pause new subscriptions due to network overload, with "sold out" statuses frequently appearing. Regulatory hurdles add another layer of complexity. For instance, Uganda’s licensing process was still unresolved as of January 2026, and South Africa’s Black Economic Empowerment requirements may push Starlink to establish local business units.

OneWeb‘s Approach in Africa

Technology and Network Infrastructure

OneWeb has chosen a different route compared to Starlink. Its 648 satellites orbit at an altitude of 745 miles (1,200 km) – more than twice as high as Starlink’s satellites, but still far below the traditional geostationary satellites positioned at 22,236 miles (35,786 km) above Earth. This middle-ground orbit results in latency ranging from 50–70 milliseconds, which is slightly higher than Starlink’s 25–50 ms but still quick enough for most online applications.

The network delivers 1.1 terabits per second (Tbps) of capacity across a wide area, utilizing 16 spot beams per satellite. However, OneWeb’s first-generation satellites lack inter-satellite laser links, which means they rely on ground gateways for connectivity. To support this, the company has established or leased about 50 gateway sites across more than 20 countries.

OneWeb’s merger with Eutelsat created the first-ever "multi-orbit" network, blending the low latency of LEO satellites with the high-capacity broadcasting of GEO satellites. This hybrid system provides automatic fallback between orbits, which is especially attractive to enterprise clients that require consistent uptime. This technical framework underpins OneWeb’s unique approach to the market.

Market Entry and Partnerships

Unlike Starlink, which sells directly to consumers, OneWeb focuses on wholesale partnerships. It sells capacity to telecom operators, governments, and enterprises that then serve end users. This partner-driven approach helps OneWeb navigate Africa’s complex regulatory environment by collaborating with local companies that already hold licenses and understand the market landscape.

A $500 million investment from Bharti Global in July 2020 played a key role in OneWeb’s entry into Africa, leveraging Bharti’s existing partnerships on the continent. Bharti’s presence through Airtel provided OneWeb with access to multiple markets. In November 2025, OneWeb teamed up with Paratus Group to expand LEO satellite connectivity in Southern Africa, focusing on countries like South Africa, Angola, Namibia, Botswana, and Zambia. This partnership targets industrial connectivity for fixed sites and mobile solutions, such as trucks, trains, and mining equipment.

Additionally, OneWeb acquired TrustComm in May 2021, a U.S.-based satellite services provider, which has since been rebranded as OneWeb Technologies. This acquisition established a dedicated government distribution channel, further reinforcing OneWeb’s position as an enterprise-focused provider in Africa. By targeting sectors like cellular backhaul, OneWeb enables telecom operators to expand 4G and 5G networks into rural areas where fiber deployment is cost-prohibitive.

Advantages and Obstacles

OneWeb’s strategy of partnering with local telecom operators offers several advantages. By leveraging existing billing systems, customer service structures, and regulatory approvals, the company integrates smoothly into local markets. This approach also aligns with concerns around data sovereignty, as OneWeb works within local frameworks rather than operating as an independent foreign provider.

Positioning itself as an "enterprise specialist", OneWeb focuses on high-revenue sectors such as mining, oil and gas, maritime, and government services rather than targeting residential users. This approach helps the company avoid the affordability challenges that consumer-focused providers often face in Africa.

However, challenges remain. The cost of OneWeb’s services is steep, with reseller fees ranging from $1,000 to $1,500 per month – a price point far beyond the reach of most individual consumers or small businesses.

Looking ahead, OneWeb’s second-generation satellites, expected between 2025 and 2026, will include advanced features like digital regenerative payloads and "beam-hopping" technology, allowing for more dynamic capacity allocation. These upgrades, however, are still in development.

Competition also poses a major hurdle. While OneWeb has carved out a niche in the enterprise market, Starlink’s aggressive pricing and direct-to-consumer model have allowed it to capture significant market share. As Ismail Patel, Senior Analyst at GlobalData, pointed out:

"Starlink obviously is headed by Elon Musk, who has demonstrated in recent months that he might not be the most palatable partner… this is why some would be reticent to giving Starlink carte blanche to operate… without assurances of privacy".

Despite its advantages, OneWeb’s reliance on partners to reach end users can limit its ability to adapt quickly to market changes or address customer needs directly.

SES‘s Approach in Africa

Technology and Network Infrastructure

SES employs a dual-orbit satellite strategy, combining Geostationary (GEO) and Medium Earth Orbit (MEO) satellites to deliver connectivity across Africa. GEO satellites, stationed at 22,369 miles (36,000 km) above Earth, work alongside MEO satellites orbiting at approximately 5,592 miles (9,000 km). This setup gives SES a level of flexibility that single-orbit providers can’t achieve.

The O3b mPOWER constellation, SES’s next-generation MEO network, is often referred to as "fiber in the sky" due to its ability to deliver high-capacity backhaul similar to terrestrial fiber. As Simon Gatty Saunt, SES’s VP of Sales for Europe and Africa, explains:

"We do a lot of backhaul today – anything from 30 megabits all the way up to multiple gigabits of bandwidth".

MEO satellites offer latency of 120–150 milliseconds, placing them between Starlink’s sub-100 ms latency and the 800 ms typical of traditional GEO satellites. For applications like cloud services and mobile backhaul, this latency is nearly as efficient as fiber-optic cables.

SES’s plan includes deploying a total of 13 O3b mPOWER satellites, with launches scheduled through 2025 and 2026 to expand bandwidth across Africa. Thanks to MEO’s broader field of view compared to Low Earth Orbit (LEO) satellites, just six satellites can provide global equatorial coverage. SES integrates this architecture with software-defined wide area network (SD-WAN) technology, enabling GEO satellites to serve remote sites while MEO satellites handle high-capacity links – all on a seamless platform. This setup positions SES to meet specialized enterprise needs effectively.

Market Focus and Enterprise Customers

SES concentrates its services on enterprise and government sectors, steering clear of the direct-to-consumer market that companies like Starlink target. Instead of residential internet kits, SES offers high-capacity backhaul services to Mobile Network Operators (MNOs), which helps extend 4G and 5G coverage to areas where deploying fiber – at about $30,000 per mile – is prohibitively expensive and vulnerable to damage.

In February 2025, SES partnered with Vodacom in the Democratic Republic of Congo to build an O3b mPOWER gateway in Kinshasa with the help of systems integrator Gilat. This project delivers multi-gigabit bandwidth to support mobile backhaul in four major cities. Around the same time, SES sold its entire bandwidth capacity in the Central African Republic to Orange, enabling the telecom provider to expand its 4G network using a combination of GEO satellites for rural sites and O3b mPOWER for international links routed to a Paris data center.

SES also supports large industrial projects in remote areas. For example, the Kamoa-Kakula Copper Mine in the DRC, located 168 miles (270 km) from the nearest city, has relied on SES’s MEO network since 2018 for IoT and communication needs under a "network-as-a-service" model. Additionally, SES collaborated with Orange/Sonatel to establish Africa’s first O3b mPOWER gateway in Gandoul, Senegal, enabling low-latency, cloud-optimized connectivity across the region.

Advantages and Obstacles

SES’s multi-orbit approach offers distinct benefits for enterprise clients. It guarantees service-level agreements (SLAs) and certified performance, being the only satellite provider with MEF Carrier Ethernet (CE) 2.0 certification, which ensures its satellite Ethernet services match the reliability of terrestrial fiber. This level of dependability is critical for industries like mining, oil and gas, and government operations where downtime isn’t an option.

Partnerships with established operators like Orange and Vodacom allow SES to tap into existing local infrastructure. Its multi-orbit system also provides redundancy, which has proven vital in restoring national connectivity during submarine cable outages in countries like Madagascar and Somalia.

However, SES faces challenges. Its focus on enterprise clients means it doesn’t compete in the consumer market, where Starlink has rapidly gained traction. While avoiding affordability concerns for individual users, this strategy limits SES’s market reach. Additionally, the infrastructure costs for MEO ground terminals and gateway facilities are substantial, making the service accessible mainly to large enterprises and telecom operators.

Competition from LEO networks adds further pressure. Starlink’s lower latency and aggressive pricing for enterprise services challenge SES’s traditional market. To adapt, SES has started integrating LEO capabilities into its solutions through partnerships with other operators, particularly for government and maritime customers. As Gatty Saunt notes:

"LEO satellites provide high-burst, best-effort data applications while our fleet of GEO and MEO satellites [is] ideal for delivering reliable and high-throughput connectivity flexibly".

With internet penetration in Africa at just 33%, and only 15% in rural areas, the potential market is enormous. However, SES must continue expanding its O3b mPOWER constellation and local gateway infrastructure to stay competitive as the race for satellite internet dominance intensifies across the continent. While SES offers a unique value proposition, its success will depend on whether enterprises and telecom operators see the premium for guaranteed performance and redundancy as worth the cost.

Technology Comparison: LEO vs MEO vs GEO

Technical Differences and Performance Data

The three satellite systems vying for Africa’s internet market operate at different altitudes, which significantly impacts their performance. Starlink and OneWeb rely on Low Earth Orbit (LEO) satellites, positioned between 310 and 745 miles (500–1,200 km) above Earth. SES’s O3b mPOWER operates in Medium Earth Orbit (MEO) at about 5,592 miles (9,000 km), while SES’s traditional satellites are located in Geostationary Orbit (GEO) at roughly 22,369 miles (36,000 km).

LEO satellites deliver the best latency performance. By early 2025, Starlink achieved a latency of 53 milliseconds in Kenya and 60 milliseconds in Nigeria after deploying local Points of Presence in Nairobi and Lagos. SES’s MEO network offers latency around 120 milliseconds, while traditional GEO satellites lag behind with approximately 800 milliseconds. Here’s a quick comparison of these technical differences:

| Feature | LEO (Starlink/OneWeb) | MEO (SES O3b mPOWER) | GEO (SES/Intelsat) |

|---|---|---|---|

| Altitude | 310–745 miles (500–1,200 km) | ~5,592 miles (9,000 km) | ~22,369 miles (36,000 km) |

| Latency | 50–100 ms | ~120 ms | ~800 ms |

| Coverage per Satellite | Small | Moderate | Very Large |

| Satellites Needed | Thousands | 6 | 3 for global coverage |

| Terminal Size | Small (consumer-grade) | Medium to large (enterprise) | Large fixed antennas |

| Primary Use | Consumer broadband, rural connectivity | Enterprise, mobile backhaul, government | Broadcast, wholesale capacity |

Coverage requirements also differ greatly. LEO networks need thousands of satellites due to their limited coverage area per satellite – Starlink already operates over 7,000 satellites. Meanwhile, SES achieves full equatorial coverage across Africa with just six O3b mPOWER satellites. GEO satellites require only three satellites for global coverage, thanks to their extensive reach.

These technical differences also affect the size and cost of user terminals. Starlink’s compact consumer dishes are priced between $200 and $700, while OneWeb’s enterprise terminals cost anywhere from $5,000 to $15,000. SES relies on tracking antennas and fixed VSAT dishes, which are tailored for enterprise and government use.

Fit for African Connectivity Needs

The choice of orbit does more than influence technical performance – it directly impacts how well these technologies address Africa’s connectivity challenges. With only 27% mobile internet penetration in Sub-Saharan Africa by the end of 2023 and 60% of the population still unconnected, satellite systems offer a practical alternative to costly fiber networks.

As Ismail Patel, Senior Analyst at GlobalData, explains:

"What the LEO market has done is potentially unlocked this opportunity, not only for Africa, but also for the rest of the world, as either a replacement for fixed and mobile traditional connectivity, or as a technology to install where there is no fixed or mobile connectivity."

LEO satellites are particularly effective in rural areas. During Q1 2025, Starlink delivered median download speeds of 106.36 Mbps in Botswana and 86.18 Mbps in Eswatini, outperforming many local terrestrial internet providers. Their low latency also supports real-time applications like video calls and online education, which are critical in underserved regions.

However, LEO systems face challenges in high-density urban areas. By early 2026, Starlink paused new sign-ups in cities like Lagos, Nairobi, and Lusaka due to network congestion. The limited coverage of each satellite makes it harder to scale in areas with high user demand.

MEO satellites, on the other hand, are well-suited for enterprise and infrastructure needs. SES’s O3b mPOWER constellation provides multi-gigabit backhaul for mobile operators extending 4G and 5G networks into remote areas. With latency around 120 milliseconds, it supports most business and cloud applications, while the higher altitude allows fewer satellites to cover larger regions. This makes MEO systems ideal for connecting enterprises, government facilities, and telecom infrastructure where fiber isn’t feasible.

GEO satellites, despite their higher latency, remain useful for specific cases. Their broad coverage is perfect for broadcasting and delivering basic connectivity to extremely remote locations.

Industry leaders increasingly agree that no single orbit type can meet all connectivity needs. Rhys Morgan, EMEA Regional Vice President at Intelsat, highlights:

"LEO will not dominate the market alone; a mix of LEO, GEO, and MEO satellite systems will be necessary to meet Africa’s growing demand for data."

The real challenge lies in combining these technologies effectively to serve Africa’s diverse connectivity needs, from rural households to large enterprises and mobile operators spread across vast regions.

sbb-itb-dd089af

Market Presence and Partnerships in Africa

Current and Planned Coverage

Starlink is operational in 23 African countries, with Nigeria leading with 59,509 subscriptions by the first quarter of 2025, and Rwanda reaching 4,503 subscriptions by March 2025. The company has ambitious plans to expand into Angola, Senegal, Tanzania, Côte d’Ivoire, and 11 additional African markets during 2025–2026.

SES, on the other hand, offers full coverage of the continent through its combined MEO (O3b mPOWER) and GEO satellite fleets. Unlike Starlink, SES focuses on providing high-capacity backhaul services to telecom operators rather than directly targeting individual consumers.

Eutelsat OneWeb has also been making strides in Africa, securing a 15-year operating license in Angola as of July 2025, which paves the way for its expansion across the continent. Unlike Starlink’s direct-to-consumer strategy, OneWeb collaborates with locally licensed entities to extend its reach.

| Provider | Current Presence (Live Markets) | Key African Partners | Planned Launches/Expansion (2025–2026) |

|---|---|---|---|

| Starlink | 23 Countries | AMN, Paratus Group, Jumia | Angola, Senegal, Tanzania, Côte d’Ivoire, and 11 others |

| SES | Full Continental Coverage | Orange, Vodacom, Moov Africa, Gilat | 3 mPOWER satellites, 2 mPOWER satellites |

| OneWeb | Angola licensed | Local MNOs and ISPs | Expanding through local partnerships |

How Partnerships Affect Market Growth

These providers are increasingly leaning on partnerships to drive growth and navigate Africa’s complex regulatory environment. Collaborations with regional players help them expand their footprint and enhance market penetration.

For example, in July 2023, Africa Mobile Networks teamed up with Starlink to deploy its terminals across over 1,500 mobile base stations in Nigeria, providing connectivity to remote communities. This marked a shift in Starlink’s approach toward infrastructure partnerships. Starlink is also working with Jumia, Africa’s largest e-commerce platform, and distribution partners like Paratus Group to broaden its reach beyond direct sales.

SES has established strong relationships with major telecom companies. A notable project includes building an mPOWER gateway in Kinshasa for Vodacom, enabling gigabit-level mobile backhaul in four major cities in the Democratic Republic of Congo. Similarly, SES supports Orange’s 4G network in the Central African Republic by combining GEO and MEO capacity, with international links routed through Portugal to Paris.

Regulatory considerations often shape these partnerships. For instance, in South Africa, Starlink is committing $107 million in investments, including $27 million to provide free high-speed internet to 5,000 rural schools, potentially benefiting 2.4 million children. These efforts are part of its licensing discussions.

As Ismail Patel, Senior Analyst at GlobalData, explains:

"A foreign operator like Starlink obviously poses problems for national governments… they might be incentivising operators to go into partnership with Starlink so they retain some degree of control of data".

Affordability and Scalability for African Users

Cost and Accessibility

Satellite internet remains an expensive option. In Kenya, Starlink’s subscription plans range from $10 for a 50GB cap to $28–$38 for unlimited data. Meanwhile, in Nigeria, hardware costs have dropped significantly – from around $700 to $216 for standard kits – though some markets still see prices as high as $381. In at least five countries (Kenya, Ghana, Zimbabwe, Mozambique, and Cape Verde), Starlink’s pricing is now lower than that of leading fixed-line ISPs.

However, affordability remains a challenge when measured against local incomes. For instance, Starlink’s $30 monthly plan represents more than 22% of the average monthly gross national income (GNI) in sub-Saharan Africa. Temidayo Oniosun, Managing Director at Space in Africa, notes:

"The entry of Starlink triggered noticeable shifts in user behavior… From a consumer perspective, this price pressure should be beneficial".

Unlike Starlink, SES and OneWeb primarily target enterprise and wholesale markets. Their pricing models – based on usage or partnerships with telecom operators – position them as higher-cost options, making them less accessible to everyday consumers.

| Provider | Hardware Cost (USD) | Monthly Service Fee (USD) | Target Market |

|---|---|---|---|

| Starlink (Standard) | $216 – $381 | $28 – $50 | Direct-to-consumer, businesses |

| Starlink (Mini) | $178 | $10 (50GB cap) | Budget-conscious consumers |

| SES | High (Enterprise Grade) | Usage-based / Wholesale | Telecom operators, enterprises |

| OneWeb | High (Enterprise Grade) | Usage-based / Wholesale | MNOs, government, ISPs |

These numbers highlight a broader issue: while satellite internet offers new opportunities, cost barriers and regulatory challenges limit its reach.

Infrastructure and Regulatory Barriers

Cost isn’t the only obstacle; infrastructure and regulatory issues also hinder growth. Network capacity is a significant concern, with Starlink expected to hit full capacity in major cities like Lagos, Abuja, Nairobi, and Johannesburg by late 2024 or early 2025. This underscores the difficulty of keeping up with demand in densely populated urban areas.

Regulations vary widely across African countries, further complicating matters. For example, South Africa requires 30% Black Economic Empowerment (BEE) ownership, which has delayed Starlink’s market entry. In Nigeria, Starlink committed $107 million in investments during licensing talks, including $27 million to provide free high-speed internet to 5,000 rural schools, potentially impacting 2.4 million children.

Infrastructure challenges add another layer of complexity. Traditional ISPs often face issues like obtaining right-of-way permits and dealing with vandalism, while satellite providers need clear sky views and local support offices to function effectively. To address rural connectivity gaps, Starlink partnered with Africa Mobile Networks (AMN) in July 2023. This initiative focuses on deploying terminals at over 1,500 mobile base stations in Nigeria, targeting areas without fiber backbone access.

Data sovereignty is another concern. Yoosuf Temitope, Technical Adviser at Nigeria Communications Satellite Limited, warns:

"The military is not meant to ride on Starlink because its data would go to the United States, which can easily mine and cook the data".

To combat performance issues, Starlink has installed local Points of Presence (PoPs) in Nigeria and Kenya, reducing latency to under 60 milliseconds in some areas. Despite these efforts, the combination of high costs, regulatory challenges, and capacity limitations means satellite internet still reaches only a small fraction of Africa’s 400 million unconnected people. For instance, Starlink’s subscriber base is projected to grow to 59,509 in Nigeria by Q1 2025 and 19,460 in Kenya by September 2025. These figures highlight the uphill battle in addressing Africa’s connectivity needs.

Who Will Lead Satellite Internet in Africa by 2026?

Main Findings from the Competition

Starlink has emerged as the frontrunner in market reach and consumer adoption. By early 2026, it operates in over 25 African countries, including the Democratic Republic of Congo, Chad, and South Sudan, making it the most accessible direct-to-consumer satellite internet provider in the region. Rapid subscriber growth, particularly in Nigeria, has fueled its expansion. Starlink’s range of hardware options makes its service somewhat more affordable, though high subscription fees remain a barrier for many consumers across the continent.

In contrast, OneWeb and SES have adopted a different approach. Rather than targeting individual users, these companies focus on partnerships with mobile network operators and enterprise clients. This business-to-business (B2B) strategy allows them to integrate with existing telecom infrastructure and leverage local trust, which helps navigate regulatory hurdles. However, this approach limits their visibility compared to Starlink’s aggressive direct-to-consumer model, highlighting a key difference in how these companies compete.

Adding to the competitive landscape, Amazon’s Project Kuiper entered Nigeria in 2026 with a broader license that includes Fixed Satellite Services, Mobile Satellite Services, and Earth Stations in Motion. This authorization surpasses the initial permissions granted to Starlink. As Elamah Mesahidu, Managing Partner at Hutchlam Services, remarked:

"Starlink has enjoyed a quasi-exclusive position. That status quo has now been punctured".

Forecast and Conclusion

The satellite internet market in Africa is expected to evolve into a layered ecosystem where satellite services complement existing terrestrial networks. While dense urban areas may pose capacity challenges, Starlink is likely to maintain its lead due to its first-mover advantage, established infrastructure, and growing subscriber base. However, no single player is expected to dominate the market. As Temidayo Oniosun, Managing Director at Space in Africa, explains:

"The scale of unmet demand means that virtually every major player sees Africa as a strategic growth market".

With over 400 million Africans still offline and only 38% of the population connected as of 2024, the market offers plenty of room for multiple providers to thrive.

The company that succeeds will be the one that best addresses Africa’s unique challenges: affordability, regulatory compliance, and infrastructure resilience. Starlink’s direct-to-consumer model offers speed and accessibility, while OneWeb and SES strengthen existing networks through partnerships. Meanwhile, Amazon’s entry into the market is expected to intensify competition further. As African governments adopt more pragmatic policies, providers willing to invest locally and form strategic alliances will have the best chance of success. Local engagement and collaboration will remain critical for all players.

How Fast is Starlink in Nairobi? 5G vs Satellite Face-off!

FAQs

What challenges does Starlink face in expanding across Africa?

Starlink is facing several obstacles as it works to expand its satellite internet services across Africa, with regulatory complexities being a major roadblock. Each African nation operates under its own set of legal frameworks and licensing requirements. This means Starlink must invest significant time and resources to navigate these varied regulations, which can delay or complicate its rollout.

Another challenge comes from local ownership and empowerment rules, such as South Africa’s B-BBEE regulations. These policies often require companies to partner with local stakeholders or contribute to community development programs. While Starlink has taken steps to address these requirements – like investing in local infrastructure and promoting digital inclusion – such initiatives can slow down its ability to scale quickly.

Combined, these regulatory and operational challenges present substantial hurdles for Starlink’s growth in Africa.

How does OneWeb’s partnership strategy support its growth in Africa?

OneWeb’s approach to partnerships is central to its growth in Africa, as it taps into local expertise, infrastructure, and regulatory knowledge. These collaborations allow the company to manage complex challenges such as licensing and compliance, while also building positive relationships through contributions to local economies.

By teaming up with regional partners, OneWeb can speed up satellite deployment, tailor its services to specific market demands, and scale operations effectively. This strategy not only bolsters its competitive edge but also aligns with broader objectives like creating jobs and expanding digital access, positioning it as a strong player in Africa’s satellite internet landscape.

Why does SES prioritize enterprise clients over individual consumers?

SES focuses on enterprise clients because its satellite services are built to address the unique demands of businesses, governments, and industries, rather than individual users. These clients typically need reliable, scalable, and secure connectivity for applications such as telecommunications, broadcasting, and managing critical infrastructure.

By concentrating on enterprises, SES delivers customized solutions, offering dedicated bandwidth and fostering long-term partnerships. This approach not only ensures consistent revenue but also allows SES to sidestep the intense price wars and regulatory challenges that often come with consumer-focused satellite internet. In regions like Africa, where connectivity needs are growing but infrastructure remains limited, SES’s strategy aligns perfectly with the requirements of large organizations and remote operations.

Related Blog Posts

- Top 7 African Countries Using Partnerships for Rural Internet

- Starlink Partners with Airtel & Vodacom: From Rival to Ally

- Airtel Africa to Launch ‘Direct-to-Cell’ Satellite Service in 2026

- Vodacom Integrates Satellite Tech to Reach Rural South Africa