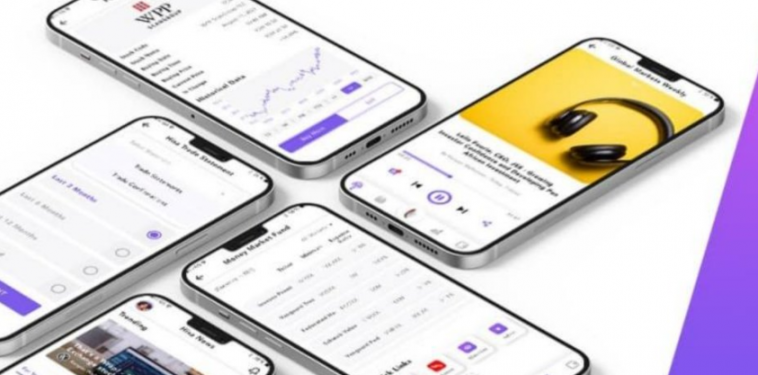

Hisa Technologies has unveiled the Hisa mobile that allows anyone in Kenya to invest in US stocks and ETFs directly from their phones through mobile money. As a wealth management platform, Hisa offers Kenyans a chance to own fractional shares from their favorite companies such as Apple, Google, Tesla, and others. Through the app, users will receive real-time market updates, follow-on market discussions, and real-time business and financial news, and access to hundreds of podcasts.

The fintech startup in partnership with Faida Investment Bank Limited received approval from Kenya’s Capital Markets Authority (CMA). The players have also partnered with DriveWealth LLC, a US-based global brokerage infrastructure.

In a statement shared in the press release, Erick Asuma the CEO/co-founder said, “our vision is to allow anyone across the continent to access different global investment options.”

Rina Hicks, the Operations Director of Faida Investment Bank pointed out “We are pleased to have received a nod from CMA as we continue to make steady progress in our partnership with Hisa Technologies.”

Fractional investing enables investors to buy less than a full share of a security or stock. Kenyan investors will buy a percentage of a single share enabling them to diversify their investments through the distribution of small capital amounts. Hisa can be accessed on the iOS AppStore or Google Play Store.

More on Hisa at KenyanWallStreet