TechInAfrica – Mobile banking services have long been a crucial part of the everyday lives of millennials. From paying bills, topping up phone subscriptions and data plans, making cashless transactions, to viewing your savings account while transferring money seamlessly to other people. Nigeria serves as no exception towards this development in the finance sector—with the nation’s growth in various aspects, mobile banking has also begun to fit in the society. FairMoney, a Paris-based fintech startup, recently introduced an in-app payment function to its users in Nigeria.

Alongside the launch of FairMoney 2.0, the company claims, “FairMoney understands that managing finances on a day to day can be challenging. This is why we have created a smooth process which facilitates access to credit via your mobile phone anytime, anywhere for all your needs.”

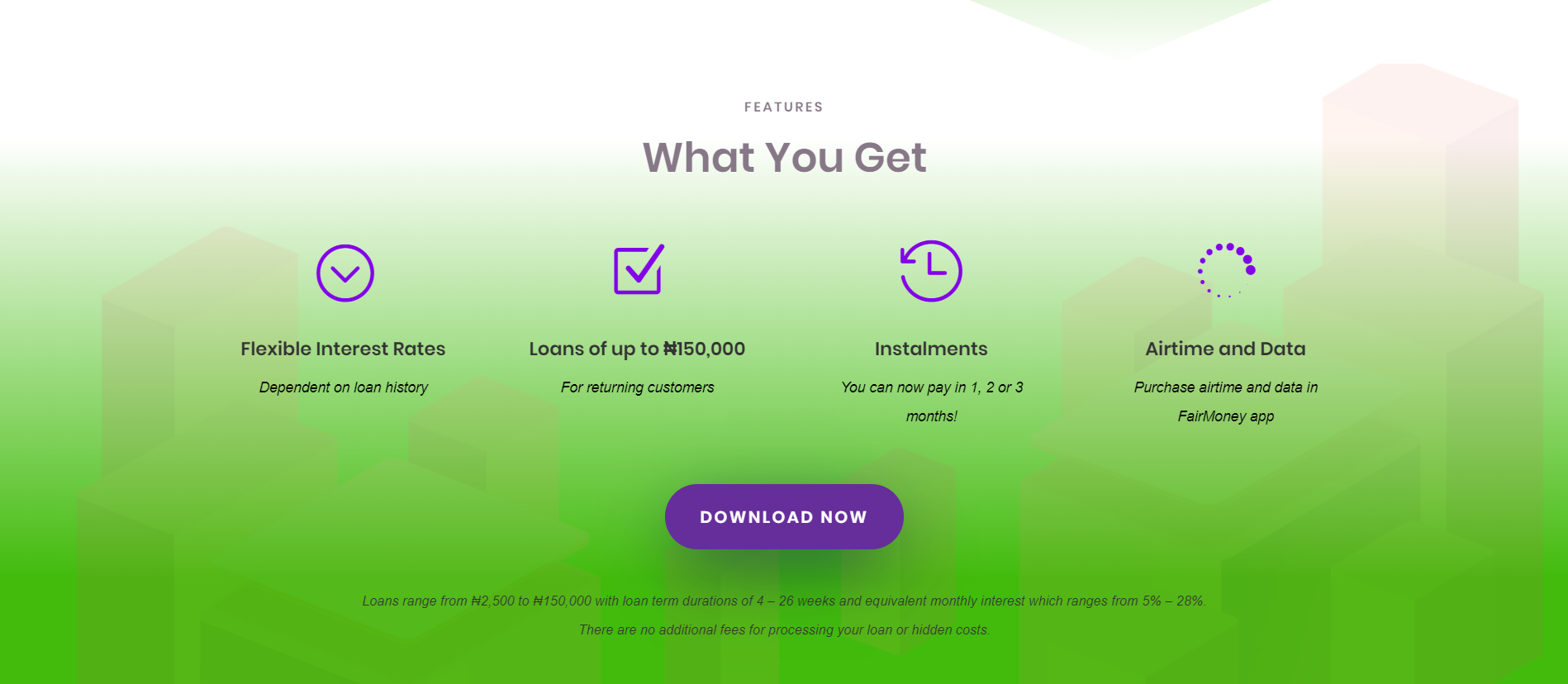

Accessible anywhere within Nigeria, FairMoney boasts over 200,000 (and counting) regular users that implements their services on a daily basis. Loans are mainly focused to finance and bolster small-to-medium business needs, with a limit of up to ₦150,000 per transaction—that’s roughly 400 USD. In addition, FairMoney applies an interest rate between 15-30% in the condition customers repay the funds back within six months. The company also offers data purchases in alternative to the loans.

Laurin Hainy, CEO of FairMoney spoke that the company visions itself to provide an easy-to-use platform for the potential customers, as well as being a one-stop shop for matters regarding the finance sector. Furthermore, Hainy also expressed that the emerging markets are home to underserved customers; which would be a staggering obstacle on the company’s rapid expansion. That’s why FairMoney aspires to tackle this issue by appearing as financial mentors for users.

Source: itnewsafrica.com