A look into capital inflows from startups and their distribution reveals interesting trends. First, a huge chunk of investments is going into products that have yet to reach full development. For instance, investment in technology companies increased from US$25.97 million in 2015 to US$88.32 million by 2015.

2019 was a record year for investments, with a lot of activity happening in the last two Quarters where total funding closed at $1.93 billion. The logistics, energy, AgTech, and finTech industries have contributed greatly to the rise. The Q1 of 2020 registered a higher investment number at $283 million, exceeding the figure in Q1 of 2019 by US$26 million due to an over-performance by the Fintech and Transportation sectors. Despite these positive numbers, funding directed to seed and pre-seed investments decreased in that quarter.

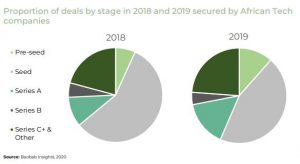

Pre-seed investments grew by 5.73% in 2018 to 9.49% in 2019. It remains to be seen whether this investment will remain a long-term trend as we are seeing investors go for ventures that are yet to develop a fully nurtured product. The report also examines the market drivers behind some of the figures arrived at.