TechInAfrica – At some point in our lives—well, most of us, that is—we wonder what it’s like to delve further into the cryptocurrency scene. At least I did, circa 2014 when I had initially generated my first bitcoin address; but that’s a tale for another day.

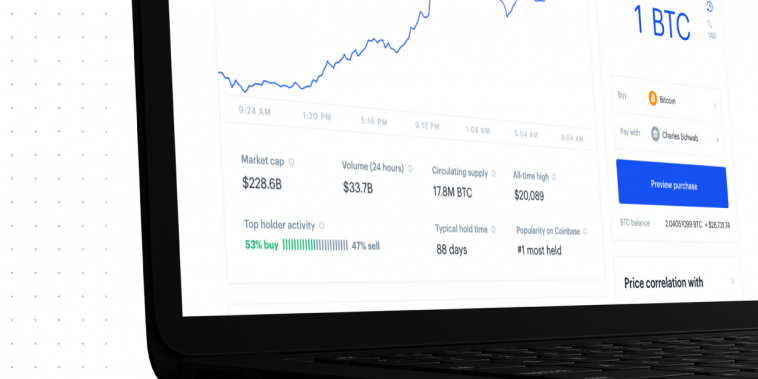

Coinbase, a digital currency exchange headquartered in San Francisco, California, launched new tools for entry-level crypto users in order for them to have the insights regarding the latest what’s and how’s—courtesy of seasoned merchants. In their official blog post, Coinbase stated “that’s why we’re making exclusive trading data available to any Coinbase customer — for free — starting today.”

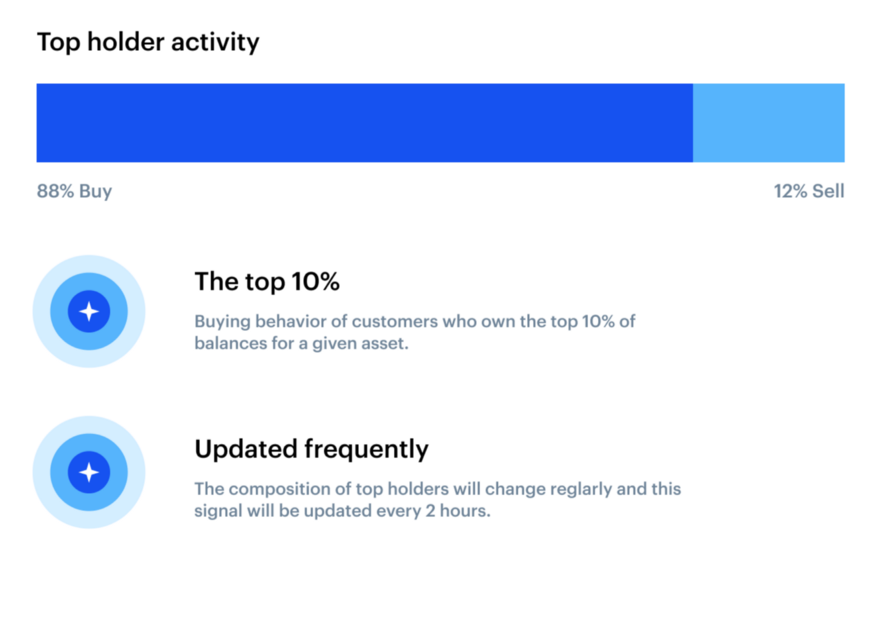

One of the most fervent implementations of the tools offers to broadcast the activity of Coinbase’s top traders. “The top holder activity signal is the percentage of Coinbase customers with large balances of an asset (top 10%) who have net increased (bought) or decreased (sold) their positions in that asset through trading over the last 24 hours. This is updated approximately every 2 hours,” explained Coinbase in the referred blog post. This feature is regarded substantial by Coinbase due to the unpredictable nature of cryptocurrency—so we may look into issues that are less uncertain; the activity of the top 10% customers.

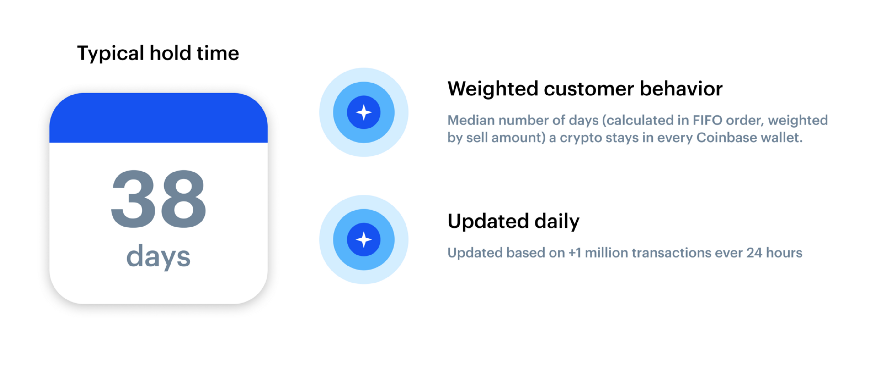

Other than the ability to see Coinbase’s top traders’ activities, another tool—also free of charge—also offers retail users to know the median number of days an asset stays in a Coinbase customer’s account or vault before it’s sold or sent to another address or wallet. Updated once approximately every 24 hours, this tool also lets users identify how many customers hold a particular cryptocurrency—signified as the popularity of such subject.

This serves a slightly different purpose from the first apparatus, in which the Typical hold time & Popularity on Coinbase tool allows users to see the average Coinbase customers’ activities, by observing hold times and popularity in general. Yet these trends can be influenced by countless factors, due to the huge diversity in Coinbase’s customer base. Graphs can be swayed in correspondence to the assets in which each of them finds interesting—respectively.

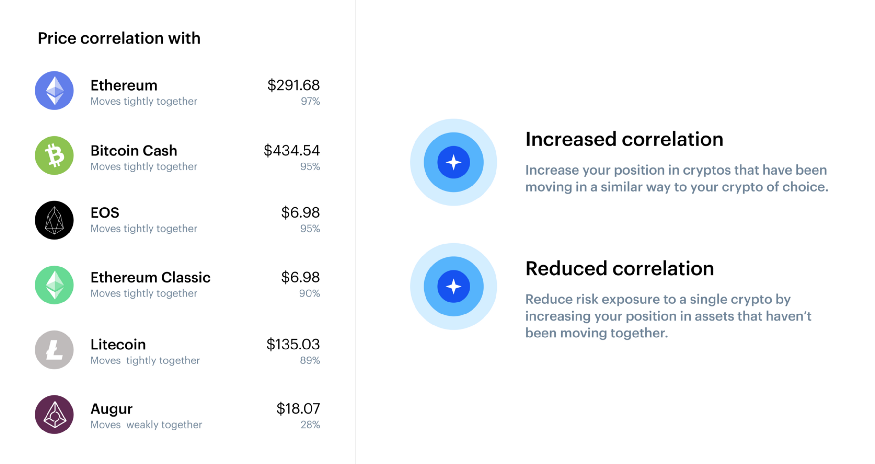

Moving on to the third free tool, Coinbase also encourages users to manifest in their new Price correlation mechanics. “The price correlation signal measures how cryptocurrency prices have moved in relation to each other,” Coinbase claimed. Like the previous tool, this one is also updated approximately every 24 hours.

When the correlation ratio is high and positive, this means those assets’ prices have tended to move in the same direction. Contrarily, when the numbers are high yet negative, this would mean those assets’ prices have tended to move in the opposite direction. Alternatively, Coinbase asserted in their blog post that “low or no correlation (around 0%) means the assets’ prices haven’t tended to be related.”

Price correlations are designed initially for users to regard future potential risk exposures—as well as helping users to assess the historical diversity of their portfolio. Coinbase, on one of the prime examples this feature might be used:

For example, if you want to increase your exposure to potential BTC-related price movements, you could buy cryptocurrencies that are highly correlated to BTC.

If you also want to, say, avoid your bets from BTC-related price movements, you can buy cryptocurrencies with high negative value of correlation towards BTC. Alternatively, you can also buy cryptocurrencies with little to no effect on BTC prices by manifesting those with around 0% of correlation percentage.

With these new signals and tools, Coinbase also hopes that future customers—as well as old ones—will implement this feature to inform themselves of a more diversified crypto portfolio. Yet, with all these new gizmos that Coinbase has offered us, they stressed that this should not be, in any way, considered to be investment advices. Consulting a financial professional is highly endorsed by the San Francisco-based company as users should always make their own independent assessment; as well as managing and creating their own crypto strategy.

Coinbase declared:

We think trading signals, backed by verified transactional data, are an important step to raising the level of trust in the cryptoeconomy. Coinbase customers can now use these signals to suit their needs.

To use these features mentioned above, users can download the Coinbase app on iOS or Android.

Source: blog.coinbase.com and coindesk.com