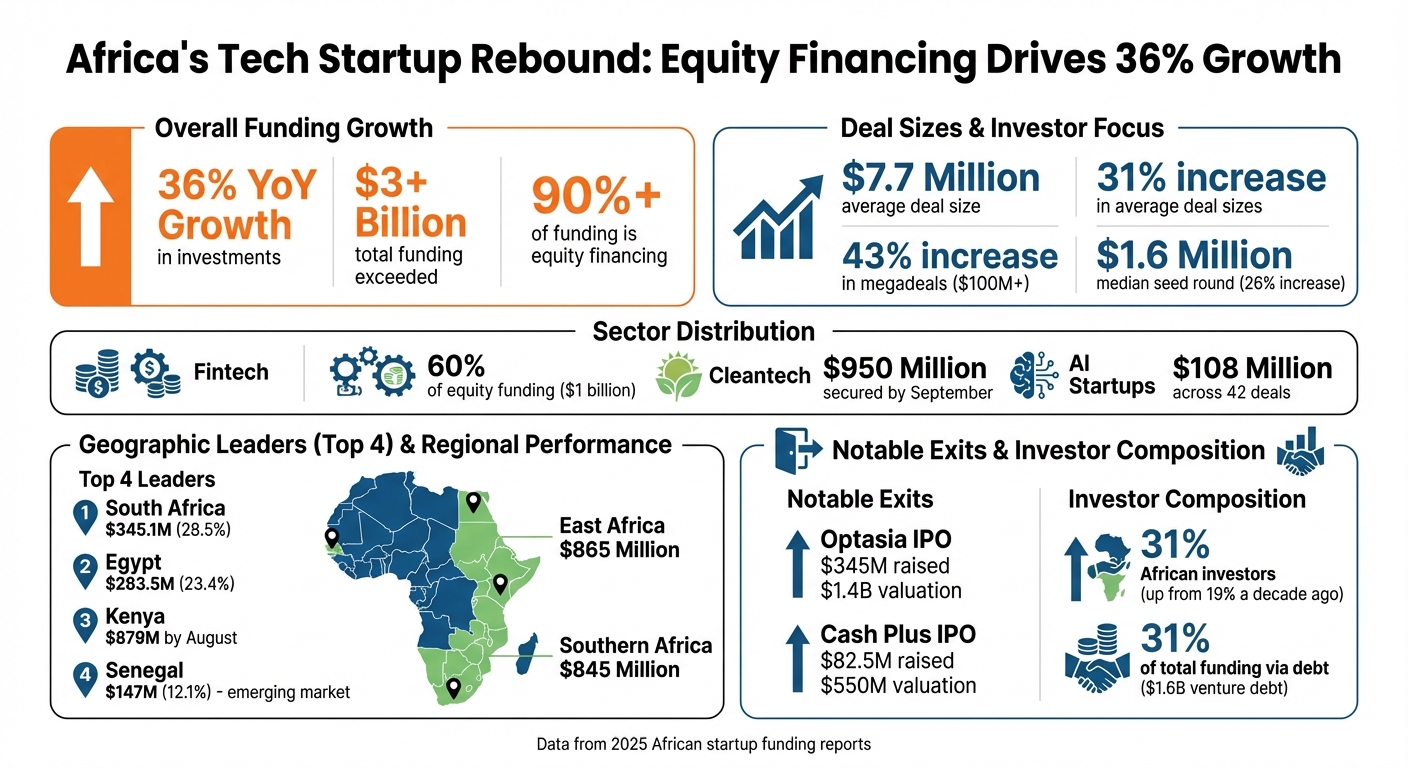

Africa’s tech startup ecosystem is bouncing back in 2025, driven by a sharp rise in equity financing. Here’s what’s happening:

- Funding Surge: Investments grew 36% year-over-year, exceeding $3 billion. Equity now accounts for over 90% of all funding.

- Investor Focus: Backing startups with strong unit economics, reliable revenue, and scalable models. Average deal sizes increased 31% to $7.7 million.

- Sector Growth: Fintech remains dominant (60% of equity funding), but cleantech is catching up, securing $950 million by September.

- Geographic Shifts: Nigeria, Kenya, Egypt, and South Africa lead, with emerging players like Senegal and Togo gaining traction.

- Exits and Confidence: IPOs like Optasia’s $345M listing show African startups can deliver returns, fueling more investments.

Equity financing is reshaping how startups grow, focusing on long-term sustainability, infrastructure-driven solutions, and investor confidence. This marks a turning point for Africa’s tech landscape.

Africa’s 2025 Startup Funding Rebound: Key Statistics and Trends

Investing in Africa’s Future Through Private Equity

Major Trends in Equity Financing for 2025

The evolving dynamics of equity financing are reshaping Africa’s tech ecosystem, with some notable trends taking center stage.

Large Funding Rounds and Sector Shifts

Funding deals are scaling up in size. Megadeals – those exceeding $100 million – saw a 43% increase in count and a 57% jump in total value. Meanwhile, the median seed round climbed 26%, reaching $1.6 million.

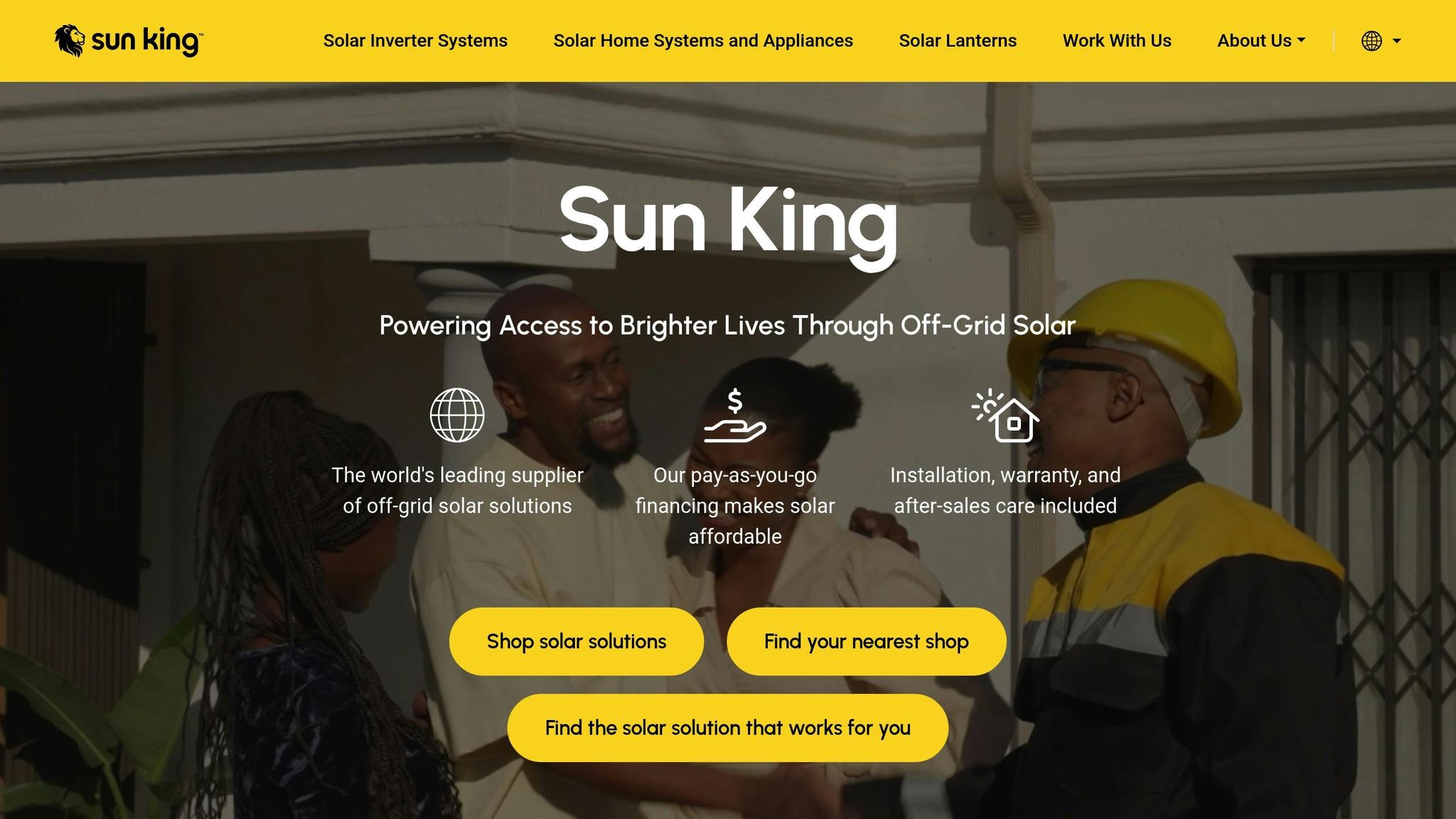

Cleantech is emerging as a serious contender to fintech. By September 2025, cleantech ventures had secured nearly $950 million, closely rivaling fintech’s $1 billion. For instance, Kenyan solar energy provider d.light raised $300 million in debt financing to expand its renewable energy solutions across the region. Similarly, Sun King secured $236 million to grow its solar energy offerings. This surge highlights Africa’s urgent need for energy infrastructure and the growing appeal of ESG-aligned investments.

As deal sizes grow, the focus naturally shifts to where these funds are being directed.

Geographic Funding Trends

Nigeria, Kenya, Egypt, and South Africa continue to dominate, capturing between 60% and 83% of startup funding in 2025. During the first half of the year, South Africa led with $345.1 million (28.5%), followed by Egypt with $283.5 million (23.4%). By August, Kenya and South Africa had raised $879 million and $848 million, respectively. This concentration of funding in established markets reflects investor confidence in ecosystems with a proven track record.

East and Southern Africa emerged as the top-funded regions, attracting $865 million and $845 million, respectively, by August. While Nigeria has historically been a leader, it raised only $186 million in the first eight months of the year. Francophone Africa is also gaining traction, with Senegal securing $147 million in the first half of 2025 (12.1% of total funding), and Togo breaking into the top five funding destinations in Q1 2025. These shifts illustrate how equity financing is opening doors for broader market opportunities across the continent.

Role of Development Finance Institutions and Local Banks

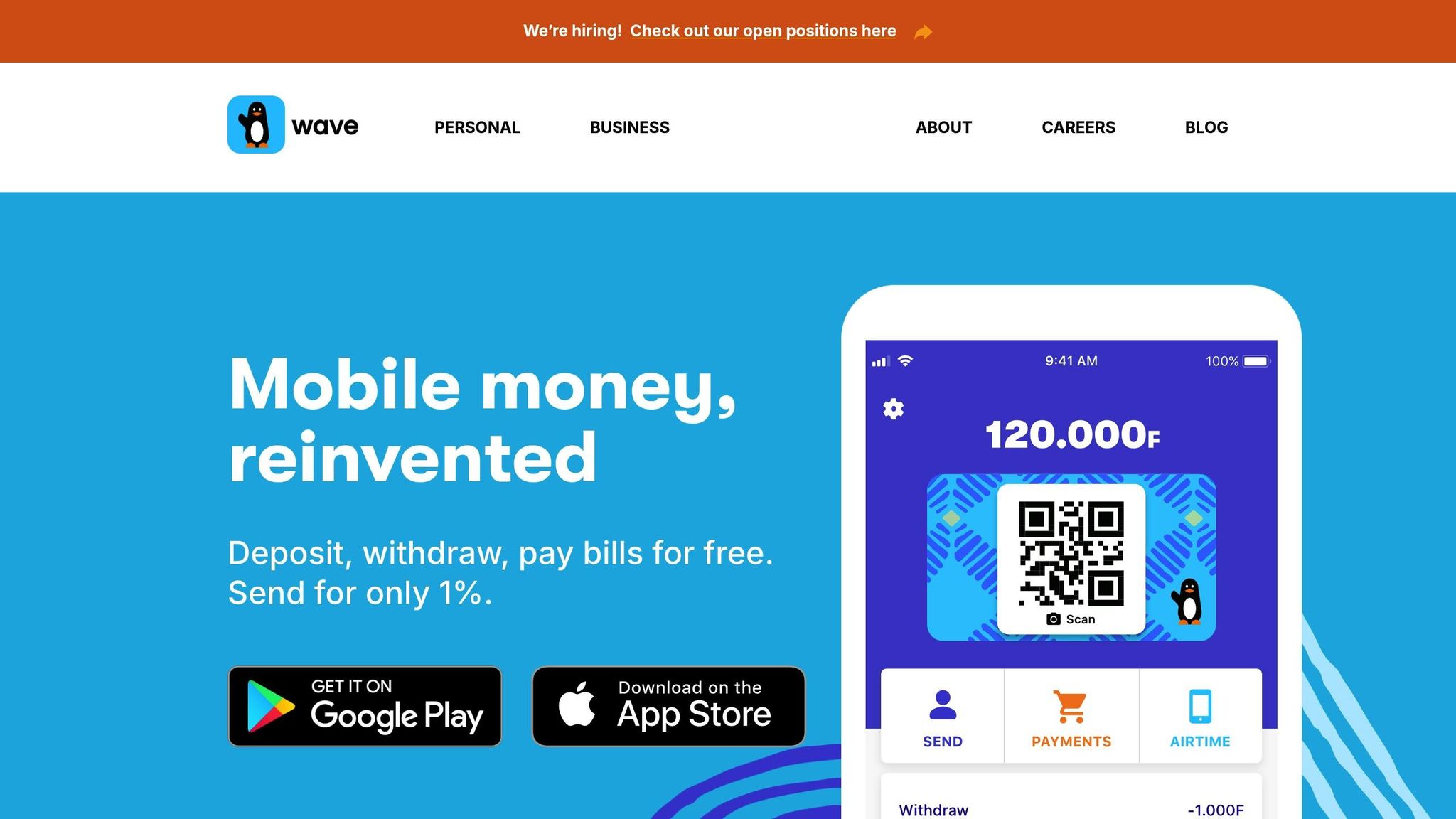

Development Finance Institutions (DFIs) like the IFC are playing an increasingly prominent role in equity financing, while local banks are stepping up their involvement. In June 2025, Rand Merchant Bank (RMB) led a $137 million debt facility for Senegalese fintech Wave, enabling it to scale its mobile money operations. Similarly, South African banks like Nedbank are participating more frequently in growth-stage equity rounds.

This growing institutional participation is stabilizing the market. DFIs and local banks bring credibility, which attracts additional investors and signals that African startups are maturing into viable investment opportunities. Their involvement is helping to position equity financing as a key driver of long-term growth across the continent.

Startups Using Equity Financing to Drive Growth

African startups are showcasing how equity financing can fuel expansion and spark new ideas, offering valuable insights for the global startup ecosystem. Here are some standout examples of how this strategy is shaping the continent’s business landscape.

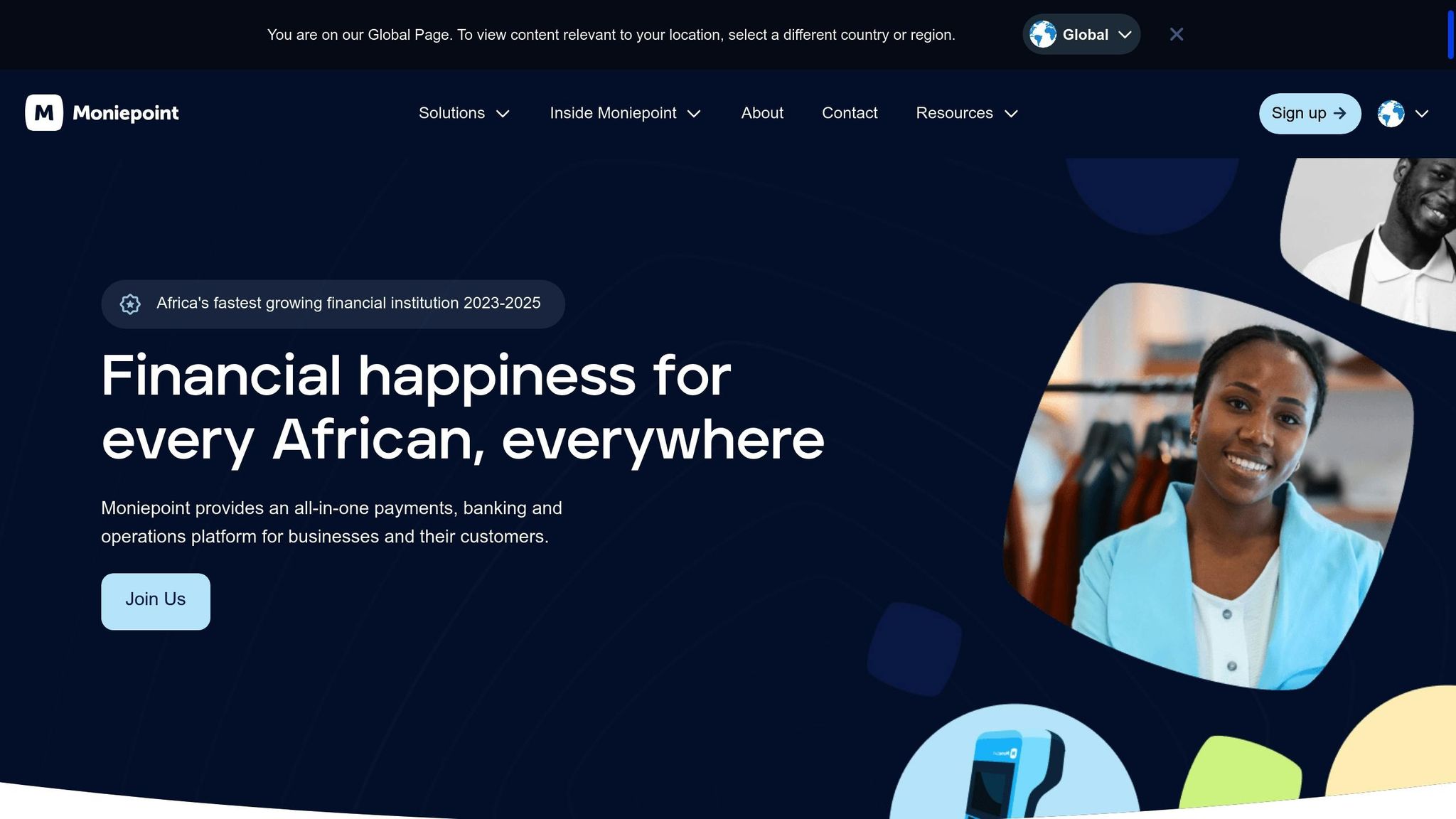

Moniepoint‘s $200 Million Series C Extension

Nigerian fintech Moniepoint wrapped up its $200 million Series C round in October 2025, with a final $90 million tranche led by Development Partners International (DPI) and backed by LeapFrog Investments. This round preserved the company’s $1 billion valuation, solidifying its place as a unicorn.

The funds are driving Moniepoint’s expansion across Africa, including a significant entry into Kenya’s $67.3 billion mobile payments market through the acquisition of a majority stake in Sumac Microfinance Bank. Additionally, $7.39 million has been allocated for entering the UK market to support cross-border remittances. Beyond geographic growth, the company is diversifying its offerings with new inventory management tools, contactless payment cards, and the "MonieWorld" remittance product. With over $250 billion in digital payments processed annually and a customer base exceeding 10 million businesses and individuals in Nigeria, Moniepoint is making its mark.

"The proceeds from our Series C will be deployed judiciously to generate even more momentum as we enter the next chapter of Moniepoint’s story – with financial happiness for Africans everywhere remaining our ultimate goal".

CEO Tosin Eniolorunda’s words underscore how equity financing is powering Moniepoint’s ambitious goals and the broader tech revival across Africa.

Sun King‘s Clean Energy Expansion

Kenyan cleantech company Sun King leveraged equity financing to scale its clean energy solutions. In Q3 2025, the company secured $156 million in funding by partnering with Development Finance Institutions like British International Investment (BII) and local banks, including Absa Bank Kenya Ltd and KCB Bank Kenya Limited. This mix of international and local support provided both the scale and currency stability needed for its operations.

Sun King has shifted its focus to becoming an infrastructure solutions provider, aiming to address energy access for nearly 600 million people across Africa. This pivot attracted long-term investments from institutional backers interested in impactful projects. Kenya’s push for 100% renewable energy by 2030 has also created a stable regulatory environment, reducing risks for investors.

Wave‘s Equity-Debt Funding Structure

Senegal-based fintech Wave opted for a hybrid approach, securing $137 million in debt financing between January and September 2025, led by Rand Merchant Bank (RMB). This strategy allowed the company to finance its mobile money infrastructure and expand its agent network without significantly diluting equity.

The steady revenue streams from mobile money services made debt a practical option for Wave’s growth.

"Debt funding unlocks equity funding by allowing investors to focus on growth-driving activities".

Frank Samuel, Investment Associate at Sahara Impact Ventures, highlighted how this model helped Senegal attract 12.1% of total African funding in the first half of 2025, making it one of the top four funding destinations.

| Startup | Funding Amount | Funding Type | Core Use |

|---|---|---|---|

| Moniepoint | $200 million | Equity | Pan-African expansion (Kenya), UK remittances, product diversification |

| Sun King | $156 million | Equity (DFI + local banks) | Scaling solar energy infrastructure |

| Wave | $137 million | Debt | Mobile money infrastructure and agent network expansion |

Why Equity Financing Works for African Startups

Equity vs. Debt vs. Blended Funding Models

African startups operate in a challenging environment that makes equity financing a particularly effective option. Unlike debt, equity financing doesn’t require collateral – an essential advantage for startups that often lack significant assets or formal credit histories. Traditional banks, by contrast, typically demand collateral that early-stage tech companies simply cannot provide.

Another key factor is the repayment structure. With equity financing, there are no fixed repayments, allowing startups to reinvest their early cash flows into growth instead of servicing debt. This flexibility is especially important in regions where volatile currencies can make USD-denominated debt much more expensive. For instance, startups in Nigeria, Egypt, and Kenya have all felt the strain of local currency devaluations against the U.S. dollar. This flexibility has helped African tech startups weather economic challenges and rebound strongly.

Beyond just providing capital, equity investors often bring strategic value. Venture capitalists can offer more than funding – they contribute expertise, business discipline, and access to international networks. These resources help startups navigate challenges like currency fluctuations and income instability.

Another advantage? Equity investors share the downside risk. If a startup struggles, equity investors don’t demand repayment, offering a safety net that debt financing simply doesn’t provide. On top of that, successful equity rounds can act as a signal of quality. They help startups gain credibility, making it easier to secure future debt or blended finance once the business model has been validated.

Here’s a quick look at how equity financing compares to other funding options:

| Factor | Equity Financing | Debt Financing | Blended Funding |

|---|---|---|---|

| Cost of Capital | High (ownership dilution) | Lower (interest rates) | Variable (mixed structure) |

| Scalability | High (long-term capital) | Medium (limited by repayment capacity) | High (optimized for infrastructure) |

| Investor Expertise | High (active involvement, networks) | Low (transactional relationship) | Medium (DFI support, technical aid) |

| Exit Potential | High (IPO or acquisition potential) | None (repayment only) | Variable (depends on structure) |

| Risk to Founder | Low (no personal guarantees) | High (risk of default, asset loss) | Medium (balanced risk layering) |

How Equity Financing Enables Growth and Innovation

Equity financing doesn’t just keep startups afloat – it fuels long-term growth and innovation. In African markets, where access to capital markets is limited, equity funding becomes a critical growth driver. Although only 10% of young firms in emerging markets are backed by venture capital, these companies are responsible for nearly 50% of all R&D spending in those regions. This underscores how equity financing can be a game-changer for innovation.

One of the biggest advantages of equity financing lies in its ability to support long-term development. Unlike debt, which can pressure founders to prioritize quick returns to meet repayment schedules, equity allows startups to focus on sustained R&D and strategic pivots. This emphasis on long-term growth is why investors in 2025 are increasingly backing companies with solid unit economics and clear paths to profitability.

Equity rounds also carry a validation effect. For example, in September 2025, Nigerian fintech Kredete raised $22 million in a Series A round led by AfricInvest, with participation from Partech. This funding not only boosted the company’s credibility but also restored investor confidence, paving the way for future funding opportunities. Such milestones highlight how equity financing can position startups for sustainable growth in Africa’s tech ecosystem.

"Pure equity investors want their money focused on scaling the business and not on costs that don’t directly drive growth. By raising debt, startups can cover those needs… This, in turn, makes them more attractive to equity investors."

- Frank Samuel, Investment Associate, Sahara Impact Ventures

sbb-itb-dd089af

Challenges and Solutions in Equity Financing

Increased Focus on Unit Economics

Investors are becoming increasingly selective, prioritizing startups with solid unit economics and proven business models. The conversion rate from Seed to Series A funding has plummeted from 35% in 2019 to just 5% in 2023, highlighting this shift.

"Investors today are less focused on ‘growth at all costs’ and more on strong unit economics from day one."

- Brian Waswani Odhiambo, Partner, Novastar Ventures

For B2B startups, institutional venture capitalists now expect $10,000+ in Monthly Recurring Revenue (MRR) at the seed stage, while consumer-focused startups need 5,000+ Monthly Active Users. By the Series A stage, these benchmarks rise to $100,000+ MRR with consistent growth.

Interestingly, startups that bootstrap their way to their first $1,000 in MRR are 40% more likely to secure seed funding compared to those still in the idea phase. This underscores the importance of early revenue validation. Founders who demonstrate traction early on can significantly boost their chances of attracting investors.

While refining financial metrics is critical, startups must also navigate sector-specific hurdles as they expand beyond traditional industries.

Moving Beyond Fintech

Sector diversification is becoming a key challenge for startups. Cleantech has emerged as the second-largest vertical, making up 13% of all tech-enabled deals in 2024. In just the first half of 2025, energy and water startups raised approximately $219 million.

This growing interest reflects investor appetite for "infrastructure-anchored" business models that offer essential services resilient to currency fluctuations and economic challenges. AI-related startups are also gaining momentum, raising $108 million across 42 deals in 2024, cementing their place among the top four sectors.

Some notable examples include:

- Sun King, which secured $40 million in equity funding from Lightrock in March 2025 to expand solar energy operations.

- CubeSpace, a Cape Town-based satellite technology company, which received $3 million from Futuregrowth Asset Management in February 2025.

- Everlectric, a commercial electric vehicle leasing startup, which obtained venture debt funding from the Vumela Fund to drive EV adoption in logistics.

Despite these successes, non-fintech startups often struggle to find investors who truly understand their industries. However, the involvement of Development Finance Institutions (DFIs) is helping bridge this gap by de-risking investments, making them more attractive to private capital. Additionally, countries like Ghana and Nigeria are revising pension fund regulations to allow greater investment in private equity, which could unlock more local funding for diverse sectors.

Funding Large-Scale Infrastructure Projects

African startups are increasingly tackling infrastructure challenges, such as AI-driven credit scoring, energy transition solutions, and logistics networks. These ventures often require substantial upfront investment.

To support such capital-intensive projects, the funding landscape is shifting. Venture debt reached $1.6 billion in the first nine months of 2025, offering startups with steady cash flows an alternative to equity financing and reducing founder dilution. Debt financing accounted for 31% of the total $3.2 billion in startup funding in 2024.

Blended financing models, which combine equity, debt, and DFI backing, are becoming essential for scaling infrastructure projects. These models provide startups with the patient capital needed for long-term growth while minimizing equity dilution. Investors are also favoring ventures with revenue streams invoiced in hard currencies to safeguard against local currency depreciation.

"Capital now follows clarity, not hype."

- David Lanre Messan, Founder, FirstFounders

Corporate venture capital is another growing trend. Funding rounds backed by corporates saw a 44% increase in the first half of 2025, with local manufacturers and banks actively investing in infrastructure-focused startups. Beyond funding, these partnerships offer strategic advantages, such as faster deployment and improved access to markets.

What to Expect After 2025

Continued Focus on Large Investments

Africa is moving into a "utility-first" cycle, where investments are shifting toward building essential infrastructure rather than focusing on consumer-facing ventures. This marks a shift in priorities, as stakeholders recognize the need for large-scale, resource-heavy solutions to address the continent’s most pressing challenges.

"Africa is entering a utility-first VC cycle in 2026, where capital flows target foundational rails: payments, mobility, energy, AI infrastructure, B2B SaaS, and commerce enablers."

- Afritech Biz Hub

Fintech will still dominate the funding scene, capturing between 45% and 60% of total equity investments. However, the focus is evolving. Instead of basic payment apps, investors are now channeling funds into areas like regtech, embedded finance, and B2B trade finance infrastructure. Cleantech is also gaining momentum, with projected annual growth rates of 20% to 30% in 2026. Startups are addressing energy challenges through innovations like solar-as-a-service, mini-grids, and electric vehicle solutions.

The investment landscape is also becoming more localized. African investors now make up 31% of active venture capital participants, a significant rise from 19% a decade ago. New regulations in countries like Nigeria and Ghana are enabling pension funds to allocate more capital to private equity, creating a more sustainable domestic funding base. At the same time, Middle Eastern investors, particularly from the UAE and Saudi Arabia, are diversifying their portfolios by investing in Africa, with a strong focus on energy and fintech.

The exit environment is maturing as well. In November 2025, South African fintech Optasia went public on the Johannesburg Stock Exchange, raising $345 million with a market valuation of $1.4 billion – a major milestone for African tech IPOs. Around the same time, Moroccan fintech Cash Plus raised $82.5 million through its IPO on the Casablanca Stock Exchange, achieving a valuation of $550 million. These events highlight that African startups are no longer aiming solely for acquisitions; they are now building toward public market success.

"We’re no longer just building companies hoping for Series A/B rounds from international VCs. We’re building in an ecosystem where horizontal consolidation and vertical integration are becoming viable exit pathways."

- Uwem Uwemakpan, Head of Investment, Launch Africa Ventures

As the focus shifts to large-scale, foundational investments, startups must prove they have the resilience and long-term viability to thrive in this evolving environment.

How Startups Can Prove Financial Sustainability

Big ideas alone won’t cut it anymore. Investors now expect startups to deliver solid execution, generate real revenue, and demonstrate healthy unit economics right from the start. Those that can showcase profitability and clear margins will stand out in the race for equity funding post-2025.

Startups should prioritize FX-resilient business models. With local currency fluctuations being a persistent challenge, investors are favoring companies that use USD-priced SaaS subscriptions or other mechanisms to hedge against currency devaluation. B2B SaaS startups offering recurring enterprise contracts are particularly appealing, as they provide predictable revenue streams while keeping operational costs in check. This aligns with the broader shift toward sustainable, infrastructure-based growth in Africa’s startup ecosystem.

Another key strategy is adopting blended financing models that combine equity with venture debt. This approach is especially effective for infrastructure-heavy sectors like cleantech, logistics, and energy, where substantial upfront capital is often required.

Regulatory compliance is equally critical. Startups in sectors such as fintech, energy, and data must proactively align with local regulations to reduce perceived risks for investors. Early compliance not only builds trust but also attracts institutional capital from sources like Development Finance Institutions and local pension funds.

"Yes, we expect funding to increase next year because many Africa-focused funds reached both their first and final closes this year, meaning they’ll soon begin actively deploying capital."

- Frank Samuel, Investment Associate, Sahara Impact Ventures

The takeaway is clear: investors are prioritizing clarity over hype. Startups addressing real infrastructure needs with sustainable and transparent business models will be well-positioned to secure a growing share of the equity funding flowing into Africa’s tech landscape.

Conclusion

Africa’s startup scene is undergoing a major transformation. The rebound in 2025, driven by equity financing, signals a renewed sense of optimism across the continent. Investors are now channeling funds into startups with strong unit economics, consistent revenue streams, and clear plans for profitability.

This shift in funding priorities has also sparked a growing focus on infrastructure-driven business models. Sectors like clean energy, B2B software, and logistics are emerging as key areas of investment, laying a sturdy groundwork for long-term growth. Early 2025 saw a surge in equity investments, with capital being funneled into startups tackling critical infrastructure needs.

"Investors returning to Africa in 2025 are backing companies with demonstrable unit economics, recurring revenue and clear paths to profitability." – Kristin Wilson, Managing Partner, Innovate Africa Fund

These funding successes have also opened doors for impressive market exits. High-profile IPOs, such as those by Optasia and Cash Plus, highlight the maturing exit opportunities and validate the focus on equity investments. Meanwhile, the rise in local investor participation – now making up 31% of active venture capital players – is helping establish a more self-reliant and locally rooted funding ecosystem.

The message is clear: startups that prioritize financial discipline, solve pressing infrastructure challenges, and maintain strong unit economics are attracting serious attention from investors. Equity financing is not just fueling a recovery; it’s laying the foundation for a competitive and enduring tech ecosystem across Africa.

FAQs

How is equity financing driving the growth of African startups?

Equity financing is reshaping the way African startups grow and thrive, especially after a tough stretch for venture capital. In 2025, startups across the continent secured around $1.42 billion in funding during the first half of the year – a massive 78% jump compared to the previous year. This surge in capital is fueling business expansion, product diversification, and entry into fast-growing areas like clean energy and health tech.

One notable shift is the increasing presence of local investors, who now make up 31% of all venture capital participants. Local funding offers clear advantages: it minimizes currency risks and is better aligned with regional markets, enabling startups to craft solutions specifically for African consumers. Beyond just funding, equity financing promotes stronger governance, scalable business strategies, and strategic collaborations, positioning it as a critical force driving the growth of Africa’s tech ecosystem.

What industries are growing in Africa’s startup scene beyond fintech?

Africa’s startup ecosystem is thriving, with growth extending far beyond the fintech space. One area making waves is artificial intelligence (AI), where startups are diving into machine learning, natural language processing, and computer vision to create cutting-edge solutions. Meanwhile, clean energy and cleantech are gaining traction as the continent embraces sustainable energy options and technologies aimed at addressing climate challenges.

Another sector on the rise is healthtech, where innovations like AI-driven diagnostics and telemedicine platforms are transforming healthcare by improving accessibility and patient outcomes. Similarly, logistics and supply chain tech is drawing attention, with startups focused on optimizing freight, inventory management, and connecting informal businesses to larger networks. Emerging industries like PropTech (real estate technology) and agritech are also making significant strides. These ventures are addressing key issues such as boosting farming efficiency and improving access to agricultural machinery.

Why are local banks and development finance institutions turning to equity financing for African startups?

Local banks are stepping into the equity financing space as traditional venture capital funding slows down, leaving many startups struggling to secure the funding they need to grow. With global liquidity tightening, banks are no longer just passive lenders – they’re becoming active participants in the startup world. By taking equity stakes in businesses, they’re able to support companies through longer funding cycles and help them scale. A notable example is a $156 million equity-linked financing initiative in Kenya, led by a group of banks. This initiative has provided funding for solar products and smartphones, highlighting how banks are taking a more active role in driving business growth and innovation.

Development Finance Institutions (DFIs) are also adopting equity financing as a way to balance financial returns with broader development goals. Instead of relying only on grants, DFIs are investing directly in startups, which allows them to share in the businesses’ success, align their goals with those of the founders, and reduce risks for private investors. This strategy not only promotes sustainable growth but also encourages innovation within Africa’s tech ecosystem, ensuring that startups have the resources to thrive and make an impact.

Related Blog Posts

- The State of Venture Capital in Africa in 2024

- Fintech Funding in Africa: Regional Breakdown

- African Startups Raise $289M in Jan 2025: A 240% YoY Surge

- Nigeria & Kenya Lead as Africa’s Big 4 Dominate 2025 Funding