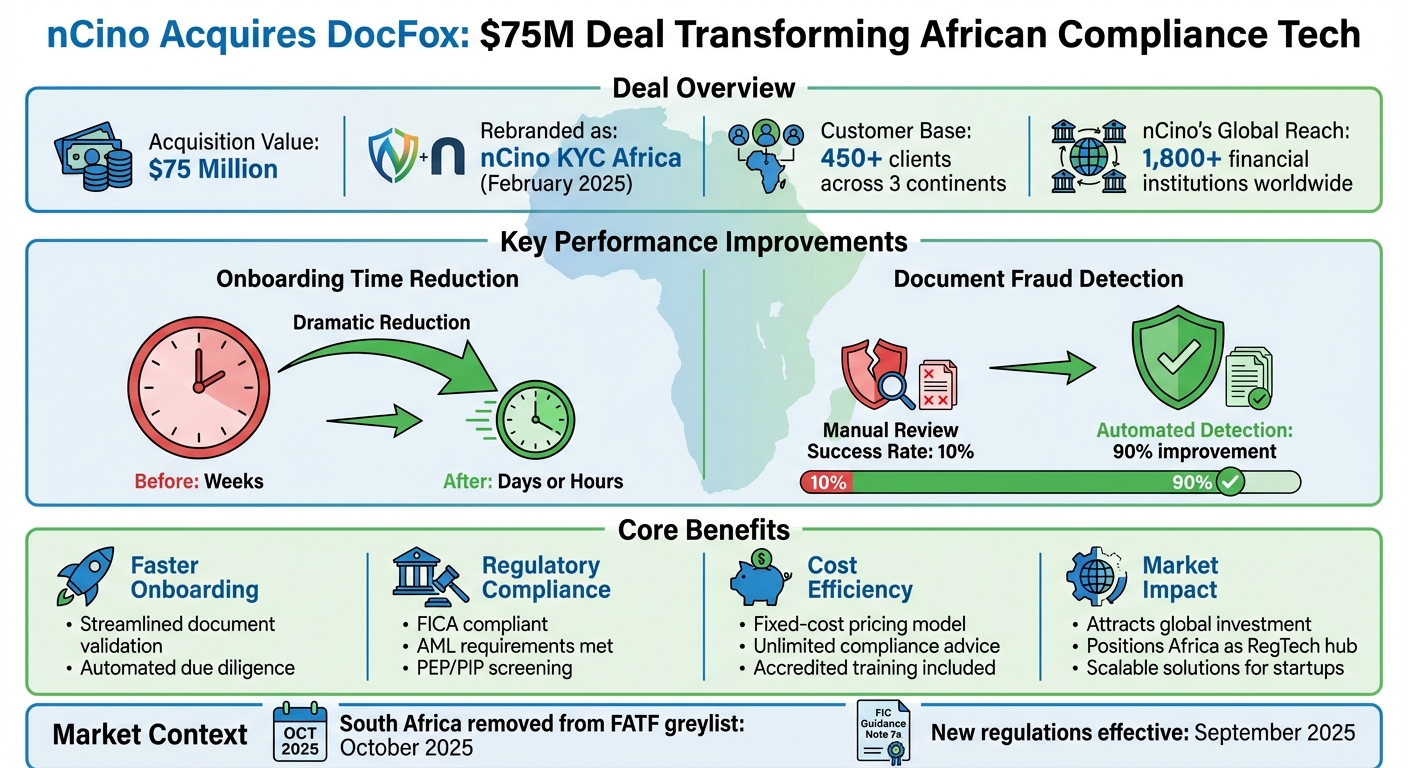

nCino‘s $75 million acquisition of DocFox marks a major step in advancing compliance technology for African financial institutions. This deal not only strengthens nCino‘s global reach but also introduces faster, more efficient KYC (Know Your Customer) and AML (Anti-Money Laundering) solutions tailored to the African market. Rebranded as nCino KYC Africa in February 2025, DocFox’s technology now offers automated compliance tools that cut onboarding times from weeks to days or hours, helping startups and banks meet strict regulatory standards while reducing costs.

Key highlights:

- Faster onboarding: Streamlines document validation and due diligence.

- Regulatory compliance: Tailored for South Africa’s FICA and AML requirements.

- Investor appeal: Signals Africa’s growing role in global fintech innovation.

- Scalable solutions: Fixed-cost pricing allows startups to manage compliance affordably.

This acquisition not only simplifies compliance but also positions African tech as globally competitive, driving growth and attracting investment in the region.

nCino’s $75M DocFox Acquisition: Key Impact Metrics and Benefits for African Fintech

Key FinTech Trends in Africa: What do investors need to know?

DocFox‘s Technology and Solutions

DocFox takes the headache out of compliance, turning it into a tool for growth. This SaaS platform streamlines document collection and due diligence, slashing the time it takes to onboard clients in commercial banking.

Key Features of DocFox Solutions

DocFox automates document validation with advanced analysis, catching fraudulent documents that manual reviews often miss. In fact, studies show that about 90% of people fail to spot fake identification documents during manual checks. The platform also integrates effortlessly through APIs, as seen with Oxygen, which used DocFox to automate business account openings during a rapid growth phase.

Customizable workflows let teams tailor their review processes, while bank account verification ensures banking details are accurate and belong to the intended account holder. This added layer of security minimizes fraud risk during onboarding.

"Growing your FinTech business isn’t possible without being able to scale both onboarding and compliance in tandem." – Ryan Canin, Co-Founder & CEO, DocFox

These tools directly address compliance challenges faced by fintech companies, especially in African markets.

Addressing Compliance Challenges in African Fintech

DocFox offers solutions tailored to the specific needs of African businesses dealing with FICA regulations. For example, the platform provides access to crucial South African Domestic Prominent Influential Persons (DPEP) and Politically Exposed Persons (PIP) lists, which are vital for meeting local compliance standards. Its risk-based approach includes configurable risk rating tools, enabling fintechs to focus their resources on high-risk clients while expediting onboarding for low-risk ones.

Beyond its technical capabilities, DocFox’s pricing model removes traditional cost barriers. With a single fixed fee, clients get unlimited FICA compliance advice, accredited training, and user access. This setup is a game-changer for African startups, allowing them to scale compliance efforts without ballooning operational costs. Daily screenings against global sanction and AML watchlists ensure compliance remains an ongoing process, not a one-time task.

These features are particularly timely, given stricter regulatory requirements introduced by updates like the Financial Intelligence Centre’s Revised Guidance Note 7a, which will take effect in September 2025. DocFox ensures that fintechs are prepared to meet these evolving standards with ease.

Why nCino Acquired DocFox

nCino’s $75 million acquisition of DocFox brings crucial technology into the fold for commercial banking. CEO Pierre Naudé explained the move, saying, "The acquisition of DocFox extends our existing functionality and will deliver a modern experience to an area of commercial and business banking that has lagged in innovation due to its complexity". By integrating DocFox’s automation tools into its Bank Operating System, nCino can now provide a seamless, end-to-end solution for client onboarding and due diligence. This decision not only addresses a significant operational gap but also strengthens global compliance capabilities.

Improving Global Compliance Capabilities

One of the biggest challenges in commercial banking is the slow pace of onboarding, and this is exactly where DocFox shines. Even with a client base of over 1,800 financial institutions worldwide, nCino lacked the specialized tools needed to streamline document validation for complex accounts. DocFox’s technology has transformed this process, cutting onboarding times from weeks to just days – or even hours. By removing manual bottlenecks, it brings a much-needed upgrade to global compliance systems.

Five Star Bank was quick to recognize the advantage of this partnership. In March 2024, its President & CEO, James Beckwith, adopted the integrated nCino and DocFox technologies to speed up onboarding for business customers. He noted that "embracing a single, integrated platform, particularly in commercial or business banking, is more than a technological upgrade – it’s a strategic imperative". This real-world example highlights that DocFox isn’t just an add-on; it’s a game-changer for staying competitive in today’s commercial banking landscape.

Entering the African Market

The acquisition also gave nCino a foothold in Africa, thanks to DocFox’s Johannesburg office. This move connects nCino to the continent’s growing fintech ecosystem. At the time of the deal, DocFox was already serving over 450 clients across three continents and had developed a strong understanding of South Africa’s Financial Intelligence Centre Act (FICA) and Anti-Money Laundering (AML) regulations. This local expertise positions nCino to better navigate and expand within the African market.

sbb-itb-dd089af

Effects on African Compliance and Fintech

Faster KYC and Regulatory Compliance

The integration of nCino and DocFox simplifies onboarding processes, cutting the time from weeks to just days – or even hours. This not only reduces costs but also speeds up revenue generation. For startups operating on tight budgets, this is a game-changer. Every day saved means less money spent on manual document reviews and fewer staff hours tied up in administrative tasks.

The platform automates essential compliance tasks like FICA and AML processes. This includes features such as digital liveness checks, document capture, and real-time bank verification, along with screening against PEP, PIP, and global sanction lists. This level of automation is particularly helpful for African fintech companies navigating intricate regulatory landscapes.

Additionally, the fixed-cost pricing model removes a significant hurdle for African startups. With nCino KYC Africa, businesses gain access to unlimited FICA compliance advice and accredited training for all employees. This allows companies to scale their compliance operations predictably while staying in line with regulatory standards and passing Financial Intelligence Centre (FIC) inspections.

These advancements not only streamline operations but also build trust with investors, signaling a more stable and scalable environment for African tech.

Increased Investor Interest in African Tech

The benefits extend beyond compliance. These developments significantly boost the region’s appeal to global investors. The $75 million acquisition of DocFox sends a strong message: African compliance technology is competitive on a global scale. nCino’s local presence further underscores Africa’s growing importance in the global tech ecosystem. This high-profile deal showcases how African-developed technology can hold its own internationally and achieve premium valuations.

This momentum comes at a critical time. As South Africa works to reverse its FATF greylisting status, there’s a heightened demand for automated KYC and FICA solutions. DocFox’s success, with over 450 customers across three continents, highlights how African-built solutions can scale globally. For investors, this is a compelling signal of the potential within Africa’s fintech landscape.

Long-Term Effects on African Tech

Expanding Compliance Tech Across Africa

In February 2025, DocFox rebranded as "nCino KYC Africa", signaling a deeper commitment to advancing compliance technology across the continent. This move connects local businesses with global research, development, and market expertise, creating a bridge between Africa and international innovation.

While originally tailored for commercial banking, the platform has expanded its scope to automate compliance for a wide range of businesses. This includes e-commerce platforms, blockchain companies, and other organizations required to meet FICA and AML standards. For industries like digital payments and online marketplaces – where speed and efficiency are critical – this solution removes compliance as a bottleneck. Instead, as nCino KYC South Africa describes it, compliance becomes "an enabler of new business".

A practical example of this can be seen in January 2022, when the digital banking platform Oxygen adopted DocFox to onboard creators and solopreneurs. Traditionally, scaling this segment manually had been a challenge. However, the API-driven system streamlined document analysis and handled exceptions efficiently, even during periods of rapid growth. This demonstrated the platform’s flexibility and its ability to serve non-traditional financial entities. By simplifying compliance, the platform not only supports innovation but also fosters a stronger connection between established finance systems and emerging markets.

As these tools continue to evolve, they are expected to boost investor confidence in Africa’s tech ecosystem, opening doors for broader opportunities.

Attracting More Investment in African Startups

The transformation of DocFox into nCino KYC Africa also builds a solid foundation for long-term investment in African tech. The $75 million acquisition highlights the premium value of African-developed technology. With DocFox now serving over 450 customers across three continents, it sets an inspiring example for African tech companies aiming to make a global impact.

Additionally, nCino’s global network of more than 1,800 financial services providers offers immediate pathways for distributing African innovations. This positions Africa as a promising hub for regulatory technology (RegTech) development. South Africa’s removal from the FATF greylist in October 2025 further strengthens the momentum for compliance-focused startups, signaling a brighter future for the region’s tech landscape.

Conclusion

The $75 million acquisition of DocFox by nCino highlights a major achievement for African compliance technology. What began as a local FICA solution has grown into nCino KYC Africa, now supporting over 450 customers across three continents. This evolution shows that technology developed in Africa can not only compete but thrive on a global scale.

The impact of this transformation is already being felt by fintech companies and financial institutions. Onboarding processes that once took weeks can now be completed in hours or days, removing compliance as a roadblock to growth. As Pierre Naudé, CEO and Chairman of nCino, explained:

"The acquisition of DocFox extends our existing functionality and will deliver a modern experience to an area of commercial and business banking that has lagged in innovation due to its complexity".

This shift is turning regulatory requirements into opportunities for growth. With nCino’s $75 million investment, African RegTech has proven its potential to attract global attention, signaling to investors that the continent is becoming a hub for financial innovation.

Looking ahead, this partnership opens the door to even greater opportunities. African businesses now have access to nCino’s network of more than 1,800 global financial institutions. By combining local expertise with global reach, African compliance solutions can scale internationally while continuing to address the unique regulatory challenges of the region.

The nCino-DocFox acquisition is a testament to the ability of African technology to deliver world-class solutions. It reinforces the broader narrative of innovation driving global competitiveness and demonstrates that major players are willing to invest heavily to integrate these groundbreaking advancements into their platforms.

FAQs

What does nCino’s acquisition of DocFox mean for African fintech companies?

nCino’s $75 million acquisition of DocFox marks a game-changer for African fintechs. By integrating DocFox’s automated KYC (Know Your Customer) and onboarding technology with nCino’s cloud-banking platform, this partnership simplifies critical processes like account opening, document verification, and due diligence. What once took weeks can now be completed in just hours, all while adhering to local regulations.

Beyond efficiency, this collaboration connects African startups and financial institutions to nCino’s global network, which supports more than 1,800 financial institutions around the world. With access to a unified platform, fintechs can cut down on compliance costs, reduce manual workloads, and shift their focus toward innovation and growth.

What compliance challenges in Africa does DocFox help solve?

DocFox takes on some of the biggest compliance hurdles faced by African banks and fintech companies, particularly those tied to the Financial Intelligence Centre Act (FICA) and anti-money laundering (AML) regulations. These regulations often involve manual processes that can be slow and error-prone. DocFox changes the game by automating these tasks, offering institutions a smooth, software-based approach to compliance.

Another critical issue the platform addresses is verifying customer identities in a region where fraud techniques are constantly evolving. By digitizing document collection, running sophisticated analyses, and maintaining ongoing risk monitoring, DocFox ensures financial institutions can meet strict Know Your Customer (KYC) standards. On top of that, it helps reduce onboarding times dramatically, allowing businesses to grow their operations without cutting corners on compliance.

Why is nCino’s $75 million acquisition of DocFox important for global investors?

nCino’s $75 million acquisition of DocFox marks a bold step in solidifying its role as a top cloud-banking platform. By bringing DocFox’s cutting-edge automated onboarding and Know Your Customer (KYC) technology into its fold, nCino boosts its ability to tackle intricate compliance challenges, with a particular focus on African markets.

This move not only extends nCino’s global reach but also sharpens its ability to improve operational workflows for financial institutions. For investors, this acquisition signals a chance to tap into the rising demand for efficient compliance tools and the ongoing shift toward digital banking in emerging markets.

Related Blog Posts

- Top 6 African Startups Fighting Payment Fraud

- Fintech Funding in Africa: Regional Breakdown

- Deel Acquires PaySpace: A Major Exit for SA HR-Tech

- African Tech M&A Activity Rose 34% in 2024: What to Expect