The COVID-19 pandemic created a strong demand for businesses across the globe – micro, small and medium-sized enterprises. MSMEs remain the strongest drivers of economic development, innovation, and employment but run on smaller operational margins. Opportunities meant for women entrepreneurs lag behind that of men. This is evident in the Ethiopia Women Entrepreneurship Development Project (WEDP) that supports 38,000 women-owned and growth-oriented micro and small enterprises with training and access to loans.

Since WEDP’s was started in 2012, businesses that participate in its programme have increased their incomes by 67% and increased their hirings by 58%. WEDP employs close to 90,000 workers, 61% of whom are female. To boost WEDP and protect any potential jobs at risk, teams from the World Bank’s Africa Gender Innovation Lab, the ITS Technology and Innovation Lab (ITSTI), and the Competitiveness & Innovation Global Practice. The cooperation resulted in the pursuit of a mobile app that could tap into POS (Point-of-Sale) data while generating business insights and maintaining transactional records.

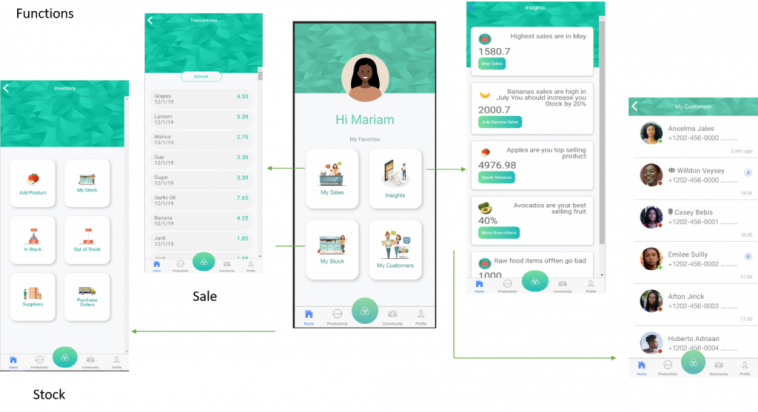

ITSTI came up with a lab prototype for the application which adopts concepts industry insiders refer to as ‘enterprise software.’ You can run the app on any smartphone and link it to wi-fi or cash registers. Ethiopian companies earning more than US$3000 are mandated to use cash registers – hence the easy adaptability.

When connected, the app will:

- Extract transactional data from your cash register

- Generate insights on sales patterns

- Provide targeted recommendations

- Remotely engage contacts and business networks

- Enable real-time price comparisons

- Enable peer-to-peer interchange and learning

The group now plans to team with the Government of Ethiopia’s SME agency and roll-out the prototype in practical user-test sessions. There will be partnerships with Ethiopian banks and microfinance institutions to create a digital transnational record which can be leveraged as an alternative credit score rating for women-owned firms.