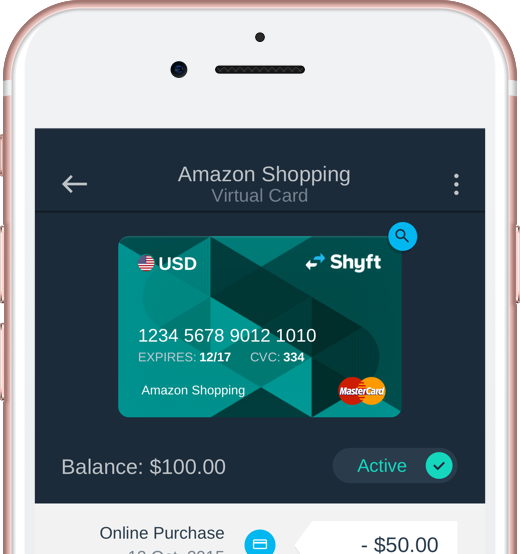

TechInAfrica – The Standard Bank of South Africa—more commonly renowned as merely Standard Bank for locals—is a South African financial services groups; also serving as Africa’s biggest lender by assets. One of their most popular services in terms of self-service banking is the Shyft App. With claims to provide availability in sending and storing foreign currency instantly on users’ mobile phone or tablet, Shyft was crowned as the Financial Solution and Business App 2017 during the year’s MTN App Awards.

Now fervently partnering up with iiDENTIFii—a company operating in the fields of remote biometric identity authentication—Standard Bank has made Shyft available for non-Standard Bank customers through identity verification. iiDENTIFii offers a more secure, more reliable security solution for present and future Shyft users. Consumers can open the app via their respective mobile phones. This notion aligns with iiDENTIFii’s aspiration to stop identity fraud by making seamless identity authentication accessible to everyone and everywhere.

Arno von Helden, Head of PBB FX Digital Solutions at Standard Bank professed that Shyft shouldn’t be restricted to be used by only Standard Bank customers. Providing easy and convenient access to foreign currency, the company deemed that it’s crucial this friction-free ethos to be reflected in the sign-up process for every customer. Despite this, non-Standard Bank customers would need to visit their nearest branch of the financial institution to verify their identity before manifesting the full usage of Shyft.

Furthermore, von Helden also asserted:

By working with iiDENTIFii, we have been able to remove the barriers to adoption for non-Standard Bank users by harnessing the digital (and thereby remote) KYC on-boarding process.

What’s new about the new iiDENTIFii technology?

In short, the new platform offers four key functions;

- It proves the person is alive; therefore enabling strong authentication.

- It matches the selfie(s) taken with the ID on the legal documents.

- It extracts data off the person’s legal documents; names, surnames, and ID numbers.

- It matches itself with the newly-augmented facial biometric systems.

Alongside this concept, Standard Bank is slowly—yet surely—moving towards the seamless digital age where data security is regarded as most crucial. Friction-free banking solutions such as Shyft embodies such perception.

Source: itnewsafrica.com